Wake North Carolina Exchange Addendum to Contract — Tax Free Exchange Section 1031: A Comprehensive Guide Overview: The Wake North Carolina Exchange Addendum to Contract — Tax Free Exchange Section 1031 is a crucial legal document that facilitates tax-free exchanges (also known as Section 1031 exchanges) of properties in Wake County, North Carolina. This addendum serves as an integral part of the real estate contract, ensuring compliance with the Internal Revenue Service (IRS) regulations governing like-kind exchanges. Key Points: 1. Tax-Free Exchanges (Section 1031): The Wake North Carolina Exchange Addendum allows property owners to defer capital gains taxes by swapping one investment property for another. This provision is governed by Section 1031 of the Internal Revenue Code. 2. Criteria for Section 1031 Exchanges: To qualify for a tax-free exchange, the properties involved must be held for investment or used in trade or business purposes. Personal residences or properties primarily held for resale are excluded. 3. Like-Kind Requirement: Both the relinquished property (property being sold) and the replacement property (property being acquired) in the exchange must be of like-kind. In real estate terms, this means the properties should be of the same nature, character, or class, despite differences in quality or grade. 4. Identification Period and Exchange Period: The addendum outlines crucial timelines for the exchange process. The identification period allows the seller 45 calendar days from the transfer of the relinquished property to identify potential replacement properties. The exchange period, on the other hand, requires the closing of the replacement property within 180 calendar days following the transfer of the relinquished property. 5. Qualified Intermediary (QI): The addendum highlights the requirement to employ the services of a Qualified Intermediary (QI). A QI is an independent third party who facilitates the exchange process, ensuring compliance with IRS regulations. The addendum may provide space for the identification of the QI and their contact information. Types of Wake North Carolina Exchange Addendum to Contract — Tax Free Exchange Section 1031: 1. Residential Real Estate Exchange Addendum: This addendum is designed specifically for tax-free exchanges involving residential properties, such as single-family homes, condos, or townhouses. 2. Commercial Real Estate Exchange Addendum: This addendum caters to tax-free exchanges involving commercial properties, including office buildings, retail spaces, industrial properties, or multi-unit residential buildings. 3. Mixed-Use Property Exchange Addendum: For individuals involved in tax-free exchanges concerning mixed-use properties, which combine both residential and commercial elements, this addendum provides specific guidance and clauses. 4. Land Exchange Addendum: This addendum caters to the needs of buyers or sellers engaged in tax-free exchanges solely involving vacant land or undeveloped properties. By utilizing the Wake North Carolina Exchange Addendum to Contract — Tax Free Exchange Section 1031, individuals or entities can take advantage of this valuable tax strategy, deferring taxes on capital gains and potentially increasing their investment portfolios.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Anexo de cambio al contrato - Sección de cambio libre de impuestos 1031 - Exchange Addendum to Contract - Tax Free Exchange Section 1031

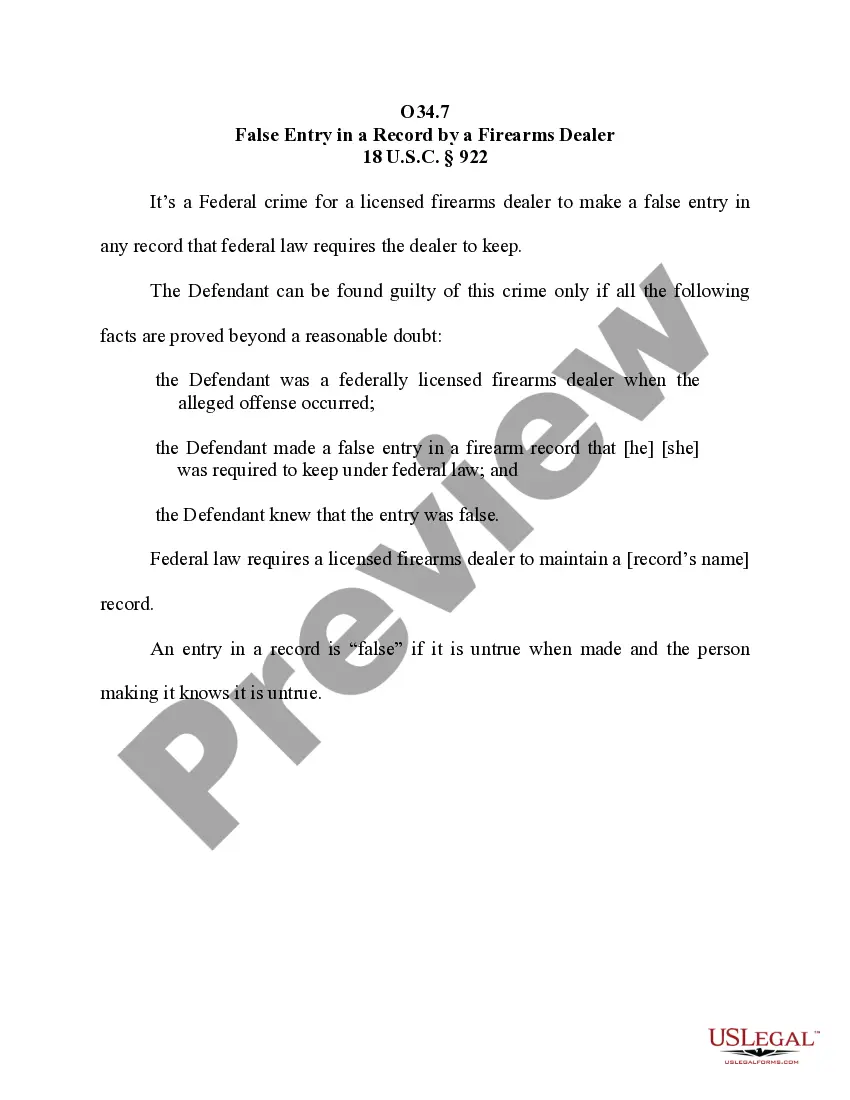

Description

How to fill out Wake North Carolina Anexo De Cambio Al Contrato - Sección De Cambio Libre De Impuestos 1031?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Wake Exchange Addendum to Contract - Tax Free Exchange Section 1031.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Wake Exchange Addendum to Contract - Tax Free Exchange Section 1031 will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Wake Exchange Addendum to Contract - Tax Free Exchange Section 1031:

- Ensure you have opened the proper page with your regional form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form corresponds to your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Wake Exchange Addendum to Contract - Tax Free Exchange Section 1031 on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!