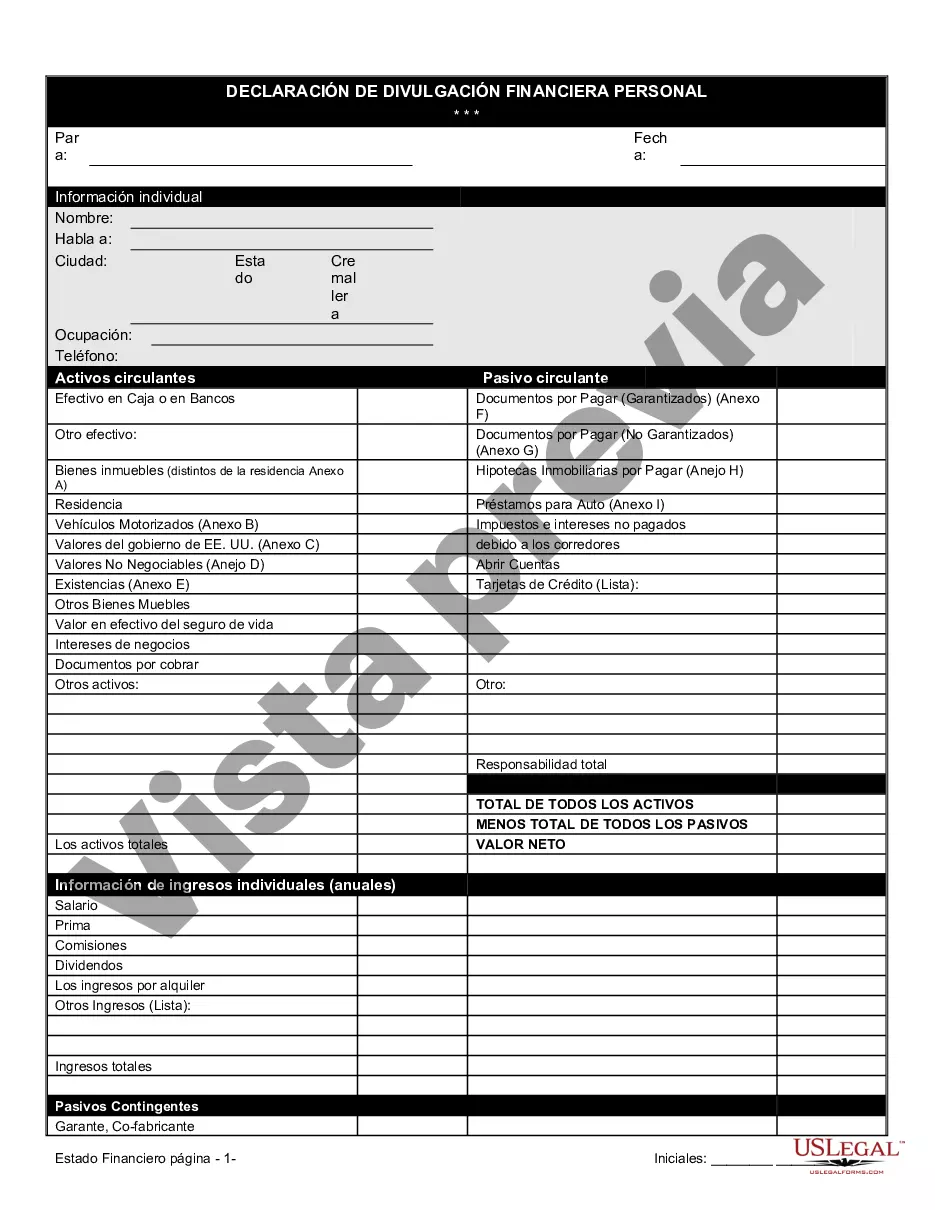

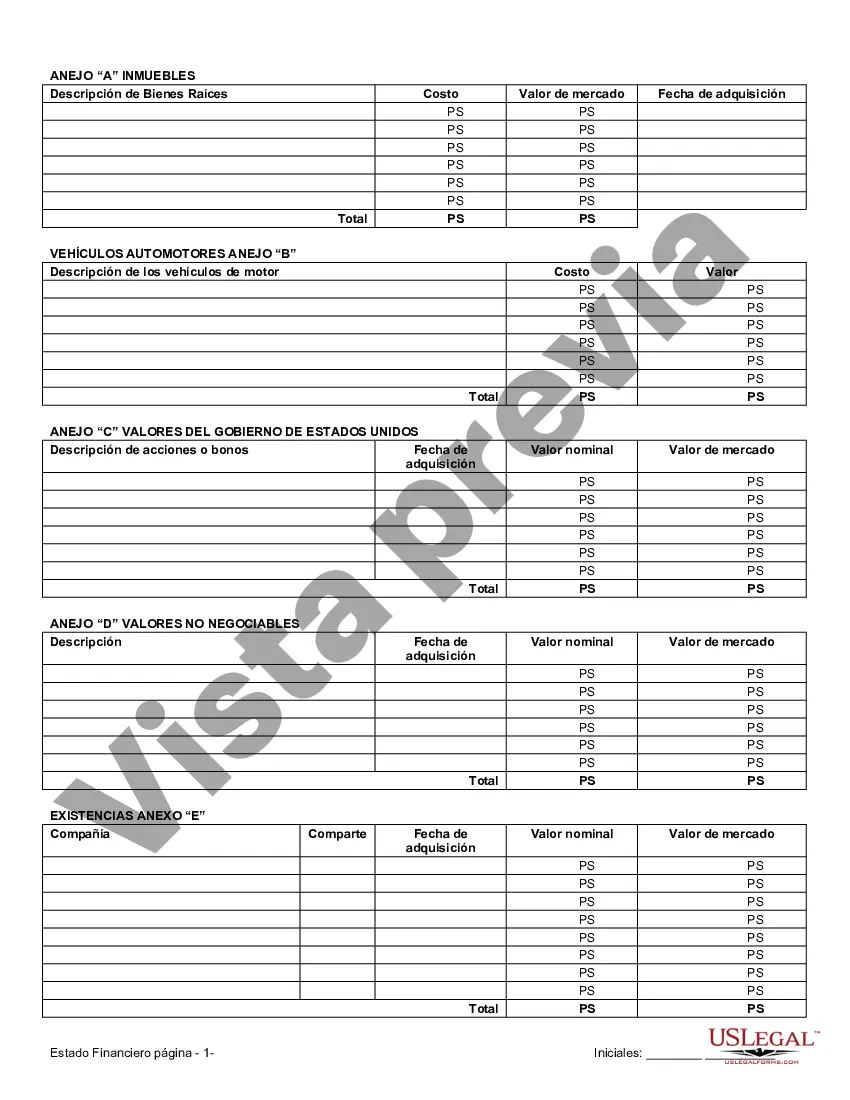

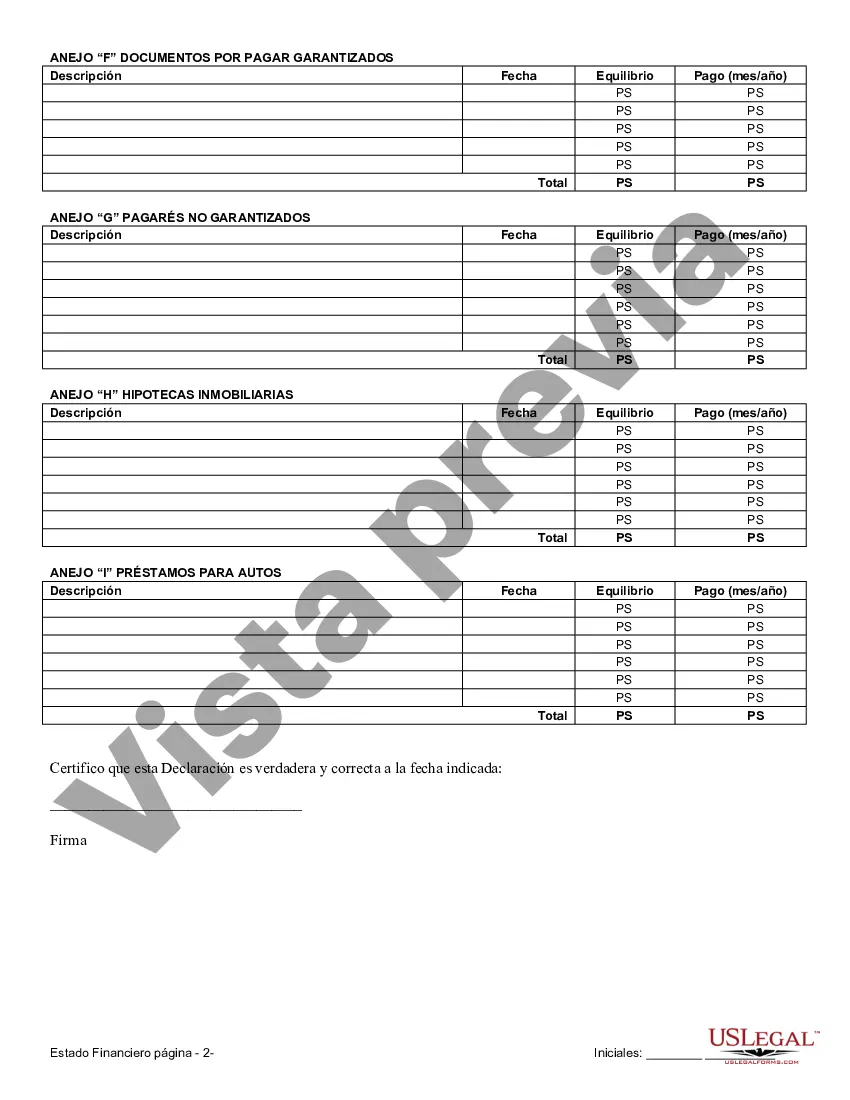

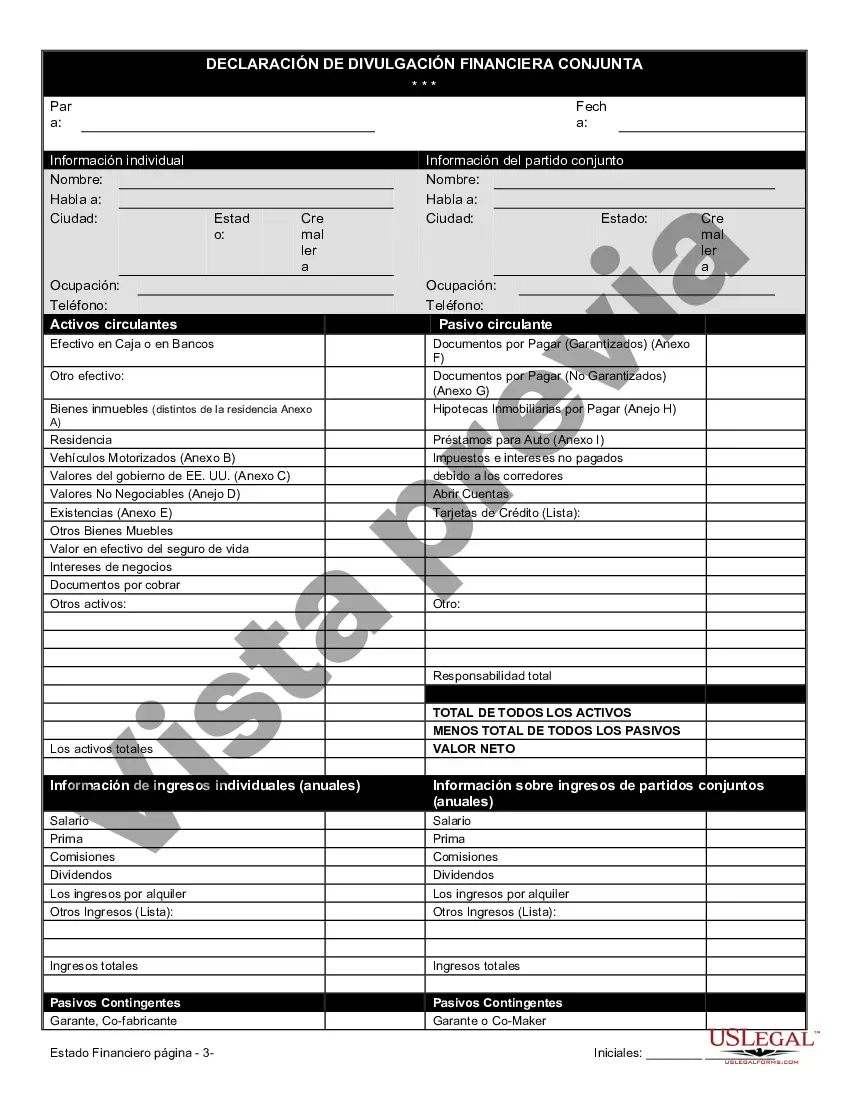

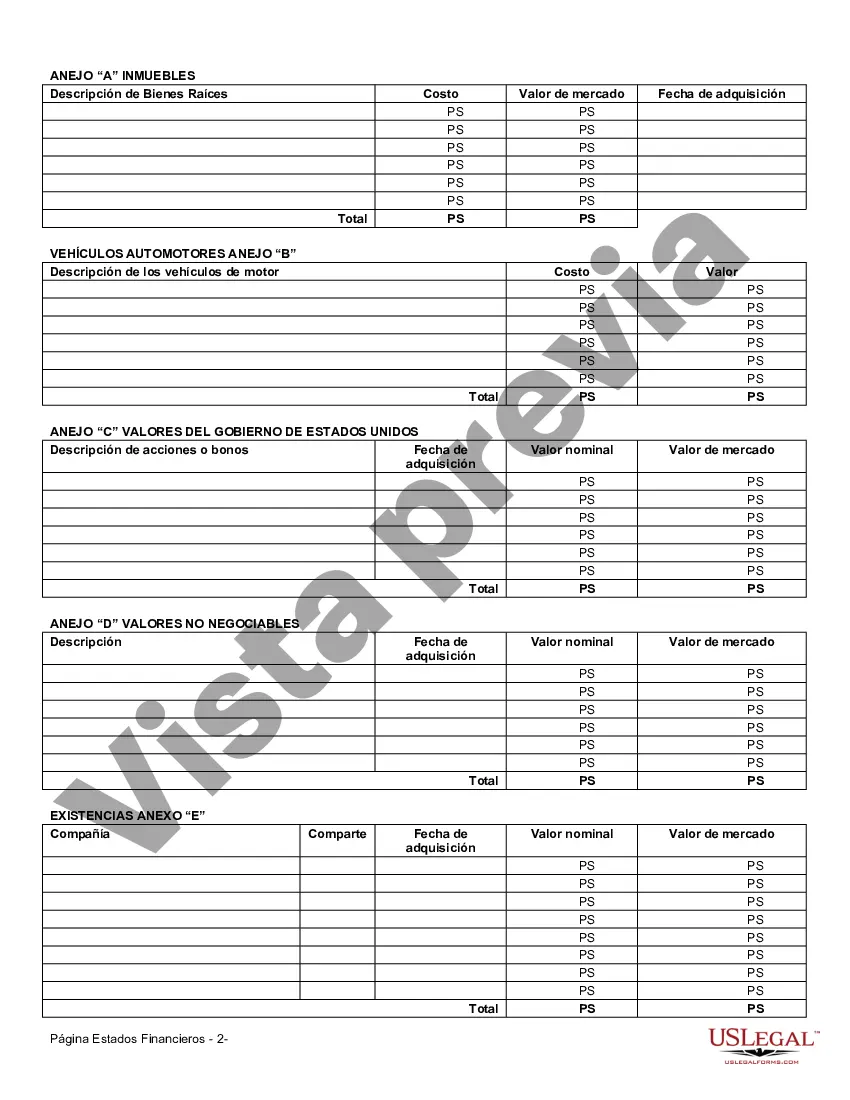

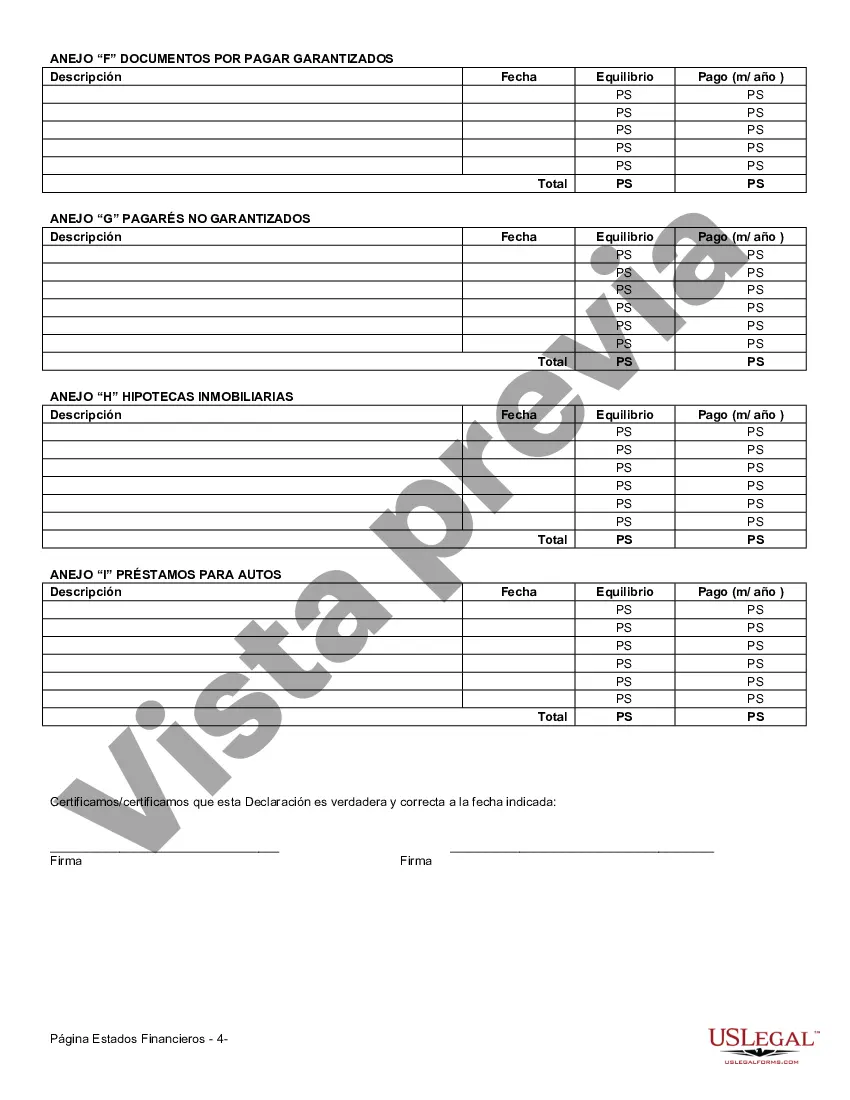

Broward Florida Financial Statement Form — Universal Use is a standardized document designed to capture detailed financial information for individuals and businesses located in Broward County, Florida. This form is primarily used for reporting financial data to various entities such as banks, financial institutions, and government agencies. The Broward Florida Financial Statement Form — Universal Use consists of several sections that cover different aspects of an individual or business's financial situation. These sections include personal information, income details, asset and liability declaration, and other relevant financial information. The form collects personal information including name, address, contact details, and social security number (for individuals) or employer identification number (for businesses). This information is essential for identification and verification purposes. The income details section in the Broward Florida Financial Statement Form captures information about the individual or business's sources of income. This includes details about employment income, rental income, investment income, and any other sources of revenue. The asset and liability declaration section requires the disclosure of all assets owned by the individual or business, such as real estate properties, vehicles, investments, bank accounts, and retirement accounts. Additionally, it requires the declaration of all outstanding liabilities including mortgages, loans, credit card debts, and any other financial obligations. The Broward Florida Financial Statement Form — Universal Use may have variations or specific versions for different purposes. Some possible variations could include: 1. Individual Financial Statement Form: This version of the form is specifically designed for individuals and focuses on personal financial information rather than business-related data. 2. Business Financial Statement Form: This version of the form is tailored to capture financial information for businesses. It includes sections for reporting business income, expenses, assets, and liabilities. 3. Self-Employed Financial Statement Form: This variation of the form is designed for individuals who are self-employed or have freelance income. It incorporates sections for reporting income from self-employment, business expenses, and other relevant financial details. 4. Non-Profit Organization Financial Statement Form: This version of the form is specifically designed for non-profit organizations operating in Broward County, Florida. It includes sections for reporting donations, grants, program expenses, and other financial information relevant to non-profits. In conclusion, the Broward Florida Financial Statement Form — Universal Use is a comprehensive document that captures detailed financial information for individuals and businesses in Broward County. It serves as a crucial tool for reporting financial data to various entities and allows for better transparency and accountability in financial matters.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Formulario de estado financiero - Uso universal - Financial Statement Form - Universal Use

Description

How to fill out Broward Florida Formulario De Estado Financiero - Uso Universal?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Broward Financial Statement Form - Universal Use suiting all regional requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. Aside from the Broward Financial Statement Form - Universal Use, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Specialists check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can get the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Broward Financial Statement Form - Universal Use:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Broward Financial Statement Form - Universal Use.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!