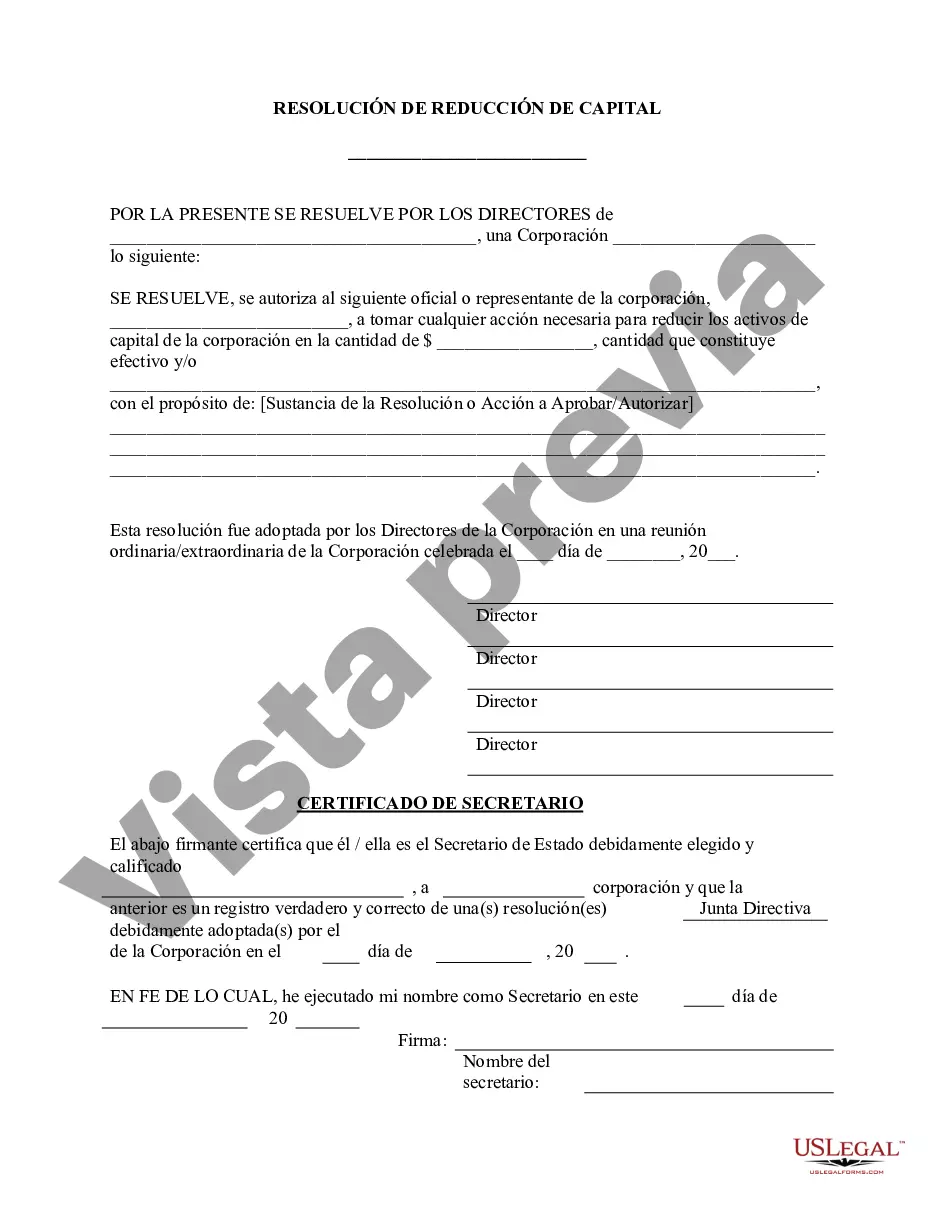

Nassau County, located in the state of New York, is known for its vibrant business environment and rich cultural heritage. Within this county, there are various corporate resolutions types, one of which is the Nassau New York Reduce Capital — ResolutioFormmReducedcCapitalta— - Resolution Form is a crucial document used by corporations operating in Nassau County to legitimize the reduction of their capital investment. This resolution signifies the company's decision to decrease the overall invested capital, which could be due to various reasons such as financial restructuring, strategic reallocation, or regulatory compliance. By executing a Reduce Capital — Resolution Form, corporations ensure transparency and compliance with legal requirements. This document is typically drafted by legal experts or corporate attorneys, adhering to the laws and regulations specific to Nassau County and the state of New York. The form includes comprehensive details such as the company's legal name, identification number, and registered address. It also calls for a detailed explanation of the reasons behind the capital reduction and the proposed amount by which the capital will be reduced. This form may require the approval of the company's board of directors, shareholders, or both, depending on the corporation's bylaws and state regulations. Benefits of using the Nassau New York Reduce Capital — Resolution Form for corporate resolutions include: 1. Legal Compliance: By utilizing this form, corporations ensure compliance with the specific legal requirements applicable to Nassau County and the state of New York. 2. Transparency: The form provides a transparent record of the capital reduction decision, ensuring clarity for all stakeholders involved. 3. Organizational Stability: By reducing capital following proper procedures, companies can strategically reallocate resources and optimize their financial stability. 4. Regulatory Adherence: Adhering to the mandated capital reduction procedures protects the corporation from potential legal or regulatory consequences. Other types of corporate resolutions in Nassau County might include: 1. Nassau New York Increase Capital — Resolution Form: This resolution form is used when corporations intend to increase their capital investment or authorize additional shares issuance. 2. Nassau New York Merger — Resolution Form: This form is utilized when two or more companies plan to merge their operations, assets, and liabilities into a single entity. 3. Nassau New York Appointment of Officers — Resolution Form: This resolution declares the appointment or removal of corporate officers, such as the CEO, CFO, or company secretary, within a corporation. 4. Nassau New York Dissolution — Resolution Form: This form is employed when a corporation decides to terminate its operations, liquidate its assets, and dissolve its legal existence. In conclusion, the Nassau New York Reduce Capital — Resolution Form is a crucial tool for corporations operating in Nassau County, enabling them to legally and transparently reduce their capital investment. Through this form, companies ensure compliance with specific legal requirements while optimizing their financial stability and conducting strategic reallocation. Other notable types of corporate resolutions in Nassau County include the Increase Capital, Merger, Appointment of Officers, and Dissolution forms, each serving different purposes within the corporate landscape.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Reducir Capital - Formulario de Resolución - Resoluciones Societarias - Reduce Capital - Resolution Form - Corporate Resolutions

Description

How to fill out Nassau New York Reducir Capital - Formulario De Resolución - Resoluciones Societarias?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Nassau Reduce Capital - Resolution Form - Corporate Resolutions, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the documents can be used many times: once you obtain a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Nassau Reduce Capital - Resolution Form - Corporate Resolutions from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Nassau Reduce Capital - Resolution Form - Corporate Resolutions:

- Take a look at the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!