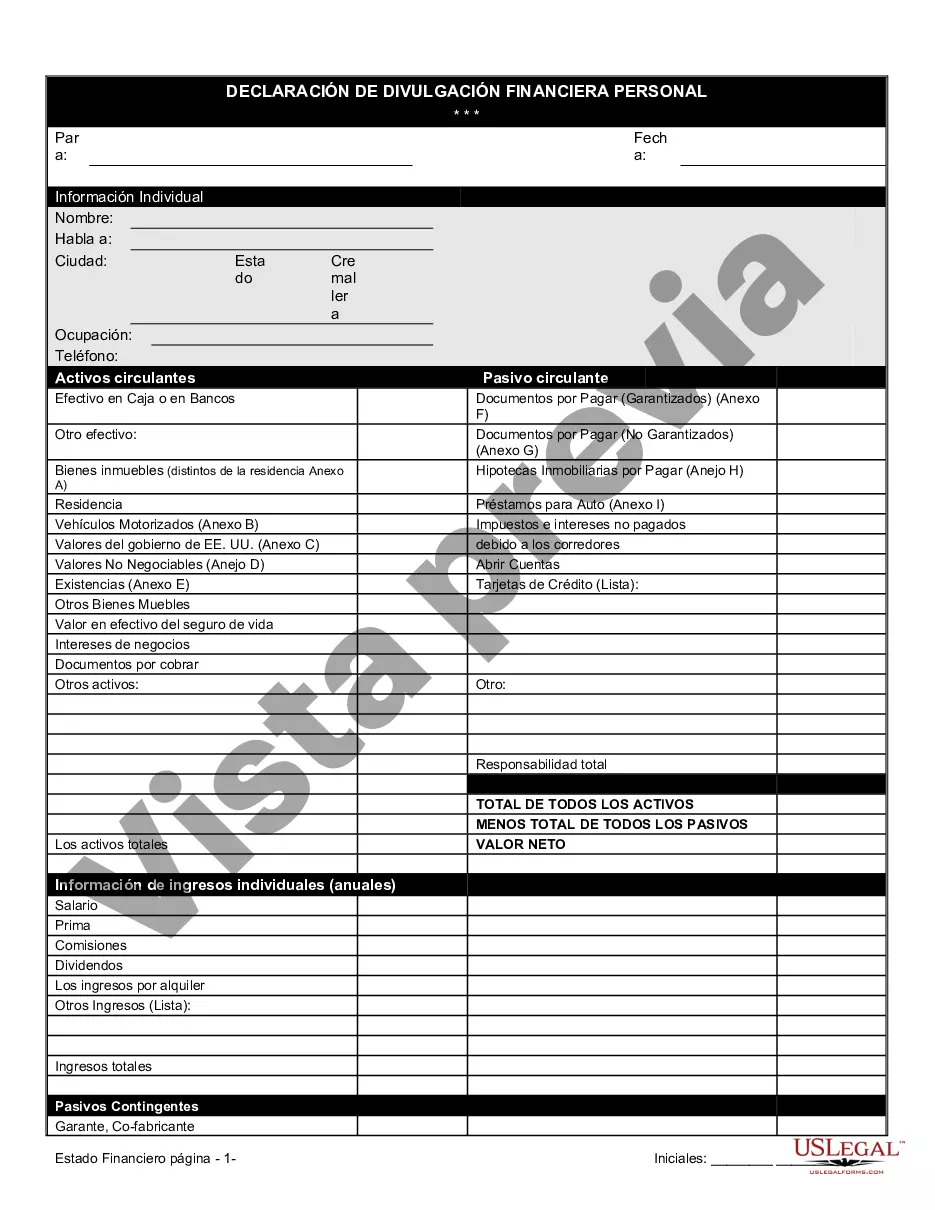

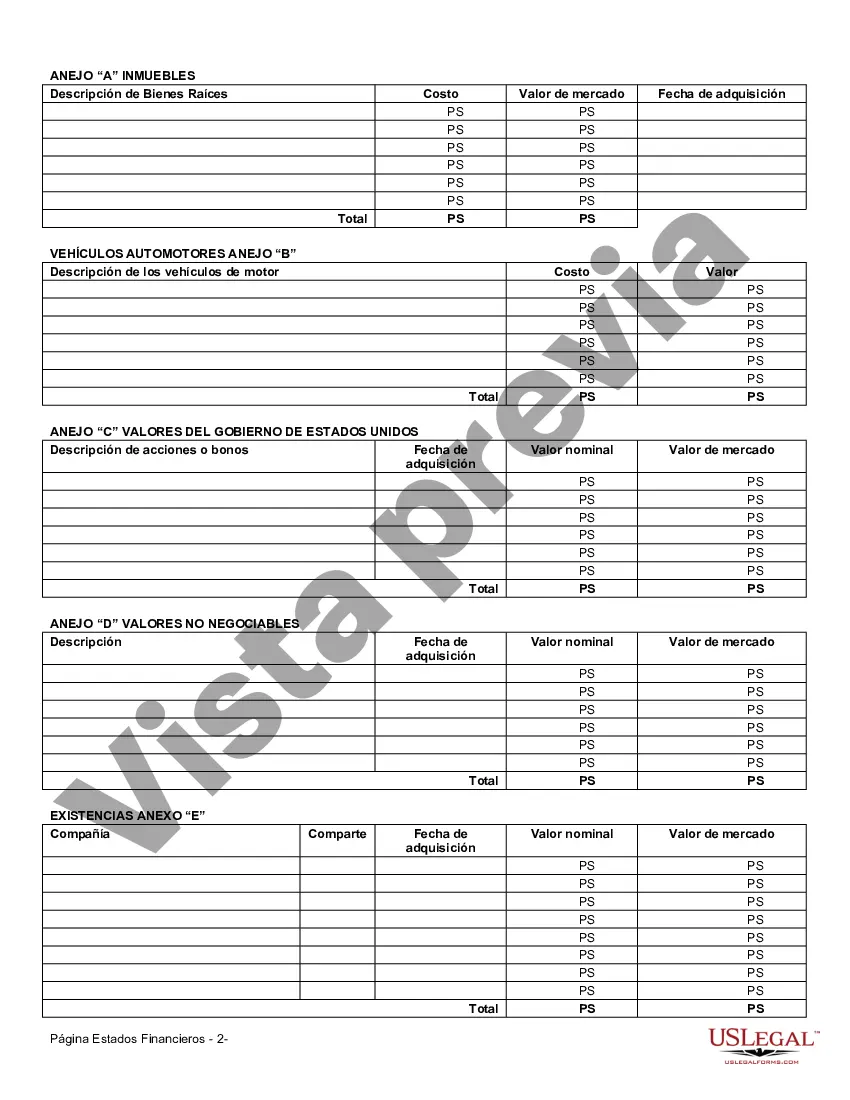

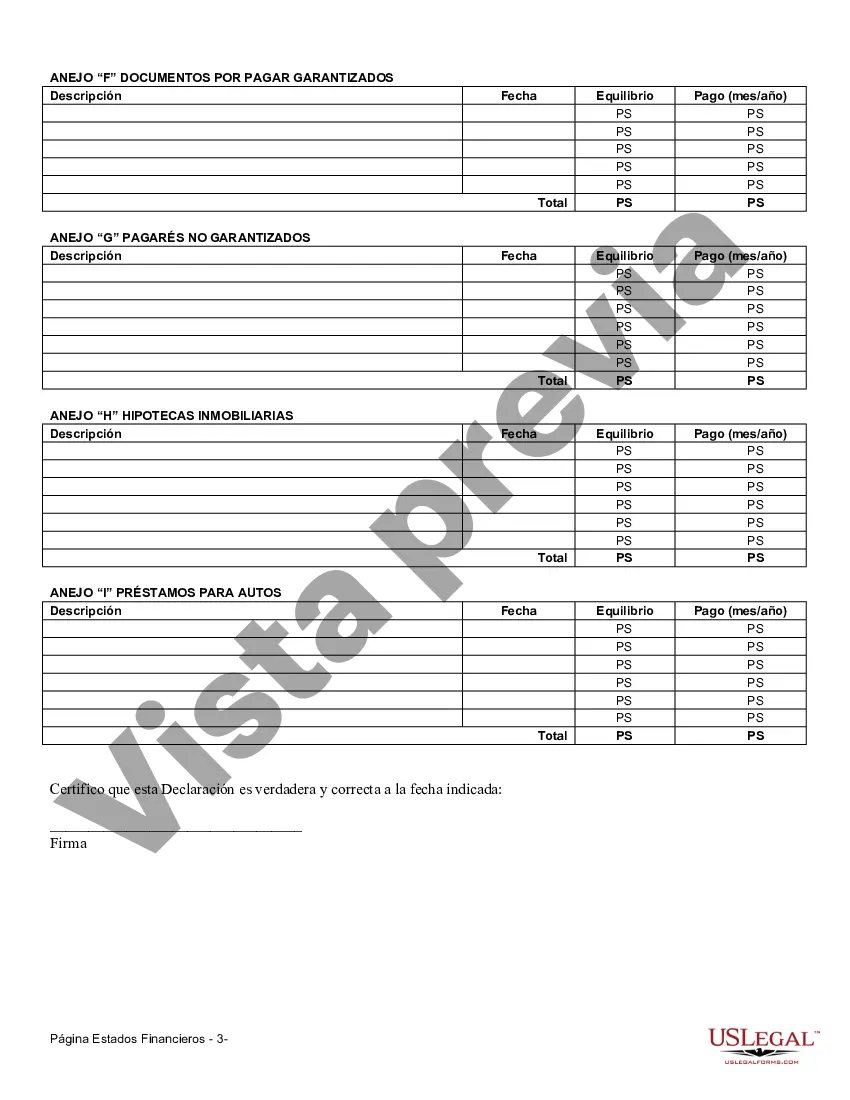

Clark Nevada Financial Statement Form — Individual is a legal document that assists individuals in effectively organizing and presenting their financial information. This form is specifically designed to create a comprehensive snapshot of an individual's financial status, ensuring accuracy and transparency. The Clark Nevada Financial Statement Form — Individual covers various key aspects of personal finance, allowing individuals to showcase their income, assets, liabilities, and expenses. It is a valuable tool for various purposes, including loan applications, divorce proceedings, estate planning, and financial planning. The form consists of multiple sections, each focusing on a specific aspect of the individual's financial profile. These sections typically include: 1. Personal Information: This section collects basic personal details, such as name, address, contact information, and Social Security number, ensuring accurate identification of the individual. 2. Income: In this section, individuals list all sources of income, such as salaries, wages, self-employment earnings, rental income, investment income, and any other sources of revenue. This helps in assessing the individual's earning capacity and financial stability. 3. Expenses: Here, individuals provide a comprehensive breakdown of their monthly expenses, including mortgage or rent payments, utilities, transportation costs, healthcare expenses, insurance premiums, education expenses, and any other regular expenditures. This section assists in evaluating the individual's spending patterns and financial obligations. 4. Assets: This section requires individuals to list all their assets, such as real estate properties, vehicles, bank accounts, investments, retirement accounts, and valuable personal possessions. It helps in determining the individual's net worth and overall financial health. 5. Liabilities: In this section, individuals disclose their outstanding debts, such as mortgages, student loans, credit card balances, auto loans, and any other loans or lines of credit. This section allows for a comprehensive assessment of an individual's financial obligations and debt-to-income ratio. 6. Additional Information: This section provides space for individuals to include any additional relevant information that may impact their financial situation, such as pending legal matters, ongoing lawsuits, or any significant changes in income or expenses. It is important to note that while specific requirements may vary, the Clark Nevada Financial Statement Form — Individual typically follows a format similar to the one outlined above. This form plays a crucial role in ensuring accurate financial representation and can have significant legal implications. Therefore, it is essential to complete the form carefully and honestly. In conclusion, the Clark Nevada Financial Statement Form — Individual is a comprehensive document that individuals can use to present their financial information accurately. By utilizing this form, individuals can effectively document their income, expenses, assets, liabilities, and additional information, enabling a thorough evaluation of their financial standing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Formulario de Estados Financieros - Individuo - Financial Statement Form - Individual

Description

How to fill out Clark Nevada Formulario De Estados Financieros - Individuo?

Draftwing documents, like Clark Financial Statement Form - Individual, to take care of your legal matters is a tough and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal issues into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents crafted for different scenarios and life situations. We ensure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Clark Financial Statement Form - Individual template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly simple! Here’s what you need to do before downloading Clark Financial Statement Form - Individual:

- Make sure that your template is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Clark Financial Statement Form - Individual isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our website and download the form.

- Everything looks good on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!