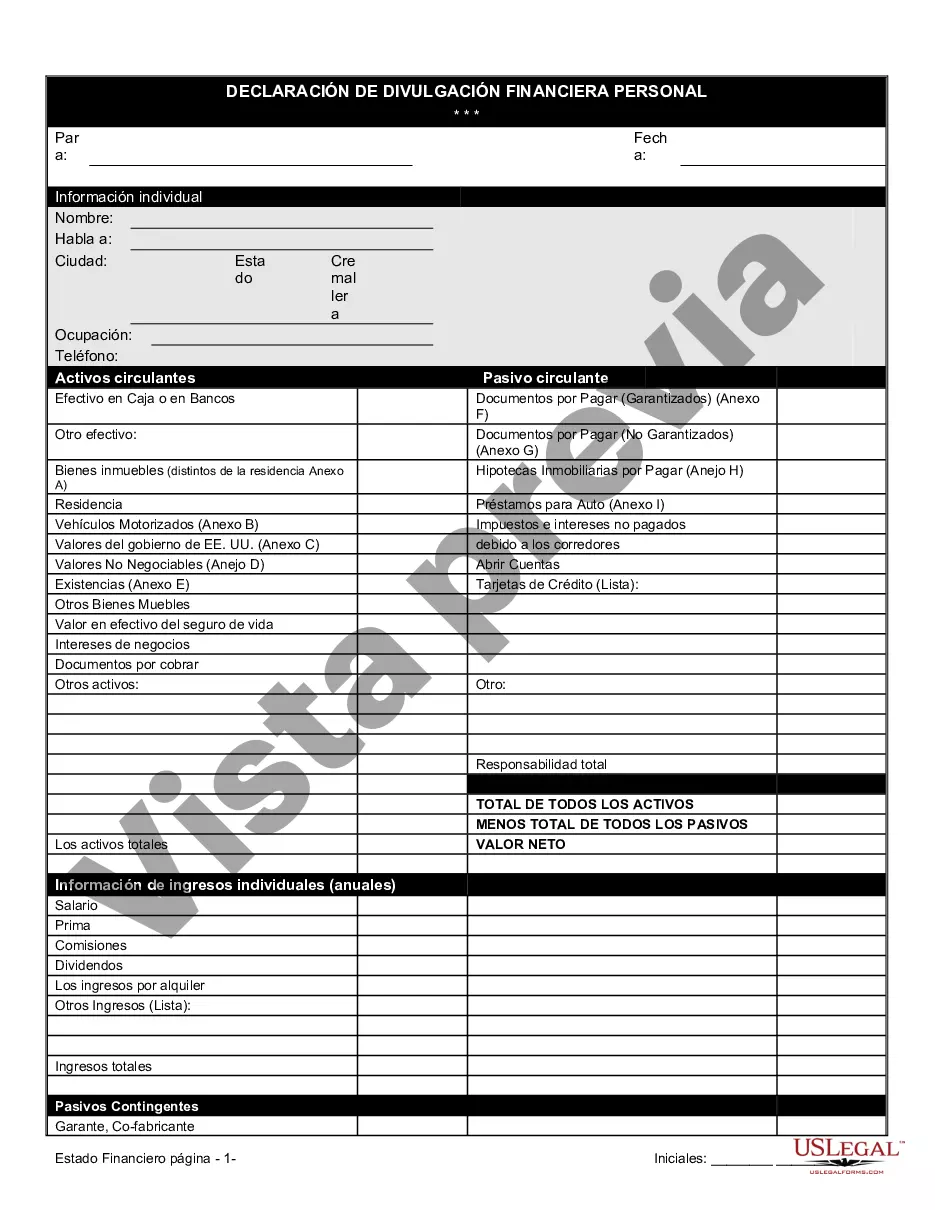

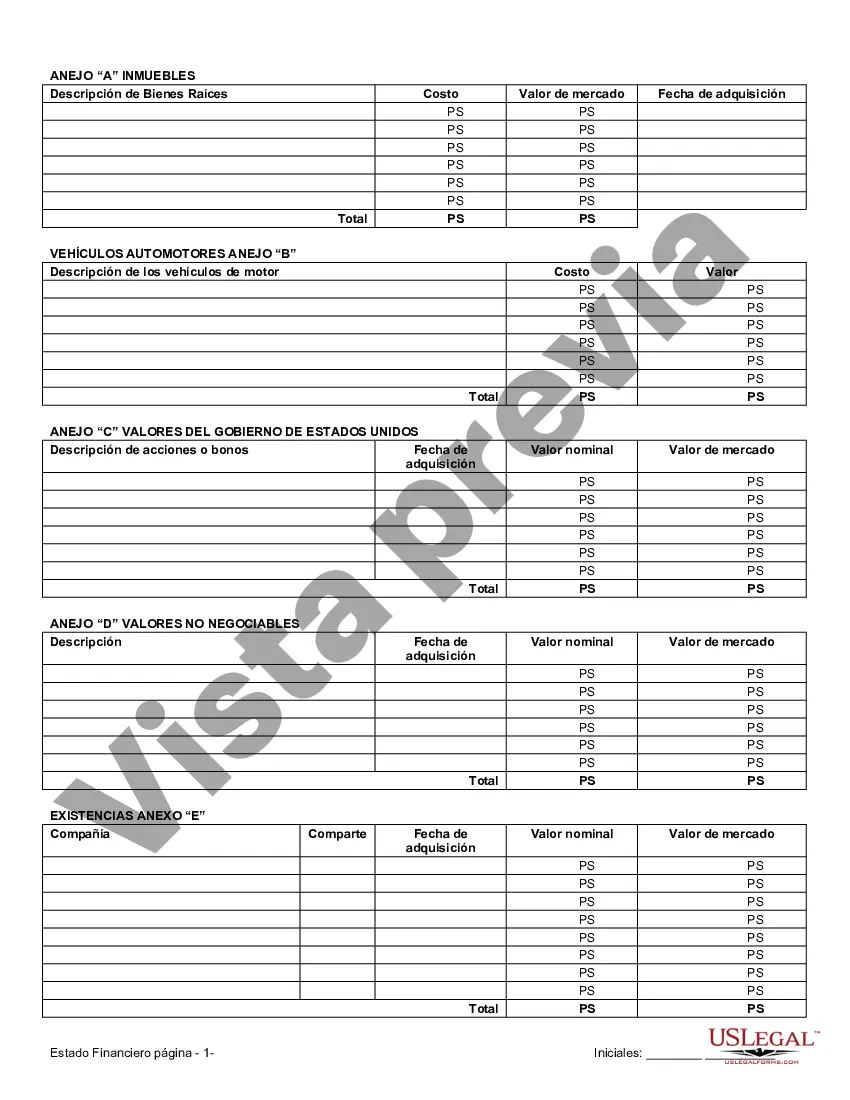

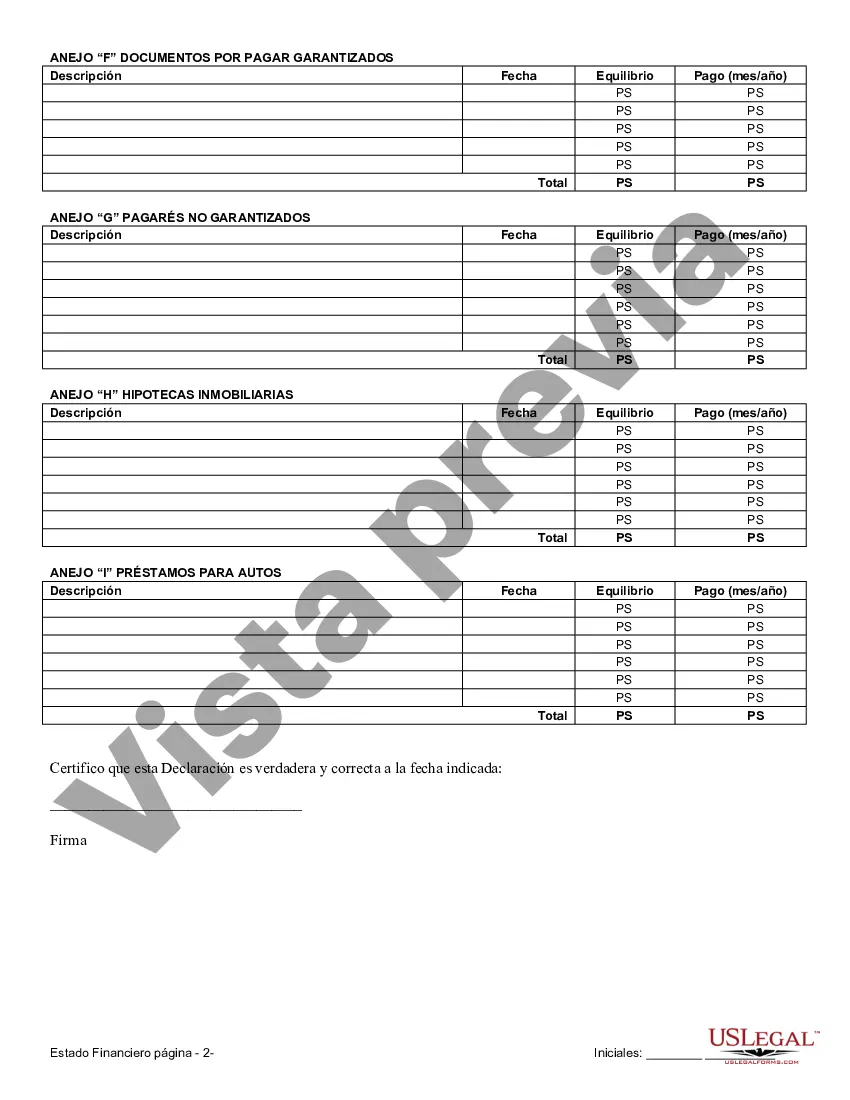

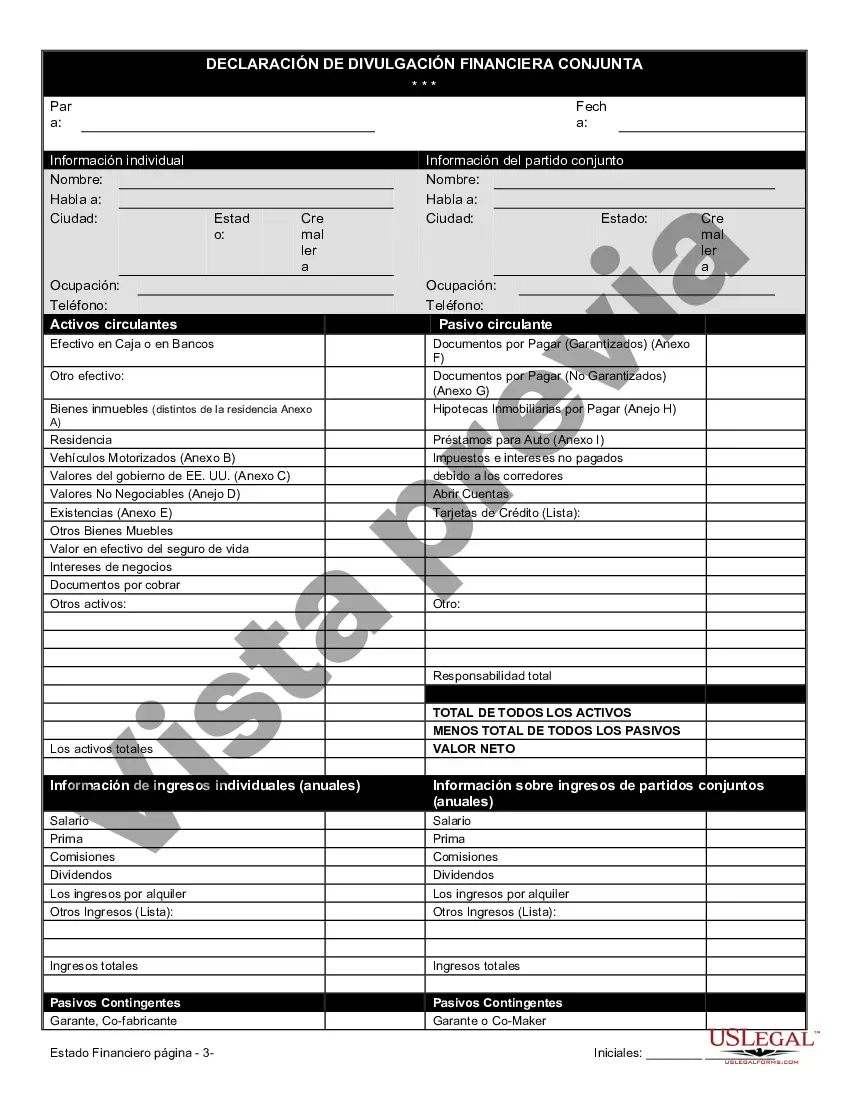

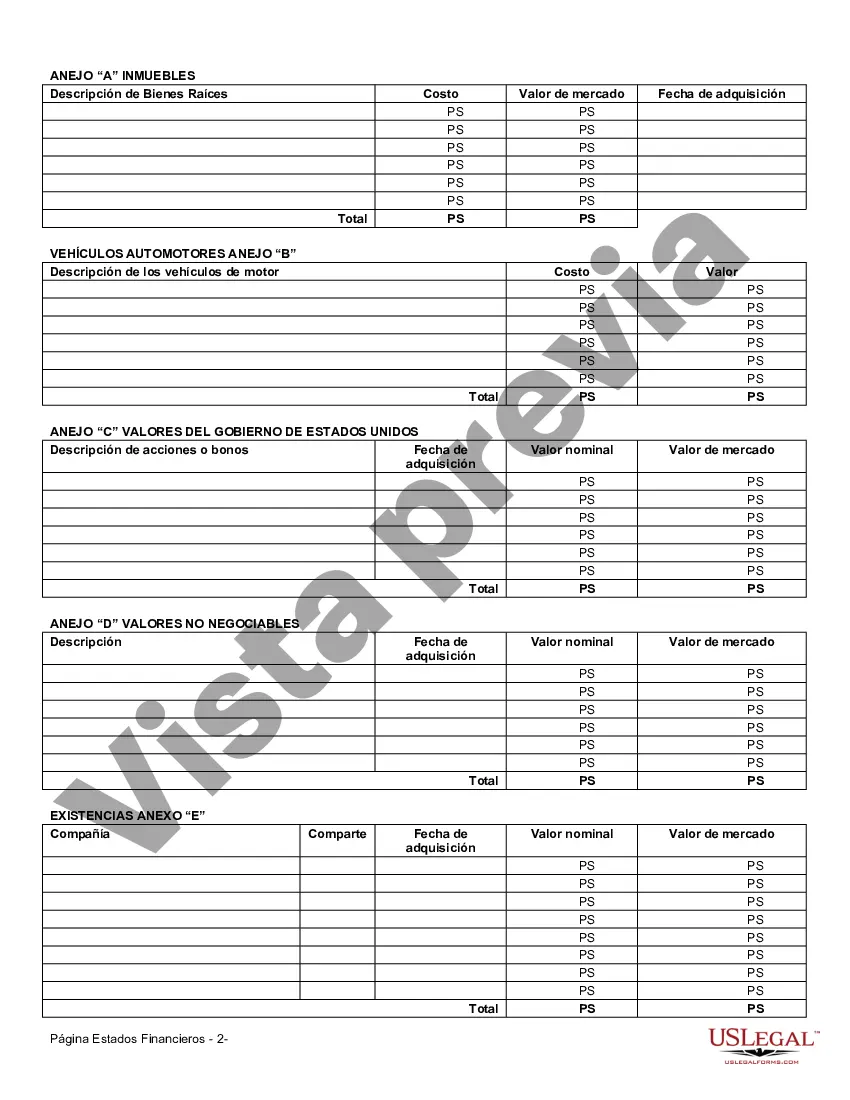

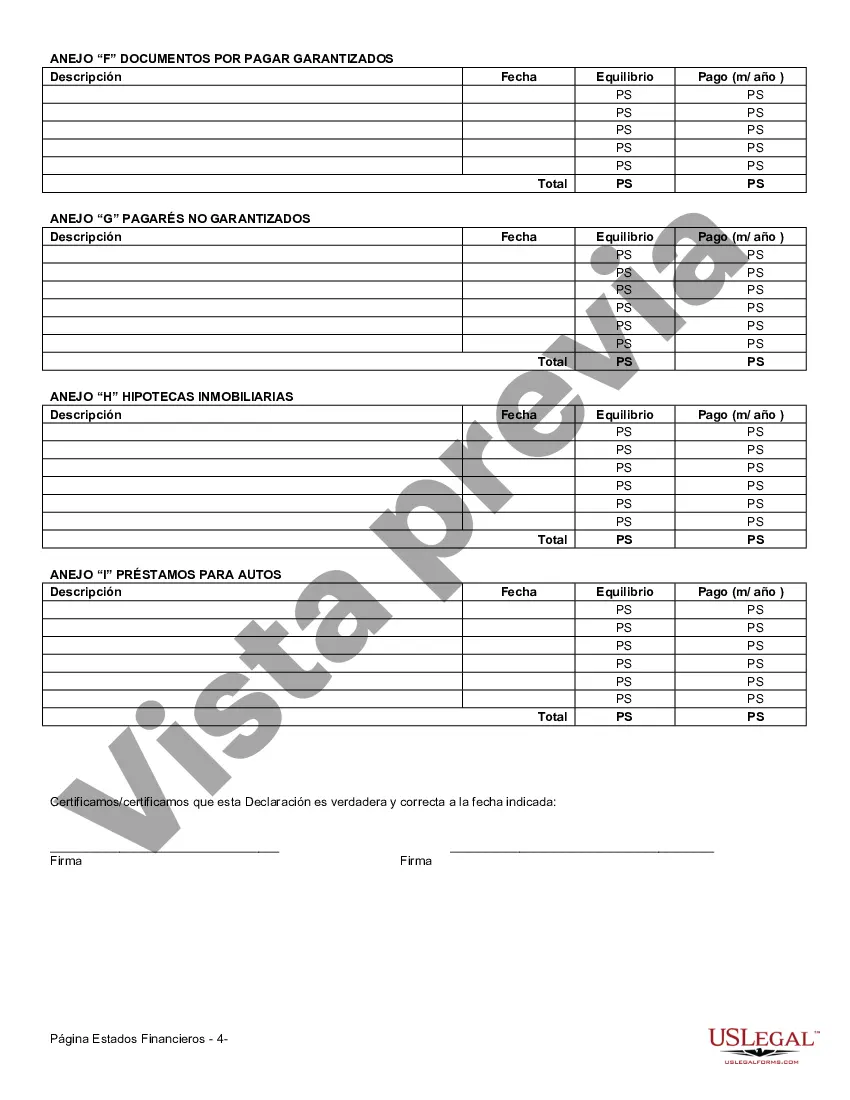

Allegheny Pennsylvania Financial Statement Form — Universal Use is a standardized document designed to assist individuals and businesses in reporting their financial information accurately and comprehensively. This form serves as a crucial tool for various entities, including individuals, small businesses, corporations, non-profit organizations, and partnerships, operating within the jurisdiction of Allegheny County, Pennsylvania. This financial statement form portrays the financial condition and performance of an individual or organization by representing their income, expenses, assets, liabilities, and equity. It enables individuals and entities to present a clear snapshot of their financial affairs and aids in making informed decisions regarding investments, loans, mortgages, taxation, and other financial matters. The Allegheny Pennsylvania Financial Statement Form — Universal Use encompasses several sections, each requiring specific information to be filled in accurately. These sections generally consist of: 1. Personal Information: This section captures personal details like name, address, contact information, social security number or employer identification number (EIN), and tax identification number (TIN) for businesses. 2. Income: The income section entails reporting all sources of revenue, such as wages, business income, rental income, dividends, interest, royalties, and any other miscellaneous earnings. 3. Expenses: In this section, individuals or businesses provide a breakdown of their expenses, including but not limited to mortgage or rent, utilities, insurance premiums, payroll costs, advertising expenses, property taxes, maintenance, and repairs. 4. Assets: Here, individuals or organizations disclose their tangible and intangible assets, including bank accounts, investments, real estate, vehicles, equipment, inventory, intellectual property, and any other assets with significant value. 5. Liabilities: This section outlines all outstanding debts and obligations, such as mortgages, loans, credit card debts, outstanding taxes, lines of credit, and any other liabilities. 6. Equity: The equity section reveals the net worth of an individual or entity and is calculated by subtracting total liabilities from total assets. It includes the initial capital investment, retained earnings, contributed capital, and any other forms of owner's equity. By completing the Allegheny Pennsylvania Financial Statement Form — Universal Use thoroughly and diligently, individuals and organizations can provide a comprehensive overview of their financial status. This detailed report helps lenders, financial institutions, investors, and tax authorities evaluate creditworthiness, verify income, determine tax liabilities, and assess the overall financial health of an individual or business. While there may not be different types of Allegheny Pennsylvania Financial Statement Forms — Universal Use, variations might exist for specific industries or entities. For instance, there could be specific versions, such as Allegheny Pennsylvania Financial Statement Form for Non-Profit Organizations or Allegheny Pennsylvania Financial Statement Form for Small Businesses, tailored to meet the unique reporting requirements of these entities. However, the core structure and purpose of the form remain consistent across these variations, focusing on providing an accurate and comprehensive representation of an organization's or an individual's financial standing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Formulario de estado financiero - Uso universal - Financial Statement Form - Universal Use

Description

How to fill out Allegheny Pennsylvania Formulario De Estado Financiero - Uso Universal?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Allegheny Financial Statement Form - Universal Use, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Therefore, if you need the recent version of the Allegheny Financial Statement Form - Universal Use, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Allegheny Financial Statement Form - Universal Use:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Allegheny Financial Statement Form - Universal Use and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!