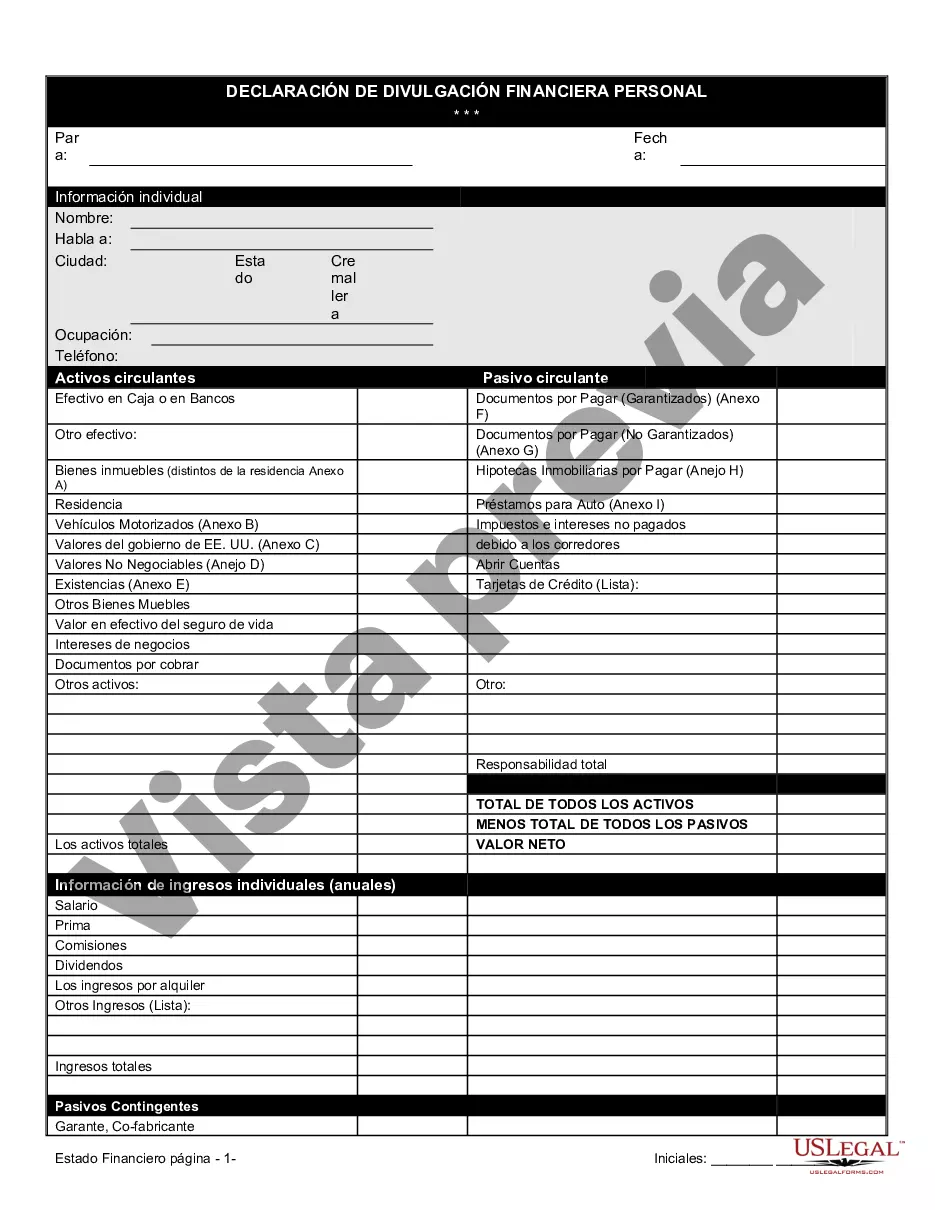

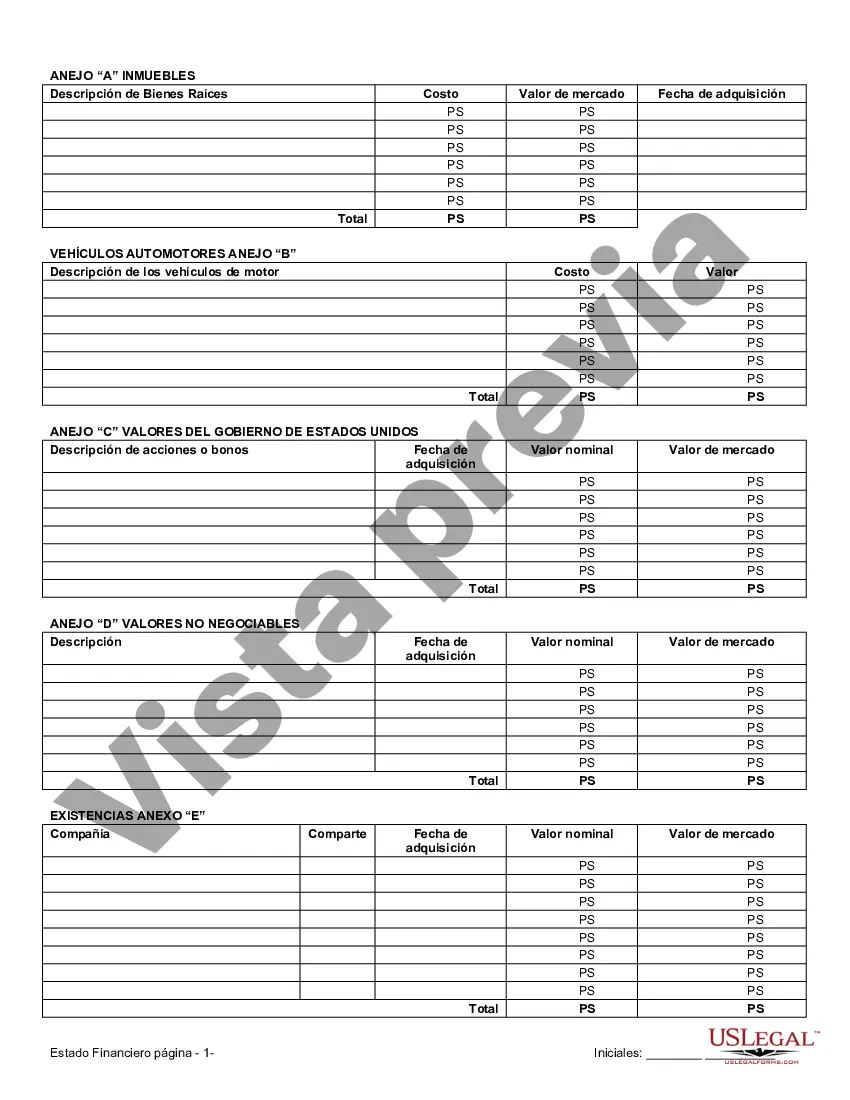

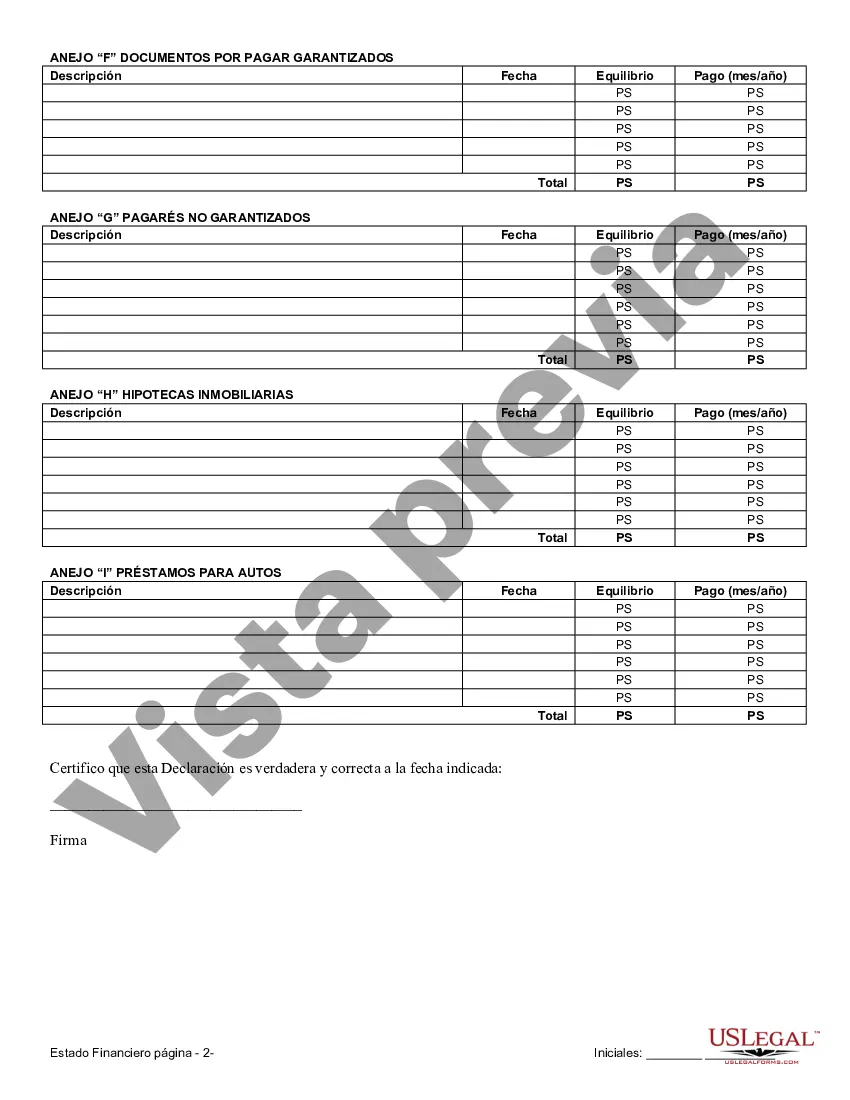

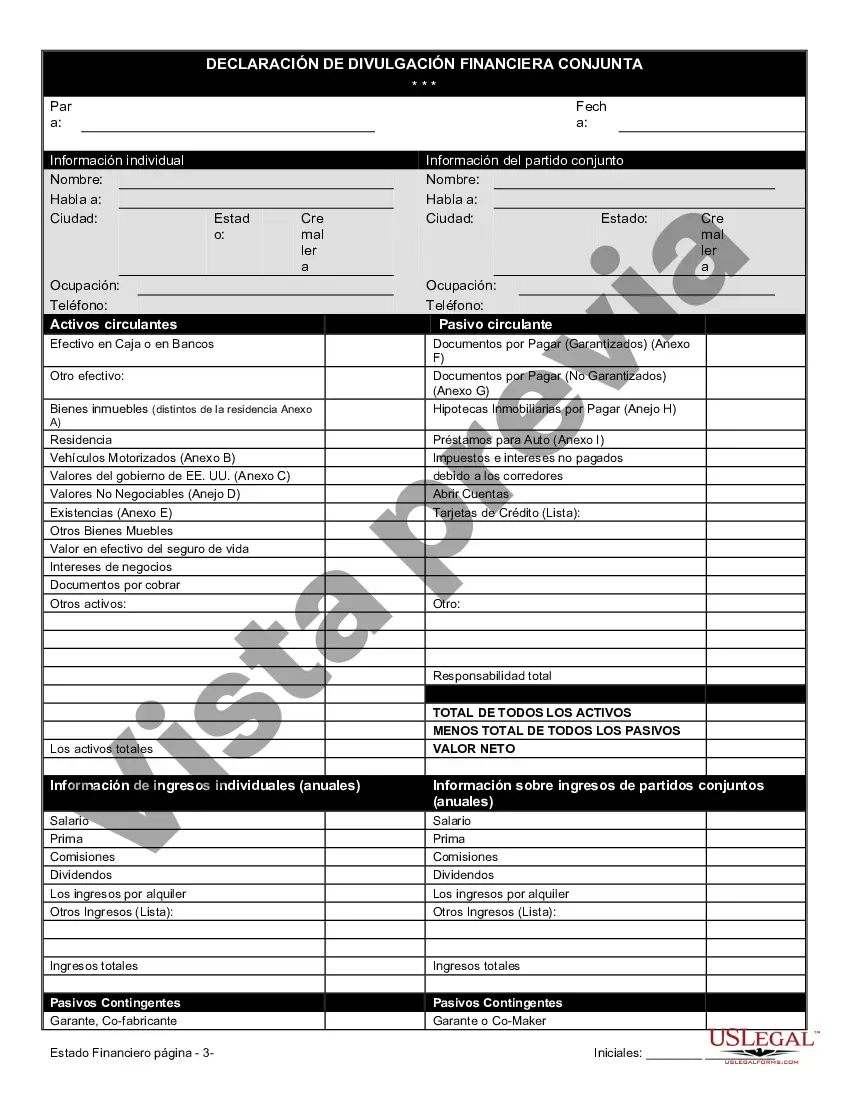

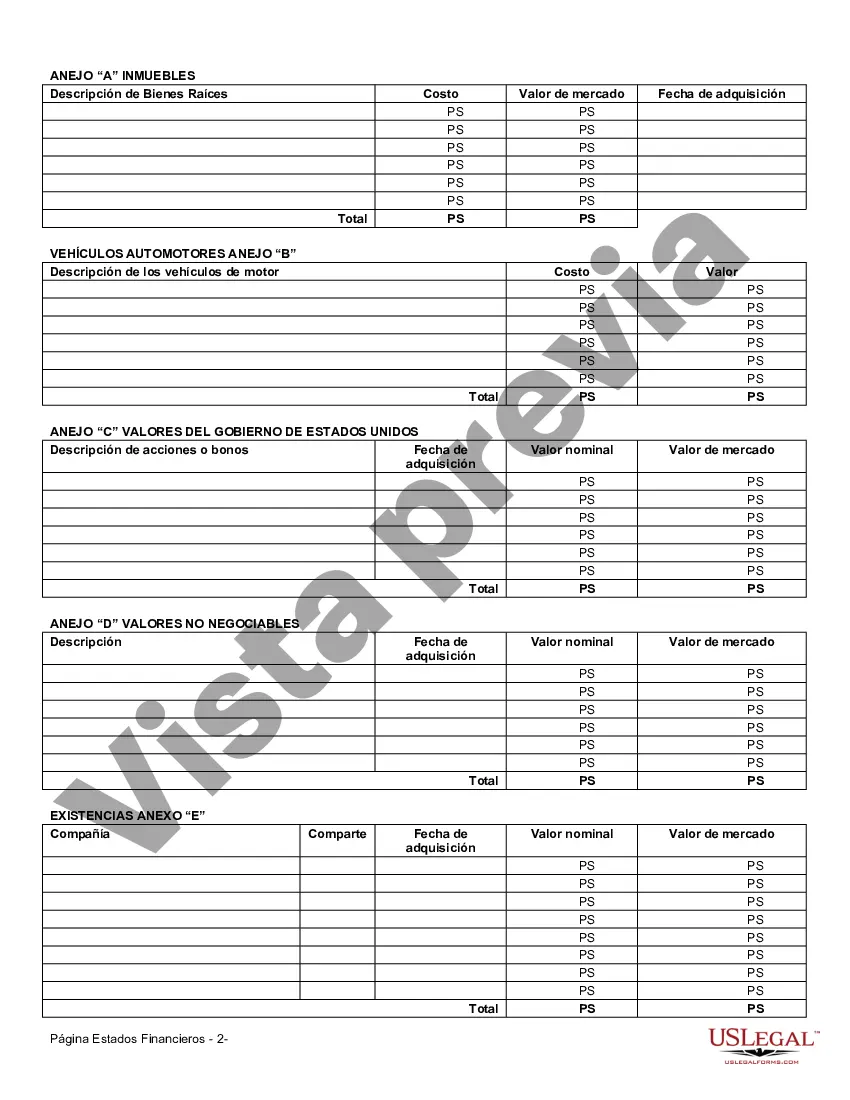

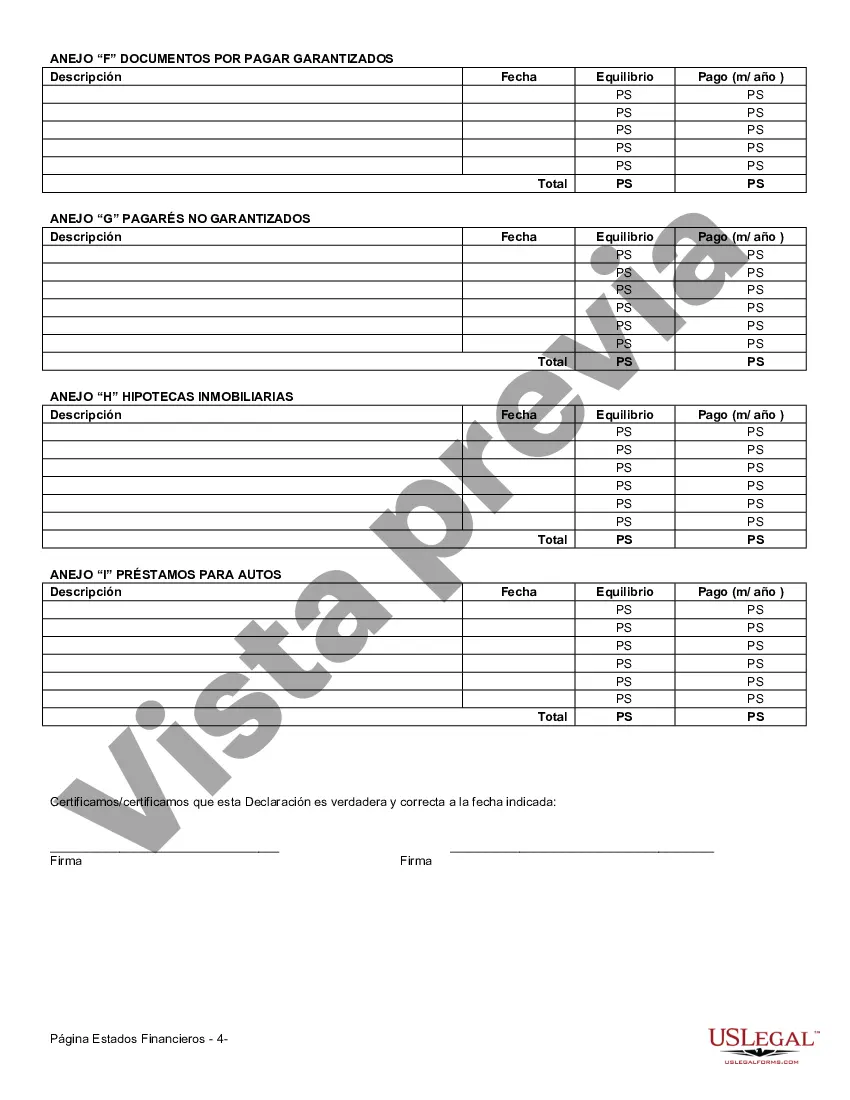

Cook Illinois Financial Statement Form — Universal Use is a comprehensive document used for recording and analyzing the financial details of individuals or businesses in Cook County, Illinois. This form serves as a valuable tool for assessing the financial health, assets, liabilities, and ongoing financial activities of a person or organization. The Cook Illinois Financial Statement Form — Universal Use is designed to be applicable to various entities, including individuals, partnerships, corporations, and nonprofit organizations. It offers a standardized framework for organizing financial information to facilitate accurate reporting and efficient analysis. This financial statement form is essential for several purposes, such as: 1. Loan Applications: When applying for loans, banks and financial institutions often require applicants to provide a financial statement. Using the Cook Illinois Financial Statement Form — Universal Use ensures that all necessary financial data is accurately presented, enhancing the chances of securing the desired loan. 2. Taxation: Completing the financial statement is crucial for accurate tax reporting. By offering a systematic layout to record income, expenses, assets, and liabilities, the form enables individuals or businesses to report their financial activities correctly. 3. Business Planning: Entrepreneurs and business owners can utilize this financial statement form to evaluate the financial position of their ventures. It helps them assess profitability, cash flow, and financial ratios, enabling informed decision-making for future business ventures, expansions, or investments. 4. Estate Planning: The Cook Illinois Financial Statement Form — Universal Use is valuable for estate planning, allowing individuals to ascertain their net worth and plan for the distribution of assets after their demise. It helps in determining the value of the estate, managing taxes, and ensuring a smooth transition for beneficiaries. While the form is designed to be universally applicable, there may be specific variations based on the entity type: 1. Individual Financial Statement Form: This form is tailored for individuals and collects personal financial details like income from various sources, expenses, assets, and liabilities. 2. Business Financial Statement Form: Specifically created for partnerships, corporations, or other business entities, this form focuses on capturing financial information relevant to the organization, including revenue, expenses, inventory, and shareholder equity. 3. Nonprofit Financial Statement Form: Nonprofit organizations have unique financial reporting requirements. This variation of the form includes sections dedicated to tracking donations, grants, program expenses, and fundraising activities. Completing the Cook Illinois Financial Statement Form — Universal Use accurately is crucial for individuals and business entities to provide a comprehensive overview of their financial position. Whether for securing loans, ensuring compliance with tax regulations, or making informed business decisions, this form acts as a reliable documentation tool for a wide range of financial activities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Formulario de estado financiero - Uso universal - Financial Statement Form - Universal Use

Description

How to fill out Cook Illinois Formulario De Estado Financiero - Uso Universal?

Are you looking to quickly draft a legally-binding Cook Financial Statement Form - Universal Use or probably any other document to manage your personal or corporate matters? You can go with two options: contact a legal advisor to draft a legal document for you or draft it completely on your own. The good news is, there's another option - US Legal Forms. It will help you receive professionally written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific document templates, including Cook Financial Statement Form - Universal Use and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate document templates. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- First and foremost, carefully verify if the Cook Financial Statement Form - Universal Use is adapted to your state's or county's laws.

- In case the document comes with a desciption, make sure to check what it's suitable for.

- Start the searching process again if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Cook Financial Statement Form - Universal Use template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. In addition, the paperwork we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!