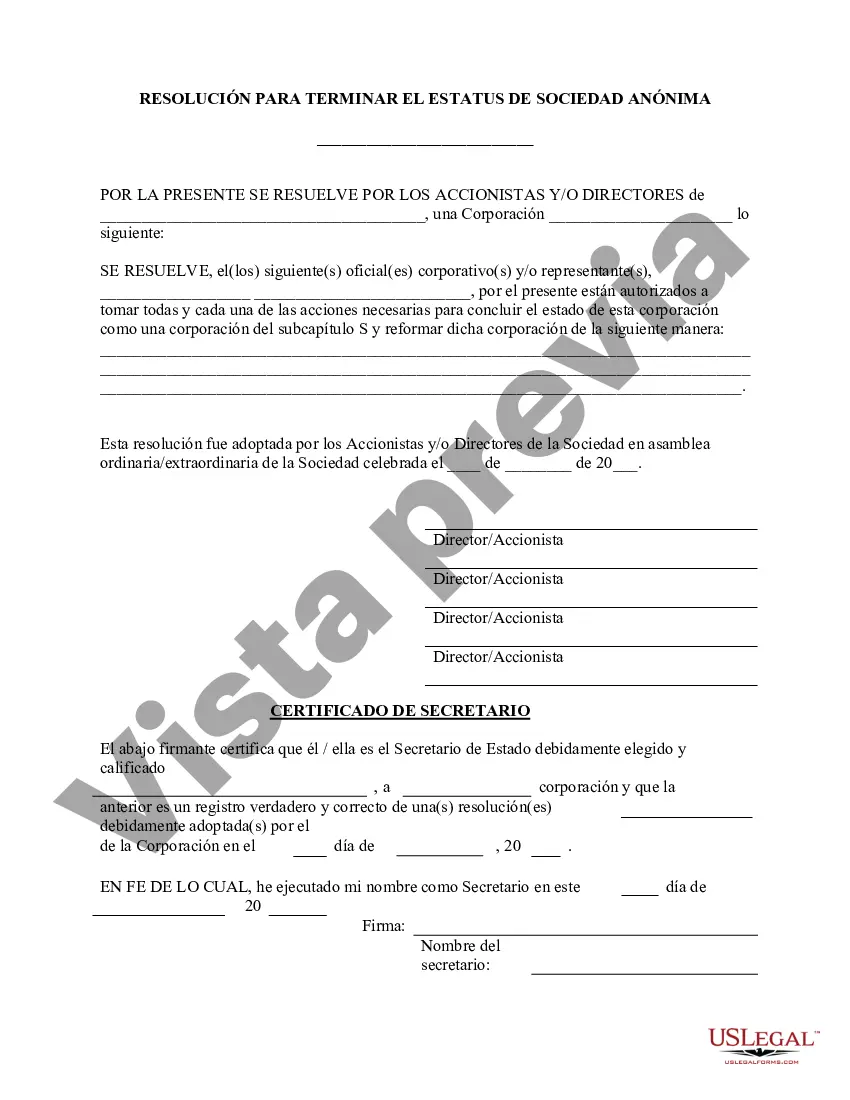

Contra Costa California Terminate S Corporation Status — Resolution For— - Corporate Resolutions is a legal document used by businesses in Contra Costa County, California, to officially terminate their S Corporation status. This form is essential when a company decides to cease operating as an S Corporation and wishes to transition into a different business entity or no longer qualify for the tax benefits associated with S Corporation status. The termination of S Corporation status must be authorized by the corporation's directors and shareholders, and this form serves as a formal resolution documenting their decision. The completion of this form is necessary to comply with California state laws and regulations regarding corporate dissolution and conversion. When filling out the Contra Costa California Terminate S Corporation Status — Resolution For— - Corporate Resolutions, businesses need to provide various details including the corporation's name, address, federal tax ID number (EIN), and the purpose of the dissolution. Additionally, the form requires information about the directors and shareholders who approved the termination, their roles within the corporation, and their respective addresses. As for other types of Contra Costa California Terminate S Corporation Status — Resolution Form— - Corporate Resolutions, these may include: 1. Contra Costa California Terminate S Corporation Status — Resolution For— - Voluntary Dissolution: This form is used when a corporation decides to voluntarily dissolve and cease all business operations, including terminating S Corporation status. It involves completing additional paperwork and is appropriate if the decision to dissolve the corporation is not due to a statutory requirement. 2. Contra Costa California Terminate S Corporation Status — Resolution For— - Conversion to another Entity: This form is utilized when a corporation wishes to terminate it's S Corporation status and convert into a different business entity, such as a C Corporation, Limited Liability Company (LLC), or Partnership. It requires additional information about the chosen entity and may involve filing additional conversion documents with the state government. 3. Contra Costa California Terminate S Corporation Status — Resolution For— - Involuntary Dissolution: This form is used when the dissolution of a corporation is not voluntarily initiated by its directors and shareholders but is instead mandated by court order or other external circumstances. It may be required due to non-compliance with state regulations, bankruptcy, or other legal conflicts. Completing the Contra Costa California Terminate S Corporation Status — Resolution For— - Corporate Resolutions accurately and in accordance with the applicable laws is crucial to ensure a smooth transition out of S Corporation status. However, it is strongly recommended consulting with an attorney or a legal professional well-versed in business law before undertaking any significant changes to a corporation's status.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Terminar el estado de la corporación S - Formulario de resolución - Resoluciones corporativas - Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out Contra Costa California Terminar El Estado De La Corporación S - Formulario De Resolución - Resoluciones Corporativas?

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business case. All files are grouped by state and area of use, so opting for a copy like Contra Costa Terminate S Corporation Status - Resolution Form - Corporate Resolutions is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few additional steps to obtain the Contra Costa Terminate S Corporation Status - Resolution Form - Corporate Resolutions. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Contra Costa Terminate S Corporation Status - Resolution Form - Corporate Resolutions in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!

Form popularity

FAQ

Para la referencia de credito (Credit Score), la C CORP puede construirlo a nombre de la empresa. En la LLC, en cambio, el credito es construido por medio de los socios, lo que resulta mas dificil para los extranjeros no residentes en los Estados Unidos. La Corporation le da acceso a diferentes clases de acciones.

Una compania de responsabilidad limitada (LLC) no paga impuestos a nivel empresarial. En cambio, los ingresos de la LLC se tributan a la declaracion de impuestos sobre la renta personal del miembro.

Beneficios De Formar Una Corporacion Una corporacion tiene gran flexibilidad en las deducciones de impuestos. Ya que una corporacion es una entidad legal, puede proteger a los accionistas de ciertas obligaciones y riesgos legales. Una corporacion tiene existencia perpetua y puede vivir mas que los mismos accionistas.

Las Resoluciones Corporativas se utilizan para mantener un registro de las decisiones formales, mociones y acciones de la empresa. Describen aquello que la empresa y/o su junta directiva decide aprobar en materia de mociones, politicas corporativas y procedimientos organizacionales o estructurales.

Como declarar impuestos en tu pequena empresa Paso 1: Repasa tu informacion financiera.Paso 2: Organiza tus documentos.Paso 3: Ten en cuenta extensiones, deducciones y reembolsos.Paso 4: Busca asesoria especializada.Formularios para Propiedades Individuales.Formularios para Sociedades y LLCs.

Hay dos formas principales de crear una S Corp: Formando una LLC y eligiendo el estatus fiscal de corporacion S del IRS cuando solicites tu numero de identificacion de empleador (EIN) Formando una corporacion y eligiendo el estatus de corporacion S del IRS.

Las sociedades anonimas de tipo S son sociedades anonimas que optan por pasar los ingresos, perdidas, deducciones y creditos comerciales a traves de sus accionistas para los propositos del impuesto federal.

Para hacer tu declaracion, necesitas tener tu RFC y una contrasena. Si aun no cuentas con ella puedes generarla desde la pagina web del SAT, para conseguirla no es necesario acudir a las oficinas. Para facilitar el proceso a los contribuyentes, el SAT cuenta con herramientas que te hacen mas facil el trabajo.

Las sociedades anonimas de tipo S son sociedades anonimas que optan por pasar los ingresos, perdidas, deducciones y creditos comerciales a traves de sus accionistas para los propositos del impuesto federal.

Que incluir en una resolucion corporativa Nombre legal de la empresa. La fecha, hora y lugar donde se crea la resolucion. El organo rector responsable de tomar la resolucion corporativa (generalmente es la junta directiva) Titulo y proposito de la resolucion.