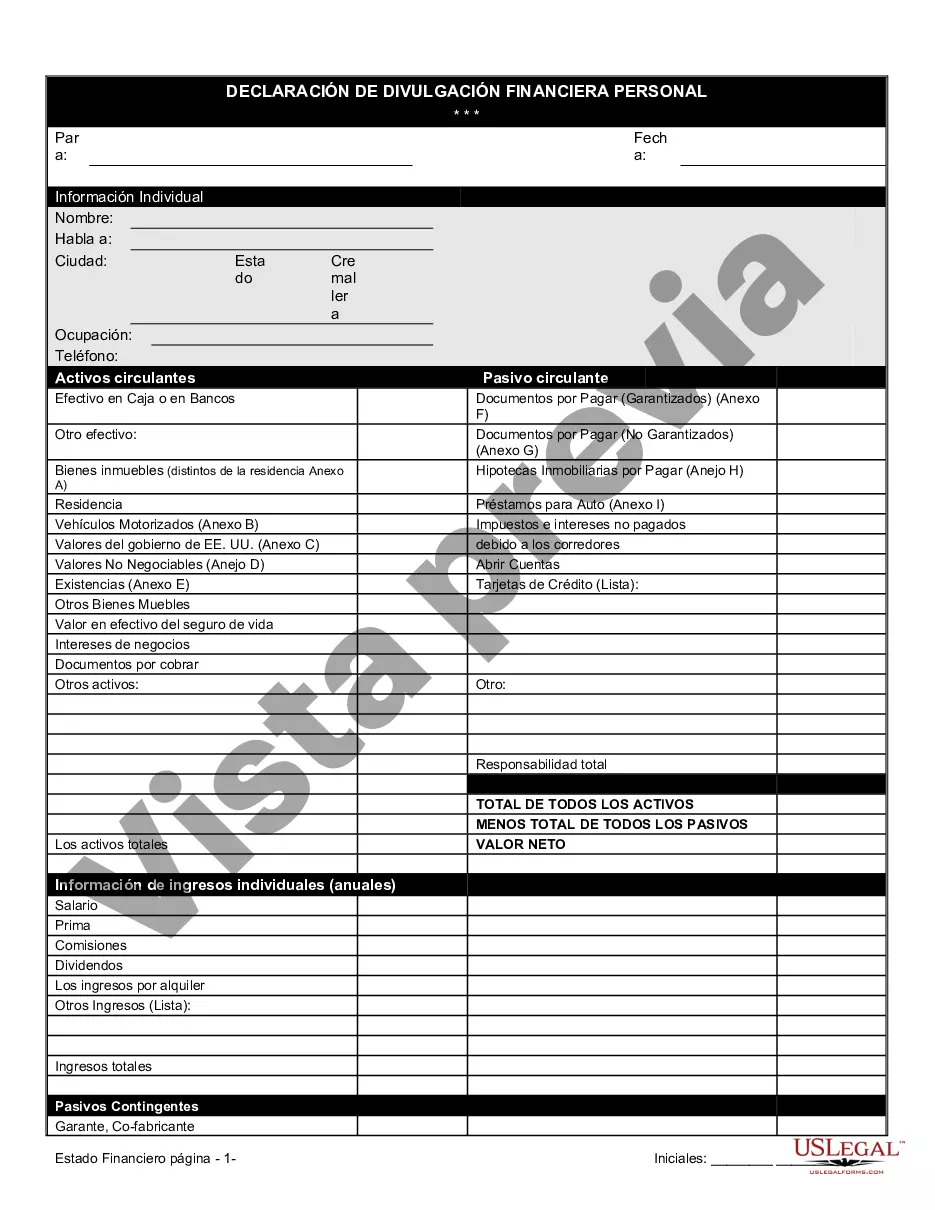

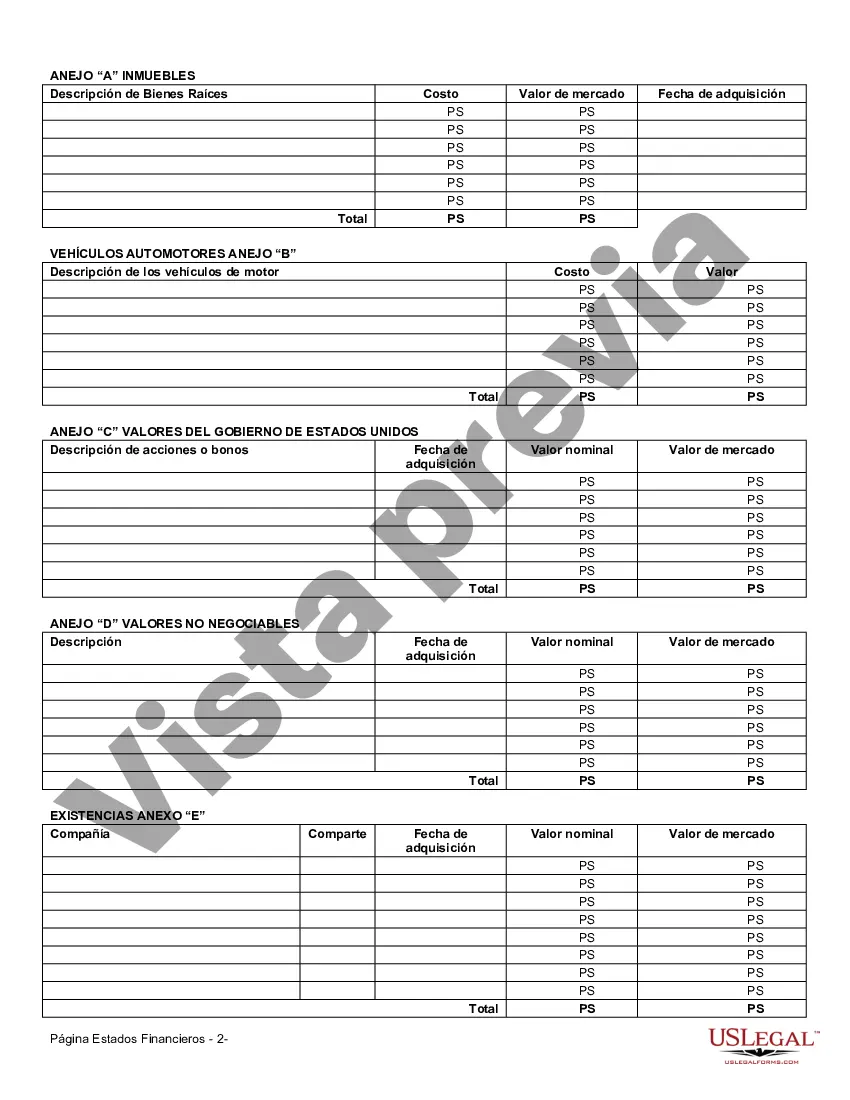

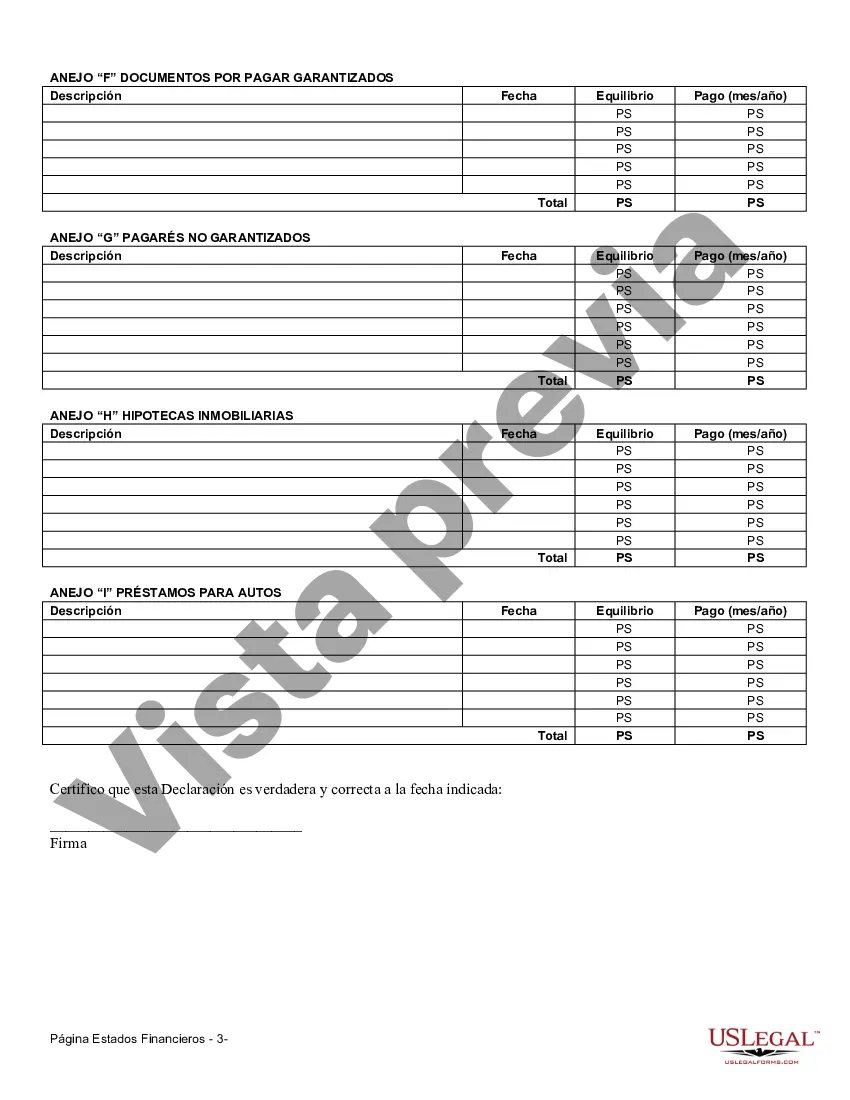

San Antonio Texas Financial Statement Form — Individual is a crucial document used for assessing an individual's financial situation in relation to various matters like loan applications, credit evaluations, and tax calculations. This form allows individuals to provide comprehensive information about their income, assets, liabilities, and expenses. The San Antonio Texas Financial Statement Form — Individual comes in different variations to cater to specific requirements. Some common types include: 1. San Antonio Texas Personal Financial Statement Form: This type of form focuses on an individual's personal finances, including their personal income, expenses, assets (such as real estate, vehicles, investments), and liabilities (such as mortgages, loans, credit card debt). 2. San Antonio Texas Tax Financial Statement Form: This form is specifically designed for individuals to report their income, deductions, and tax liabilities. It includes details on various sources of income, such as wages, interest, dividends, and rental income, as well as deductions like mortgage interest, medical expenses, and charitable contributions. 3. San Antonio Texas Loan Financial Statement Form: This form is used by individuals while applying for loans to provide detailed information about their financial status. It includes sections focusing on income, assets, liabilities, credit history, and other relevant information necessary for lenders to assess the borrower's creditworthiness. 4. San Antonio Texas Credit Evaluation Financial Statement Form: This type of form is commonly utilized by financial institutions and lenders to evaluate an individual's creditworthiness and determine their ability to repay debts. It requires individuals to disclose their income, existing debts, credit card balances, and other financial obligations. San Antonio Texas Financial Statement Forms — Individual are essential tools as they help individuals and financial institutions make informed decisions. These documents enable lenders to determine the creditworthiness of borrowers, secure loans, set interest rates accordingly, and ensure responsible lending practices. Additionally, individuals can utilize these forms while applying for mortgages, managing taxes, and evaluating their financial health. It is advised to consult with legal or financial professionals to ensure accuracy and compliance with applicable laws while completing these forms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Formulario de Estados Financieros - Individuo - Financial Statement Form - Individual

Description

How to fill out San Antonio Texas Formulario De Estados Financieros - Individuo?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the San Antonio Financial Statement Form - Individual, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the San Antonio Financial Statement Form - Individual from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the San Antonio Financial Statement Form - Individual:

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!