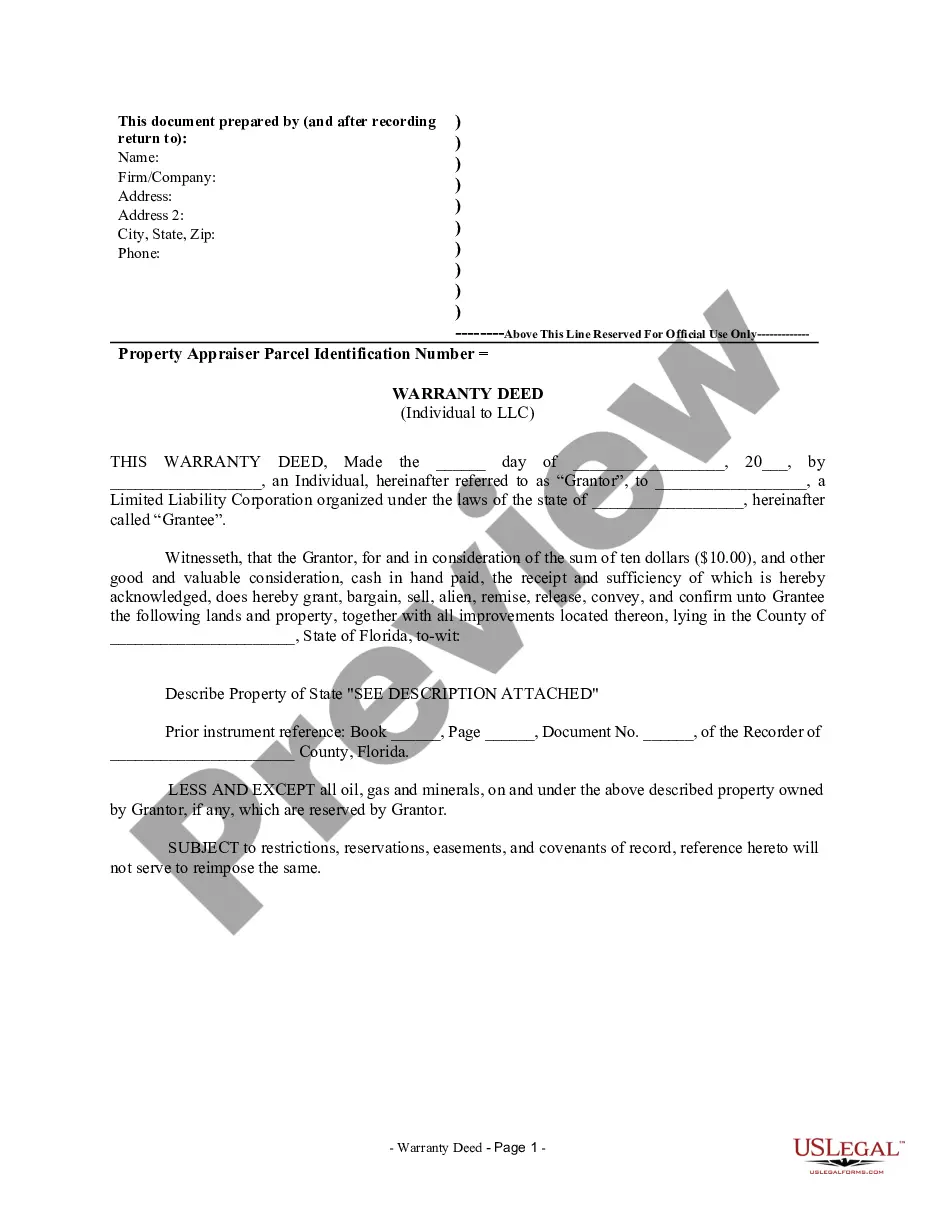

Cuyahoga Ohio Guaranty of Promissory Note by Individual — Individual Borrower is a legal document that serves as a guarantee for a promissory note. This type of agreement is commonly used in financial transactions where an individual borrower seeks a loan from a lender in Cuyahoga County, Ohio. It provides an additional layer of security and assurance to the lender, ensuring that the borrower's obligation to repay the loan will be fulfilled. The Cuyahoga Ohio Guaranty of Promissory Note by Individual — Individual Borrower includes various key elements to establish a legally binding agreement. It outlines the parties involved, including the individual borrower and the lender. The specific details of the promissory note, such as the principal amount, interest rate, repayment terms, and maturity date are also recorded. The guaranty agreement often includes essential provisions that detail the responsibilities and obligations of the guarantor, typically the individual borrower. The guarantor confirms their intent to guarantee the repayment of the promissory note and acknowledges that they will be held accountable if the borrower defaults on the loan. Furthermore, the document may specify the remedies available to the lender in case of a default. Different types of Cuyahoga Ohio Guaranty of Promissory Note by Individual — Individual Borrower may vary based on the specific terms and conditions of each loan agreement. Some common variations or specific types may include: 1. Limited Guaranty: This form of guaranty may restrict the guarantor's liability to a certain amount or for a time-limited duration. It offers a level of protection to the guarantor by limiting their responsibility for the loan. 2. Unconditional Guaranty: This type of guaranty holds the guarantor fully responsible for the repayment of the loan, without any limitations or conditions. It provides the lender with greater confidence in the borrower's ability to repay and minimizes the risks associated with default. 3. Joint and Several guaranties: In this scenario, multiple individual borrowers act as guarantors for a single promissory note. Each guarantor is then jointly and individually liable for the entire loan amount, meaning the lender can pursue any one guarantor for the full debt amount. It is crucial for all parties involved to carefully review and understand the terms and implications of a Cuyahoga Ohio Guaranty of Promissory Note by Individual — Individual Borrower before signing it. Seeking legal advice or consulting an attorney is advisable to ensure compliance with local laws and to protect the interests of both the borrower and the lender.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Garantía de Pagaré por Individuo - Prestatario Individual - Guaranty of Promissory Note by Individual - Individual Borrower

Description

How to fill out Garantía De Pagaré Por Individuo - Prestatario Individual?

What is the typical duration it takes for you to create a legal document.

Considering that each state enforces its own laws and regulations across various aspects of life, finding a Cuyahoga Guaranty of Promissory Note by Individual - Individual Borrower that meets all local standards can be laborious, and procuring it from a qualified attorney is frequently expensive.

Numerous online platforms provide the most sought-after state-specific documents for download, but utilizing the US Legal Forms repository offers the greatest benefits.

Click Buy Now when you are confident in your selected file. Choose the subscription plan that best fits your needs. Create an account on the platform or Log In to continue to payment options. Pay using PayPal or your credit card. Adjust the file format if needed. Click Download to save the Cuyahoga Guaranty of Promissory Note by Individual - Individual Borrower. Print the document or utilize any preferred online editor to complete it digitally. Regardless of how many times you require the purchased document, you can access all files you have stored in your profile via the My documents tab. Give it a try!

- US Legal Forms is the most extensive online collection of templates, categorized by states and areas of application.

- In addition to the Cuyahoga Guaranty of Promissory Note by Individual - Individual Borrower, you can find any particular document necessary to conduct your business or personal matters, adhering to your local regulations.

- All samples are validated by professionals, ensuring that you can prepare your documents accurately.

- Using the service is relatively straightforward.

- If you already possess an account on the site and your subscription is active, you simply need to Log In, select the desired sample, and download it.

- You can choose the file in your profile at any later time.

- If you are a new user to the site, you will need to follow a few additional steps to acquire your Cuyahoga Guaranty of Promissory Note by Individual - Individual Borrower.

- Examine the content of the webpage you are currently visiting.

- Review the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

Form popularity

FAQ

Un prestatario es un agente economico que recibe una cantidad de dinero determinada. El prestatario se compromete a devolver esta cantidad de dinero mas intereses en un periodo de tiempo determinado o fecha de vencimiento estipulada. En otras palabras, un prestatario es un individuo o sociedad que recibe un prestamo.

Un prestatario es un agente economico que recibe una cantidad de dinero determinada. El prestatario se compromete a devolver esta cantidad de dinero mas intereses en un periodo de tiempo determinado o fecha de vencimiento estipulada. En otras palabras, un prestatario es un individuo o sociedad que recibe un prestamo.

Un prestamista es un agente economico que presta una determinada cantidad de dinero a un individuo o sociedad. Esta cantidad debera ser devuelta en un periodo de tiempo determinado.

En la celebracion de un contrato de un prestamo, el prestatario es quien recibe el dinero (o capital) y, al hacerlo, adquiere la obligacion de ir devolviendolo dentro del plazo previsto y a traves del metodo de amortizacion que haya acordado.

Antes de prestar dinero, echale un ojo a esto y no sientas pena al pedir (amablemente) lo que es tuyo. Establece fechas de pago. Una firma vale mil. Conoce que onda con la vida financiera de la persona que te esta pidiendo dinero. Por si la cosa se pone seria. Pon una 'garantia' de por medio.

El prestamista es la persona o entidad que facilita una determinada cantidad de dinero, en forma de credito o prestamo, con el compromiso de la otra parte (o prestatario) de que este sera devuelto, junto a los intereses, segun las condiciones acordadas por contrato.

Una forma eficaz y rapida que puedes aplicar para evitar estos casos es, sin duda, hacer un pagare. Por ello te recomendamos que siempre que te pidan dinero prestado, pongas como condicion la firma de este documento y asi contaras con un respaldo que te servira para exigir el pago correspondiente.

¿Que garantias requiero para solicitar un credito? Garantia Natural. Se entiende como aquellos activos producto de los creditos a financiar.Aval y/o Deudor Solidario.Garantia Prendaria.Garantia Hipotecaria.Garantia Liquida.Garantias Mixtas.

Si le sirve de alivio, debe saber que las deudas contraidas antes del matrimonio no seran trasladas automaticamente a la propiedad mancomunada una vez casados. Por lo tanto, las deudas son responsabilidad unica de quien las contrajo y no se convertiran en bienes comunes.

La demanda debe presentarse frente al juez civil del lugar donde vive la persona que le debe el dinero. Una vez haya presentado la demanda, y si el juez considera que se cumplen los requisitos, ordenara al deudor incumplido pagar lo que se debe, en determinado plazo.