Franklin Ohio Corporation is a prominent entity in the state of Ohio, primarily engaged in various business activities ranging from manufacturing to services. When it comes to the transfer of stock within the corporation, several types of transactions exist, each serving different purposes. 1. Intercompany Transfer of Stock: This type of transfer involves the movement of shares between various subsidiaries or affiliated companies within the Franklin Ohio Corporation. Such transfers help consolidate ownership, streamline operations, or facilitate efficient resource allocation among different entities under the corporation's umbrella. 2. Individual Transfer of Stock: This type of transfer occurs when a shareholder, who owns stock in Franklin Ohio Corporation, decides to sell or transfer their shares to another individual or entity. This could be an outright sale to an interested buyer or a donation to a charitable organization or an heir. Stock transfers of this nature require proper documentation and adherence to regulatory guidelines. 3. Employee Stock Ownership Plan (ESOP): Franklin Ohio Corporation may establish an ESOP, where company shares are transferred to the employees as part of their compensation package. Sops are intended to motivate employees, foster a sense of ownership, and align the workforce's interests with the corporation's success. The transfer of stock in an ESOP is driven by specific rules and regulations set forth by the Employee Retirement Income Security Act (ERICA). 4. Merger or Acquisition: If Franklin Ohio Corporation merges with another company or is acquired by a new entity, the transfer of stock is often a crucial aspect of such transactions. Shareholders from both companies may need to transfer their existing shares to the newly formed entity in exchange for stock or cash, depending on the terms of the merger or acquisition. 5. Inheritance or Estate Planning: Stock transfer can also occur due to the transferor's demise, where their shares in the corporation are transferred to their heirs or beneficiaries as per the provisions of the will or applicable inheritance laws. Franklin Ohio Corporation — Transfer of Stock for estate planning purposes involves legal proceedings and documentation to ensure a smooth transfer of ownership. 6. Stock Gifting: Franklin Ohio Corporation may allow shareholders to gift their stock holdings to individuals or charitable organizations. The transfer can be made to family members, friends, or even institutions, aligning with the shareholder's philanthropic objectives. In summary, Franklin Ohio Corporation administers various types of stock transfers, including intercompany transfers, individual transactions, Sops, mergers/acquisitions, inheritance-related transfers, and gifting. Each type requires careful consideration of legal, financial, and regulatory aspects to facilitate smooth transfers and ensure compliance with applicable laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Corporación - Transferencia de Acciones - Corporation - Transfer of Stock

Description

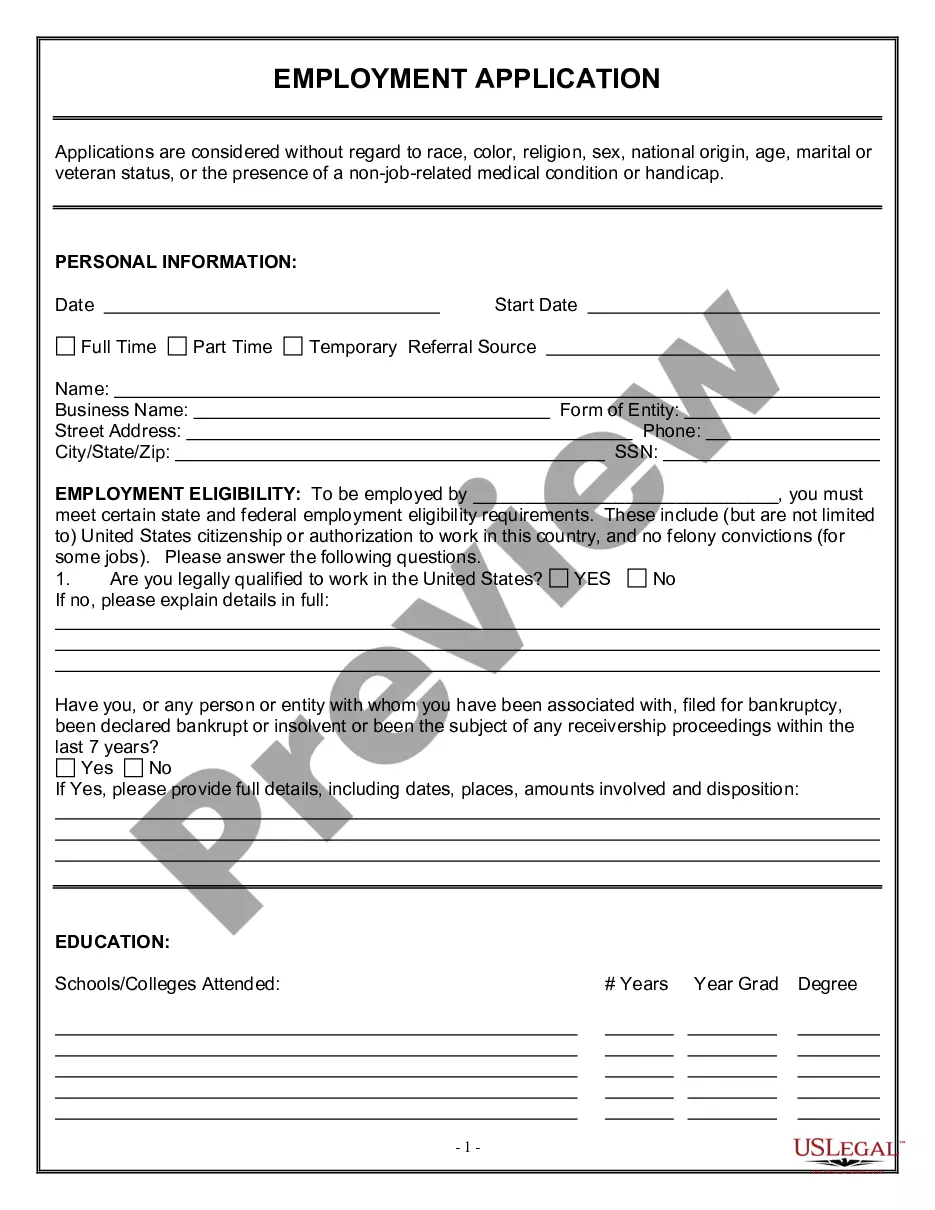

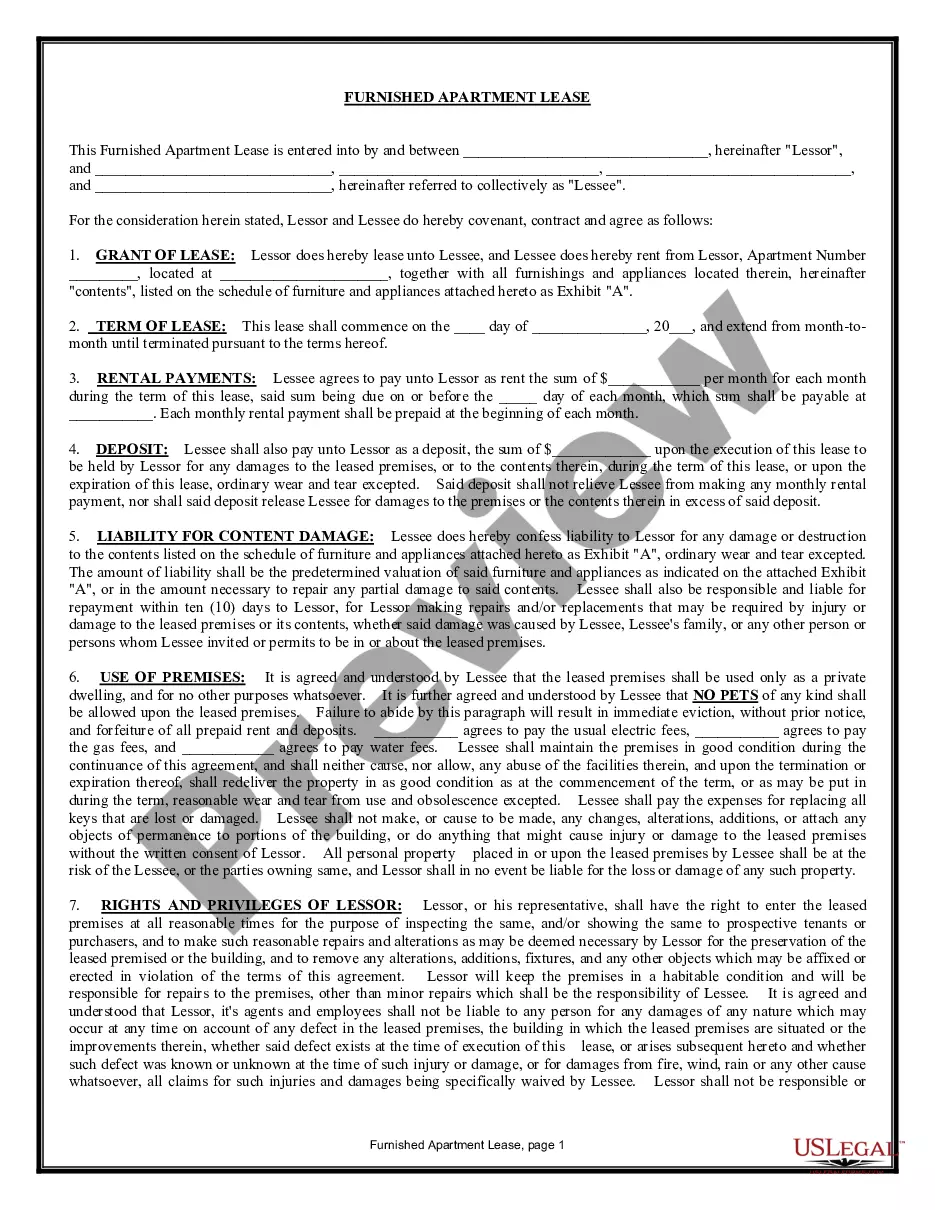

How to fill out Franklin Ohio Corporación - Transferencia De Acciones?

Creating forms, like Franklin Corporation - Transfer of Stock, to take care of your legal matters is a tough and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for a variety of cases and life circumstances. We ensure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Franklin Corporation - Transfer of Stock template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Franklin Corporation - Transfer of Stock:

- Ensure that your form is compliant with your state/county since the rules for writing legal papers may differ from one state another.

- Learn more about the form by previewing it or reading a brief description. If the Franklin Corporation - Transfer of Stock isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to start utilizing our website and download the form.

- Everything looks good on your side? Click the Buy now button and select the subscription option.

- Select the payment gateway and type in your payment details.

- Your template is ready to go. You can try and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!