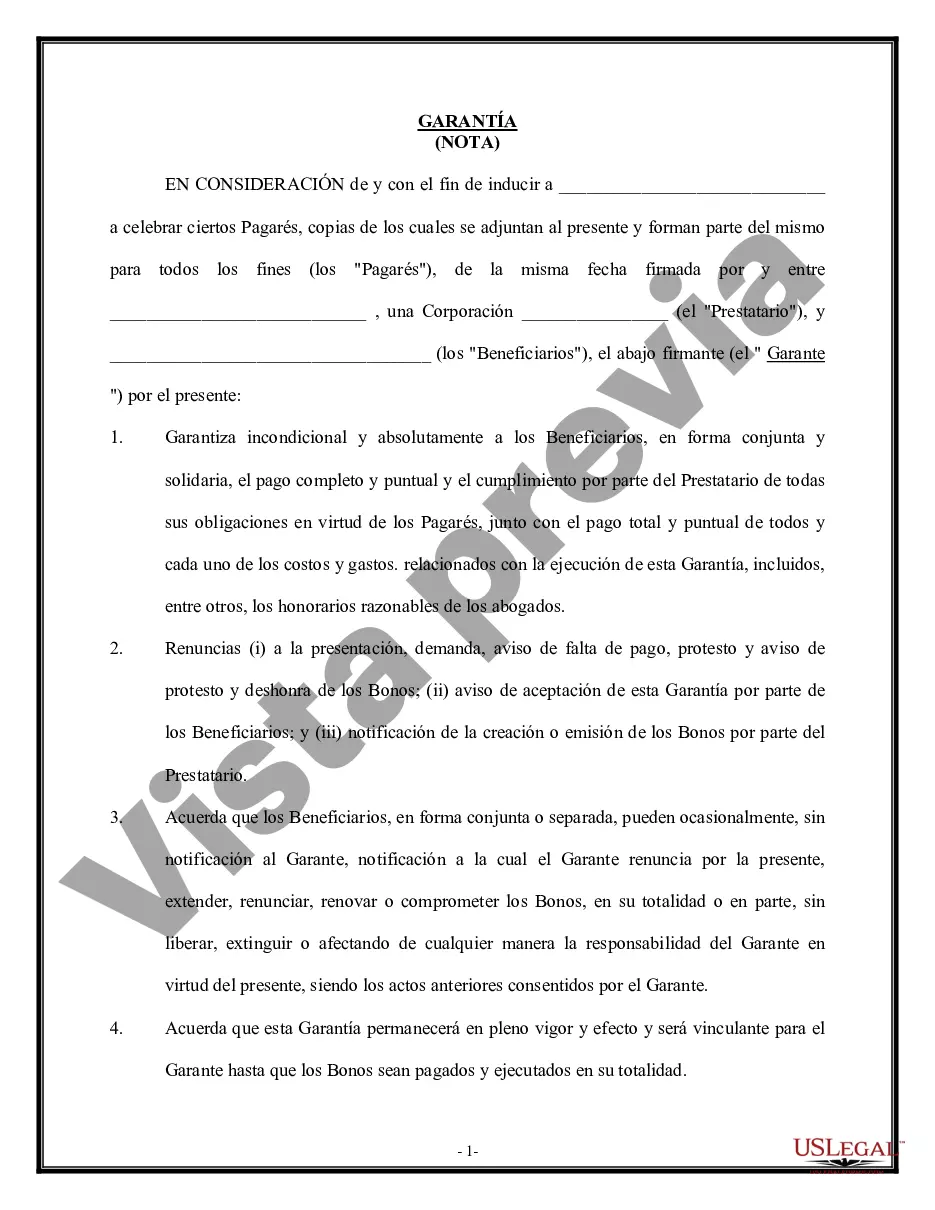

Cook Illinois Guaranty of Promissory Note by Individual — Corporate Borrower is a legally binding document that outlines the terms and conditions of a loan guarantee provided by an individual to a corporate borrower. This type of agreement serves as a guarantee of repayment for the promissory note or loan taken by the corporate borrower. The Cook Illinois Guaranty of Promissory Note by Individual — Corporate Borrower is created to protect the lender's rights and ensure that the borrowed funds are repaid in a timely manner. It provides an additional layer of security to the lender by holding the individual guarantor responsible for the repayment should the corporate borrower default on the loan. Key provisions included in the Cook Illinois Guaranty of Promissory Note by Individual — Corporate Borrower may encompass the following: 1. Identification of Parties: The agreement clearly identifies the individual guarantor and the corporate borrower involved in the loan transaction. It may include their legal names, contact details, and relevant identification information. 2. Loan Details: The document specifies the details of the loan, including the principal amount, interest rate, payment terms, and any additional fees or charges applicable. 3. Guarantee Obligations: The individual guarantor assumes the responsibility to guarantee the repayment of the loan on behalf of the corporate borrower. This includes obligations to repay the outstanding balance, along with accrued interest and any associated costs. 4. Default and Remedies: The agreement outlines the consequences of default, such as late payments or non-payment by the corporate borrower. It may describe the remedies available to the lender, which can include accelerating the loan, pursuing legal actions, or enforcing any collateral or security interests held. 5. Governing Law and Jurisdiction: The document specifies the jurisdiction and governing law under which the Cook Illinois Guaranty of Promissory Note by Individual — Corporate Borrower is executed and will be interpreted. This ensures consistency and clarity in legal matters. Different types of Cook Illinois Guaranty of Promissory Note by Individual — Corporate Borrower may include various variations or additional clauses tailored to specific circumstances. Examples might include: 1. Limited Guaranty: This type of guaranty could restrict the individual guarantor's liability to a specific sum or be limited in duration. 2. Continuing Guaranty: A continuing guaranty does not have a specified termination date and remains in effect until it is revoked or terminated by the guarantor or lender. 3. Unconditional Guaranty: An unconditional guaranty binds the individual guarantor to the full payment of the loan irrespective of any disputes or defenses that the corporate borrower may have against the lender. In summary, the Cook Illinois Guaranty of Promissory Note by Individual — Corporate Borrower is a contract where an individual agrees to guarantee the repayment of a loan on behalf of a corporate borrower. It provides an added layer of security for lenders and outlines the responsibilities and obligations of the individual guarantor. Different variations may exist to adapt to specific circumstances, ensuring a tailored approach to loan guarantees.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Garantía de Pagaré por Individuo - Prestatario Corporativo - Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Cook Illinois Garantía De Pagaré Por Individuo - Prestatario Corporativo?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Cook Guaranty of Promissory Note by Individual - Corporate Borrower, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Therefore, if you need the current version of the Cook Guaranty of Promissory Note by Individual - Corporate Borrower, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cook Guaranty of Promissory Note by Individual - Corporate Borrower:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Cook Guaranty of Promissory Note by Individual - Corporate Borrower and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Una razon expresa la relacion matematica entre dos o mas cantidades, de ahi que mediante estas puedas calcular la relacion existente entre algunos conceptos de los estados financieros.

El administrador financiero de una empresa es quien se encarga de tomar decisiones enmarcadas en el area financiera. Entre ellas estan: la administracion de activos, las decisiones de inversion, las fuentes de financiamiento, el control de gastos y la maximizacion de utilidades.

La funcion financiera son todas las actividades que se encargan de la toma de decisiones de adquisicion, financiamiento y administracion de los activos de la empresa. Su principal ob- jetivo es maximizar el valor de la empresa, lo cual se logra a traves del manejo eficiente de los recursos humanos.

El CFO es el responsable de la planificacion y la ejecucion economica y la gestion de la informacion financiera. Generalmente, el CEO o director ejecutivo es el unico cargo de mayor autoridad en la estructura corporativo y a el reporta de forma directa.

Las razones financieras son relaciones entre dos o mas conceptos (rubros o renglones) que integran los estados financieros, estas se pueden clasificar desde muy diversos puntos de vista.

Hay cuatro tipos de razones financieras, que se clasifican en grupos, y cada una de ellas analiza una cuestion diferente dentro de la estructura financiera empresarial. Razones de liquidez.Razones de endeudamiento.Razones de rentabilidad.Razones de cobertura.

Un administrador de empresas puede ser el jefe de un departamento o el director de una organizacion, puede ubicarse en posiciones que demanden un alto grado de organizacion y de liderazgo de equipos.

Existen cuatro tipos basicos de razones financieras: de Liquidez, Solvencia, Endeudamiento y Rentabilidad que pueden ser utilizadas por los gerentes, inversionistas y acreedores de la empresa.

Los principios de finanzas corporativas dictan que los costos de oportunidad surgen en presencia de una eleccion. Si parece que solo se presenta una opcion en el proceso de toma de decisiones, la alternativa predeterminada es no hacer nada, con un costo asociado de cero.

El flujo de efectivo, tambien llamado flujo de caja, o cash flow en ingles, es la variacion de entrada y salida de efectivo en un periodo determinado. Controla el flujo de efectivo de tu negocio usando un programa de facturacion.