Collin Texas Corporation — Transfer of Stock is a legal process that involves the sale and transfer of ownership of stock shares in a company based in Collin County, Texas. This procedure enables individuals or entities to transfer their ownership interest in the corporation to another party. The Collin Texas Corporation — Transfer of Stock is a significant component of the corporate governance structure, allowing shareholders to buy, sell, or gift their stock holdings. This transaction involves various steps and legal documentation to ensure a smooth and legitimate transfer of ownership. There are a few different types of Collin Texas Corporation — Transfer of Stock, including: 1. Direct Transfer: This type of transfer occurs when an existing shareholder directly sells or transfers their stock shares to another party. It involves filling out and submitting the appropriate transfer forms to the corporation, ensuring all necessary details and signatures are provided. 2. Gift Transfer: In certain cases, an owner may choose to gift their stock shares to another individual or organization. This type of transfer often requires additional documentation, such as a gift letter and proper valuation of the stock being transferred. 3. Inheritance Transfer: When a shareholder passes away, their stock shares may be passed on to their heirs or beneficiaries as part of their estate. This type of transfer typically involves legal processes, such as probate or estate settlement, to ensure a smooth transfer of ownership. 4. Merger or Acquisition Transfer: In the event of a merger, acquisition, or consolidation involving the Collin Texas Corporation, the transfer of stock may occur as part of the overall transaction. This type of transfer is usually coordinated and approved by the company's board of directors and may require the involvement of legal and financial advisors. It is important to consult with legal and financial professionals when conducting a Collin Texas Corporation — Transfer of Stock to ensure all legal requirements and regulations are followed. This helps safeguard the interests of both the buyer and the seller and ensures a valid transfer of ownership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Corporación - Transferencia de Acciones - Corporation - Transfer of Stock

Description

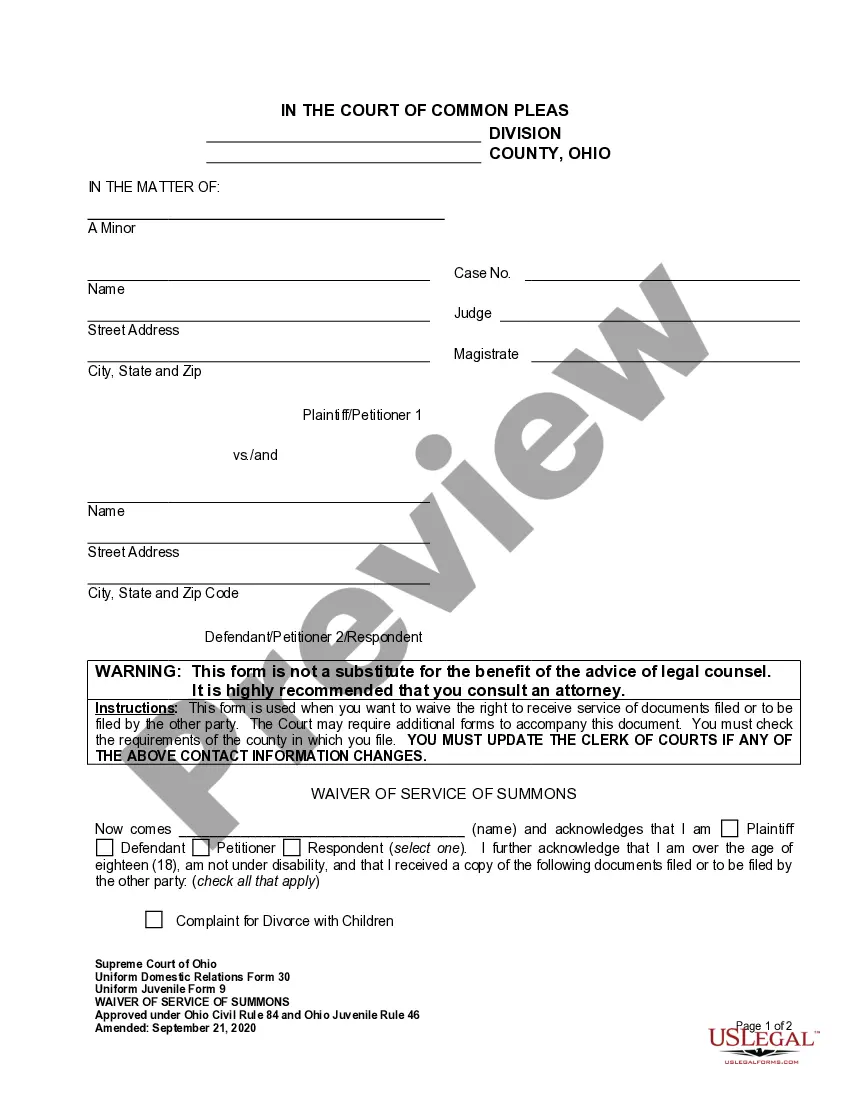

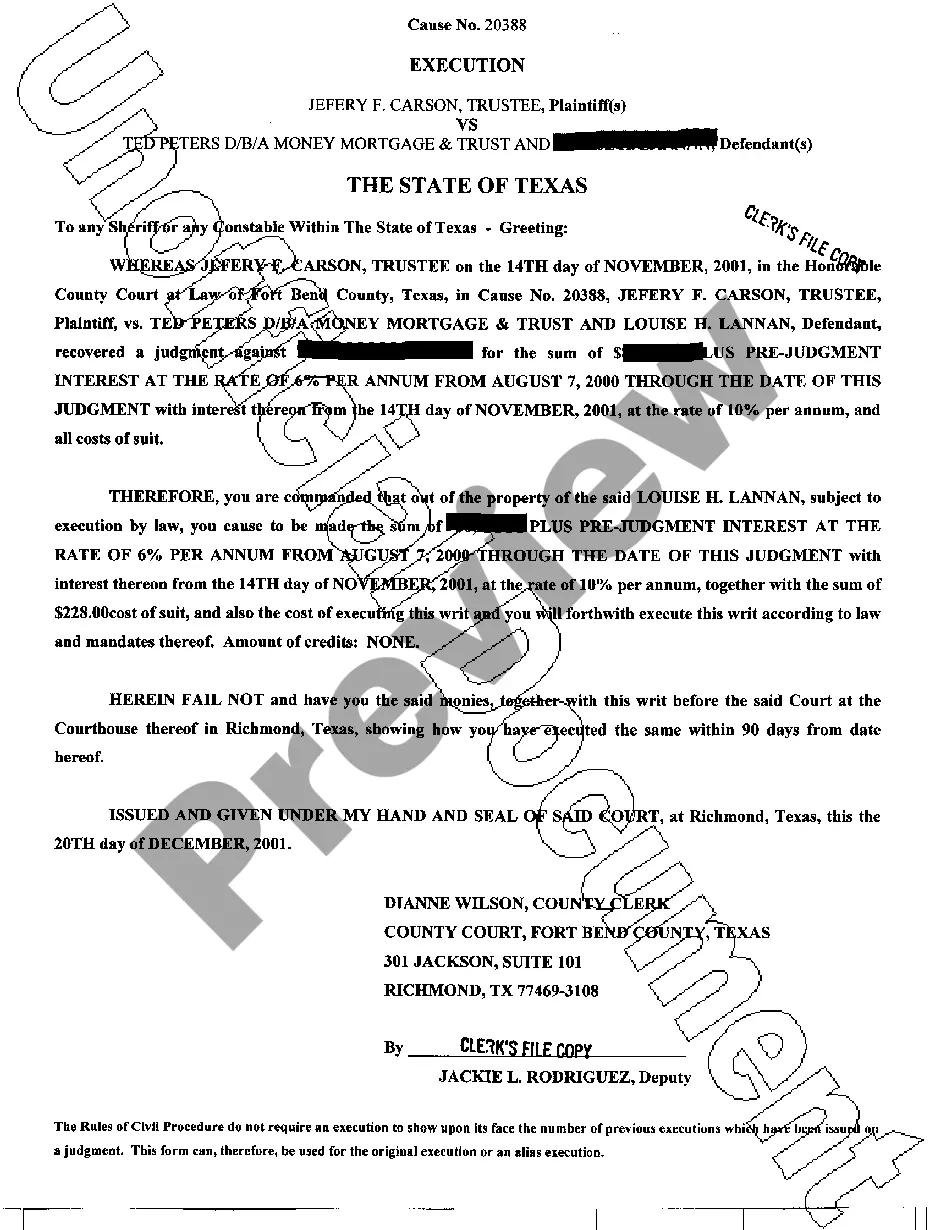

How to fill out Collin Texas Corporación - Transferencia De Acciones?

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life sphere, locating a Collin Corporation - Transfer of Stock meeting all regional requirements can be stressful, and ordering it from a professional attorney is often expensive. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. In addition to the Collin Corporation - Transfer of Stock, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Collin Corporation - Transfer of Stock:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Collin Corporation - Transfer of Stock.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!