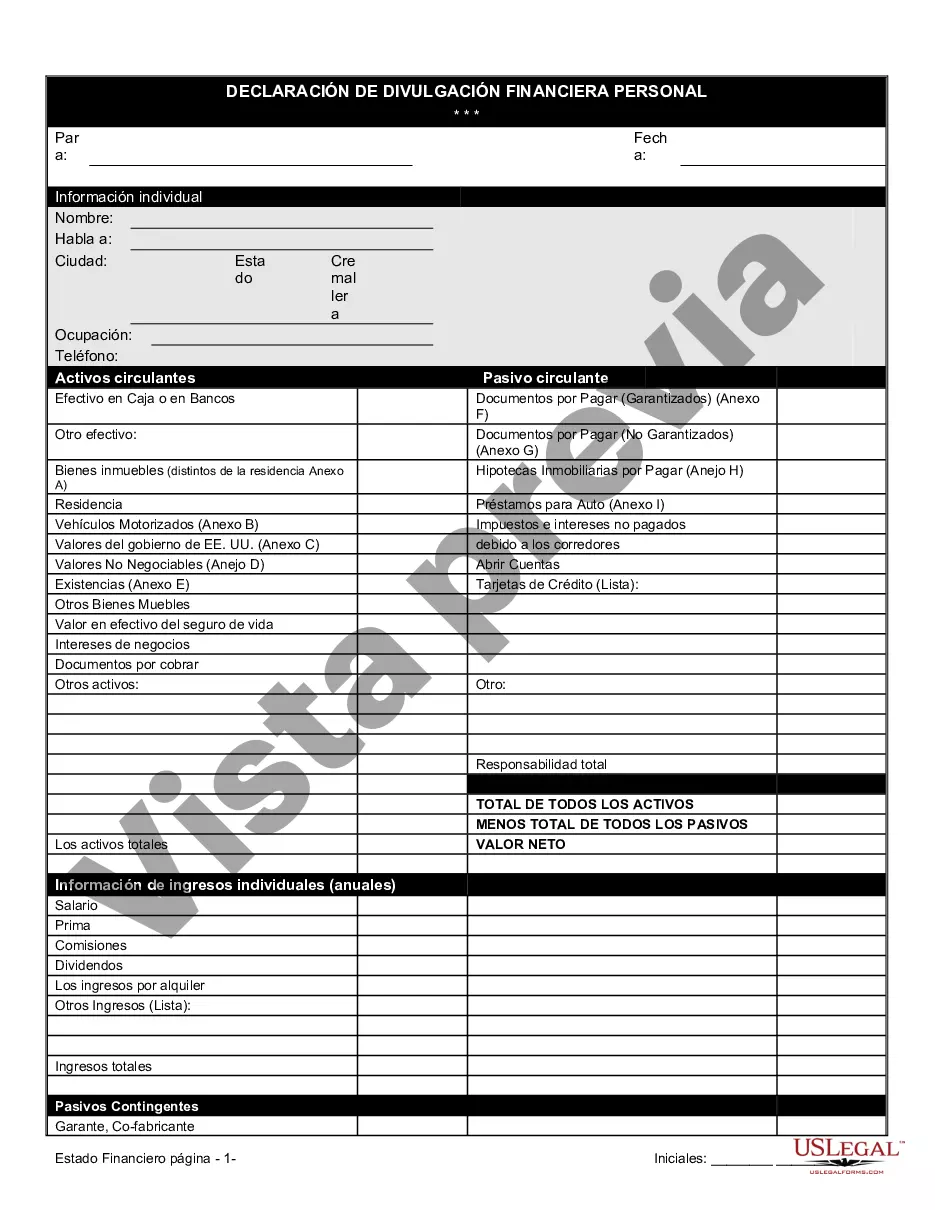

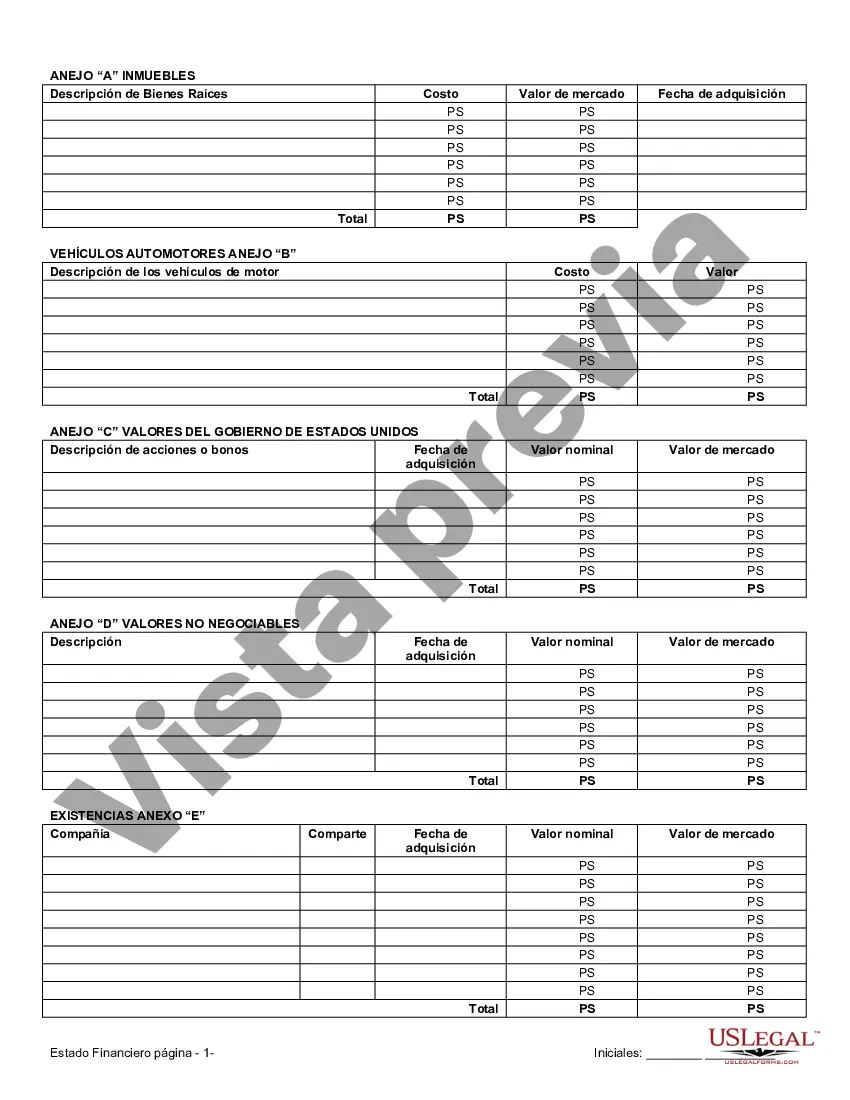

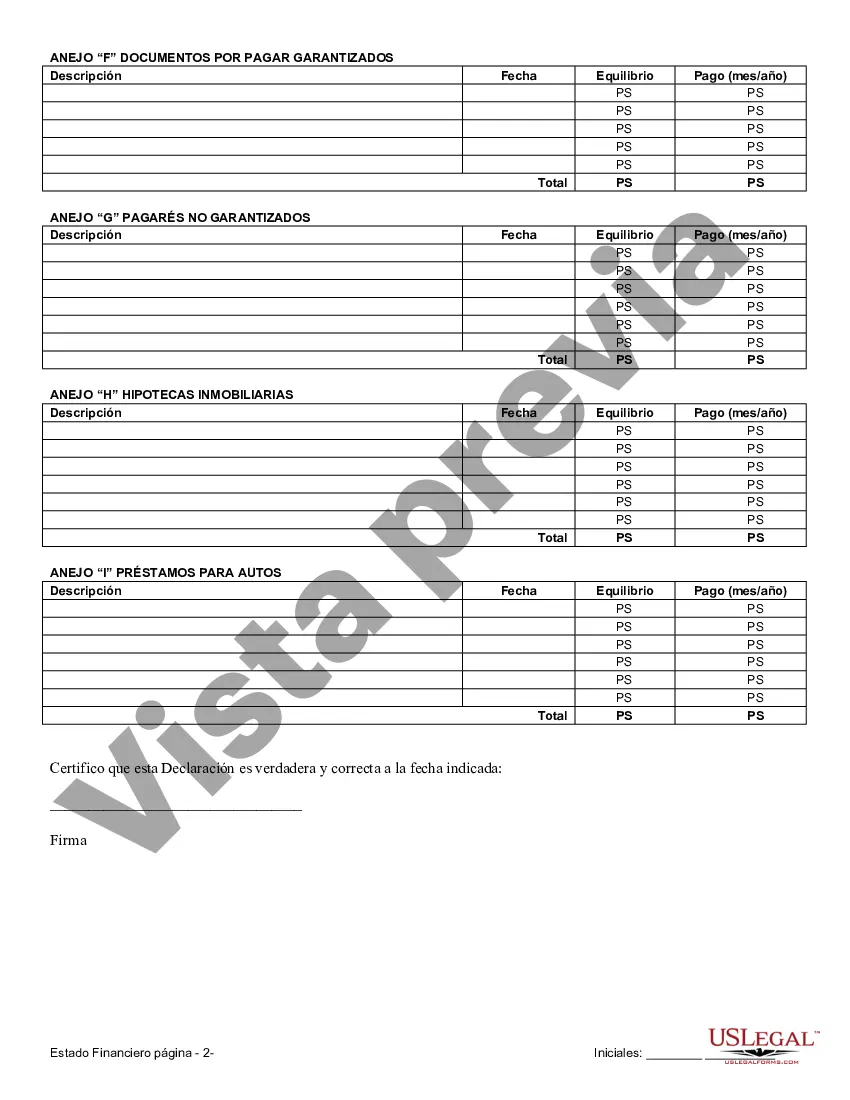

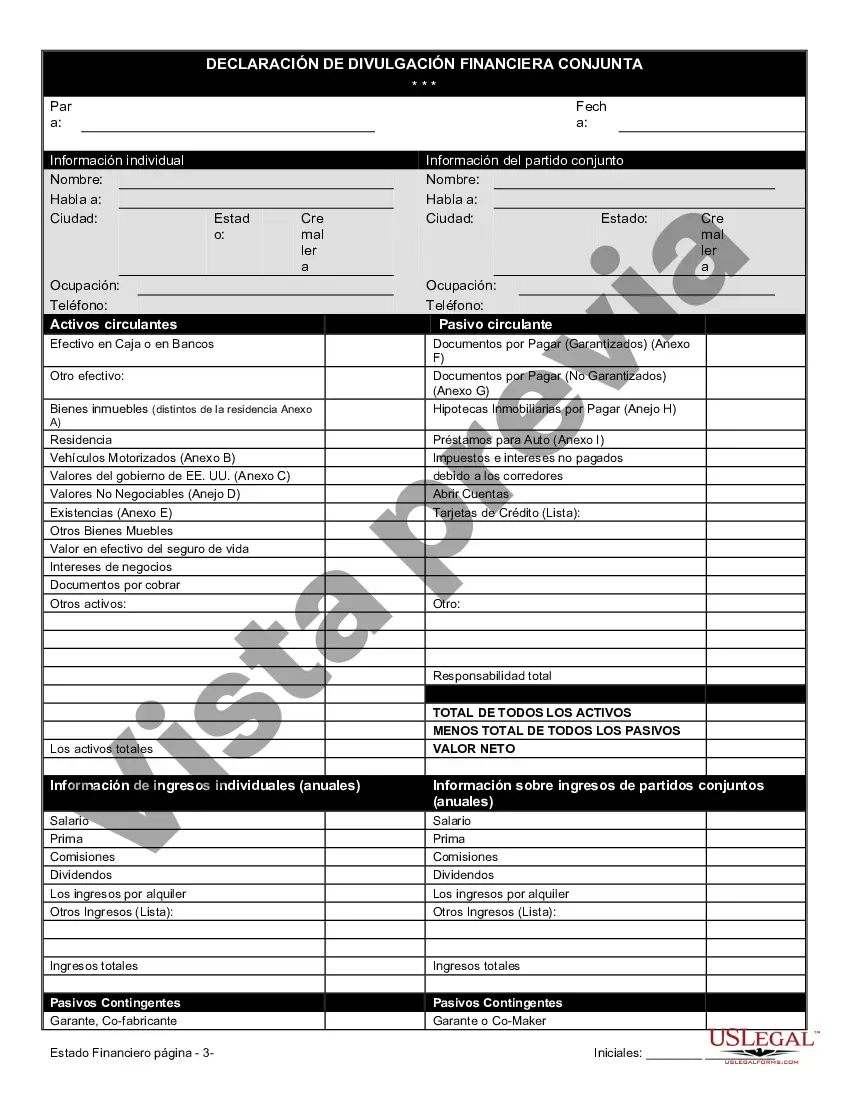

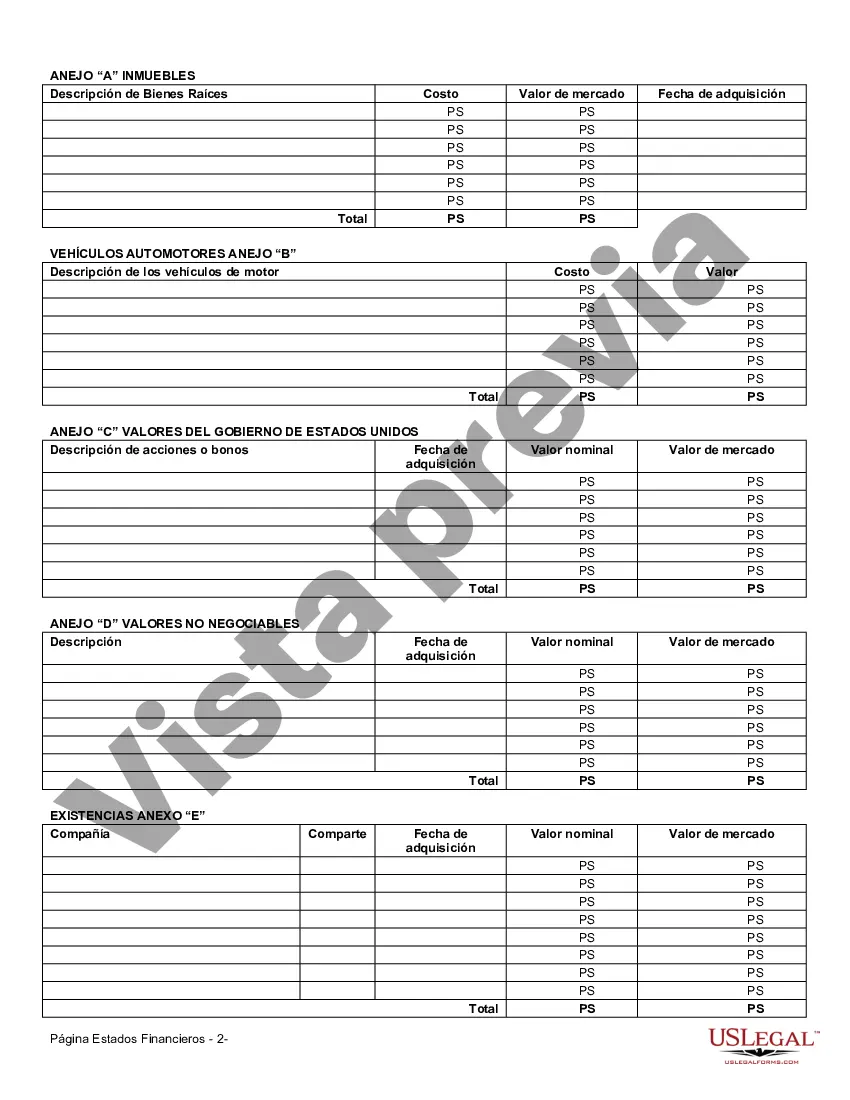

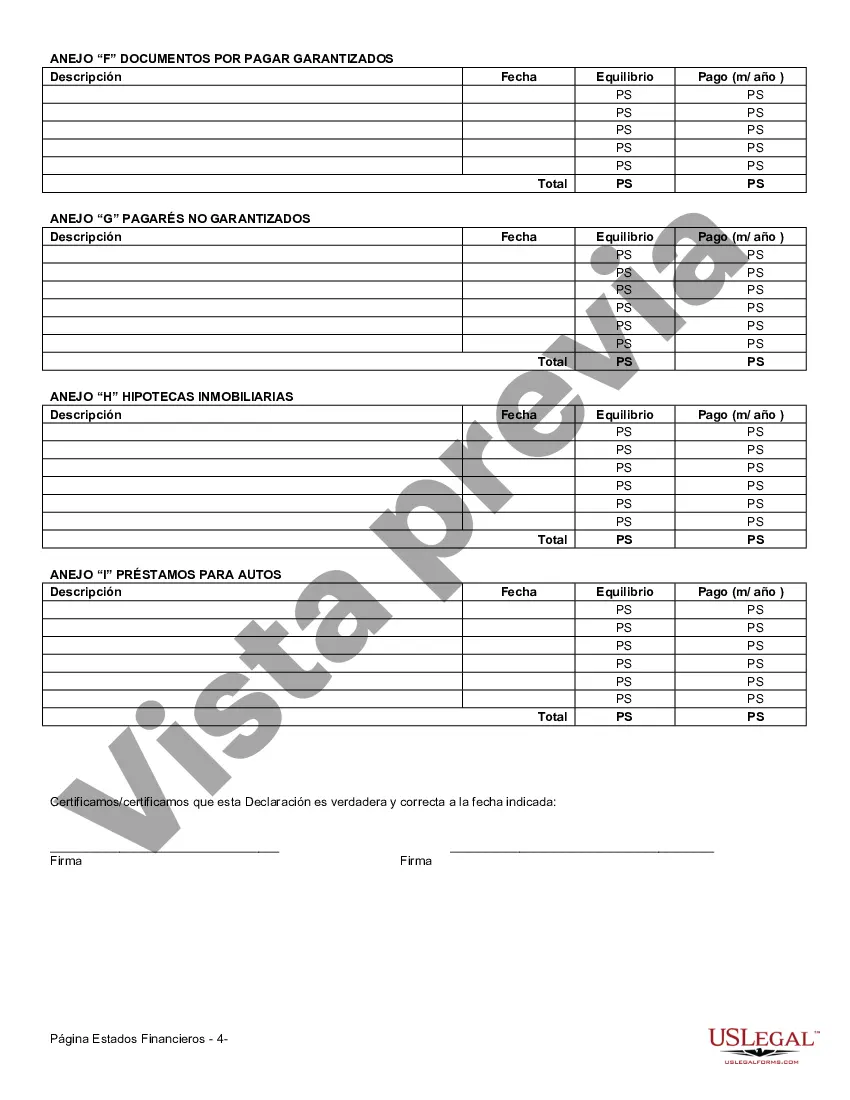

The San Jose California Financial Statement Form — Universal Use is a crucial document that serves as an all-inclusive financial record for individuals and businesses in San Jose, California. This comprehensive form enables individuals, corporations, and organizations to accurately report their financial standing and disclose financial information to relevant parties such as lenders, investors, and government agencies. This financial statement form is designed to cover various aspects of an entity's financial situation, facilitating a comprehensive analysis of its economic activities. It incorporates several sections, each dedicated to specific financial information, ensuring a detailed and organized approach to reporting. The standard San Jose California Financial Statement Form — Universal Use includes the following sections: 1. Personal/Business Identification: This section requires the complete identification details of the individual, business, or organization filing the financial statement. It includes the name, address, contact information, tax identification number, and industry type. 2. Balance Sheet: The balance sheet section summarizes the financial position of the filer at a particular point in time. It includes assets (both short-term and long-term), liabilities (current and long-term), and owners' equity. This section provides a snapshot of the entity's financial standing concerning its resources and obligations. 3. Income Statement: The income statement section presents the entity's financial performance over a specific period. It includes revenue, expenses, gains, and losses, resulting in the calculation of net income or net loss. This section reflects the organization's ability to generate profit or incur losses during the stated period. 4. Cash Flow Statement: The cash flow statement section outlines the sources and uses of cash, categorizing them into operating activities, investing activities, and financing activities. This section presents a clearer picture of how cash moves within the organization, enabling analysis of cash inflows and outflows. 5. Notes to Financial Statements: This section provides additional explanations, clarifications, and details that supplement the presented financial information, ensuring proper understanding and interpretation of the disclosed data. It may include specific accounting policies applied, contingencies, or any significant transactions that impact the financial statements. The San Jose California Financial Statement Form — Universal Use allows individuals and entities to comprehensively present their financial information in a standardized format. It enables accurate analysis, comparison, and tracking of financial performance over time. Additionally, it ensures transparency and accountability, helping businesses secure financing, comply with reporting regulations, and make informed decisions. Multiple types of financial statement forms may exist in San Jose, California, tailored for specific industries or purposes. For instance, there might be separate forms for non-profit organizations, government agencies, or specialized sectors such as healthcare or insurance. However, the standard San Jose California Financial Statement Form — Universal Use described above serves as a versatile tool applicable to diverse individuals, businesses, and organizations across industries.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Formulario de estado financiero - Uso universal - Financial Statement Form - Universal Use

Description

How to fill out San Jose California Formulario De Estado Financiero - Uso Universal?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a legal professional to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the San Jose Financial Statement Form - Universal Use, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Consequently, if you need the current version of the San Jose Financial Statement Form - Universal Use, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the San Jose Financial Statement Form - Universal Use:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your San Jose Financial Statement Form - Universal Use and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!