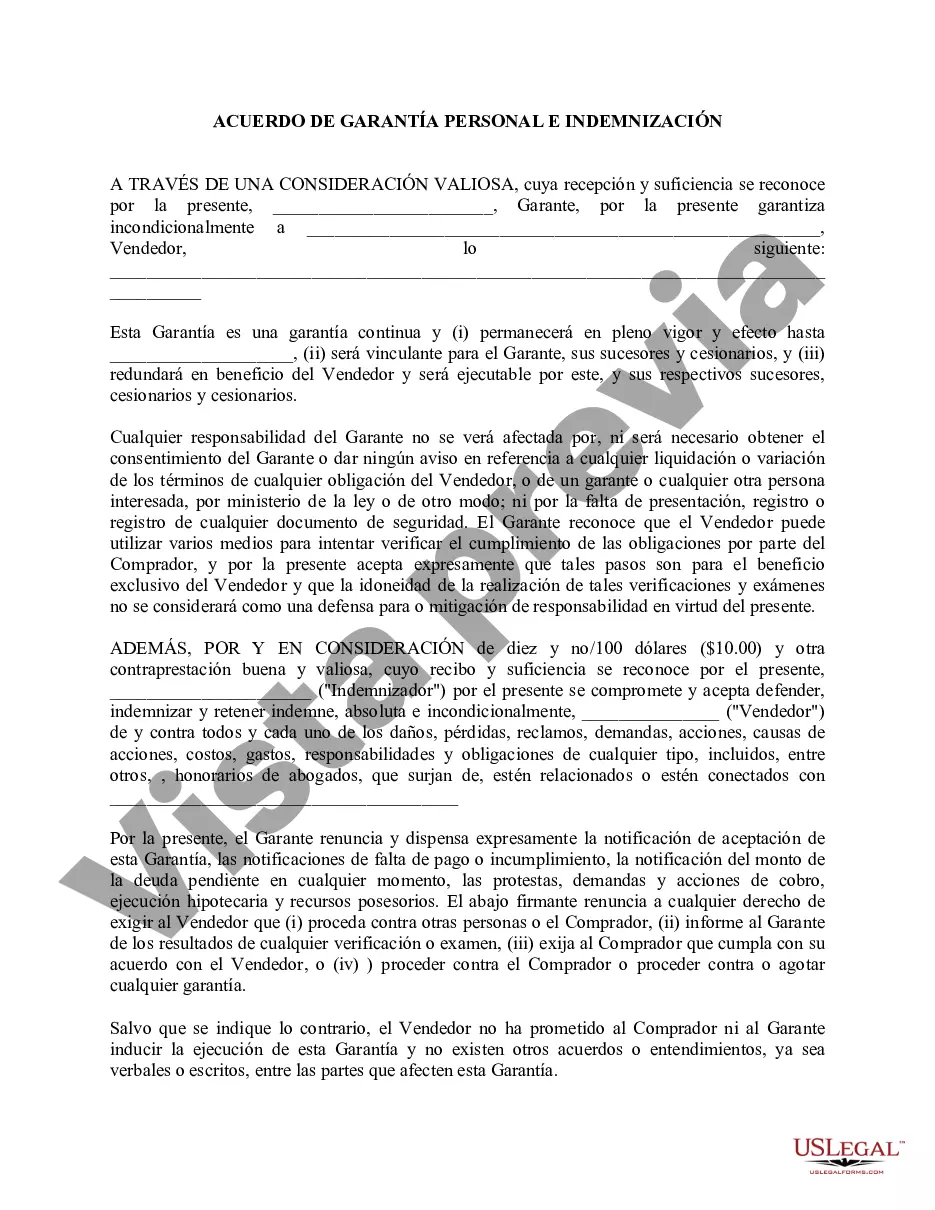

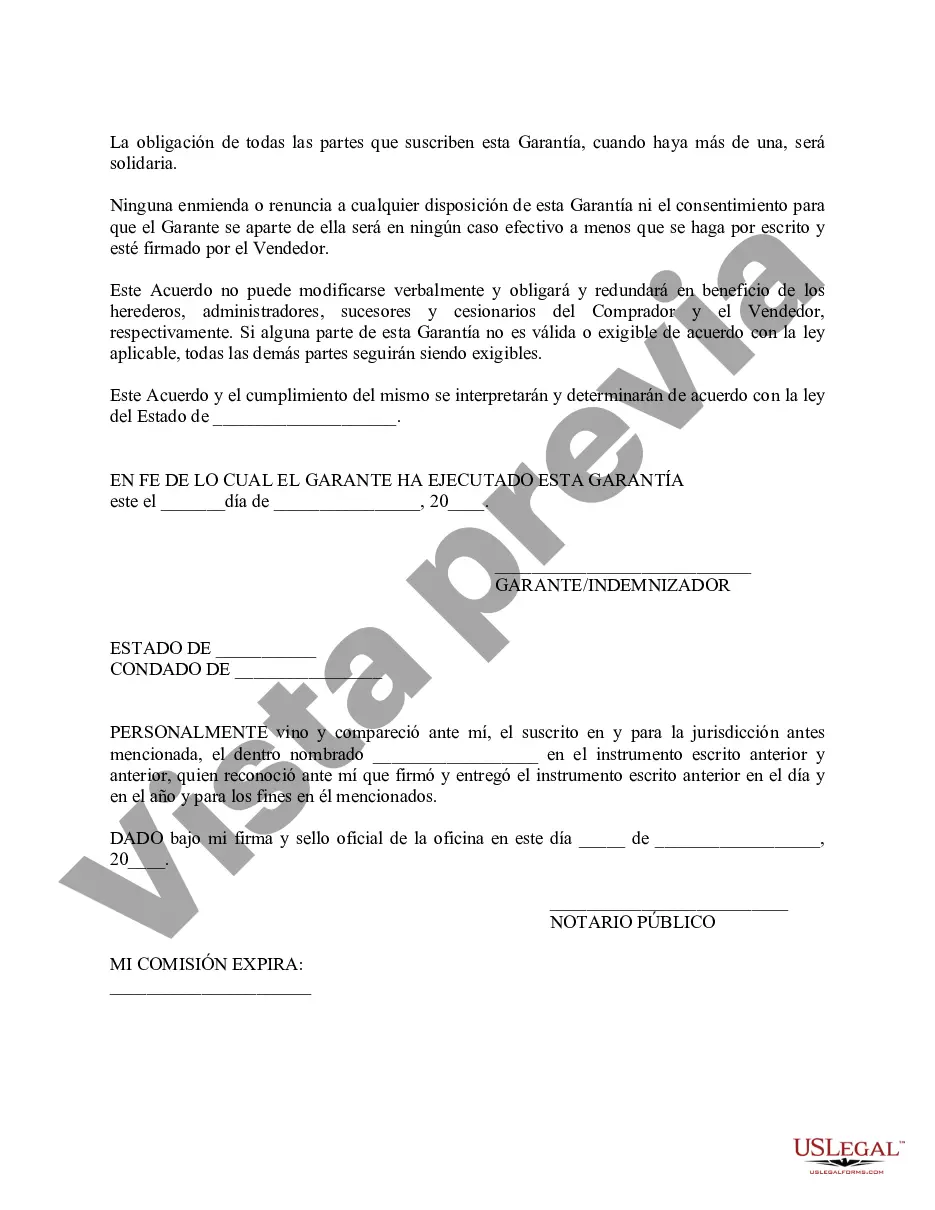

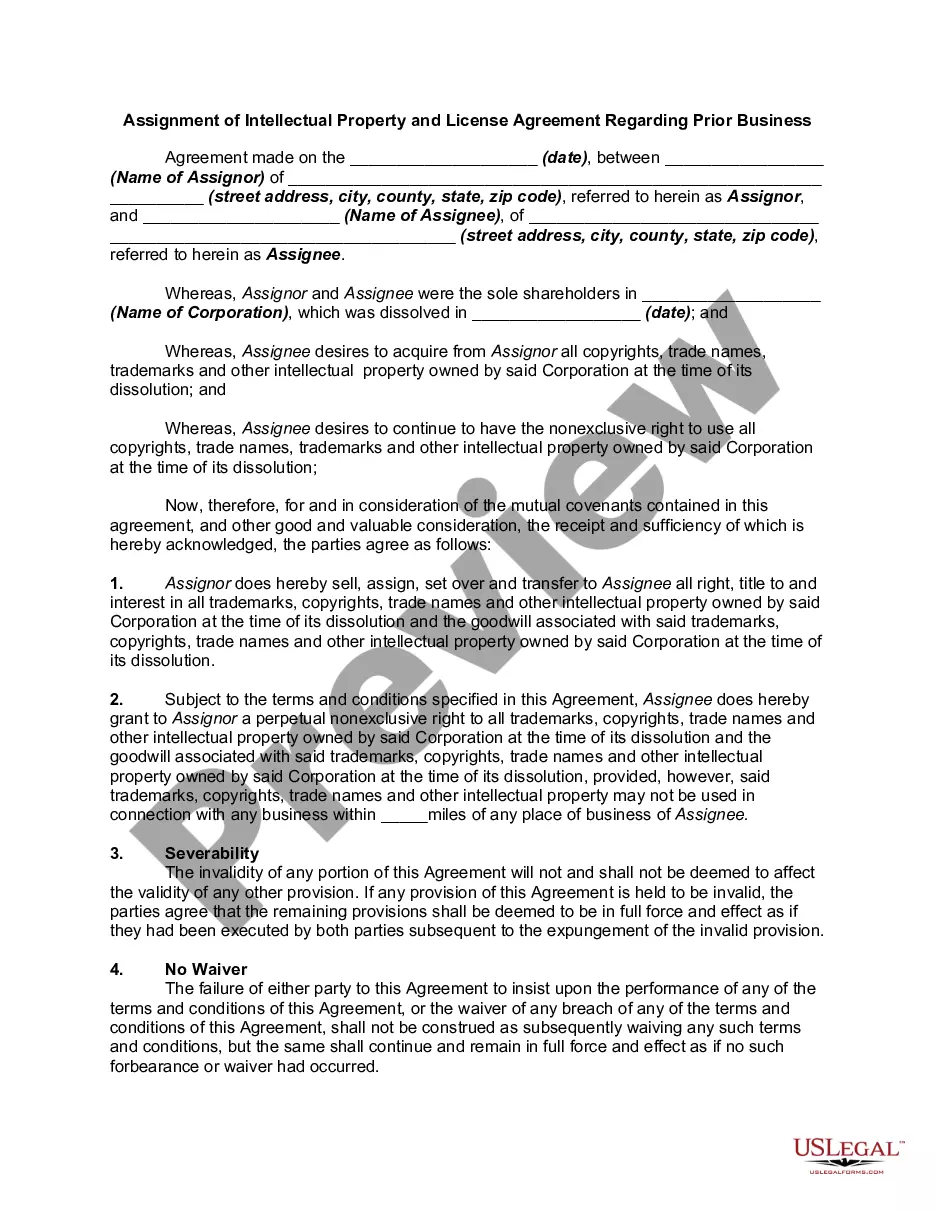

A Chicago Illinois General Guaranty and Indemnification Agreement is a legally binding contract that outlines the terms and conditions agreed upon by two parties — the guarantor and the beneficiary. This agreement ensures that the guarantor assumes responsibility for the debts, liabilities, and obligations of another party, referred to as the principal debtor. The purpose of a General Guaranty and Indemnification Agreement is to provide assurance to the beneficiary that they will be protected in the event that the principal debtor fails to fulfill their obligations. By signing this agreement, the guarantor agrees to indemnify the beneficiary for any losses, damages, costs, or expenses incurred due to the default or breach of contract by the principal debtor. It is important to note that there can be different types of General Guaranty and Indemnification Agreements specific to Chicago, Illinois. They may include: 1. Commercial Guaranty: This type of agreement is commonly used in business transactions where a third party, such as a bank or a vendor, requires additional security to grant credit or provide goods/services. The guarantor pledges their assets or agrees to repay the debt if the principal debtor fails to do so. 2. Lease Guaranty: In scenarios where a tenant does not meet the required financial qualifications for leasing a property, a lease guaranty agreement can be used. The guarantor agrees to be responsible for the tenant's rent, additional charges, and any damage caused to the property during the lease term. 3. Construction Guaranty: This agreement is frequently used in construction projects where a guarantor agrees to ensure payment to subcontractors, suppliers, or laborers if the contractor defaults on their payment obligations. In Chicago, Illinois, these agreements are often governed by state laws, including the Illinois Uniform Commercial Code (UCC), which provides guidelines and regulations for such contracts. Parties entering into a General Guaranty and Indemnification Agreement should carefully review the document, understand their rights and obligations, and seek legal advice if necessary. Overall, a Chicago Illinois General Guaranty and Indemnification Agreement provides a level of security and financial protection to beneficiaries, ensuring that their interests are safeguarded should the principal debtor fail to fulfill their obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo General de Garantía e Indemnización - General Guaranty and Indemnification Agreement

Description

How to fill out Chicago Illinois Acuerdo General De Garantía E Indemnización?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official paperwork that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business purpose utilized in your county, including the Chicago General Guaranty and Indemnification Agreement.

Locating samples on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Chicago General Guaranty and Indemnification Agreement will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guide to obtain the Chicago General Guaranty and Indemnification Agreement:

- Make sure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Chicago General Guaranty and Indemnification Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!