Title: Phoenix Arizona Relocation Agreement: Employer-Employee Moving Expenses Arrangement Keywords: Phoenix Arizona, relocation agreement, employer, employee, moving expenses, types Introduction: A Phoenix Arizona relocation agreement is a contractual document entered into between an employer and an employee. This agreement outlines the terms and conditions regarding the employee's relocation to Phoenix, Arizona, and the reimbursement of the associated moving expenses by the employer. It is crucial for both parties to understand the specific details mentioned in the relocation agreement to ensure a smooth and transparent relocation process. 1. Comprehensive Relocation Agreement: The comprehensive relocation agreement is the most common type of agreement between an employer and an employee in Phoenix, Arizona. It covers various aspects related to moving expenses, such as transportation costs, storage fees, temporary housing, packing and unpacking, shipping of personal belongings, insurance coverage, and any additional financial support required during the relocation process. 2. Lump Sum Relocation Agreement: In some cases, employers opt for a lump sum relocation agreement. This type of agreement provides the employee with a fixed amount of money, known as a lump sum relocation allowance, to cover all the expenses associated with the move. It allows the employee flexibility in managing their relocation, as they have control over how the funds are allocated. 3. Temporary Living Expense Agreement: Sometimes, employers provide a temporary living expense agreement in addition to the standard relocation agreement. This agreement ensures that the employee has access to suitable temporary housing and covers expenses such as rent, utilities, and other essential living costs. It enables the employee to settle into their new location without worrying about immediate housing arrangements. 4. Tax Equalization Agreement: Employers may also offer a tax equalization agreement to help employees manage their tax liabilities related to relocation. This agreement ensures that the employee is neither financially burdened nor advantaged due to tax variations resulting from the move. Tax equalization agreements provide clarity and fairness, ensuring that both parties are on the same page regarding tax obligations. Conclusion: Phoenix Arizona relocation agreements between employers and employees regarding moving expenses can take various forms, including comprehensive agreements, lump sum agreements, temporary living expense agreements, and tax equalization agreements. Each agreement type serves different purposes and ensures a smooth and well-structured relocation process. Clear communication and a thorough understanding of the agreement are essential for both parties to ensure a successful relocation to Phoenix, Arizona.

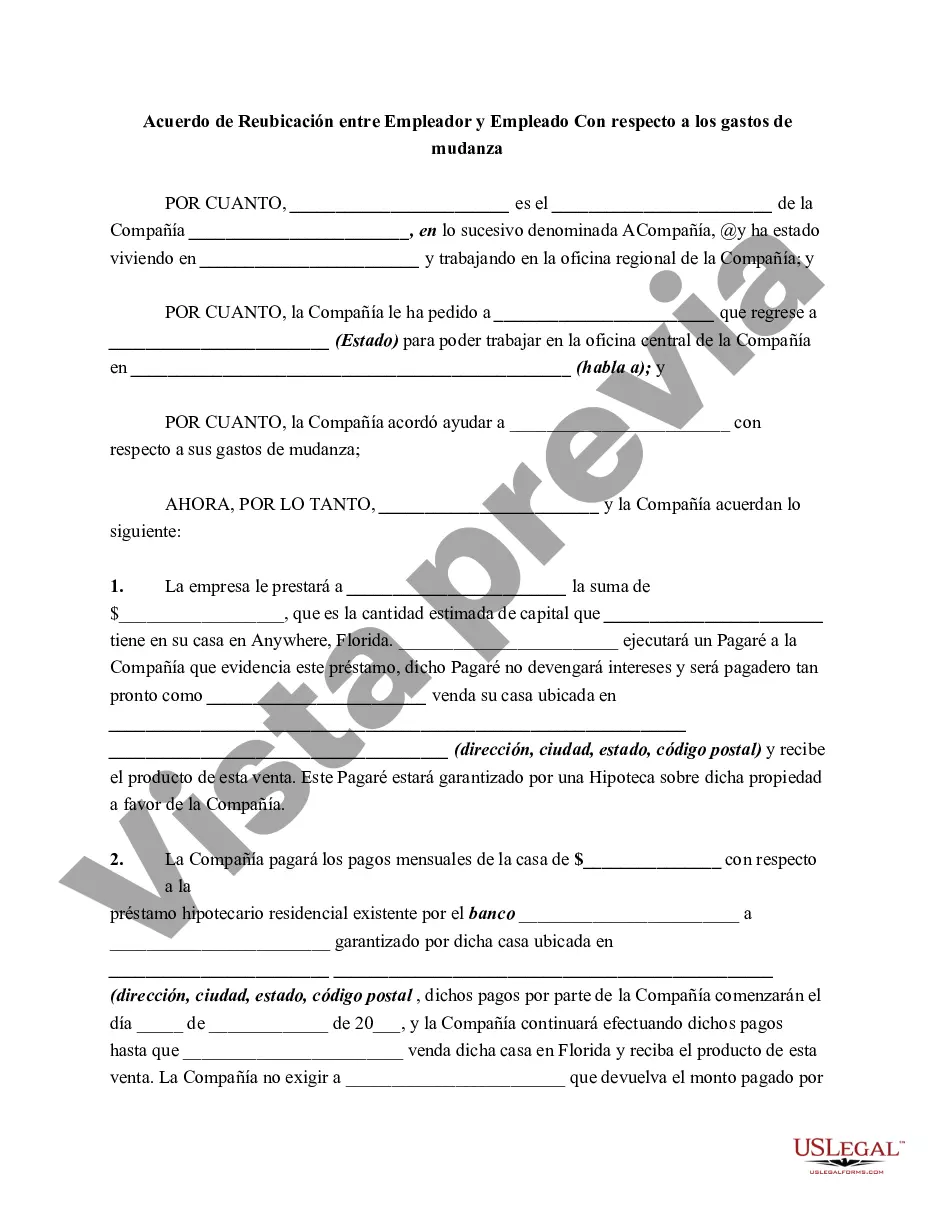

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Acuerdo de reubicación entre el empleador y el empleado con respecto a los gastos de mudanza - Relocation Agreement between Employer and Employee Regarding Moving Expenses

Description

How to fill out Phoenix Arizona Acuerdo De Reubicación Entre El Empleador Y El Empleado Con Respecto A Los Gastos De Mudanza?

Do you need to quickly create a legally-binding Phoenix Relocation Agreement between Employer and Employee Regarding Moving Expenses or probably any other form to manage your personal or business affairs? You can go with two options: contact a professional to write a valid document for you or create it completely on your own. Thankfully, there's another solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-compliant form templates, including Phoenix Relocation Agreement between Employer and Employee Regarding Moving Expenses and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, carefully verify if the Phoenix Relocation Agreement between Employer and Employee Regarding Moving Expenses is tailored to your state's or county's regulations.

- In case the document has a desciption, make sure to verify what it's intended for.

- Start the searching process over if the document isn’t what you were seeking by using the search box in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Phoenix Relocation Agreement between Employer and Employee Regarding Moving Expenses template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. Additionally, the paperwork we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!