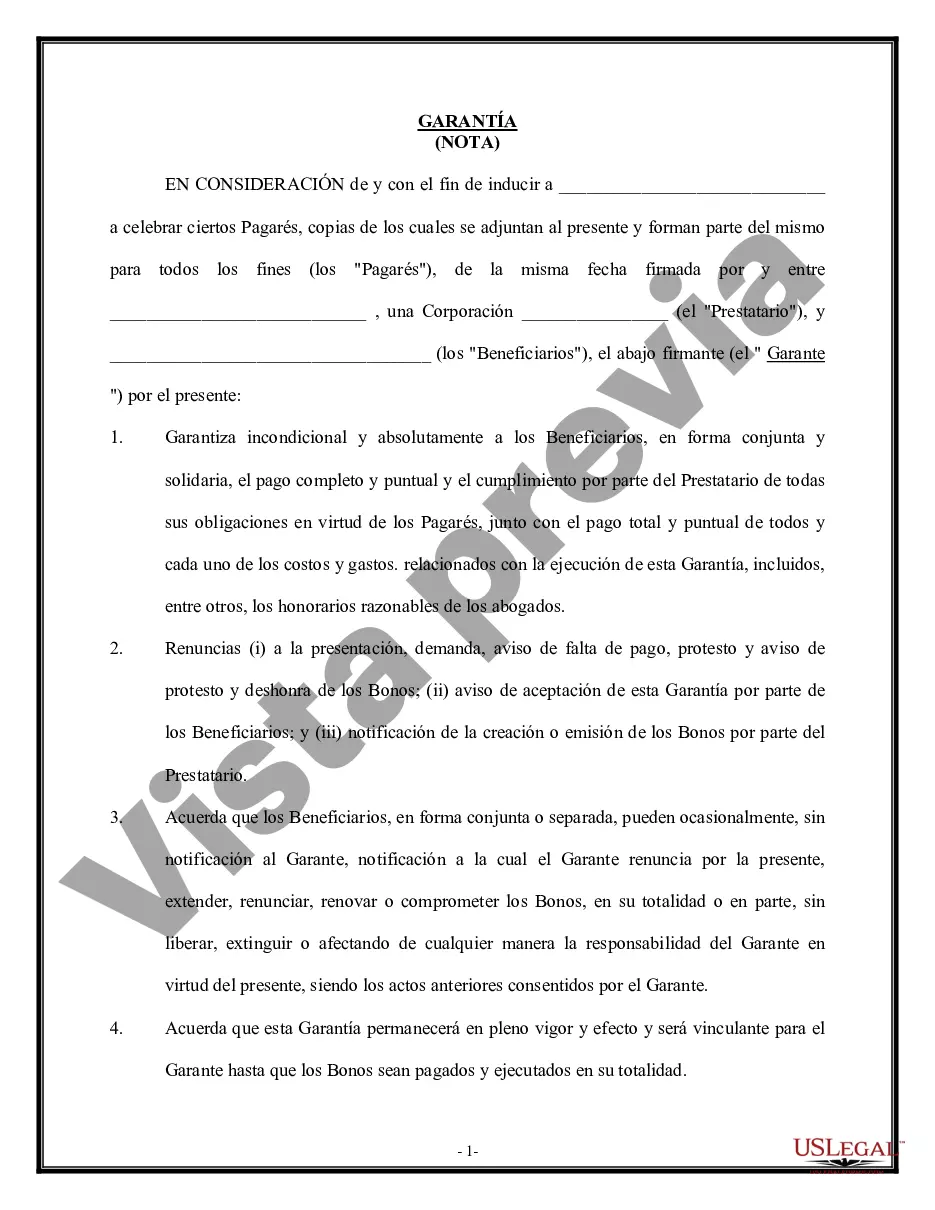

Orange California Guaranty of Promissory Note by Individual — Corporate Borrower is a legal document that outlines the specific terms and conditions under which an individual agrees to guaranty the repayment of a promissory note issued by a corporate borrower in the city of Orange, California. This legally binding agreement ensures that the individual guarantor (referred to as the "Guarantor") will be held personally liable for the full repayment of the promissory note in case the corporate borrower defaults on their payment obligations. The Orange California Guaranty of Promissory Note by Individual — Corporate Borrower includes various key elements to provide clarity and protect the rights of both parties involved. It typically outlines the names and addresses of the Guarantor and the corporate borrower, along with the effective date of the agreement. The promissory note being guaranteed is also referenced, specifying the principal amount, interest rate, repayment schedule, and any additional terms associated with the loan. Moreover, the document outlines the Guarantor's unconditional and irrevocable guarantee to be bound by the terms of the promissory note. It specifies that the Guarantor shall be fully responsible for the repayment of the outstanding balance, accrued interest, and any other costs associated with the promissory note. Additionally, it often includes provisions about the Guarantor's waiver of certain rights, indemnification of the lender, and the lender's rights to seek remedies on default, such as pursuing legal action or applying any security pledged. Different types of Orange California Guaranty of Promissory Note by Individual — Corporate Borrower may include variations in terms and conditions based on the specific requirements of the lender and borrower. For instance, there could be variations in the interest rate, repayment schedule, or additional provisions related to security or collateral. However, the general purpose of all types remains the same — to ensure that the Guarantor shoulders the primary responsibility for the repayment and any associated costs in the event of default. In summary, the Orange California Guaranty of Promissory Note by Individual — Corporate Borrower is a crucial legal document that provides protection to lenders and serves as a means to secure loan repayment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Garantía de Pagaré por Individuo - Prestatario Corporativo - Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Orange California Garantía De Pagaré Por Individuo - Prestatario Corporativo?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Orange Guaranty of Promissory Note by Individual - Corporate Borrower, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Consequently, if you need the current version of the Orange Guaranty of Promissory Note by Individual - Corporate Borrower, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Orange Guaranty of Promissory Note by Individual - Corporate Borrower:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Orange Guaranty of Promissory Note by Individual - Corporate Borrower and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!