Salt Lake Utah relocation agreement between employer and employee regarding moving expenses is a legal document that outlines the terms and conditions under which an employer agrees to cover or assist in covering the moving expenses of an employee who is relocating to Salt Lake City, Utah for work-related purposes. This agreement ensures clarity and fairness for both parties involved, protecting their respective rights and responsibilities during the relocation process. Keywords: Salt Lake Utah relocation agreement, employer, employee, moving expenses, relocation, Salt Lake City, Utah, work-related purposes, terms and conditions, clarity, fairness, rights, responsibilities. There may be different types of Salt Lake Utah relocation agreements between employers and employees regarding moving expenses, such as: 1. Lump Sum Payment Agreement: This type of agreement stipulates that the employer provides a fixed amount of money as a one-time lump sum payment to the employee to cover their moving expenses. The allocated amount is determined based on the employee's position, level of seniority, or contract negotiations. 2. Reimbursement Agreement: Under this agreement, the employee incurs the moving expenses upfront and later submits the receipts and relevant documentation to the employer for reimbursement. The employer then reimburses the employee for the eligible expenses based on specific guidelines outlined in the agreement. 3. Direct Payment Agreement: In a direct payment agreement, the employer takes care of the moving expenses directly by paying the service providers on behalf of the employee. The employer might negotiate discounted rates or have pre-approved vendors to streamline the relocation process. 4. Allowance Agreement: This type of agreement provides the employee with a specific allowance or budget that they can use to cover their relocation expenses. The employee has the flexibility to spend the allowance as they see fit, within the guidelines set by the employer. Regardless of the type of agreement, typically the Salt Lake Utah relocation agreement between employer and employee regarding moving expenses covers various aspects, including: — Eligible expenses: A detailed list of expenses that are covered by the employer, such as transportation costs, packing and unpacking fees, storage fees, temporary housing, and additional costs related to selling or terminating the employee's previous residence. — Timeframe: The duration within which the employee must complete the relocation process and submit the required documentation to receive the promised benefits. — Documentation requirements: Clear instructions on the documents the employee needs to provide to substantiate their moving expenses, such as receipts, invoices, and contracts with service providers. — Repayment obligations: Any conditions under which the employee may be required to repay all or a portion of the covered moving expenses, such as voluntary termination within a specified timeframe after relocation or failure to comply with the terms of the agreement. — Tax implications: The agreement should address the potential tax consequences for both the employee and the employer, including any tax assistance or withholding requirements. — Dispute resolution: A mechanism to resolve any disagreements or disputes that may arise during the relocation process, such as mediation or arbitration. It is crucial for both employers and employees to carefully review and understand the terms of the Salt Lake Utah relocation agreement before signing, ensuring it aligns with their needs and expectations. Consulting with legal professionals may be advisable to ensure compliance with state and federal laws and to protect the rights and interests of both parties involved.

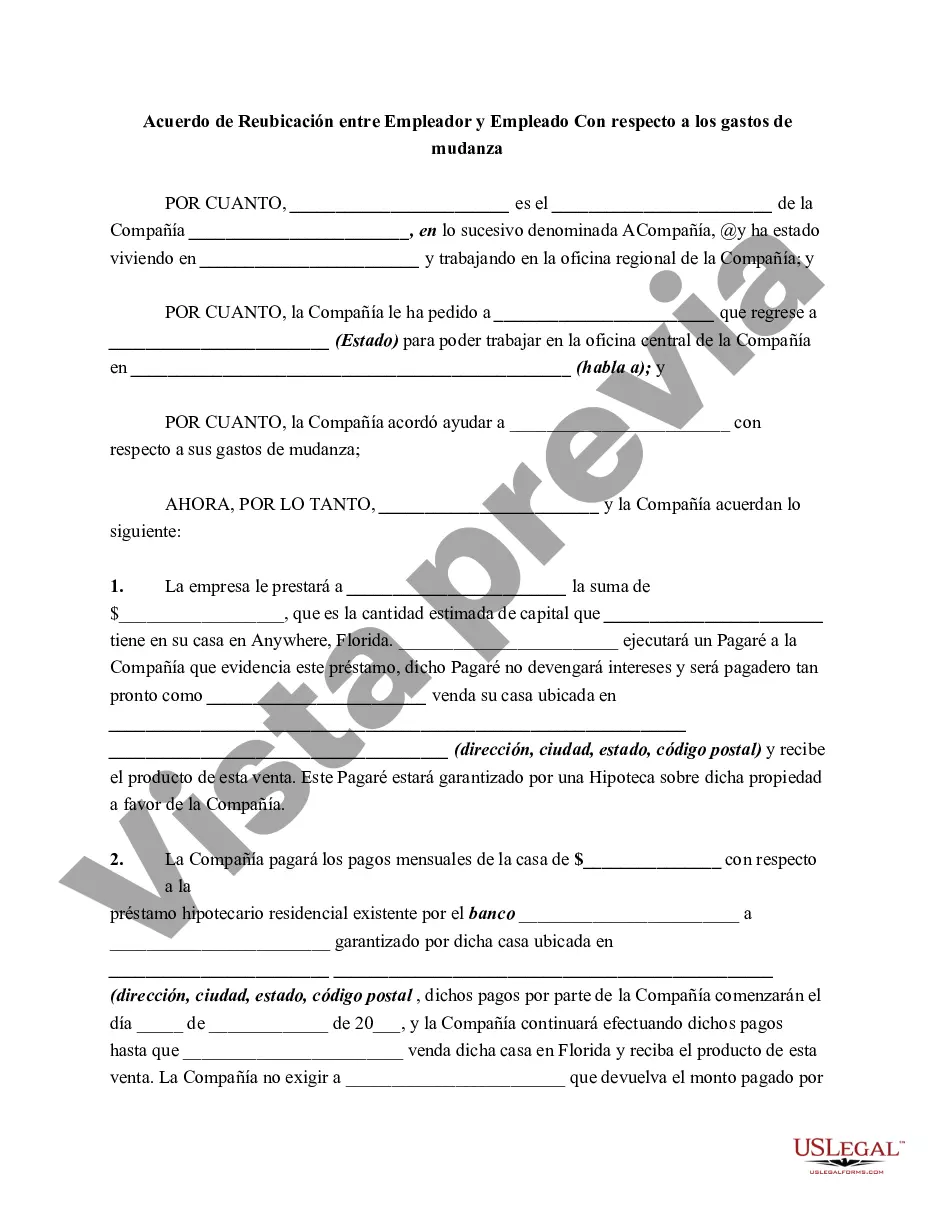

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Acuerdo de reubicación entre el empleador y el empleado con respecto a los gastos de mudanza - Relocation Agreement between Employer and Employee Regarding Moving Expenses

Description

How to fill out Salt Lake Utah Acuerdo De Reubicación Entre El Empleador Y El Empleado Con Respecto A Los Gastos De Mudanza?

Draftwing documents, like Salt Lake Relocation Agreement between Employer and Employee Regarding Moving Expenses, to take care of your legal matters is a difficult and time-consumming process. Many circumstances require an attorney’s involvement, which also makes this task expensive. However, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms intended for a variety of scenarios and life circumstances. We ensure each form is compliant with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Salt Lake Relocation Agreement between Employer and Employee Regarding Moving Expenses template. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before getting Salt Lake Relocation Agreement between Employer and Employee Regarding Moving Expenses:

- Make sure that your template is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Find out more about the form by previewing it or going through a quick intro. If the Salt Lake Relocation Agreement between Employer and Employee Regarding Moving Expenses isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our service and download the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment details.

- Your form is all set. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!