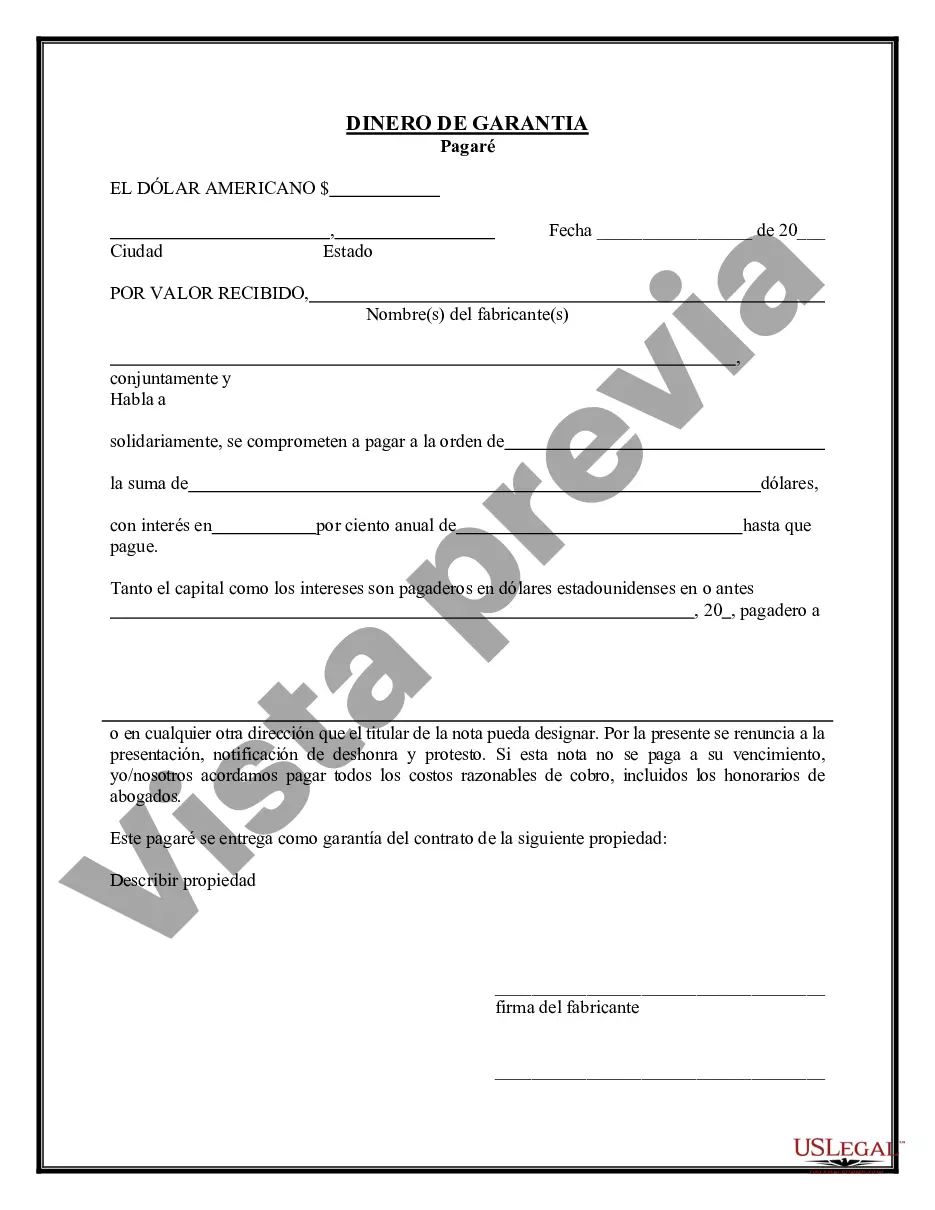

A Wake North Carolina Earnest Money Promissory Note is a legal document used in real estate transactions to confirm a buyer's commitment to purchasing a property. It serves as evidence of the buyer's intention to complete the sale and provides security to the seller. The Earnest Money Promissory Note is typically used during the initial stages of a real estate transaction, when the buyer places a deposit, known as earnest money, to demonstrate their serious intent to purchase the property. This deposit is often required by the seller as a gesture of good faith and is held in escrow until the closing of the transaction. The Wake North Carolina Earnest Money Promissory Note outlines the terms and conditions related to the deposit, including the amount, due date, and any contingencies that may apply. It also specifies the consequences if the buyer fails to fulfill their obligations, such as forfeiting the earnest money or facing potential legal action. In Wake North Carolina, there are different types of Earnest Money Promissory Notes that may be used depending on the specific transaction: 1. Contingent Earnest Money Promissory Note: This type of note includes specific conditions or contingencies that must be met for the earnest money to be released or refunded to the buyer. Common contingencies may include a satisfactory home inspection, obtaining financing, or clear title. 2. Non-Contingent Earnest Money Promissory Note: Unlike a contingent note, a non-contingent note does not have any specific conditions or contingencies that would allow the buyer to cancel the transaction and receive a refund of the earnest money. It signifies the buyer's commitment to purchase the property regardless of any unforeseen issues that may arise. 3. Forfeitable Earnest Money Promissory Note: This type of note allows the seller to keep the earnest money deposit if the buyer fails to fulfill their obligations, such as backing out of the sale without a valid reason or breaching the terms of the purchase agreement. 4. Refundable Earnest Money Promissory Note: In contrast to a forfeitable note, a refundable note specifies that the earnest money deposit will be returned to the buyer if they decide not to proceed with the purchase for valid reasons allowed by the contract or applicable laws. It is important for both buyers and sellers to carefully review the terms and conditions of the Wake North Carolina Earnest Money Promissory Note before signing to ensure they understand their rights and obligations. It is often recommended consulting with a real estate attorney or agent to navigate the complexities of the note and protect their interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Pagaré de arras - Earnest Money Promissory Note

Description

How to fill out Wake North Carolina Pagaré De Arras?

If you need to find a trustworthy legal document supplier to obtain the Wake Earnest Money Promissory Note, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it simple to locate and execute different documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply select to look for or browse Wake Earnest Money Promissory Note, either by a keyword or by the state/county the form is created for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Wake Earnest Money Promissory Note template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately ready for download as soon as the payment is processed. Now you can execute the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less pricey and more reasonably priced. Create your first company, organize your advance care planning, draft a real estate agreement, or execute the Wake Earnest Money Promissory Note - all from the convenience of your sofa.

Sign up for US Legal Forms now!