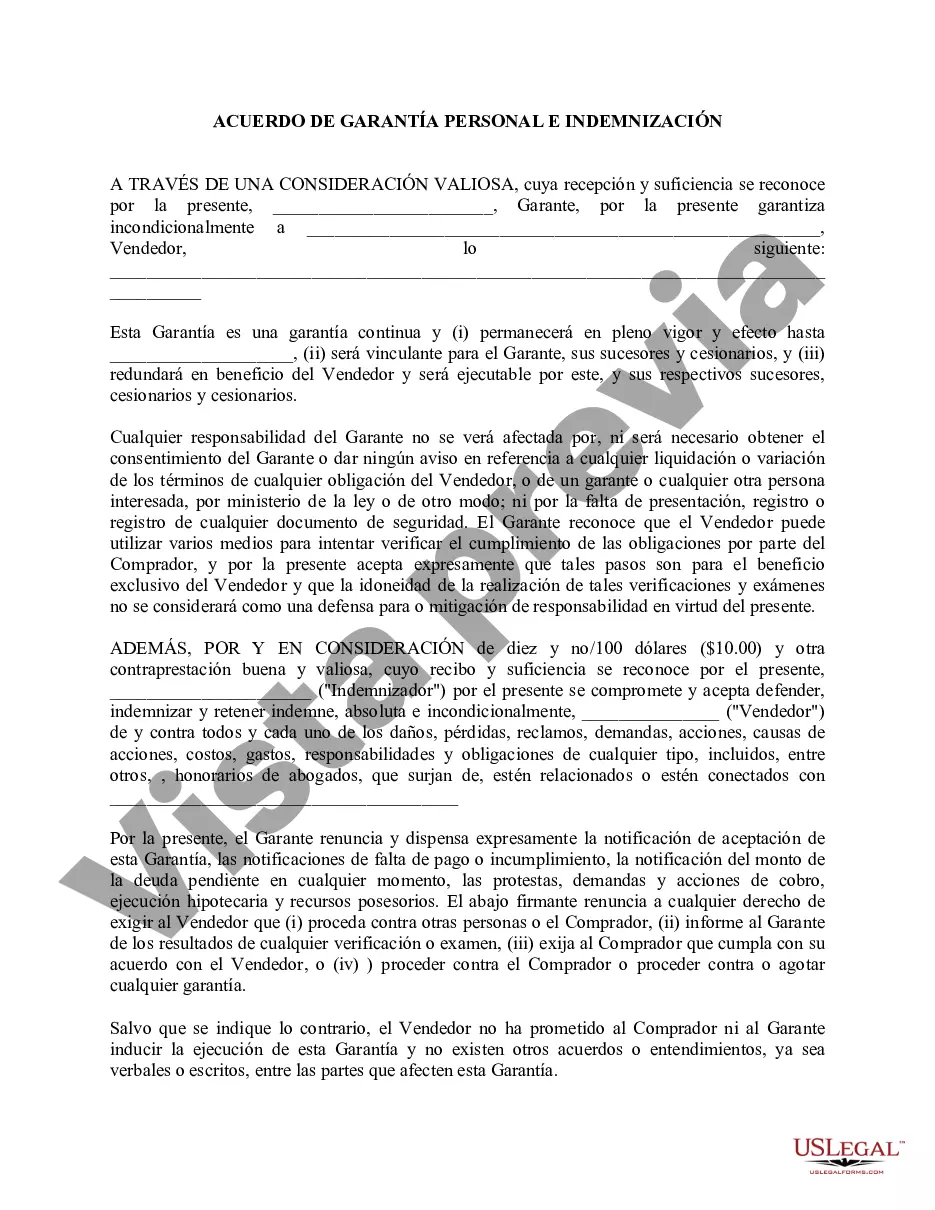

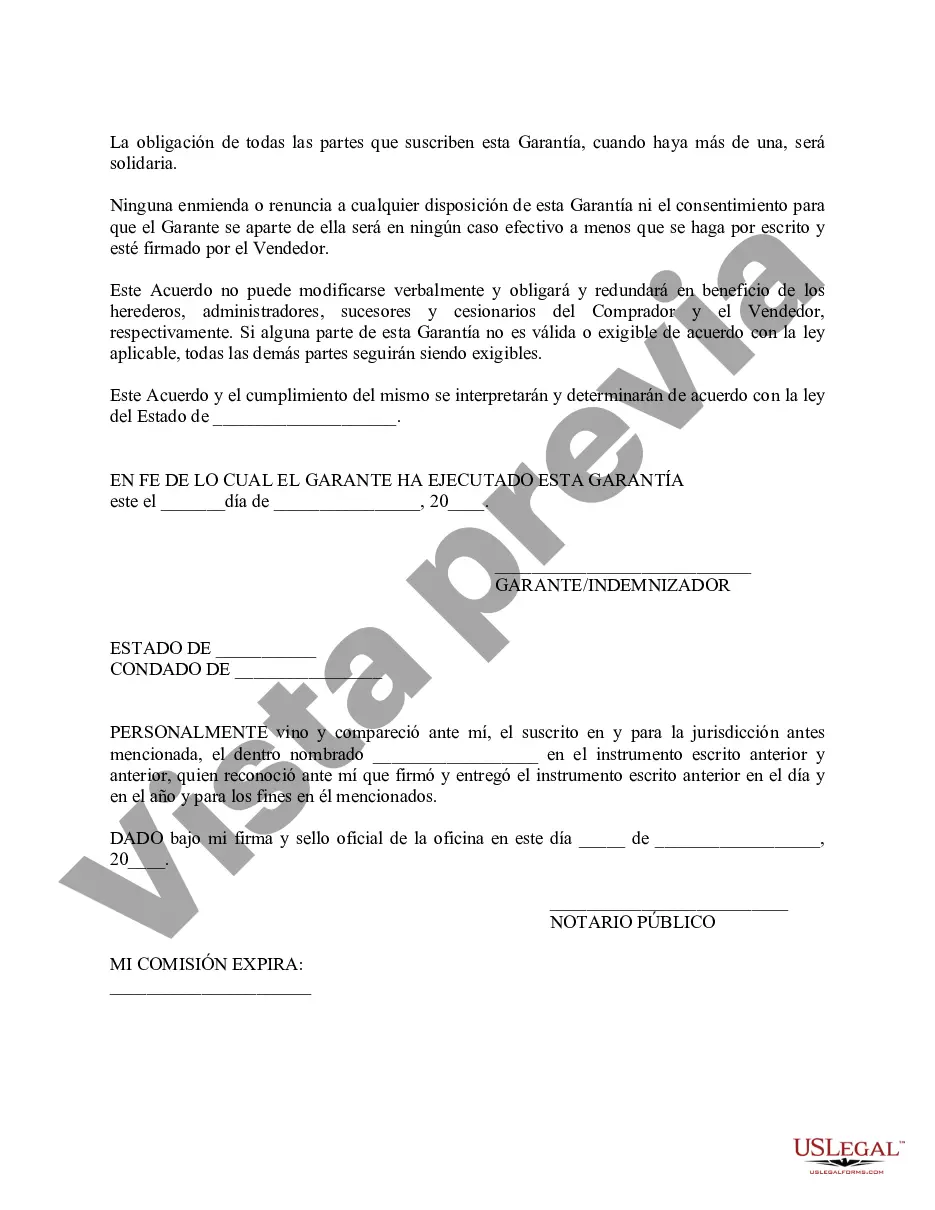

Suffolk New York General Guaranty and Indemnification Agreement is a legally binding contract that provides protection and financial security in various business transactions. This agreement is designed to safeguard the interests of parties involved, particularly lenders and creditors, by guaranteeing indemnification for any losses, damages, or liabilities incurred. The Suffolk New York General Guaranty and Indemnification Agreement encompasses a wide range of provisions and clauses, which may vary depending on the specific nature of the agreement. These agreements are typically used in real estate transactions, commercial loans, leases, and other financial arrangements. Here are some key types of Suffolk New York General Guaranty and Indemnification Agreements: 1. Real Estate Guaranty and Indemnification Agreement: This type of agreement is commonly used in property purchases, leases, and refinancing. It ensures that the guarantor assumes responsibility for any potential defaults, breaches, or financial obligations that may arise from the transaction. 2. Commercial Loan Guaranty Agreement: In this case, the guarantor agrees to repay the lender the outstanding loan amount if the borrower defaults on their payment obligations. It offers an additional layer of security to the lender by minimizing the risk of non-payment. 3. Corporate Guaranty and Indemnification Agreement: This agreement is often employed when a business entity guarantees the obligations of another company within the same group or subsidiaries. By providing the guarantee, the parent or affiliated company assures the creditor of financial support and the indemnification of any losses incurred. 4. Personal Guaranty and Indemnification Agreement: This type of agreement is utilized when an individual (the guarantor) personally guarantees the repayment of a loan or fulfillment of contractual obligations. It places the guarantor's personal assets and credit at risk, thus providing additional reassurances to the creditor or lender. In summary, Suffolk New York General Guaranty and Indemnification Agreements serve as a crucial tool for risk management and protection of financial interests. They lay out the terms and conditions under which a guarantor fully indemnifies a creditor or lender, ensuring the parties involved have legal recourse and financial security in case of default or breach.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Acuerdo General de Garantía e Indemnización - General Guaranty and Indemnification Agreement

Description

How to fill out Suffolk New York Acuerdo General De Garantía E Indemnización?

Are you looking to quickly create a legally-binding Suffolk General Guaranty and Indemnification Agreement or probably any other form to manage your personal or business affairs? You can select one of the two options: contact a professional to write a valid paper for you or create it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay unreasonable prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant form templates, including Suffolk General Guaranty and Indemnification Agreement and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary document without extra troubles.

- To start with, carefully verify if the Suffolk General Guaranty and Indemnification Agreement is adapted to your state's or county's laws.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the search again if the form isn’t what you were seeking by utilizing the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Suffolk General Guaranty and Indemnification Agreement template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the templates we offer are updated by industry experts, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!