San Antonio, Texas Demand for Collateral by Creditor: A Comprehensive Guide In the realm of finance and lending, the concept of collateral is of utmost importance. Collateral refers to an asset or property offered by a borrower to a lender as security in case of default on loan repayments. Should a borrower fail to meet their financial obligations, creditors in San Antonio, Texas have the right to demand collateral to ensure their own protection. San Antonio, the second-largest city in Texas, boasts a vibrant economic landscape and attracts numerous investors and entrepreneurs seeking financial support through loans. To safeguard their interests, creditors in San Antonio often require borrowers to provide collateral to minimize potential risks. Here, we delve into the different types of San Antonio, Texas Demand for Collateral by Creditors and shed light on their significance: 1. Real Estate Collateral: One of the most commonly accepted forms of collateral in San Antonio is real estate. Whether residential or commercial, properties in this bustling city hold substantial market value, making them appealing assets for lenders. Mortgages, property deeds, or other legally binding documents can be demanded by creditors to mitigate potential losses. 2. Vehicle Collateral: Creditors may request vehicles as collateral to secure loans in San Antonio. These vehicles can include cars, trucks, motorcycles, or even recreational vehicles. The value of the vehicle plays a crucial role in determining the amount a lender is willing to provide. 3. Financial Asset Collateral: Lenders also consider financial assets as acceptable collateral in San Antonio. These may include stocks, bonds, mutual funds, or other investment securities. By putting these assets forward, borrowers display their commitment to meeting their financial obligations. 4. Business Asset Collateral: In cases where loans are sought for business-related purposes, creditors may demand collateral in the form of business assets. These can include equipment, inventory, machinery, or intellectual property rights. The specific type of collateral often depends on the nature of the business and its underlying assets. 5. Personal Asset Collateral: Creditors may also consider personal assets such as jewelry, art collections, antiques, or other valuable possessions as collateral in San Antonio. These items can hold substantial worth and provide lenders with added assurance of recovering their funds if necessary. Understanding the demand for collateral by creditors in San Antonio, Texas is crucial for borrowers seeking financial assistance. By comprehending the types of assets creditors commonly accept, borrowers can make informed decisions when seeking loans and negotiate favorable terms. However, it is essential to remember that the specific collateral demanded may vary depending on the lender, loan size, and individual circumstances. In conclusion, San Antonio, Texas Demand for Collateral by Creditors is a critical aspect of the lending process. Creditors often require borrowers to provide collateral to safeguard their investment and minimize potential losses. Various types of collateral, including real estate, vehicles, financial assets, business assets, and personal assets may be demanded by lenders. By understanding these different collateral options, borrowers can approach the lending process with confidence and secure the financing needed for their endeavors in San Antonio, Texas.

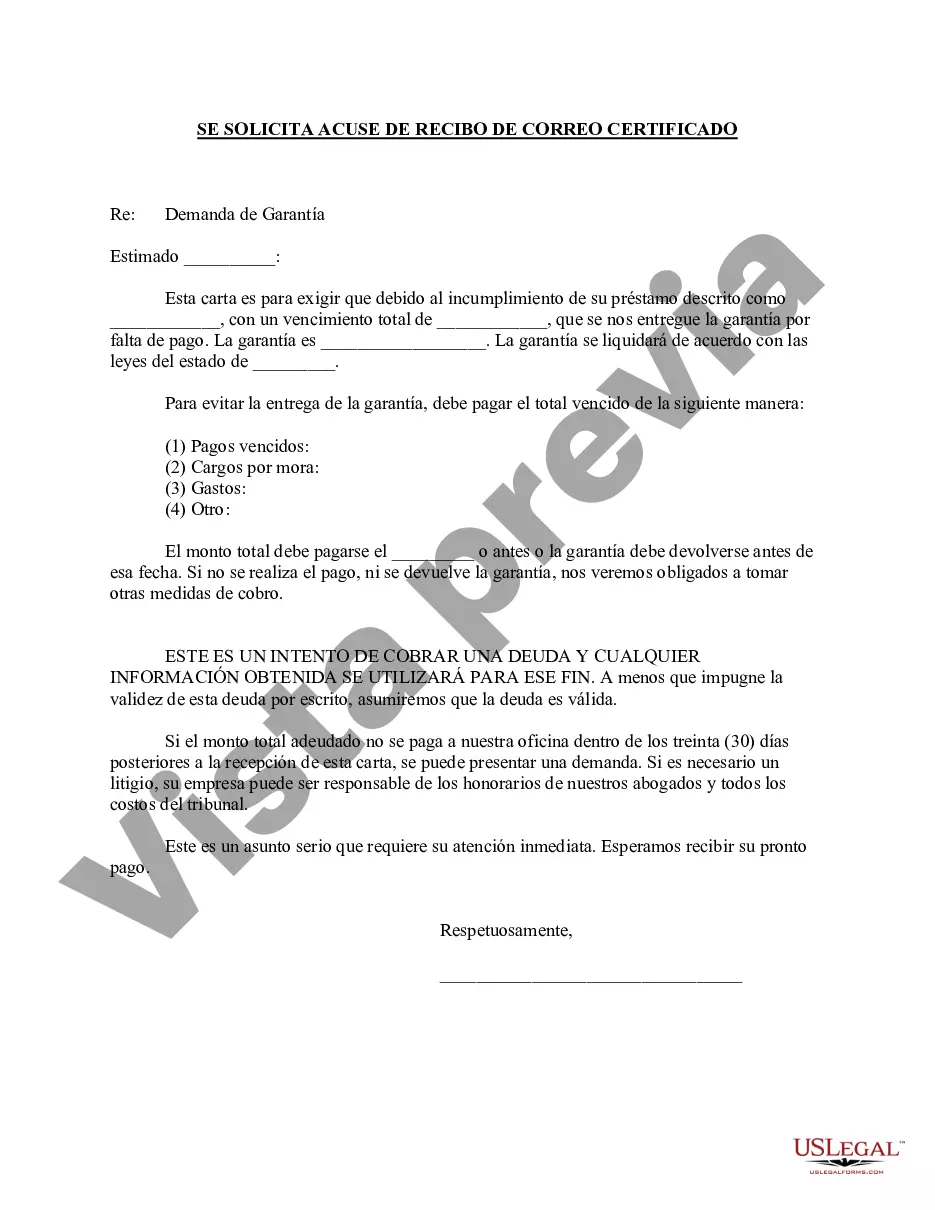

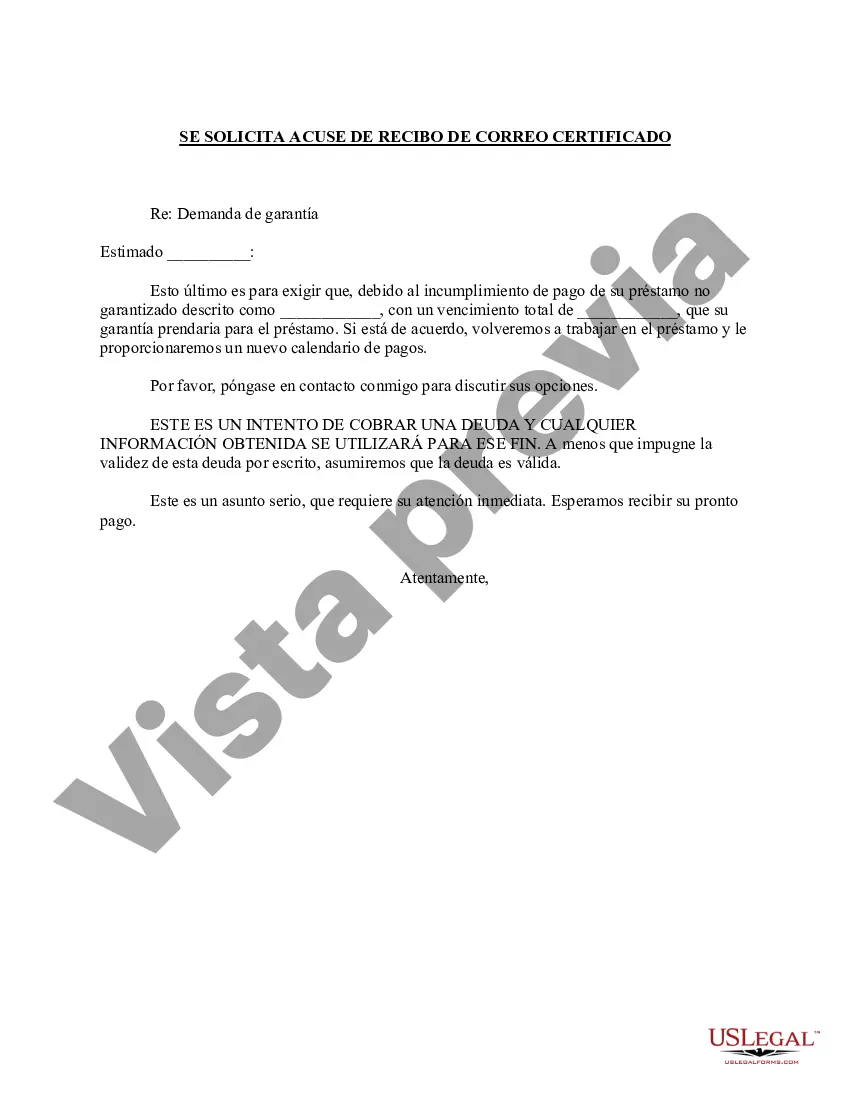

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Demanda de Garantía por Acreedor - Demand for Collateral by Creditor

Description

How to fill out San Antonio Texas Demanda De Garantía Por Acreedor?

Preparing papers for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create San Antonio Demand for Collateral by Creditor without professional help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid San Antonio Demand for Collateral by Creditor by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, follow the step-by-step guide below to get the San Antonio Demand for Collateral by Creditor:

- Examine the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any scenario with just a few clicks!