Title: Understanding Phoenix, Arizona Terminate S Corporation Status — Resolution Forms and Corporate Resolutions Introduction: In Phoenix, Arizona, terminating an S Corporation status requires a thorough understanding of the necessary legal procedures. This article aims to provide a detailed description of the Phoenix Arizona Terminate S Corporation Status — Resolution Form, along with its relevance and significance in corporate resolutions. Additionally, we will explore different types of termination forms and their purposes in the context of S Corporations. 1. What is a Terminate S Corporation Status — Resolution Form? The Terminate S Corporation Status — Resolution Form is a vital legal document used in Phoenix, Arizona, which allows a corporation to terminate it's S Corporation election. This form acts as an official declaration that the corporation no longer wishes to be taxed as an S Corporation, reverting to its default C Corporation status. 2. Importance and Relevance of the Form: a. Compliance with Tax Regulations: By terminating S Corporation status, a corporation ensures compliance with federal and state tax laws, correctly aligning its tax structure with its needs and objectives. b. Change in Reporting Requirements: Termination of S Corporation status may result in changes in reporting requirements, shifting from Form 1120S to Form 1120 for federal tax purposes. c. Financial Flexibility: Reverting to C Corporation status can provide financial flexibility and facilitate attracting different types of investments, including venture capital and foreign investment. 3. Types of Terminate S Corporation Status — Resolution Forms: a. Voluntary Termination: This form is used when the corporation willingly chooses to terminate it's S Corporation status. Reasons for voluntary termination may include a change in ownership structure, reorganization, or adopting a tax strategy that better aligns with the corporation's long-term goals. b. Involuntary Termination: In cases where the Internal Revenue Service (IRS) determines that a corporation no longer qualifies for S Corporation status, an involuntary termination form must be completed. This can occur due to failure to meet eligibility criteria, such as having more than 100 shareholders or having a disqualified shareholder. 4. Corporate Resolutions in Terminating S Corporation Status: a. Board of Directors' Resolution: A corporate resolution passed by the Board of Directors is required to authorize the termination of S Corporation status. This resolution reflects the board's decision to terminate the election and must be properly documented in the minutes of a board meeting. b. Shareholders' Resolution: A shareholders' resolution is necessary when the corporation requires approval from its shareholders before terminating the S Corporation status. Shareholders' consent typically involves a vote or written consent affirming the decision. Conclusion: Phoenix, Arizona Terminate S Corporation Status — Resolution Forms play a crucial role in corporate resolutions when a corporation decides to terminate it's S Corporation election. Understanding the significance of these forms, complying with tax regulations, and taking necessary steps can help corporations transition smoothly from S Corporation to C Corporation status. Proper documentation through corporate resolutions ensures legal compliance and reinforces the corporation's standing within the Phoenix business community.

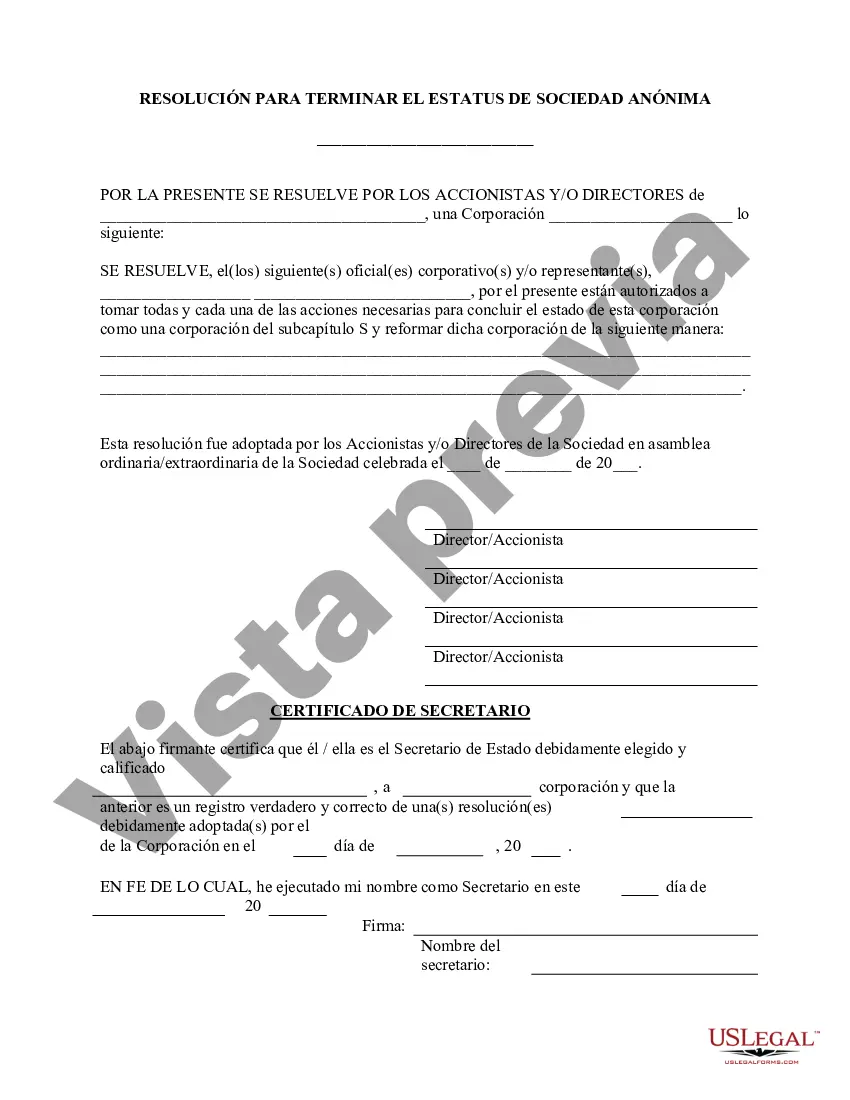

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Terminar el estado de la corporación S - Formulario de resolución - Resoluciones corporativas - Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out Phoenix Arizona Terminar El Estado De La Corporación S - Formulario De Resolución - Resoluciones Corporativas?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life sphere, locating a Phoenix Terminate S Corporation Status - Resolution Form - Corporate Resolutions suiting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, collected by states and areas of use. Aside from the Phoenix Terminate S Corporation Status - Resolution Form - Corporate Resolutions, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Phoenix Terminate S Corporation Status - Resolution Form - Corporate Resolutions:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Phoenix Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!