A trust is the legal relationship between one person, the trustee, having an equitable ownership or management of certain property and another person, the beneficiary, owning the legal title to that property. The beneficiary is entitled to the performance of certain duties and the exercise of certain powers by the trustee, which performance may be enforced by a court of equity. Most trusts are founded by the persons (called trustors, settlors and/or donors) who execute a written declaration of trust which establishes the trust and spells out the terms and conditions upon which it will be conducted. The declaration also names the original trustee or trustees, successor trustees or means to choose future trustees.

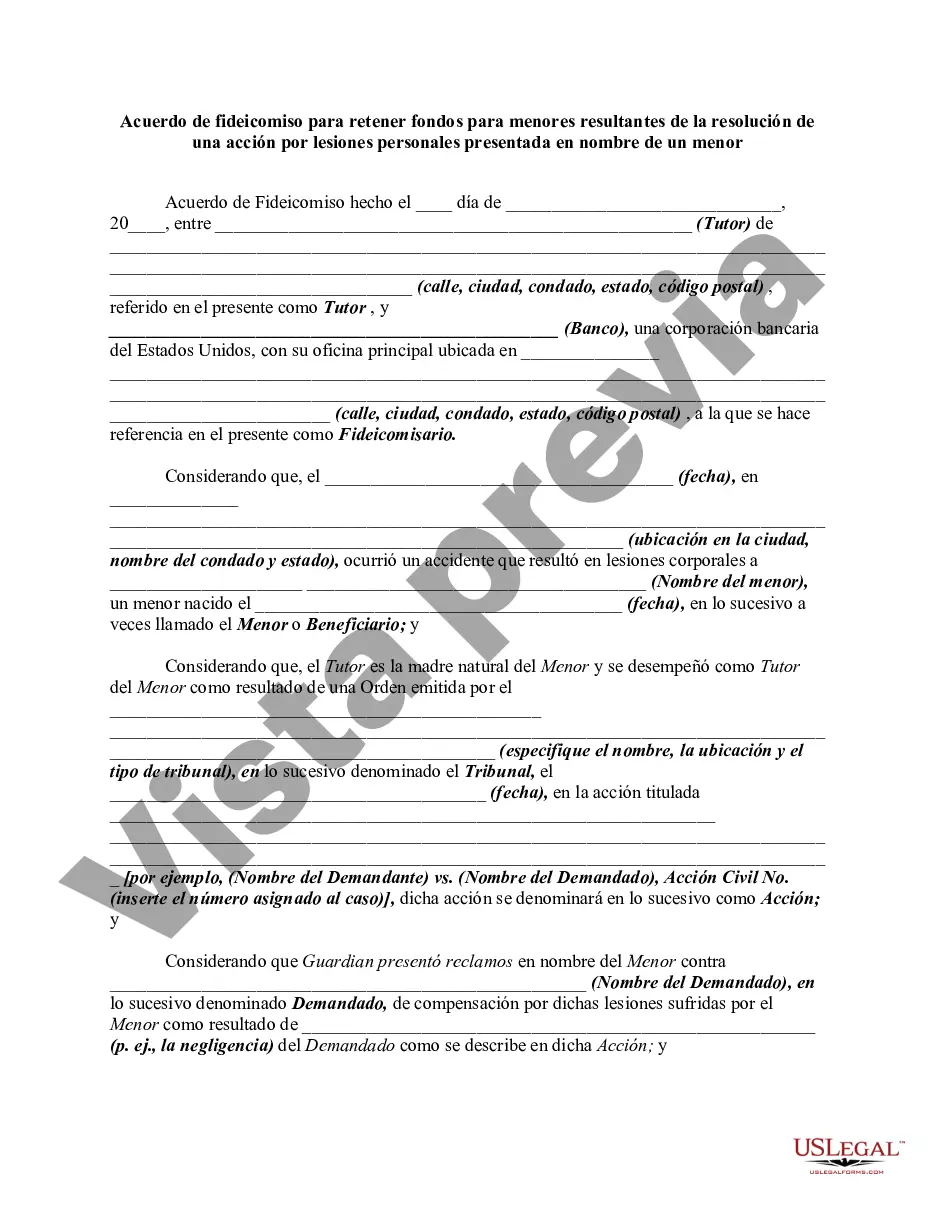

Wayne Michigan Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor A Wayne Michigan Trust Agreement to Hold Funds for a Minor Resulting from the Settlement of a Personal Injury Action Filed on Behalf of the Minor is a legal document that ensures the protection and proper management of funds awarded to a minor child in a personal injury lawsuit. This type of trust agreement creates a framework for holding and disbursing the settlement funds on behalf of the minor, with the goal of safeguarding the child's financial security and ensuring that the funds are used appropriately for their long-term benefit. The trust agreement is typically established by a guardian or a designated trustee, who acts in the best interest of the minor. The Wayne Michigan Trust Agreement includes the following key elements: 1. Settler: The individual or entity creating the trust is known as the settler. In this case, it would be the legal guardian of the minor or the representative filing the personal injury lawsuit on behalf of the minor. 2. Trustee: The trustee is responsible for managing and administering the trust. They are entrusted with the duty of investing the funds, making disbursements, and overseeing the assets until the minor reaches a specified age or milestone. 3. Beneficiary: The minor child who is the recipient of the settlement funds is the beneficiary of the trust. The agreement outlines the specific terms and conditions governing the use of the funds for the minor's support, education, medical expenses, and other needs. 4. Terms and Conditions: The trust agreement sets forth the terms and conditions under which the trust operates. It may include provisions regarding the release of funds for specific purposes, distributions at designated ages or milestones, and guidelines for the trustee's discretion in making disbursements. 5. Investment Strategy: The agreement may outline the investment strategy for the trust assets, taking into consideration factors such as risk tolerance, growth potential, and preserving the principal value of the settlement funds. Different Types of Wayne Michigan Trust Agreements to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor: 1. Revocable Trust: This type of trust allows for modifications or revocations by the settler until such time that the settler becomes incapacitated or passes away. Afterward, the trust becomes irrevocable, and the terms of the trust agreement must be adhered to. 2. Irrevocable Trust: Once established, an irrevocable trust cannot be changed or revoked without the consent of all involved parties, including the court. This type of trust provides increased asset protection and may have favorable tax implications. 3. Special Needs Trust: If the minor has special needs or disabilities, a special needs trust can be established to ensure that the settlement funds do not disqualify the child from receiving government assistance programs, such as Medicaid or Supplemental Security Income (SSI). In conclusion, a Wayne Michigan Trust Agreement to Hold Funds for a Minor Resulting from the Settlement of a Personal Injury Action Filed on Behalf of the Minor serves as a critical legal instrument to protect and manage settlement funds awarded to a minor child. By establishing a trust, it helps ensure the minor's best interests are prioritized and their financial future is safeguarded.Wayne Michigan Trust Agreement to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor A Wayne Michigan Trust Agreement to Hold Funds for a Minor Resulting from the Settlement of a Personal Injury Action Filed on Behalf of the Minor is a legal document that ensures the protection and proper management of funds awarded to a minor child in a personal injury lawsuit. This type of trust agreement creates a framework for holding and disbursing the settlement funds on behalf of the minor, with the goal of safeguarding the child's financial security and ensuring that the funds are used appropriately for their long-term benefit. The trust agreement is typically established by a guardian or a designated trustee, who acts in the best interest of the minor. The Wayne Michigan Trust Agreement includes the following key elements: 1. Settler: The individual or entity creating the trust is known as the settler. In this case, it would be the legal guardian of the minor or the representative filing the personal injury lawsuit on behalf of the minor. 2. Trustee: The trustee is responsible for managing and administering the trust. They are entrusted with the duty of investing the funds, making disbursements, and overseeing the assets until the minor reaches a specified age or milestone. 3. Beneficiary: The minor child who is the recipient of the settlement funds is the beneficiary of the trust. The agreement outlines the specific terms and conditions governing the use of the funds for the minor's support, education, medical expenses, and other needs. 4. Terms and Conditions: The trust agreement sets forth the terms and conditions under which the trust operates. It may include provisions regarding the release of funds for specific purposes, distributions at designated ages or milestones, and guidelines for the trustee's discretion in making disbursements. 5. Investment Strategy: The agreement may outline the investment strategy for the trust assets, taking into consideration factors such as risk tolerance, growth potential, and preserving the principal value of the settlement funds. Different Types of Wayne Michigan Trust Agreements to Hold Funds for Minor Resulting from Settlement of a Personal Injury Action Filed on Behalf of Minor: 1. Revocable Trust: This type of trust allows for modifications or revocations by the settler until such time that the settler becomes incapacitated or passes away. Afterward, the trust becomes irrevocable, and the terms of the trust agreement must be adhered to. 2. Irrevocable Trust: Once established, an irrevocable trust cannot be changed or revoked without the consent of all involved parties, including the court. This type of trust provides increased asset protection and may have favorable tax implications. 3. Special Needs Trust: If the minor has special needs or disabilities, a special needs trust can be established to ensure that the settlement funds do not disqualify the child from receiving government assistance programs, such as Medicaid or Supplemental Security Income (SSI). In conclusion, a Wayne Michigan Trust Agreement to Hold Funds for a Minor Resulting from the Settlement of a Personal Injury Action Filed on Behalf of the Minor serves as a critical legal instrument to protect and manage settlement funds awarded to a minor child. By establishing a trust, it helps ensure the minor's best interests are prioritized and their financial future is safeguarded.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.