Fairfax Virginia Demand for Collateral by Creditor: A Comprehensive Overview Introduction: Fairfax, Virginia is not only recognized as a thriving suburb of Washington, D.C., but it is also home to a myriad of businesses and commercial activities. In the financial world, Fairfax Virginia Demand for Collateral by Creditor serves as a significant legal instrument that allows creditors to secure their interests in cases of default or non-payment by debtors. This article explores the concept of demand for collateral, its importance, and highlights any potential variations or types that may exist within Fairfax, Virginia. Understanding Demand for Collateral by Creditor: Demand for collateral by a creditor is a legal mechanism used to assert a creditor's rights to seize and sell the assets pledged by a debtor as collateral for a loan or credit facility. In Fairfax, Virginia, this practice can be initiated to secure repayment of various types of debts, including personal loans, mortgages, business loans, or credit lines. Why Demand for Collateral is Important: 1. Securing Repayment: Demand for collateral allows creditors to protect their investment in cases where a debtor fails to fulfill their repayment obligations, ensuring that the creditor can recover their funds. 2. Risk Mitigation: By requesting collateral, creditors reduce the risk associated with lending, as they have an alternative avenue to recoup their losses if the debtor defaults. 3. Increasing Borrower Accountability: The existence of a demand for collateral encourages borrowers to take their repayment obligations seriously, ultimately maintaining a healthy credit environment. Types of Fairfax Virginia Demand for Collateral by Creditor: While the concept of demand for collateral remains consistent, its application may vary based on specific contractual agreements or legal frameworks. Some potential types or variations of demand for collateral that may be encountered in Fairfax, Virginia, include: 1. Real Estate Collateral: In cases where a debtor defaults on a mortgage or real estate loan, the creditor can exercise their right to seize the property pledged as collateral. This could involve initiating foreclosure proceedings, followed by a public auction to sell the seized property and recover the outstanding debt. 2. Secured Business Loans: In the case of business loans, creditors may demand collateral in the form of tangible assets such as inventory, equipment, or accounts receivable. In the event of default, the creditor can exercise their rights to seize and liquidate these assets to recover their loaned amount. 3. Personal Loans and Consumer Credit: Individuals seeking personal loans or consumer credit may be required to provide collateral, such as vehicles, jewelry, or even savings accounts. In case of default, the creditor can take possession of the collateral and sell it to satisfy the unpaid debt. Conclusion: Fairfax Virginia Demand for Collateral by Creditor is an essential element in ensuring that creditors have protection in situations where debtors fail to meet their repayment obligations. By providing lenders with a legal avenue to seize and sell pledged assets, this mechanism enables the recovery of loaned amounts, fostering accountability and maintaining a healthy lending environment in Fairfax, Virginia.

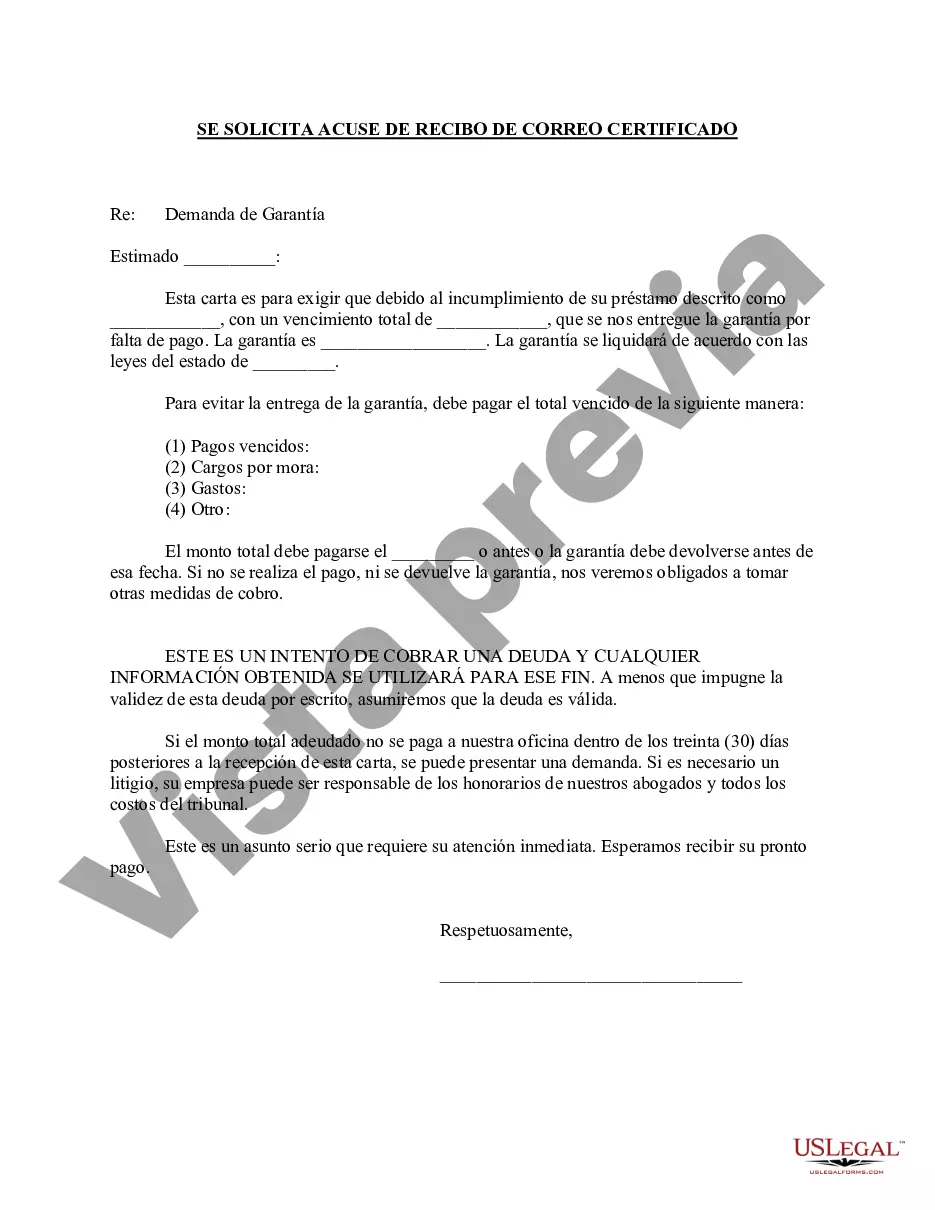

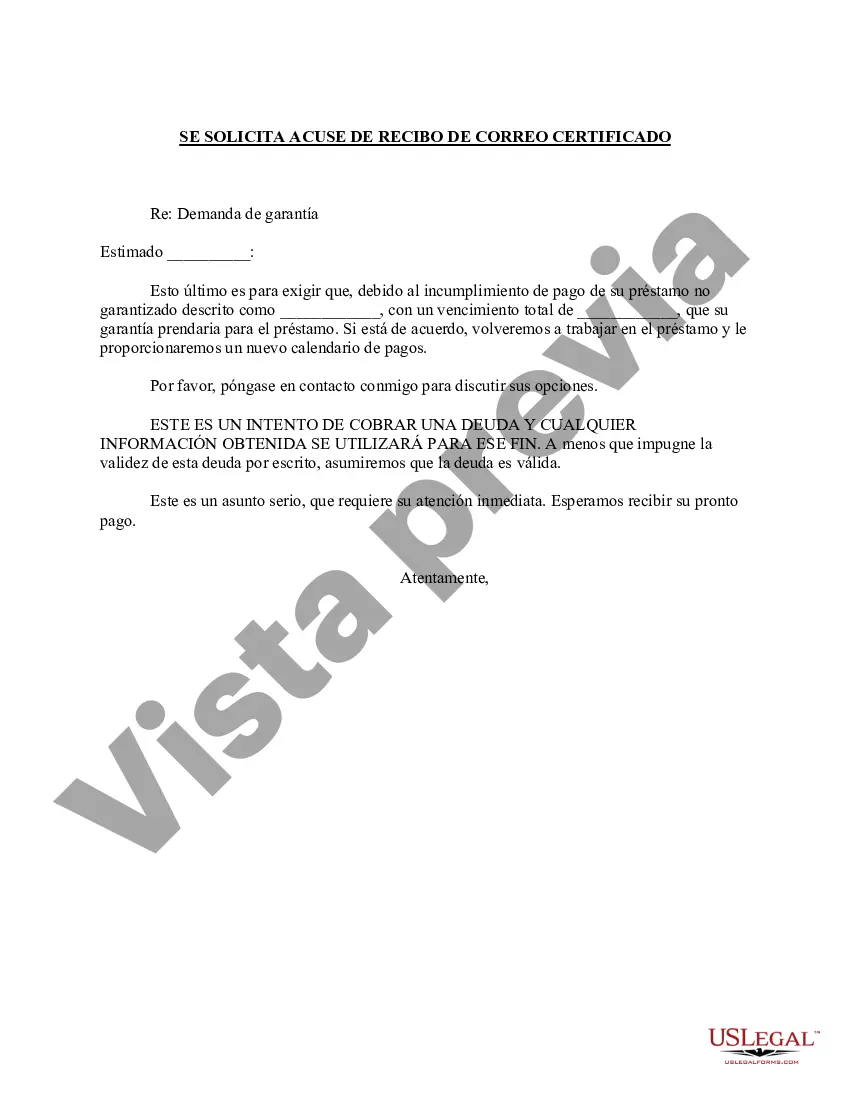

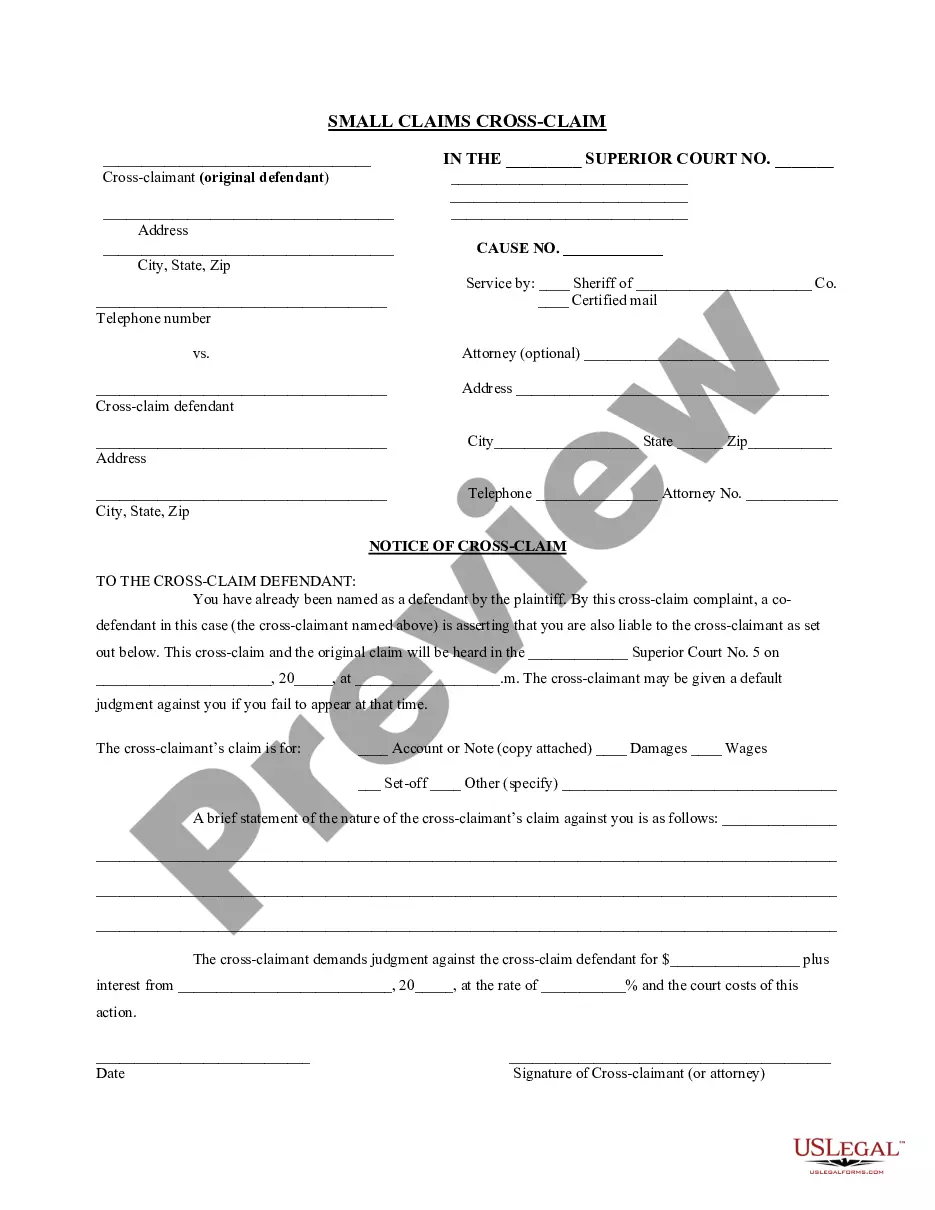

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Demanda de Garantía por Acreedor - Demand for Collateral by Creditor

Description

How to fill out Fairfax Virginia Demanda De Garantía Por Acreedor?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for qualified assistance to draft some of them from the ground up, including Fairfax Demand for Collateral by Creditor, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information resources and guides on the website to make any activities related to paperwork completion straightforward.

Here's how you can find and download Fairfax Demand for Collateral by Creditor.

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can affect the validity of some records.

- Check the similar document templates or start the search over to locate the correct file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment gateway, and purchase Fairfax Demand for Collateral by Creditor.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Fairfax Demand for Collateral by Creditor, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you need to cope with an exceptionally challenging situation, we recommend using the services of a lawyer to examine your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-specific documents effortlessly!