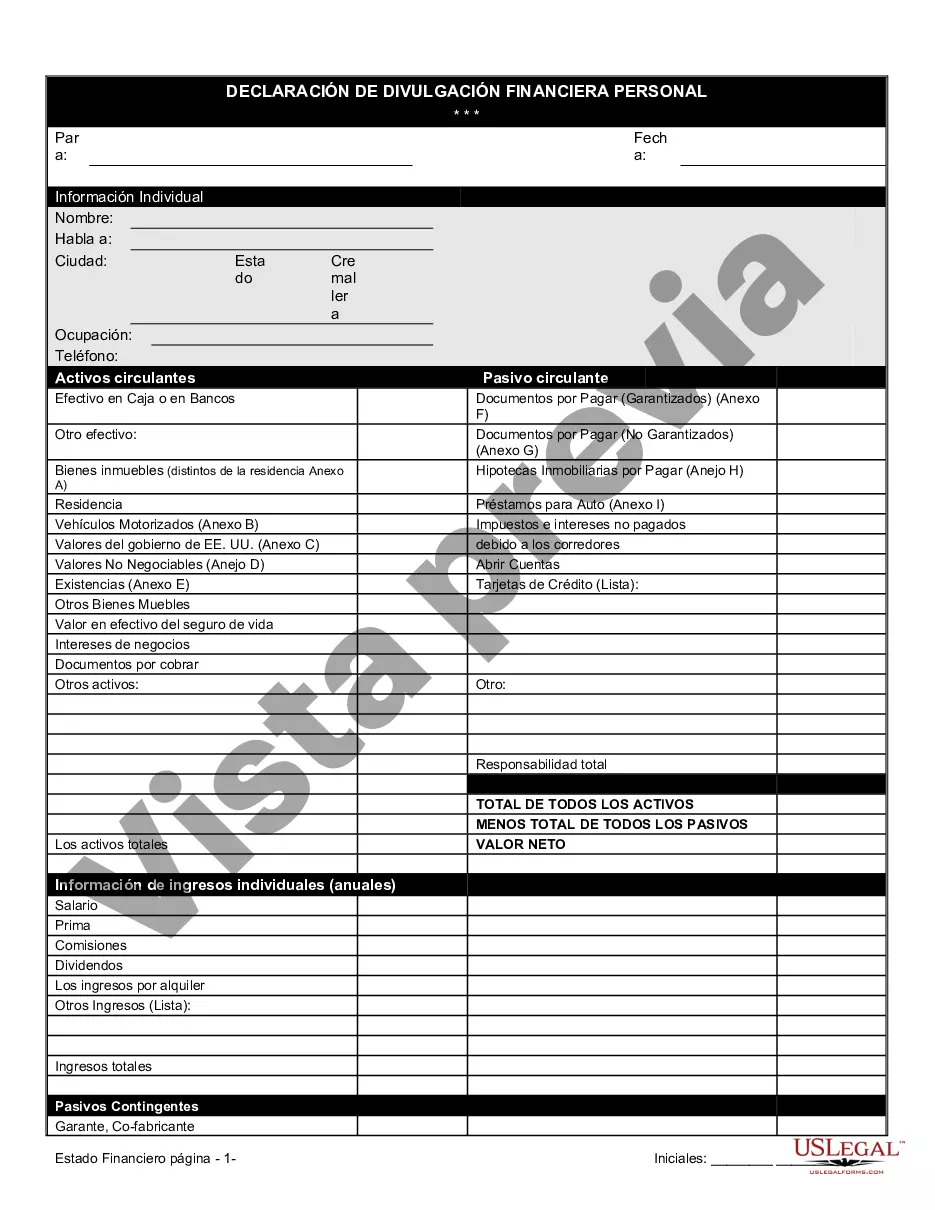

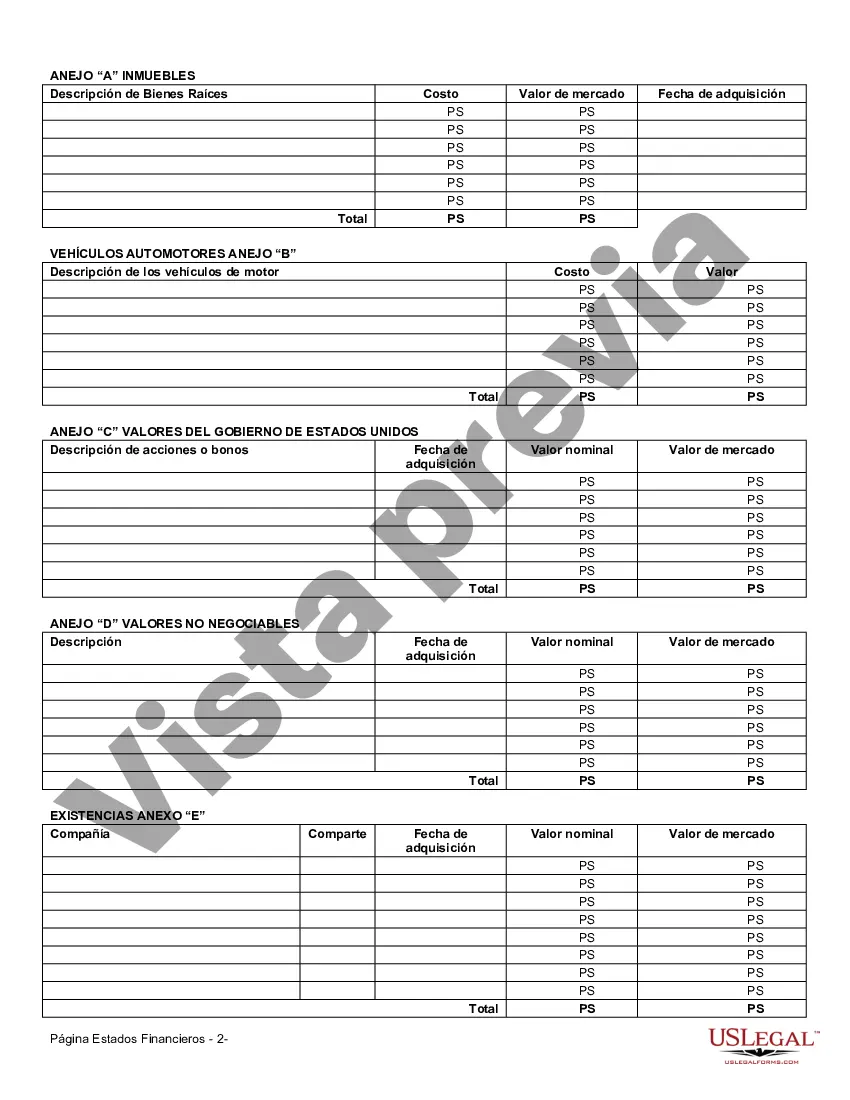

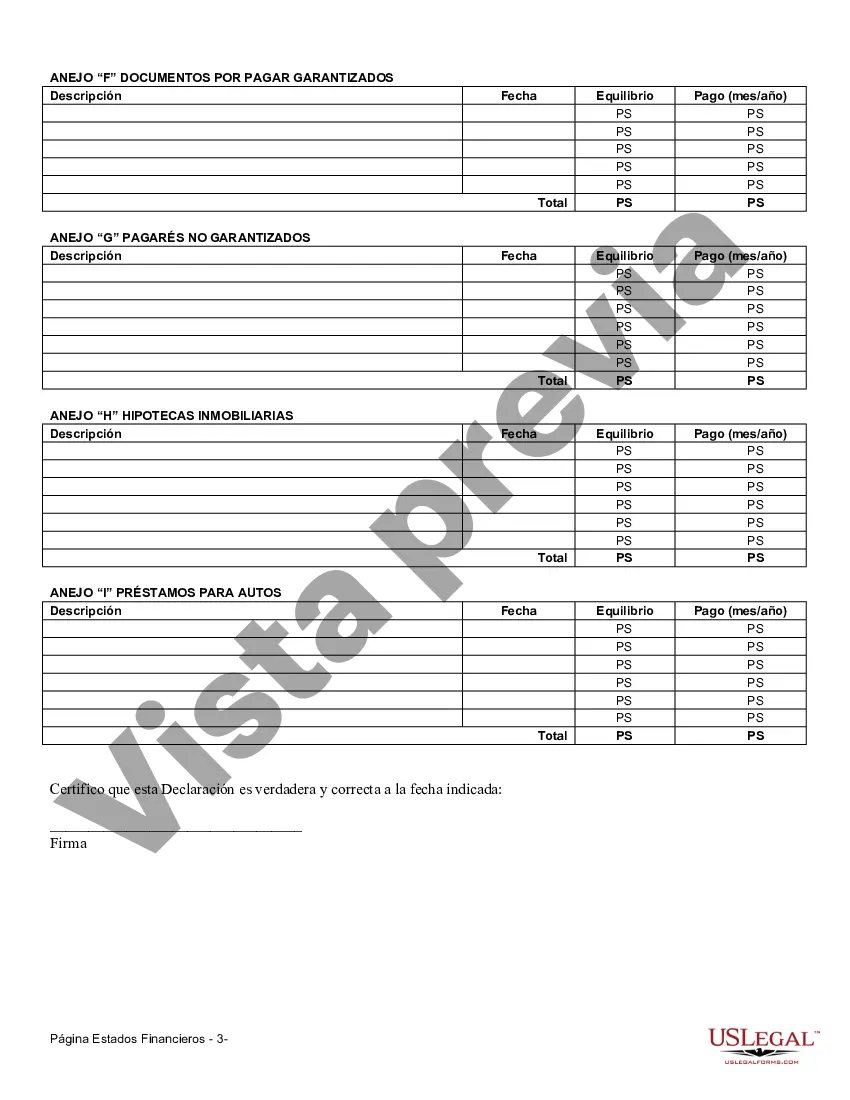

The Suffolk New York Financial Statement Form — Individual is a comprehensive document that allows individuals in Suffolk County, New York, to report their financial information accurately. This form is an essential tool used by individuals for various purposes, including loan applications, tax filings, mortgage requests, and asset verification. The Financial Statement Form collects detailed information about the individual's income, expenses, assets, and liabilities. It provides a snapshot of their financial situation, helping lenders, creditors, and other institutions assess their creditworthiness, financial stability, and ability to manage debt. By disclosing this information, individuals can present a complete picture of their financial health and ensure transparency during financial transactions. The Suffolk New York Financial Statement Form for individuals is available in various formats, catering to different purposes and needs. These may include: 1. Standard Financial Statement Form: This form is used for routine financial reporting, such as loan applications, tax filings, and general financial assessments. It gathers essential information, including income from various sources, monthly expenses, current assets (such as cash, investments, real estate, vehicles), and outstanding liabilities (such as loans, mortgages, credit card debt). 2. Mortgage Financial Statement Form: Designed specifically for mortgage applications, this form delves deeper into the individual's mortgage-related details, including current mortgage information, loan balances, interest rates, payment schedules, and any modifications requested or granted. 3. Business Income and Expense Financial Statement Form: This specialized form is tailored for individuals who operate their own businesses. In addition to personal financial information, it captures details about business income, expenses, accounts receivable, accounts payable, and business-related assets and liabilities. It helps assess the financial viability of the individual's business and its impact on their personal finances. While the specific format and layout may vary, the Suffolk New York Financial Statement Form — Individual aims to gather accurate and comprehensive financial information. This helps individuals and financial institutions evaluate the individual's financial standing, make informed decisions, and establish trust in financial transactions. By completing the Suffolk New York Financial Statement Form — Individual, individuals can provide a complete and transparent overview of their financial situation, facilitating smoother interactions with lenders, creditors, and other entities involved in financial matters. It is crucial to ensure the accuracy and honesty of the information provided, as any misrepresentation may have legal and financial consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Formulario de Estados Financieros - Individuo - Financial Statement Form - Individual

Description

How to fill out Suffolk New York Formulario De Estados Financieros - Individuo?

Whether you plan to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business case. All files are collected by state and area of use, so opting for a copy like Suffolk Financial Statement Form - Individual is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Suffolk Financial Statement Form - Individual. Follow the guidelines below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Financial Statement Form - Individual in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Pasos para armar un buen informe financiero Recopilar informacion. Durante esta etapa se recogen todos los registros financieros de la empresa.Organiza todos los registros financieros.Sistematizacion de la informacion.Por ultimo, ingresos + activo = estado financiero de la empresa.Profundizacion de los resultados.

La presentacion razonable de los estados financieros requiere una presentacion fidedigna de los efectos de las transacciones, asi como de otros sucesos y condiciones, de acuerdo con las definiciones y los criterios de reconocimiento de activos, pasivos, ingresos y gastos establecidos en el marco conceptual.

Los 6 pasos para realizar un Balance Personal Detalla tus activos. Debemos hacer un listado con todos nuestros activos, es decir, todos aquellos bienes que nos pertenecen junto con su valor.Detalla tus pasivos.Calcula tu patrimonio.Analizar balance personal.Comparar balances personales.Tomar decisiones.

La NIC 1 establece la forma de presentacion del estado de resultados, el se puede presentar de dos maneras: Metodo de la naturaleza de los gastos y Metodo de la funcion de los gastos o del costo de las ventas.

Los estados financieros son informes que reflejan el estado de una empresa en un momento determinado, normalmente un ano. Se componen de varios documentos en los que se plasma la situacion financiera de un negocio y recoge informacion, tanto economica como patrimonial, de las empresas.

Tipos de estados financieros de una empresa Balance de situacion. Este balance forma parte de las cuentas anuales que las empresas elaboran al termino de cada ejercicio contable.Cuenta de resultados del ejercicio.Estado de cambios en el patrimonio neto.Estado de flujos de efectivo.

Como Llenar un Reporte Financiero (Formulario Corto) Parte 1: Informacion Personal. Parte 2: Ingreso Semanal Bruto de Todos Origenes. Parte 3: Detallar deducciones de Ingreso Bruto. Parte 4: Cantidad Neta de Ingreso Semanal Ajustada. Parte 5: Otras Deducciones de Salario. Parte 6: Cantidad Neta de Ingreso Semanal.

Elabora un Estado de resultados paso a paso Establece tu monto de ventas.Determina el costo de ventas para obtener la utilidad bruta.Define tus gastos operativos para conocer tu utilidad operativa.Aplica la tasa de impuestos para obtener el monto de la utilidad despues de impuestos.Calcula la utilidad neta.

Un Formulario de Divulgacion Financiera es un formulario que es solicitado por el tribunal y que se requiere en cualquier caso de Ley de Familia relacionado con asuntos de divorcio o custodia de menores.