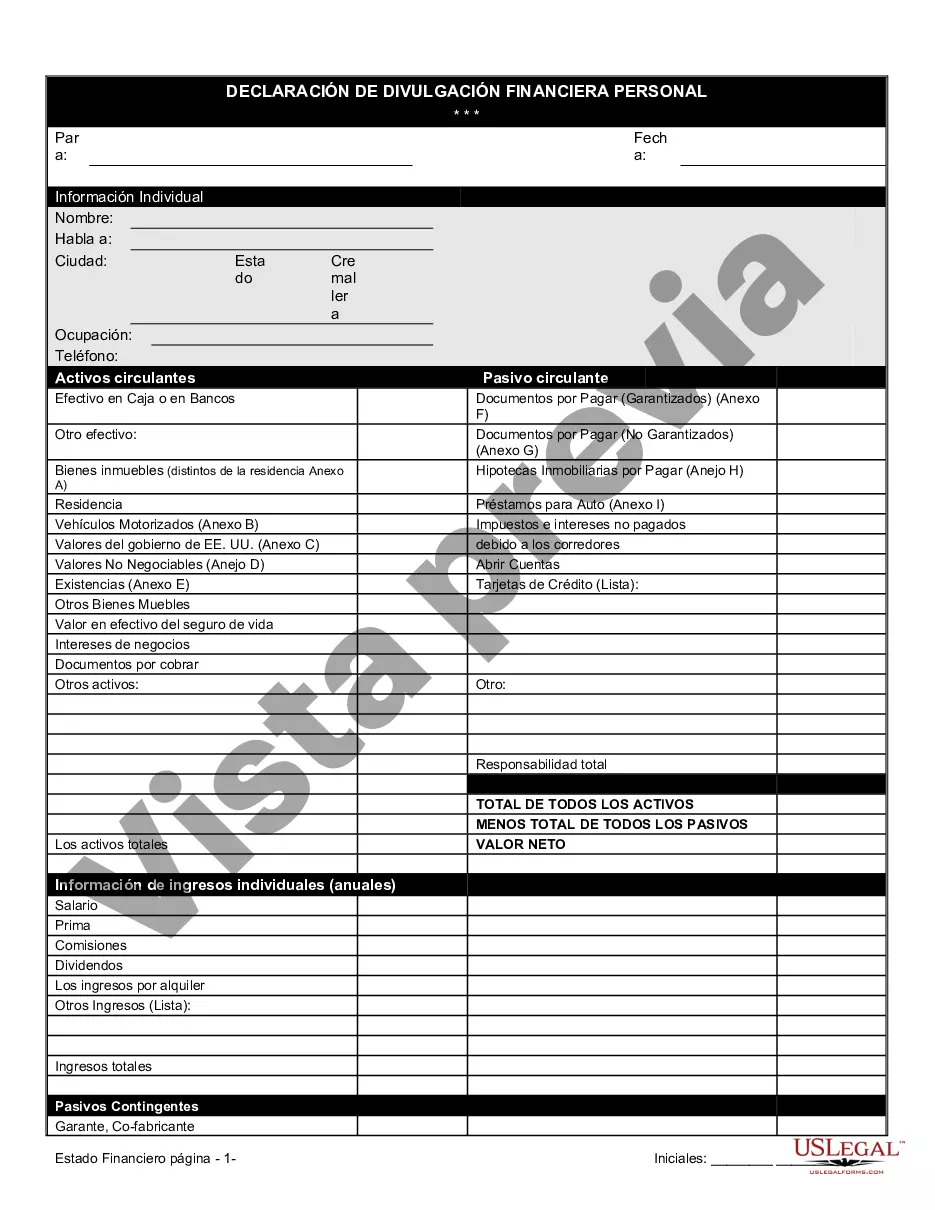

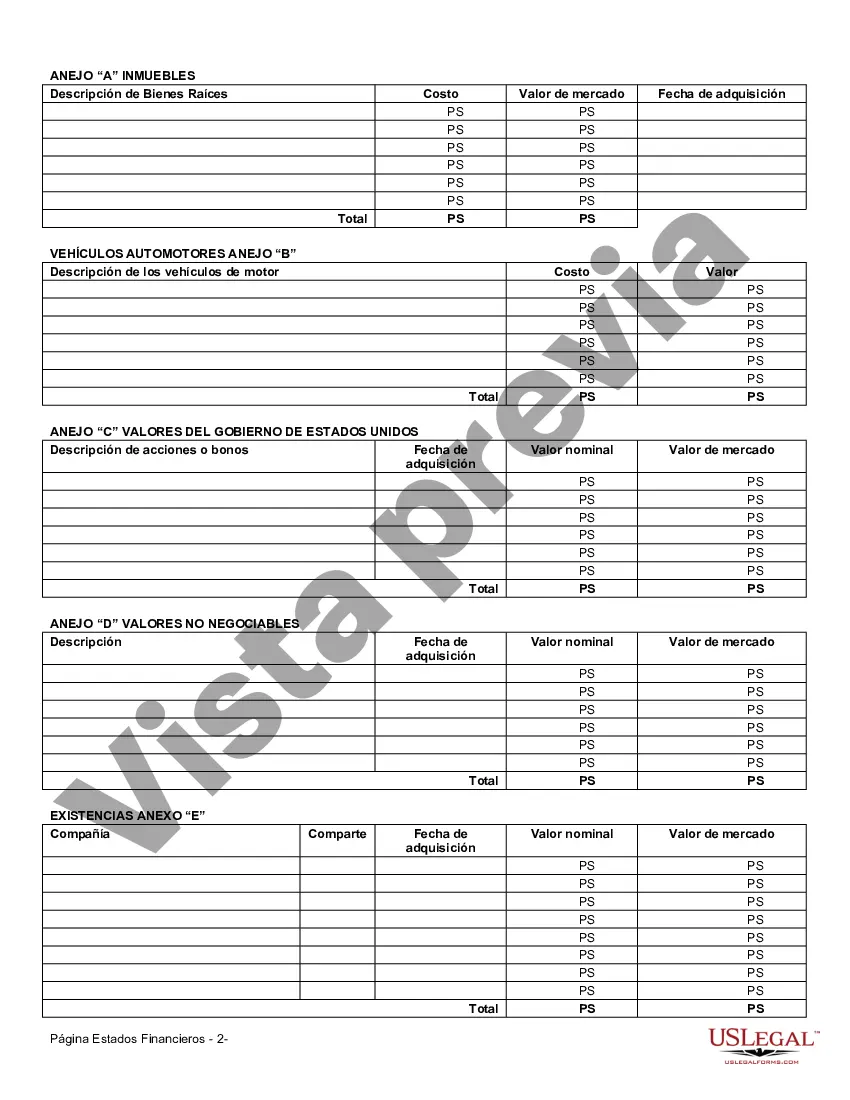

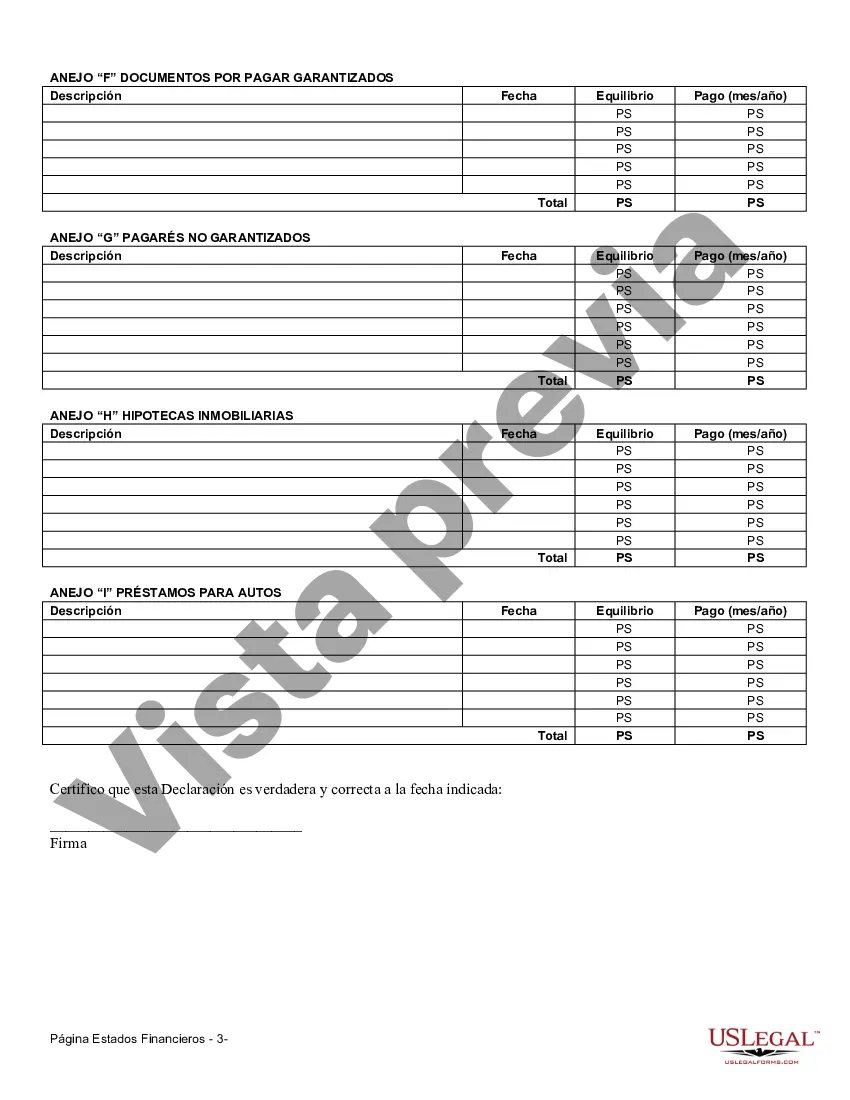

The San Diego California Financial Statement Form — Individual is a comprehensive document that enables individuals to provide a detailed overview of their personal finances. This form is essential for various purposes, including loan applications, mortgage requests, financial planning, and estate management. It ensures a transparent and accurate representation of an individual's income, expenses, assets, and liabilities. Here are some relevant keywords related to the San Diego California Financial Statement Form — Individual: 1. Income: This section requires the individual to disclose all sources of income, including employment salary, freelance earnings, investments, rental income, and any other relevant sources of revenue. 2. Expenses: This section requires a breakdown of all monthly expenses, such as housing costs, utilities, transportation expenses, insurance premiums, education costs, healthcare expenses, debts, and any other recurring expenses. 3. Assets: Individuals need to list their assets, including but not limited to real estate properties, vehicles, savings accounts, investment portfolios, retirement accounts, valuable belongings, and any other form of significant financial holdings. 4. Liabilities: This section involves detailing all outstanding debts and obligations, including mortgages, credit card balances, student loans, car loans, personal loans, alimony or child support payments, and any other outstanding liabilities. 5. Net Worth: Individuals can calculate their net worth by subtracting their liabilities from their assets, providing a snapshot of their overall financial standing. Additionally, there might be different types of San Diego California Financial Statement Form — Individual based on specific purposes or organizations, such as: 1. Loan Application Form: Tailored specifically for individuals seeking loans, it may require additional information related to the requested loan, repayment terms, and collateral details. 2. Mortgage Application Form: Designed for individuals applying for a mortgage, this form emphasizes the specific financial aspects pertinent to the real estate purchase. 3. Financial Planning Form: Aimed at individuals seeking to establish financial goals, this form may include sections related to retirement planning, education funding, and general financial objectives. 4. Estate Management Form: Focused on the management and distribution of assets after an individual's passing, this form may require more intricate information about beneficiaries, trusts, wills, and other estate-related matters. It is important to note that the specific types and variations of the San Diego California Financial Statement Form — Individual may vary depending on the institution or organization requiring the form. Thus, it is advisable to review and complete the form as per the provided instructions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Formulario de Estados Financieros - Individuo - Financial Statement Form - Individual

Description

How to fill out San Diego California Formulario De Estados Financieros - Individuo?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a lawyer to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the San Diego Financial Statement Form - Individual, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the latest version of the San Diego Financial Statement Form - Individual, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Diego Financial Statement Form - Individual:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your San Diego Financial Statement Form - Individual and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!