Title: Alameda California Relocation Agreement between Employer and Employee Regarding Moving Expenses Keywords: Alameda California, relocation agreement, employer, employee, moving expenses, types Introduction: The Alameda California Relocation Agreement between an employer and employee addresses the terms and conditions related to the employee's relocation to Alameda, California. This comprehensive agreement outlines the financial responsibilities, benefits, and provisions related to moving expenses incurred during the relocation process. There might be various types of Alameda California Relocation Agreements depending on the specifics of the relocation and the employer's policies. 1. Standard Alameda California Relocation Agreement: This type of relocation agreement outlines the general guidelines and provisions related to the employer's financial support for the employee's moving expenses. It typically covers the cost of transportation, packing, unpacking, storage, temporary accommodations, and other necessary expenses throughout the relocation. 2. Lump Sum Package Alameda California Relocation Agreement: In this type of agreement, the employer offers the employee a fixed lump sum payment as a relocation benefit. The employee can utilize this amount at their discretion to cover various moving expenses, such as transportation, accommodation, shipping, and other related costs. The guidelines and limitations regarding the lump sum payment are clearly defined within the agreement. 3. Full-Service Alameda California Relocation Agreement: This agreement provides an extensive level of support to the employee during the relocation process. It covers a wide range of expenses, including but not limited to transportation, temporary housing, real estate agent fees, home sale/purchase costs, moving company fees, and even spousal employment assistance. This comprehensive agreement aims to provide the highest level of support to ensure a smooth transition for the employee and their family. 4. Partial Reimbursement Alameda California Relocation Agreement: Under this type of agreement, the employer agrees to reimburse the employee a certain amount or percentage of their eligible moving expenses. The agreement clearly defines the eligible expenses, any maximum limits imposed, and the requirements for submitting proper documentation to receive reimbursement. 5. Flexible Spending Account Alameda California Relocation Agreement: In this innovative arrangement, the employer sets up a flexible spending account (FSA) specific to relocation expenses. The employee may contribute a portion of their pre-tax income to the FSA to cover qualified moving expenses, such as transportation, lodging, and professional services. The agreement specifies the contribution limits, eligible expenses, and the process for submitting reimbursement requests. Conclusion: The Alameda California Relocation Agreement between Employer and Employee Regarding Moving Expenses is a vital document that sets out the terms and conditions surrounding an employee's relocation. By choosing the most suitable agreement type, employers and employees can establish clear guidelines for financial support during the move to Alameda, California.

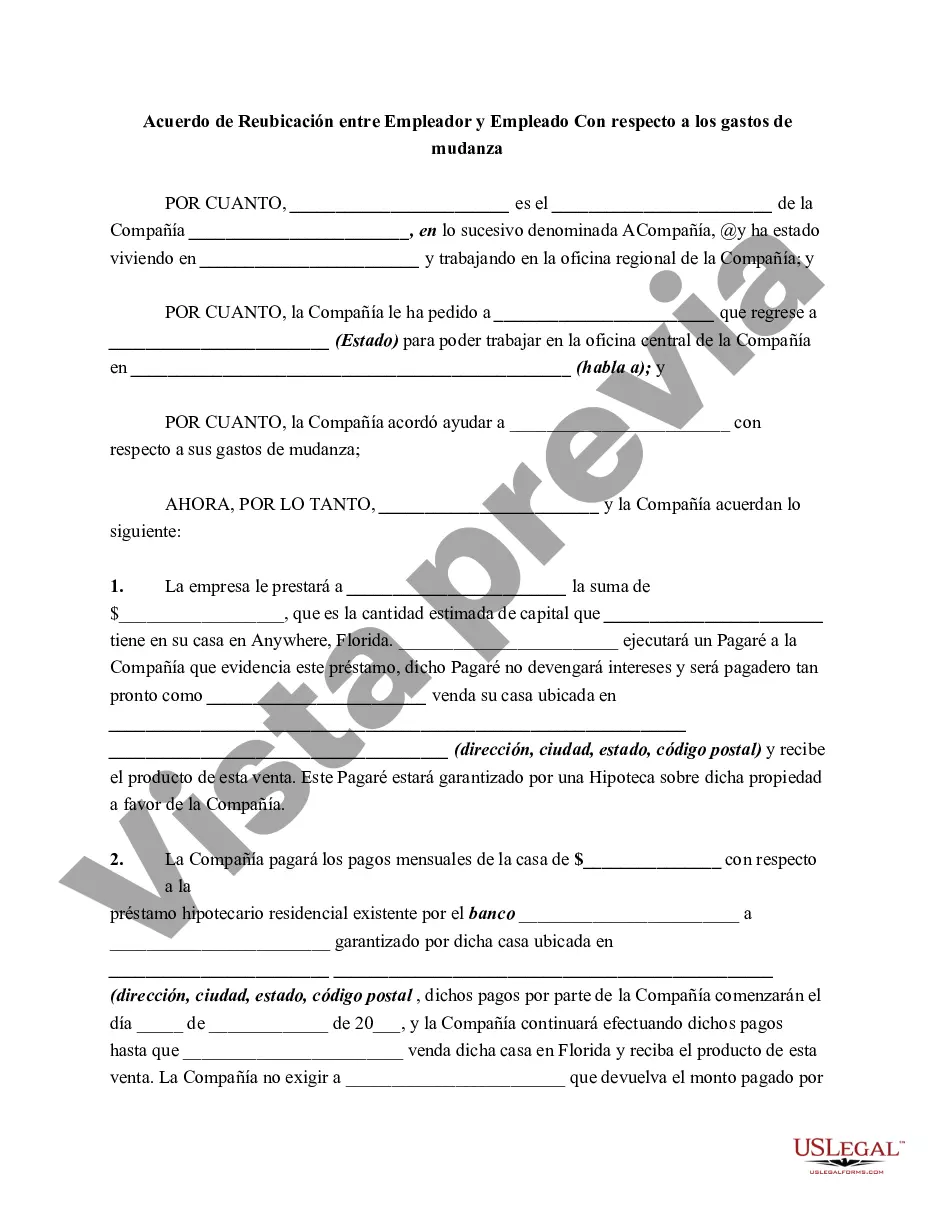

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Acuerdo de reubicación entre el empleador y el empleado con respecto a los gastos de mudanza - Relocation Agreement between Employer and Employee Regarding Moving Expenses

Description

How to fill out Alameda California Acuerdo De Reubicación Entre El Empleador Y El Empleado Con Respecto A Los Gastos De Mudanza?

Are you looking to quickly draft a legally-binding Alameda Relocation Agreement between Employer and Employee Regarding Moving Expenses or maybe any other document to take control of your own or corporate affairs? You can go with two options: contact a legal advisor to draft a valid document for you or create it completely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you get neatly written legal papers without paying sky-high prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-specific document templates, including Alameda Relocation Agreement between Employer and Employee Regarding Moving Expenses and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate document templates. We've been out there for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed template without extra troubles.

- To start with, carefully verify if the Alameda Relocation Agreement between Employer and Employee Regarding Moving Expenses is adapted to your state's or county's regulations.

- If the form comes with a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by using the search bar in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Alameda Relocation Agreement between Employer and Employee Regarding Moving Expenses template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. In addition, the paperwork we provide are reviewed by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!