Title: A Comprehensive Guide to Fulton, Georgia Relocation Agreements for Employer-Employee Moving Expenses Introduction: Relocating to Fulton, Georgia can be an exciting endeavor, but the process can also be daunting. To facilitate a smooth transition, many employers offer relocation agreements to their employees. In this detailed description, we will delve into the specifics of Fulton, Georgia Relocation Agreements between employers and employees regarding moving expenses. We will explore different types of agreements and highlight essential keywords associated with this topic. 1. Understanding the Fulton, Georgia Relocation Agreement: — Definition: A Fulton, Georgia Relocation Agreement is a mutual agreement between an employer and an employee that outlines the terms and conditions related to the reimbursement or direct payment of moving and relocation expenses. — Purpose: The agreement aims to facilitate the employee's transition by minimizing financial burdens associated with moving to Fulton, Georgia, while also outlining the responsibilities and limitations of both parties. — Key terms: Relocation expenses, employer reimbursement, direct payment, relocation package, relocation benefits, relocation assistance, moving costs, relocation policy. 2. Common Types of Fulton, Georgia Relocation Agreements: — Full Reimbursement Agreement: The employer agrees to reimburse the employee for all qualified moving expenses, including packing, shipping, transportation, lodging, and temporary living costs. This agreement typically includes a cap or maximum reimbursement amount. — Direct Payment Agreement: The employer directly pays for the employee's moving expenses, removing the need for expense reimbursement. This type of agreement ensures that relocation costs are covered promptly, with no out-of-pocket expenses for the employee. — Lump Sum Agreement: Instead of reimbursing or directly paying for specific expenses, the employer provides the employee with a lump sum payment to cover various relocation costs. This flexible arrangement empowers the employee to allocate the funds independently as per their moving requirements and priorities. 3. Key Provisions and Clauses in Fulton, Georgia Relocation Agreements: — Eligible Expenses: Specify what expenses qualify for reimbursement or direct payment, such as transportation, storage, real estate fees, temporary housing, and utility connections. — Tax Implications: Outline the tax treatment of relocation benefits, including any tax gross-up provisions for taxable reimbursements, in compliance with federal and Georgia state laws. — Repayment Clause: Address any conditions under which an employee may be required to reimburse the employer if they leave the company shortly after relocation. — Support Services: Detail any relocation support services provided by the employer, such as remove counseling, home-buying assistance, spousal job placement assistance, and educational resources for children. Conclusion: Fulton, Georgia Relocation Agreements form a crucial component of employee benefits and play a key role in facilitating successful employee relocations. Whether it's a full reimbursement, direct payment, or lump sum agreement, these contracts ensure that employees feel supported during their transition to Fulton, Georgia. By understanding the nuances of relocation agreements and the associated keywords, employers and employees can enter into mutually beneficial arrangements that align with their needs and goals.

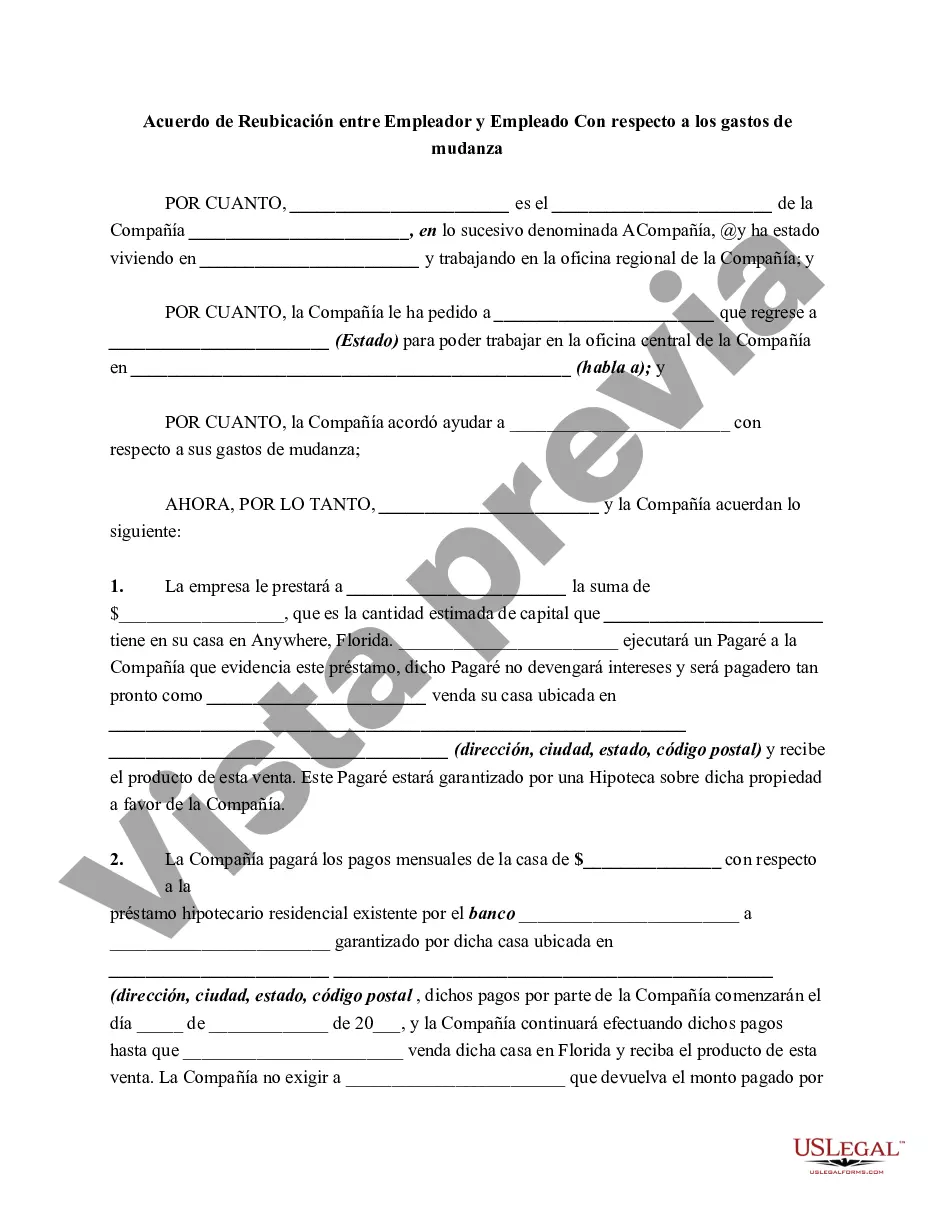

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Acuerdo de reubicación entre el empleador y el empleado con respecto a los gastos de mudanza - Relocation Agreement between Employer and Employee Regarding Moving Expenses

Description

How to fill out Fulton Georgia Acuerdo De Reubicación Entre El Empleador Y El Empleado Con Respecto A Los Gastos De Mudanza?

Do you need to quickly draft a legally-binding Fulton Relocation Agreement between Employer and Employee Regarding Moving Expenses or probably any other document to manage your personal or business matters? You can select one of the two options: contact a legal advisor to write a legal document for you or draft it completely on your own. Thankfully, there's another solution - US Legal Forms. It will help you get neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-compliant document templates, including Fulton Relocation Agreement between Employer and Employee Regarding Moving Expenses and form packages. We provide templates for an array of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary document without extra troubles.

- First and foremost, double-check if the Fulton Relocation Agreement between Employer and Employee Regarding Moving Expenses is tailored to your state's or county's regulations.

- If the form includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the template isn’t what you were seeking by using the search bar in the header.

- Select the subscription that is best suited for your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Fulton Relocation Agreement between Employer and Employee Regarding Moving Expenses template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the templates we provide are reviewed by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!