Lima Arizona Relocation Agreement between Employer and Employee Regarding Moving Expenses is a legal contract that establishes the terms and conditions for an employee's relocation from one location to Lima, Arizona. This agreement outlines the employer's responsibilities towards assisting with the employee's moving expenses, ensuring a smooth transition and minimizing financial burden on the employee. Keywords: Lima Arizona Relocation Agreement, employer, employee, moving expenses, relocation, contract, terms and conditions, responsibilities, smooth transition, financial burden. Different types of Lima Arizona Relocation Agreement between Employer and Employee Regarding Moving Expenses can include: 1. Lump-sum Payment Agreement: This type of agreement specifies that the employer will provide the employee with a one-time, fixed amount to cover their moving expenses. The employee is responsible for managing their own relocation costs and may have more flexibility in how they allocate the funds. 2. Reimbursement Agreement: In a reimbursement agreement, the employee incurs the moving expenses upfront and later submits the receipts and relevant documents to the employer for reimbursement. This type of agreement ensures that the employer will cover the actual expenses incurred by the employee, up to a specified limit. 3. Direct-payment Agreement: With a direct-payment agreement, the employer directly pays for the employee's moving expenses. The employee submits the invoices and bills to the employer, who settles the payments directly with the service providers. This type of agreement ensures that the employee doesn't need to bear any out-of-pocket expenses related to the relocation. 4. Flat-rate Allowance Agreement: In a flat-rate allowance agreement, the employer provides the employee with a fixed amount of money to cover their moving expenses. The employee has the flexibility to use these funds as they see fit, and any unused amount may be retained by the employee as additional compensation. Regardless of the specific type of agreement, Lima Arizona Relocation Agreement between Employer and Employee Regarding Moving Expenses should include details such as eligible expenses, relocation timeline, limitations on expenses, tax implications, reimbursement procedures, and any additional benefits or perks that the employer offers to facilitate the relocation process.

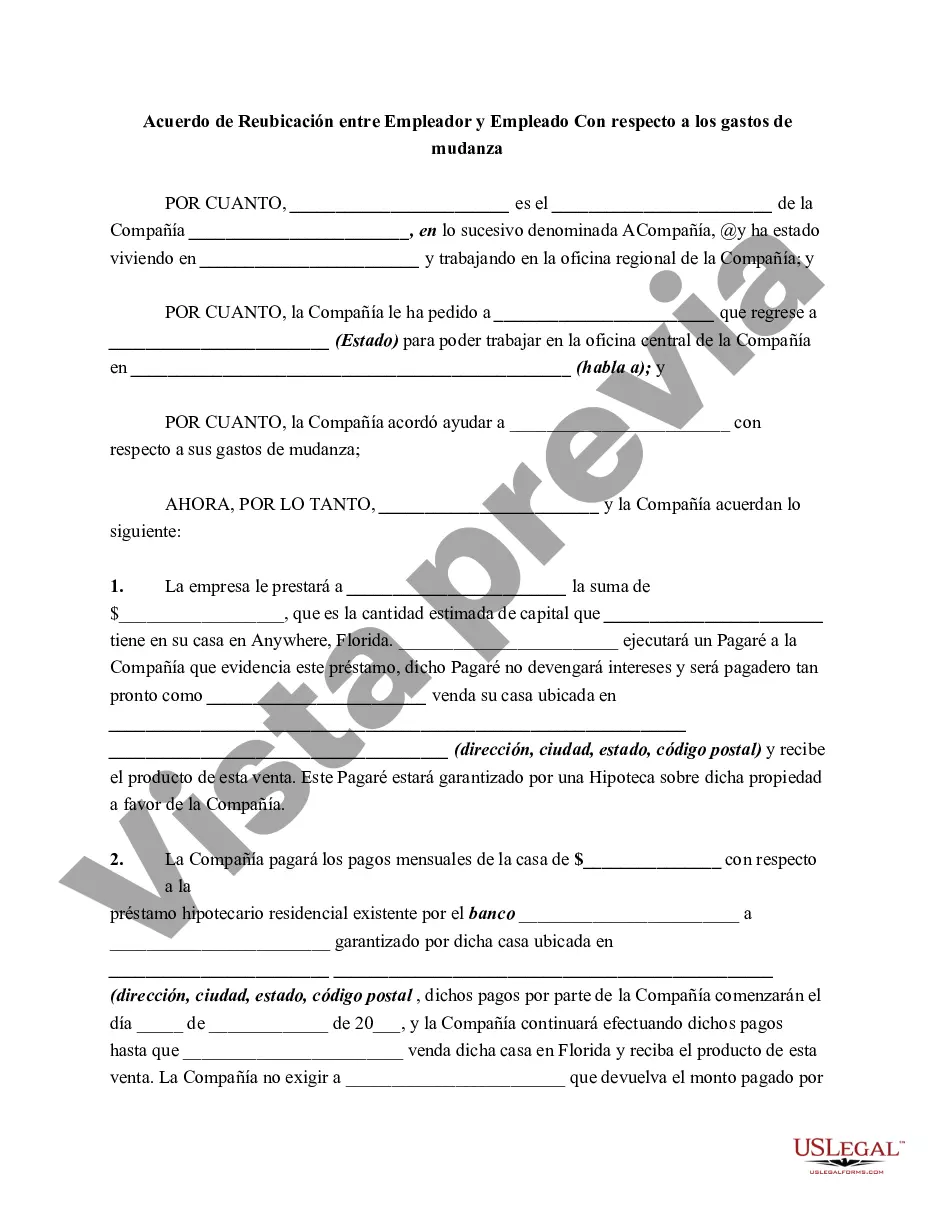

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Acuerdo de reubicación entre el empleador y el empleado con respecto a los gastos de mudanza - Relocation Agreement between Employer and Employee Regarding Moving Expenses

Description

How to fill out Pima Arizona Acuerdo De Reubicación Entre El Empleador Y El Empleado Con Respecto A Los Gastos De Mudanza?

How much time does it typically take you to draft a legal document? Because every state has its laws and regulations for every life scenario, finding a Pima Relocation Agreement between Employer and Employee Regarding Moving Expenses meeting all local requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Pima Relocation Agreement between Employer and Employee Regarding Moving Expenses, here you can get any specific form to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can get the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Pima Relocation Agreement between Employer and Employee Regarding Moving Expenses:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Pima Relocation Agreement between Employer and Employee Regarding Moving Expenses.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!