Maricopa, Arizona is a vibrant city located in Pinal County, known for its growing economy and diverse population. Within the realm of financial transactions, one important aspect is the demand for collateral by creditors. In Maricopa, just like in any other region, creditors may have various types of demands for collateral to secure the repayment of loans or debts. Let's explore some different types of Maricopa, Arizona, demand for collateral by creditors: 1. Real Estate Collateral: In many cases, creditors may request real estate as collateral. This can include residential properties, commercial buildings, or raw land. By using real estate as collateral, lenders have a tangible asset that offers security in case the borrower defaults. 2. Vehicle Collateral: Another common type of collateral demanded by creditors in Maricopa is vehicles. Cars, trucks, motorcycles, or recreational vehicles can be pledged as collateral, providing lenders some reassurance if the borrower fails to repay the loan. 3. Personal Property Collateral: Besides real estate and vehicles, creditors may also require personal property as collateral. This can encompass valuable possessions such as jewelry, art collections, electronics, or even high-end appliances. Personal property collateral can vary depending on the particular lending institution and the type of loan being sought. 4. Financial Accounts Collateral: In certain cases, Maricopa creditors may request borrowers to pledge financial accounts as collateral. This can include savings accounts, certificates of deposit (CDs), investment portfolios, or retirement funds. By having control over these assets, creditors have a means to recoup their losses if the borrower defaults. 5. Business Collateral: For entrepreneurs and business owners in Maricopa, creditors may demand collateral related to their business. This can involve commercial real estate, equipment, inventory, or even intellectual property rights. Creditors seek such collateral to mitigate the risks associated with lending to businesses. The specific type of collateral demanded by Maricopa, Arizona creditors can vary depending on the borrower's circumstances, the nature of the loan, and the lending institution's policies. It is essential for borrowers to thoroughly understand the terms and conditions of their loan agreement before pledging any collateral. Additionally, borrowers should consult with legal professionals and financial advisors to ensure they make informed decisions regarding collateral demands.

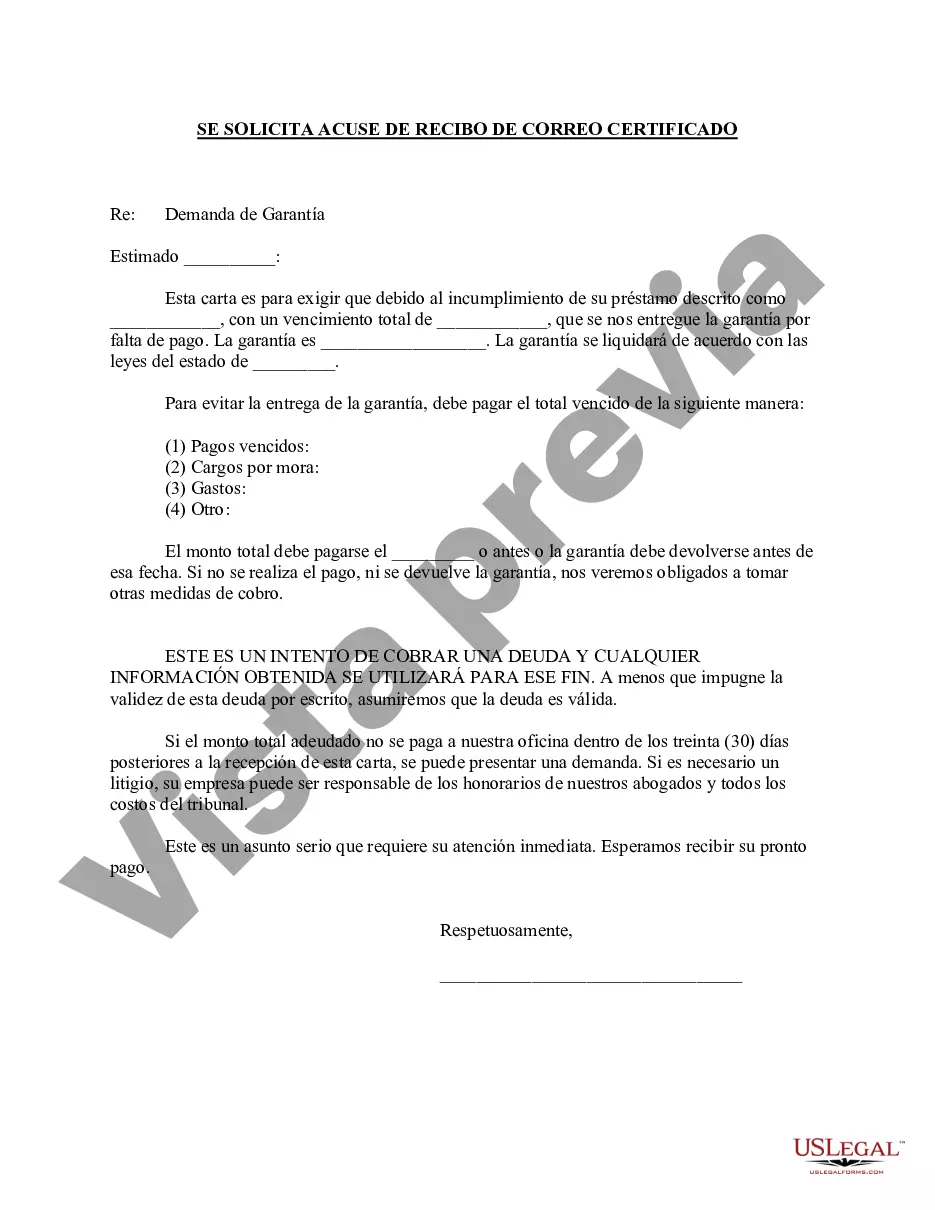

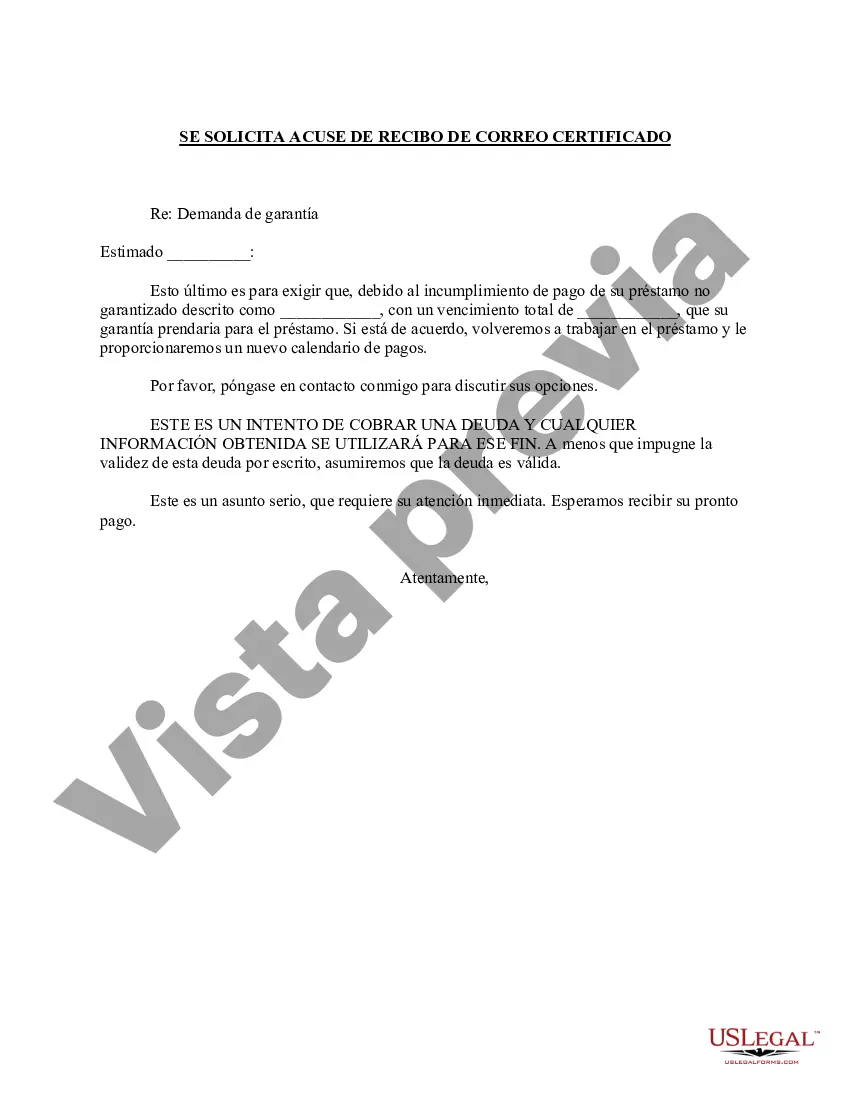

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Demanda de Garantía por Acreedor - Demand for Collateral by Creditor

Description

How to fill out Maricopa Arizona Demanda De Garantía Por Acreedor?

How much time does it usually take you to draft a legal document? Because every state has its laws and regulations for every life situation, finding a Maricopa Demand for Collateral by Creditor meeting all local requirements can be tiring, and ordering it from a professional lawyer is often costly. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, collected by states and areas of use. In addition to the Maricopa Demand for Collateral by Creditor, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Maricopa Demand for Collateral by Creditor:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Maricopa Demand for Collateral by Creditor.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!