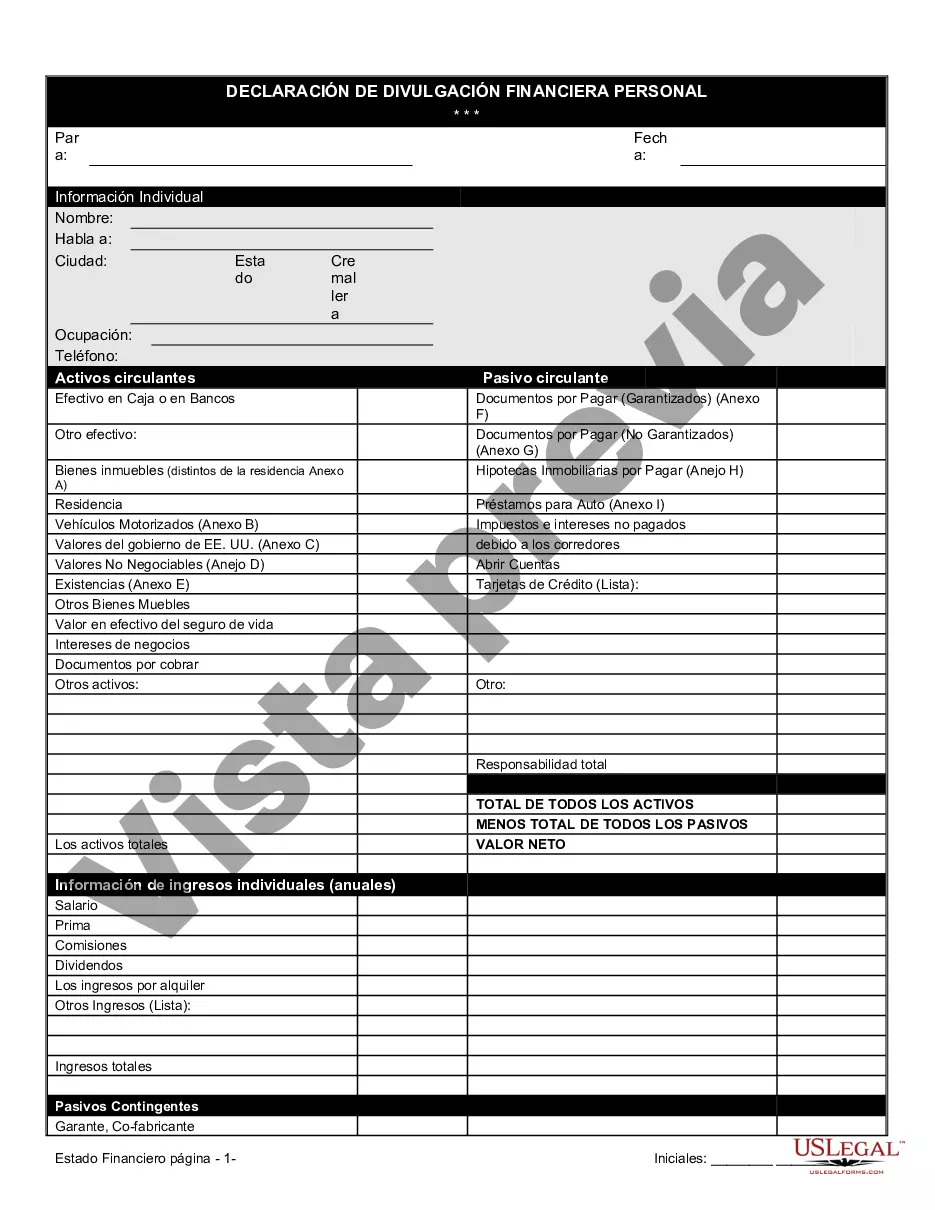

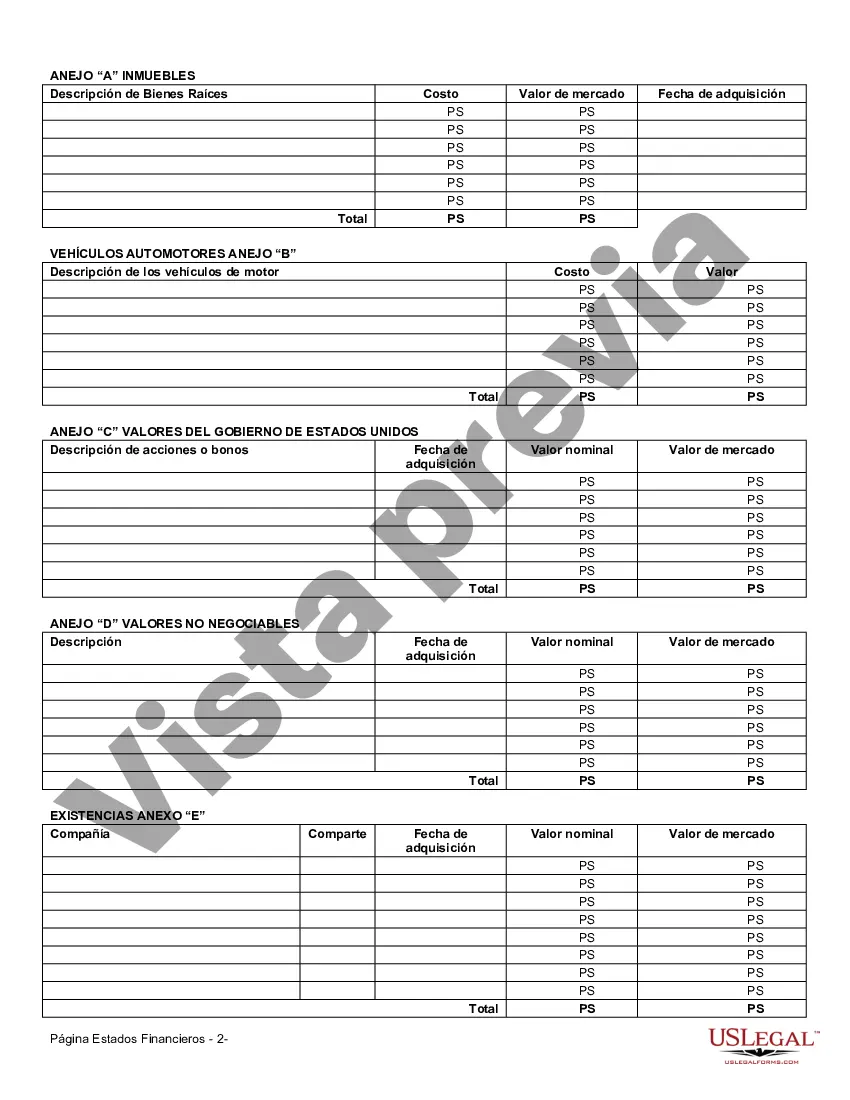

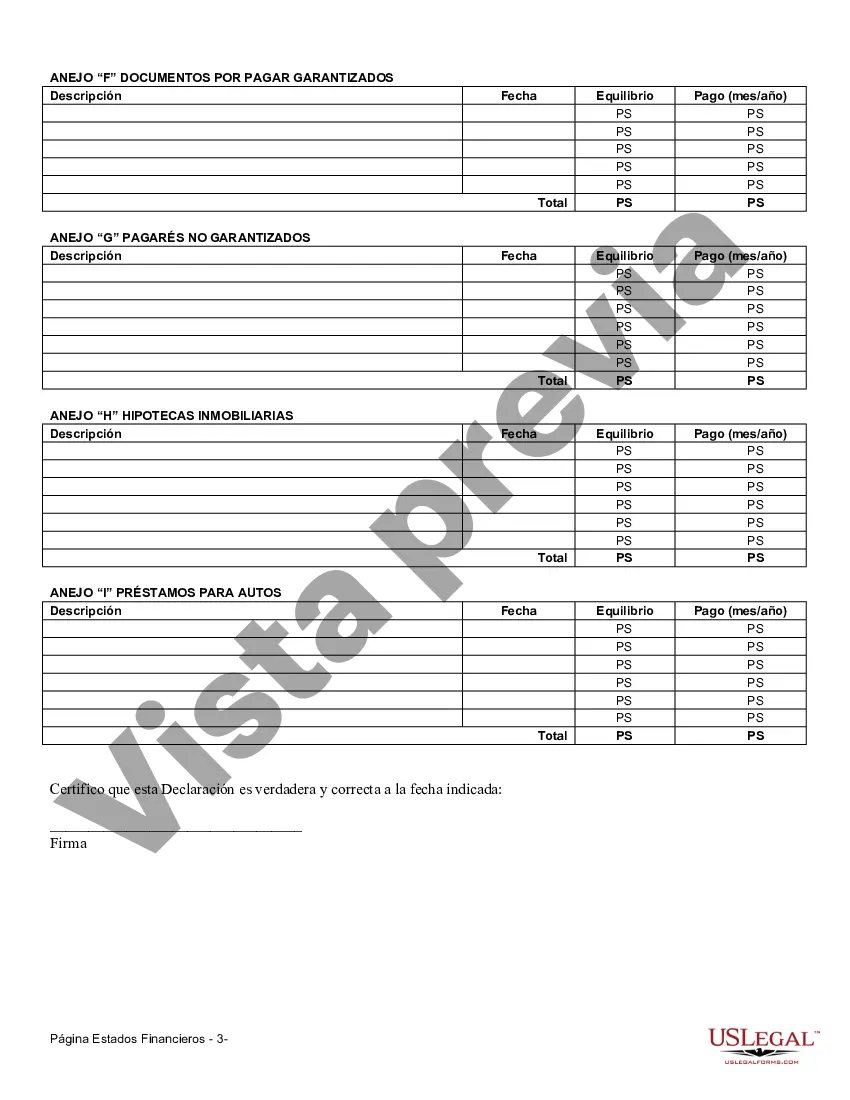

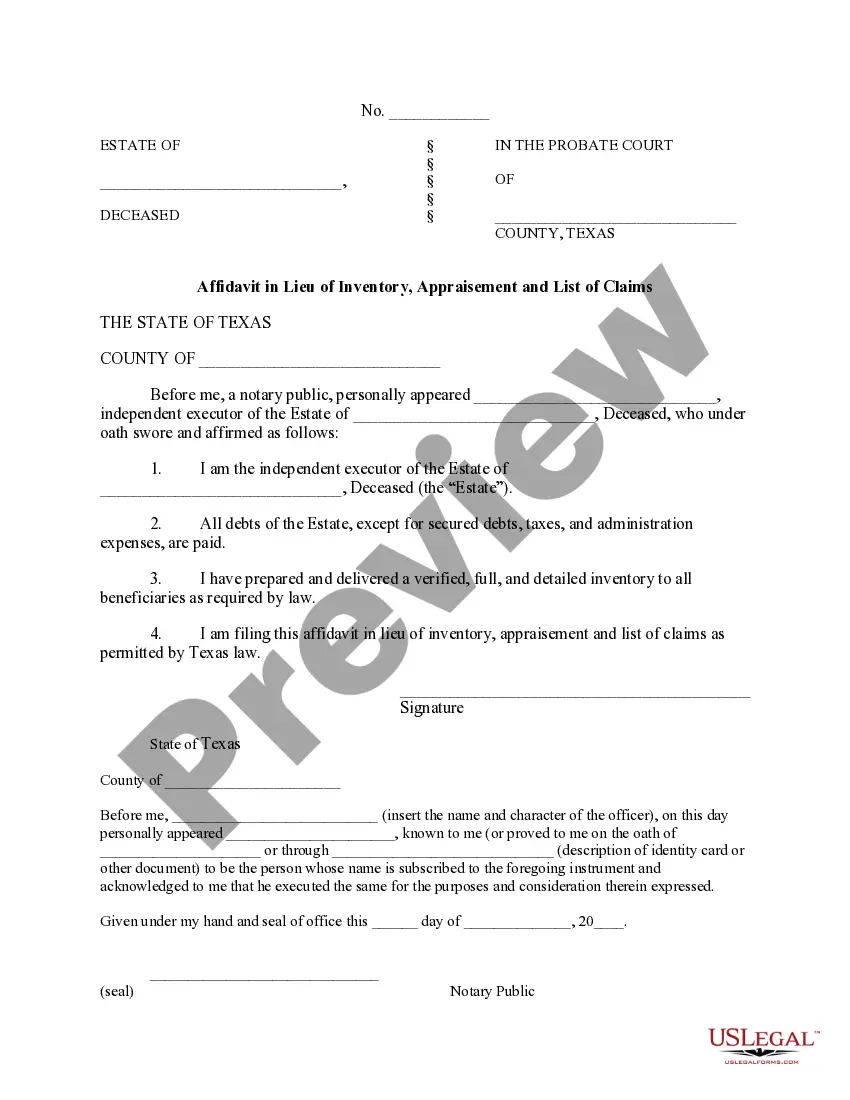

Hennepin Minnesota Financial Statement Form — Individual is a crucial document used for assessing an individual's financial standing and determining their eligibility for various financial services. This form collects comprehensive information about an individual's income, assets, liabilities, and expenses. It is essential for applications related to loans, mortgages, credit checks, and financial assistance programs. The Hennepin County Financial Statement Form — Individual is designed to cover all aspects of an individual's financial situation, aiming to provide a complete and accurate snapshot of their financial health. The form typically includes sections such as: 1. Personal Information: This section covers basic details such as the individual's name, address, contact information, and social security number. 2. Income: Here, individuals are required to provide detailed information about their sources of income, including wages, self-employment earnings, rental income, investments, retirement benefits, and any other relevant income streams. 3. Assets: This section aims to gather information about an individual's assets, such as real estate, vehicles, bank accounts, investments, stocks, bonds, or any other significant holdings. 4. Liabilities: Individuals are requested to disclose all their outstanding debts, including mortgages, loans, credit card balances, and any other liabilities. 5. Monthly Expenses: This section focuses on an individual's recurring monthly expenses, such as rent/mortgage payments, utility bills, transportation costs, healthcare expenses, insurance premiums, and other necessary expenses. 6. Other Financial Information: Additional details may be included to provide a comprehensive overview, including information about dependents, tax returns, bankruptcy history, outstanding lawsuits, or any other relevant financial information. Different types or variations of Hennepin Minnesota Financial Statement Form — Individual may exist, depending on the specific requirements of different financial institutions or programs. Some variations may include additional sections or questions tailored to meet the unique needs of particular organizations. However, the core purpose of these variations remains the same: to gather relevant financial information to assess an individual's financial status accurately. Overall, the Hennepin Minnesota Financial Statement Form — Individual plays a vital role in financial decision-making processes, providing essential details to evaluate an individual's creditworthiness and determine the appropriate financial assistance or services they may qualify for.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Formulario de Estados Financieros - Individuo - Financial Statement Form - Individual

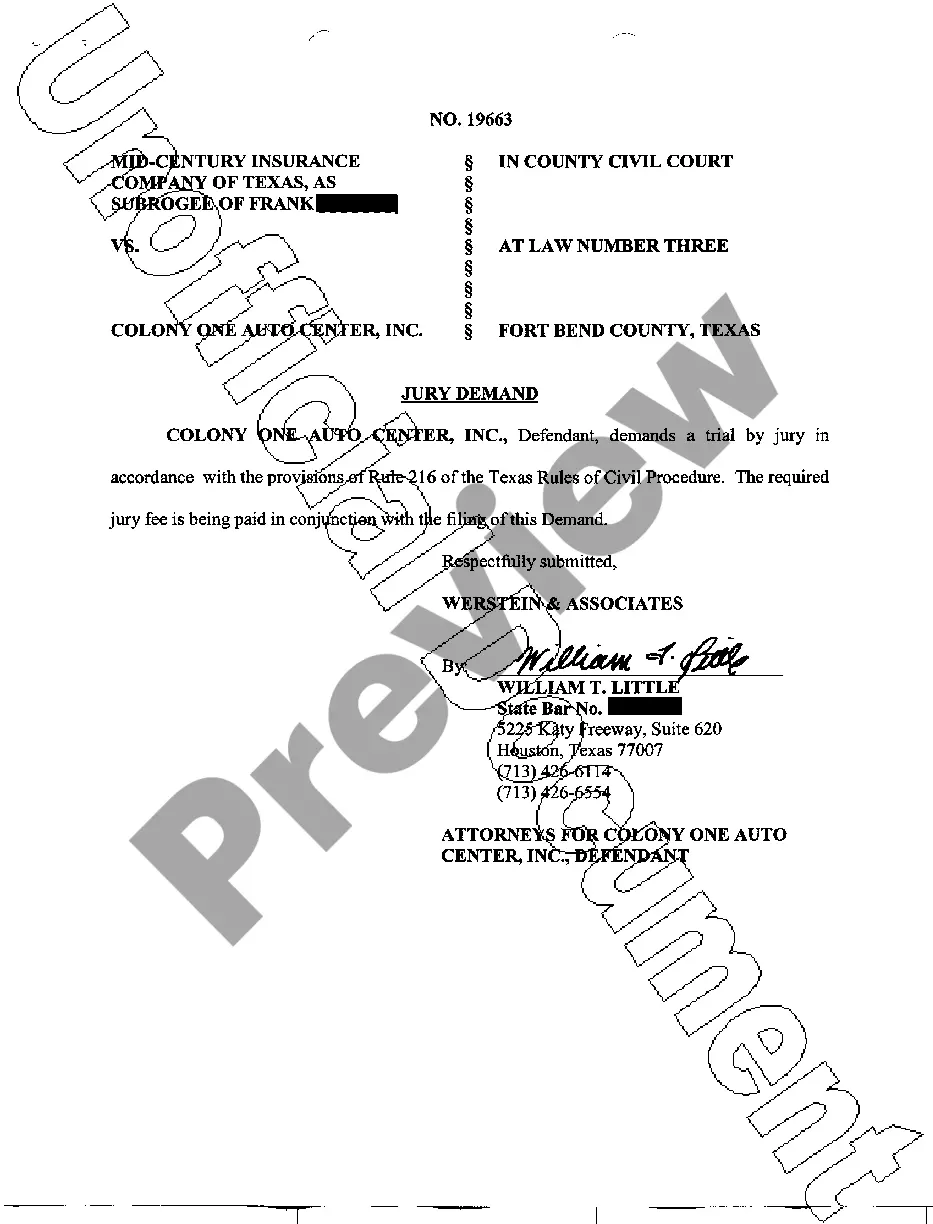

Description

How to fill out Hennepin Minnesota Formulario De Estados Financieros - Individuo?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Hennepin Financial Statement Form - Individual, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you pick a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Hennepin Financial Statement Form - Individual from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Hennepin Financial Statement Form - Individual:

- Examine the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!