Miami-Dade Florida Corporation — Transfer of Stock: Explained and Types The process of transferring stocks within a Miami-Dade Florida Corporation involves the exchange of ownership in the form of shares from one party to another. This transaction may occur due to various reasons such as investment diversification, change in ownership structure, or implementation of strategic partnerships. Understanding the intricacies of the Miami-Dade Florida Corporation — Transfer of Stock is essential for both shareholders and potential investors. When initiating the transfer of stock within a Miami-Dade Florida Corporation, certain key steps must be followed. These steps ensure a smooth and legally compliant process. Firstly, the shareholder initiating the transfer must communicate their intent to the corporation's board of directors. This communication typically includes the number of shares they wish to transfer and the name of the prospective buyer. The board of directors reviews and approves the transfer, ensuring it aligns with the corporation's bylaws and governing regulations. Upon approval, both the selling and buying parties engage in negotiations to determine the stock's value and the terms of the transaction. It is common to involve financial advisors or brokers during this process to facilitate fair valuations. Once agreed upon, a stock purchase agreement is drafted, detailing the terms, purchase price, and any restrictions or conditions associated with the transfer. To complete the Miami-Dade Florida Corporation — Transfer of Stock, the parties must execute the stock purchase agreement. This involves signing and notarizing the document, ensuring document authenticity and legal validity. Additionally, the transfer must be recorded in the corporation's stock ledger and registered with appropriate regulatory authorities. Several types of Miami-Dade Florida Corporation — Transfer of Stock exist, each catering to different scenarios and requirements. These types include: 1. Interviews Transfer: An interviews transfer refers to the transfer of stock between living individuals. This commonly occurs when shareholders decide to sell or gift their shares to someone else while they are still alive. 2. Testamentary Transfer: Testamentary transfer takes place upon the death of a shareholder. The deceased shareholder's stock is transferred to beneficiaries or heirs according to their will or applicable inheritance laws. 3. Voluntary Transfer: A voluntary transfer happens when a shareholder willingly decides to transfer their shares to another party. This may occur due to personal reasons, financial considerations, or strategic decision-making. 4. Involuntary Transfer: Involuntary transfers occur when a shareholder's stocks are transferred without their consent or against their will. This usually takes place in cases of bankruptcy, legal judgments, or government enforcement actions. Understanding the Miami-Dade Florida Corporation — Transfer of Stock and its various types is crucial for investors, shareholders, and potential buyers. Engaging legal and financial professionals during the transfer process ensures compliance with regulations and facilitates a seamless and secure transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Corporación - Transferencia de Acciones - Corporation - Transfer of Stock

State:

Multi-State

County:

Miami-Dade

Control #:

US-00480

Format:

Word

Instant download

Description

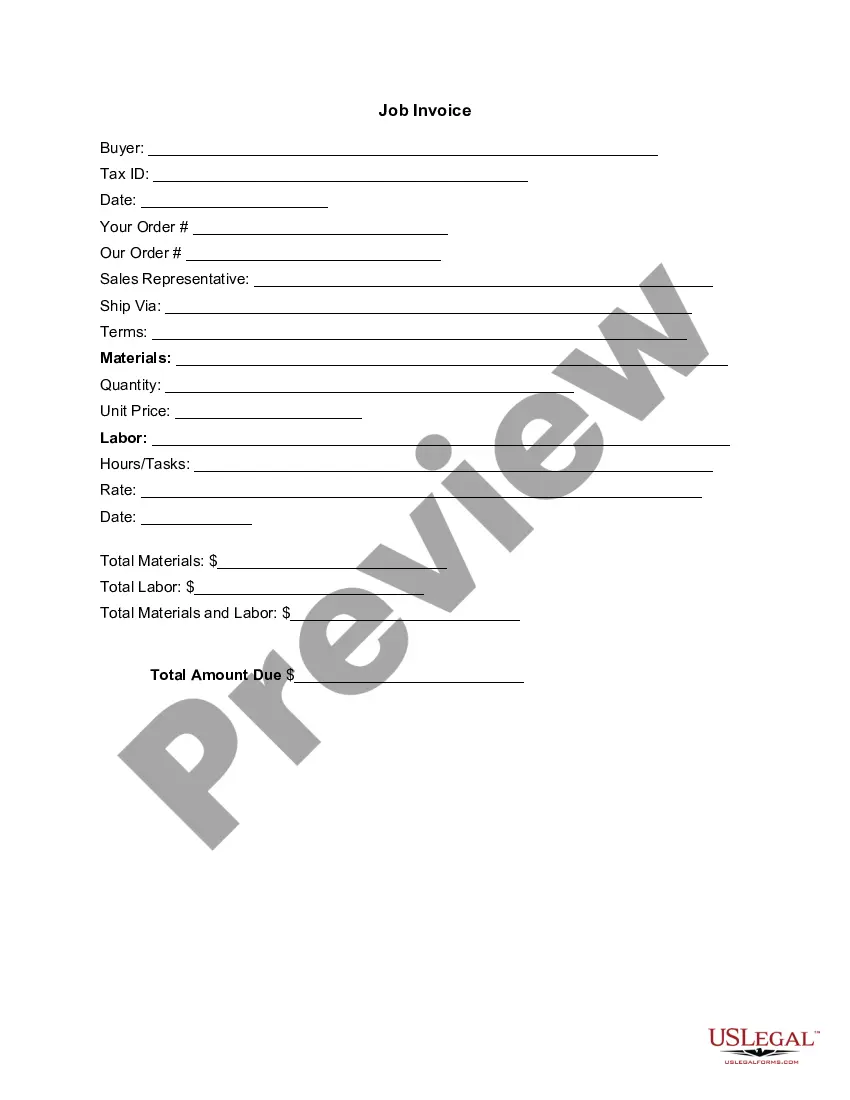

This Corporation - Transfer of Stock agreement is where the Transferor sells, transfers, assigns, and transfers unto a person or entity a certain number of shares of stock of the described Corporation and appoints an attorney-in-fact to transfer the shares on the books of the corporation. This agreement can be used in all states.

Miami-Dade Florida Corporation — Transfer of Stock: Explained and Types The process of transferring stocks within a Miami-Dade Florida Corporation involves the exchange of ownership in the form of shares from one party to another. This transaction may occur due to various reasons such as investment diversification, change in ownership structure, or implementation of strategic partnerships. Understanding the intricacies of the Miami-Dade Florida Corporation — Transfer of Stock is essential for both shareholders and potential investors. When initiating the transfer of stock within a Miami-Dade Florida Corporation, certain key steps must be followed. These steps ensure a smooth and legally compliant process. Firstly, the shareholder initiating the transfer must communicate their intent to the corporation's board of directors. This communication typically includes the number of shares they wish to transfer and the name of the prospective buyer. The board of directors reviews and approves the transfer, ensuring it aligns with the corporation's bylaws and governing regulations. Upon approval, both the selling and buying parties engage in negotiations to determine the stock's value and the terms of the transaction. It is common to involve financial advisors or brokers during this process to facilitate fair valuations. Once agreed upon, a stock purchase agreement is drafted, detailing the terms, purchase price, and any restrictions or conditions associated with the transfer. To complete the Miami-Dade Florida Corporation — Transfer of Stock, the parties must execute the stock purchase agreement. This involves signing and notarizing the document, ensuring document authenticity and legal validity. Additionally, the transfer must be recorded in the corporation's stock ledger and registered with appropriate regulatory authorities. Several types of Miami-Dade Florida Corporation — Transfer of Stock exist, each catering to different scenarios and requirements. These types include: 1. Interviews Transfer: An interviews transfer refers to the transfer of stock between living individuals. This commonly occurs when shareholders decide to sell or gift their shares to someone else while they are still alive. 2. Testamentary Transfer: Testamentary transfer takes place upon the death of a shareholder. The deceased shareholder's stock is transferred to beneficiaries or heirs according to their will or applicable inheritance laws. 3. Voluntary Transfer: A voluntary transfer happens when a shareholder willingly decides to transfer their shares to another party. This may occur due to personal reasons, financial considerations, or strategic decision-making. 4. Involuntary Transfer: Involuntary transfers occur when a shareholder's stocks are transferred without their consent or against their will. This usually takes place in cases of bankruptcy, legal judgments, or government enforcement actions. Understanding the Miami-Dade Florida Corporation — Transfer of Stock and its various types is crucial for investors, shareholders, and potential buyers. Engaging legal and financial professionals during the transfer process ensures compliance with regulations and facilitates a seamless and secure transaction.