Miami-Dade Florida Guaranty of Promissory Note by Individual — Corporate Borrower is a legal document that outlines the terms and conditions binding a corporate borrower and an individual guarantor in a loan transaction. This agreement serves as assurance to the lender that should the corporate borrower fail to fulfill their financial obligations, the individual guarantor will step in and fulfill those obligations. In Miami-Dade County, Florida, this guaranty agreement operates within the legal framework specific to the region, including the relevant laws, regulations, and practices. It is essential for both the corporate borrower and individual guarantor to understand the contents and implications of this agreement before signing. The Miami-Dade Florida Guaranty of Promissory Note by Individual — Corporate Borrower typically includes various key provisions that need to be carefully considered: 1. Parties involved: The agreement identifies the corporate borrower, the individual guarantor, and the lender. 2. Loan details: It specifies the principal amount borrowed by the corporate borrower, the interest rate, the repayment schedule, and other terms and conditions of the loan. 3. Guarantor's obligations: The individual guarantor acknowledges their responsibility to guarantee the repayment of the promissory note should the corporate borrower default. 4. Grant of security interest: If applicable, the agreement may grant the lender a security interest in certain assets of the guarantor as additional collateral. 5. Representations and warranties: Both the corporate borrower and individual guarantor make various representations and warranties regarding their legal capacity, financial condition, and authority to enter into the agreement. 6. Events of default and remedies: The agreement outlines the events or actions that would constitute a default, such as failure to pay, breach of covenants, or bankruptcy. It also specifies the remedies available to the lender in case of default. 7. Indemnification: The agreement may include a provision where the individual guarantor agrees to indemnify and hold the lender harmless from any losses or damages resulting from the corporate borrower's default. 8. Governing law and jurisdiction: The agreement specifies that Miami-Dade County, Florida, laws govern the interpretation and enforcement of the agreement. It also designates the specific court or jurisdiction for any legal disputes. Some variations or types of Miami-Dade Florida Guaranty of Promissory Note by Individual — Corporate Borrower may include specific clauses or considerations aimed at addressing different circumstances or parties involved, such as multiple guarantors or additional collateral. However, the essential elements listed above generally remain consistent across these agreements. It is crucial to consult with a qualified attorney experienced in Miami-Dade County, Florida, laws to draft or review the specific Guaranty of Promissory Note by Individual — Corporate Borrower tailored to the parties' unique circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Que Es Un Cosigner Para Comprar Casa - Guaranty of Promissory Note by Individual - Corporate Borrower

Instant download

Description

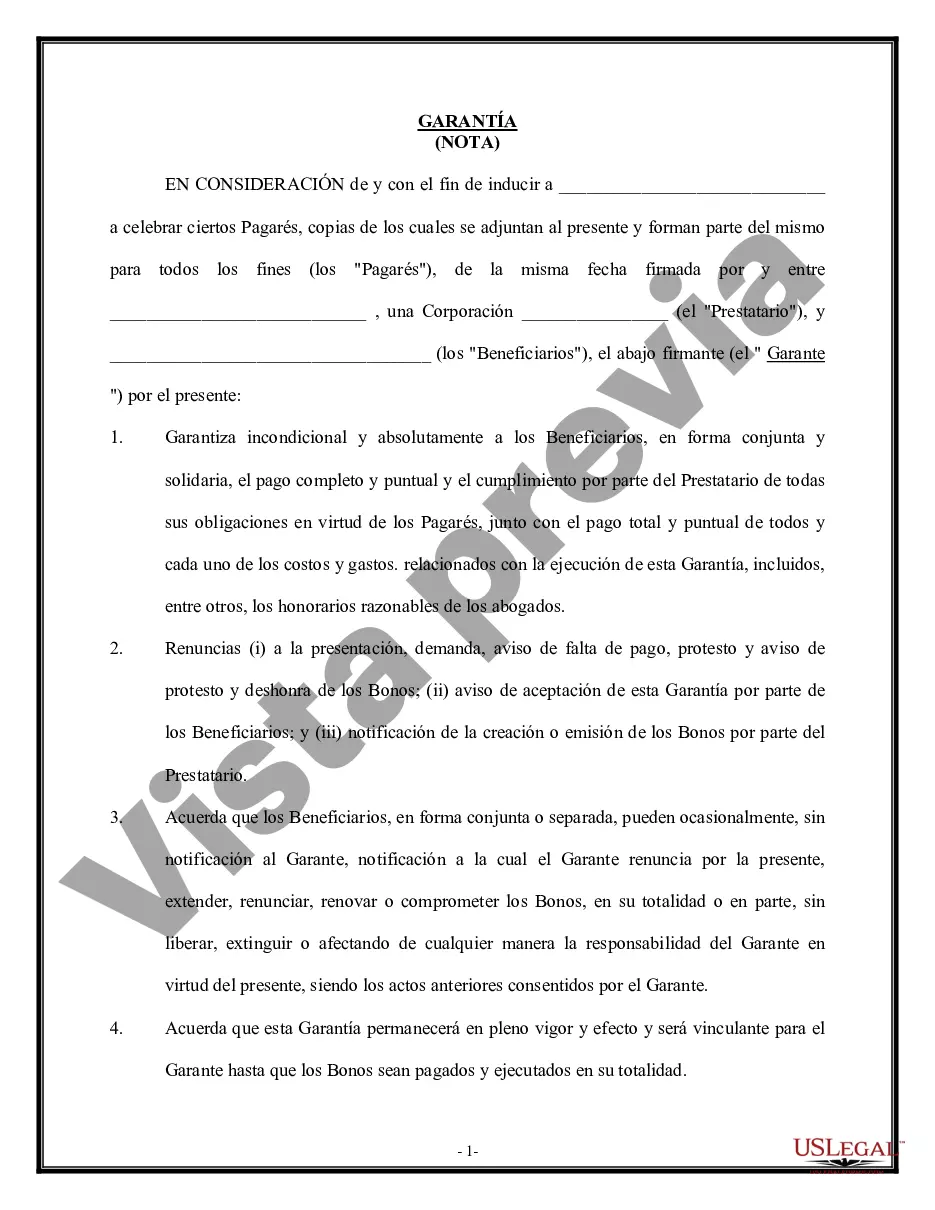

This form states that in order to get the borrower to enter into certain promissory notes, the guarantor unconditionally and absolutely guarantees to payees, jointly and severally, the full and prompt payment and performance by the borrower of all of its obligations under and pursuant to the promissory notes, together with the full and prompt payment of any and all costs and expenses of and incidental to the enforcement of this Guaranty, including, without limitation, reasonable attorneys' fees.

Miami-Dade Florida Guaranty of Promissory Note by Individual — Corporate Borrower is a legal document that outlines the terms and conditions binding a corporate borrower and an individual guarantor in a loan transaction. This agreement serves as assurance to the lender that should the corporate borrower fail to fulfill their financial obligations, the individual guarantor will step in and fulfill those obligations. In Miami-Dade County, Florida, this guaranty agreement operates within the legal framework specific to the region, including the relevant laws, regulations, and practices. It is essential for both the corporate borrower and individual guarantor to understand the contents and implications of this agreement before signing. The Miami-Dade Florida Guaranty of Promissory Note by Individual — Corporate Borrower typically includes various key provisions that need to be carefully considered: 1. Parties involved: The agreement identifies the corporate borrower, the individual guarantor, and the lender. 2. Loan details: It specifies the principal amount borrowed by the corporate borrower, the interest rate, the repayment schedule, and other terms and conditions of the loan. 3. Guarantor's obligations: The individual guarantor acknowledges their responsibility to guarantee the repayment of the promissory note should the corporate borrower default. 4. Grant of security interest: If applicable, the agreement may grant the lender a security interest in certain assets of the guarantor as additional collateral. 5. Representations and warranties: Both the corporate borrower and individual guarantor make various representations and warranties regarding their legal capacity, financial condition, and authority to enter into the agreement. 6. Events of default and remedies: The agreement outlines the events or actions that would constitute a default, such as failure to pay, breach of covenants, or bankruptcy. It also specifies the remedies available to the lender in case of default. 7. Indemnification: The agreement may include a provision where the individual guarantor agrees to indemnify and hold the lender harmless from any losses or damages resulting from the corporate borrower's default. 8. Governing law and jurisdiction: The agreement specifies that Miami-Dade County, Florida, laws govern the interpretation and enforcement of the agreement. It also designates the specific court or jurisdiction for any legal disputes. Some variations or types of Miami-Dade Florida Guaranty of Promissory Note by Individual — Corporate Borrower may include specific clauses or considerations aimed at addressing different circumstances or parties involved, such as multiple guarantors or additional collateral. However, the essential elements listed above generally remain consistent across these agreements. It is crucial to consult with a qualified attorney experienced in Miami-Dade County, Florida, laws to draft or review the specific Guaranty of Promissory Note by Individual — Corporate Borrower tailored to the parties' unique circumstances.

Free preview