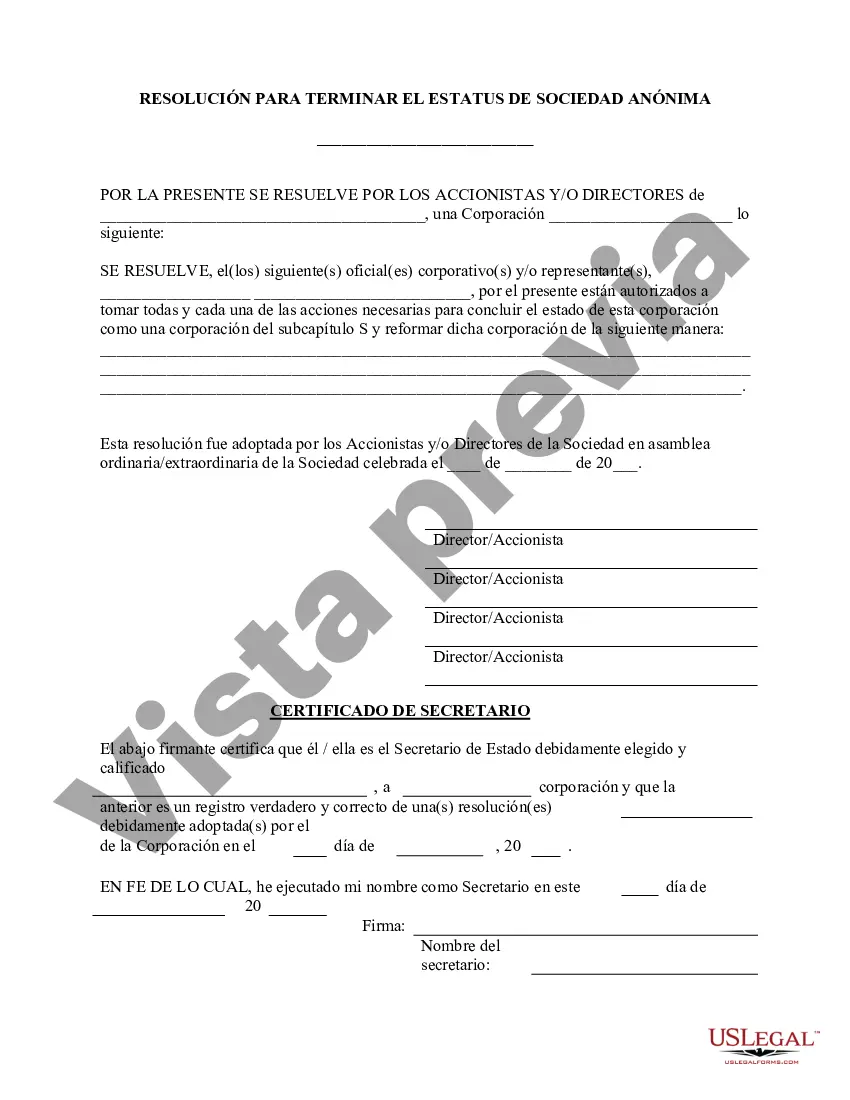

Queens, New York Terminate S Corporation Status — Resolution For— - Corporate Resolutions In Queens, New York, terminating the S Corporation status requires specific steps and documentation. One crucial document is the Terminate S Corporation Status — Resolution Form, which plays a significant role in the termination process. This form is used by S Corporations operating in Queens, New York, to officially dissolve their S Corporation status and revert to a different tax classification. The Terminate S Corporation Status — Resolution Form is a legally binding document that formalizes the decision of the S Corporation's shareholders to terminate it's S Corporation status. It outlines the resolutions and collective agreement on this matter and must be approved by both the board of directors and shareholders. To properly complete the Terminate S Corporation Status — Resolution Form, certain information needs to be provided. These include the names and addresses of shareholders, the effective termination date, and the reason for terminating the S Corporation status. Additionally, if required by state or local authorities, other supporting documents may need to be included. There might be variations of the Terminate S Corporation Status — Resolution Form tailored to different scenarios or specific situations within Queens, New York. Some possible variations include: 1. Queens, New York Terminate S Corporation Status — Resolution Form for Dissolution: This variation is for S Corporations intending to completely dissolve their entity rather than undergoing a change in tax classification. It includes additional sections detailing the dissolution process, the distribution of assets, and the appointment of a liquidator. 2. Queens, New York Terminate S Corporation Status — Resolution Form for Conversion: This variation is used when an S Corporation in Queens, New York wishes to terminate their S Corporation status and convert into another tax classification, such as a C Corporation or an LLC. It contains specific sections regarding the desired tax classification and the necessary steps to achieve the conversion. By utilizing the appropriate Terminate S Corporation Status — Resolution Form, S Corporations in Queens, New York can effectively communicate their decision to terminate their S Corporation status. However, it is recommended to consult with legal professionals or tax advisors to ensure compliance with local laws and regulations throughout the process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Queens New York Terminar el estado de la corporación S - Formulario de resolución - Resoluciones corporativas - Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out Queens New York Terminar El Estado De La Corporación S - Formulario De Resolución - Resoluciones Corporativas?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily locate and get a document for any personal or business objective utilized in your region, including the Queens Terminate S Corporation Status - Resolution Form - Corporate Resolutions.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Queens Terminate S Corporation Status - Resolution Form - Corporate Resolutions will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the Queens Terminate S Corporation Status - Resolution Form - Corporate Resolutions:

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Queens Terminate S Corporation Status - Resolution Form - Corporate Resolutions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!