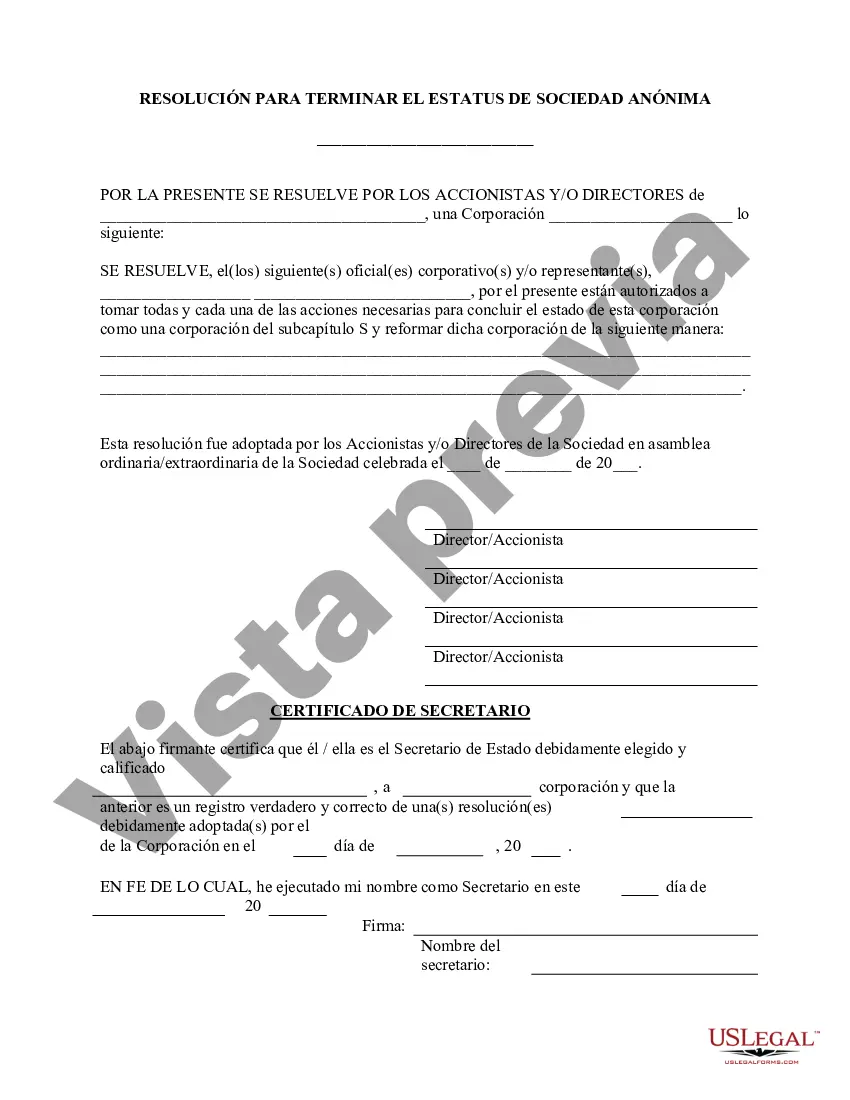

Houston, Texas Terminate S Corporation Status — Resolution For— - Corporate Resolutions is a legal document that outlines the process of terminating the S Corporation status of a company based in Houston, Texas. This form serves as a resolution for the corporation's board of directors to officially discontinue their S Corporation election in compliance with state and federal regulations. The Houston Texas Terminate S Corporation Status — Resolution For— - Corporate Resolutions contains various sections and information that need to be filled out accurately to initiate the termination process. These sections typically include: 1. Company Information: This section requires details about the corporation, such as its legal name, address, employer identification number (EIN), and the date of incorporation. 2. Board Resolution: This part includes a statement from the board of directors declaring their decision to terminate the S Corporation status. It may also mention the justification for this change and how it aligns with the corporation's goals or circumstances. 3. Shareholder Approval: If necessary, this section may require shareholders' signatures or a resolution approving the termination of S Corporation status, depending on the corporation's bylaws and the state's laws. 4. Effective Date and Filing: The form may include a section to specify the effective date of the termination. It will also outline the required steps to file the completed form with the appropriate government agencies, such as the Texas Secretary of State and the Internal Revenue Service (IRS), to ensure compliance and notify them of the change in status. Different types of Houston Texas Terminate S Corporation Status — Resolution For— - Corporate Resolutions may include variations in formatting or layout based on individual preferences or specific legal requirements. However, the fundamental purpose of the form remains the same: officially documenting the decision to terminate S Corporation status and providing the necessary information for government filing. It is crucial to consult with a qualified attorney or tax professional to ensure that the Houston Texas Terminate S Corporation Status — Resolution For— - Corporate Resolutions accurately reflects the corporation's circumstances and adheres to applicable laws. This will help avoid any potential legal or tax implications associated with the termination of S Corporation status in Houston, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Terminar el estado de la corporación S - Formulario de resolución - Resoluciones corporativas - Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out Houston Texas Terminar El Estado De La Corporación S - Formulario De Resolución - Resoluciones Corporativas?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from scratch, including Houston Terminate S Corporation Status - Resolution Form - Corporate Resolutions, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in various types varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any tasks related to document completion simple.

Here's how you can locate and download Houston Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

- Go over the document's preview and description (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state regulations can impact the validity of some records.

- Examine the similar forms or start the search over to locate the correct document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment gateway, and purchase Houston Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Houston Terminate S Corporation Status - Resolution Form - Corporate Resolutions, log in to your account, and download it. Of course, our website can’t take the place of an attorney completely. If you have to deal with an extremely difficult situation, we advise getting an attorney to check your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork effortlessly!