The admission of a new partner results in the legal dissolution of the existing partnership and the beginning of a new one. From an economic standpoint, however, the admission of a new partner (or partners) may be of minor significance in the continuity of the business. For example, in large public accounting or law firms, partners are admitted annually without any change in operating policies. To recognize the economic effects, it is necessary only to open a capital account for each new partner. In the entries illustrated in this appendix, we assume that the accounting records of the predecessor firm will continue to be used by the new partnership. A new partner may be admitted either by (1) purchasing the interest of one or more existing partners or (2) investing assets in the partnership, as shown in Illustration 12A-1. The former affects only the capital accounts of the partners who are parties to the transaction. The latter increases both net assets and total capital of the partnership.

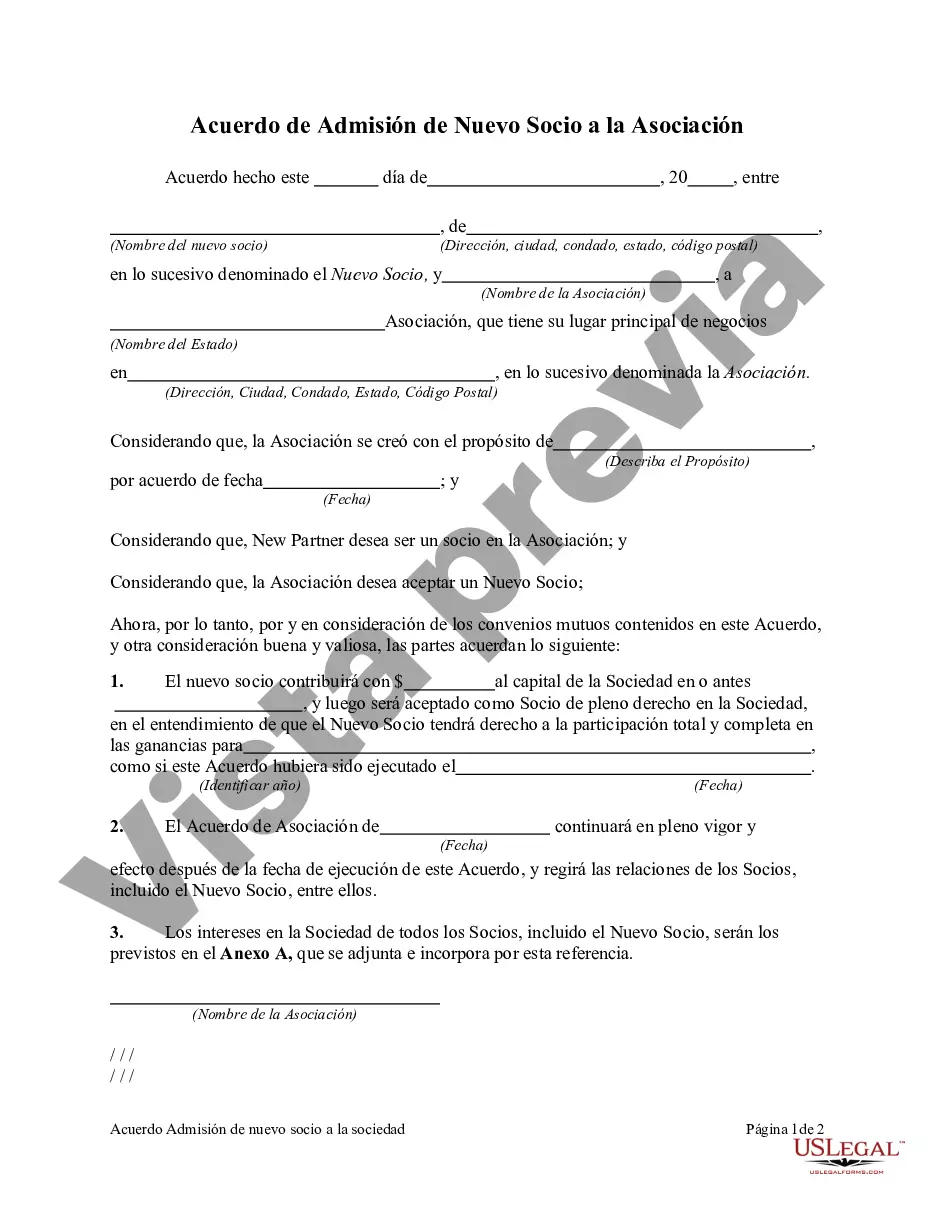

The Queens New York Agreement Admitting New Partner to Partnership is a legally binding document used in the state of New York to officially accept a new partner into an existing partnership. This agreement outlines the terms and conditions of the new partner's admission, ensuring a smooth transition and establishing the rights and responsibilities of all parties involved. In order to create a comprehensive and effective Queens New York Agreement Admitting New Partner to Partnership, several key elements must be included. First and foremost, the agreement should clearly identify the existing partnership and establish its legal status. It should state the names of the current partners, their roles, and any relevant details regarding the formation or operation of the partnership. The agreement should then outline the specific terms and conditions for admitting the new partner. This includes providing the name, contact information, and background of the incoming partner. Additionally, the agreement should address the financial aspect, such as the new partner's capital contribution, profit-sharing arrangement, and liability for any existing debts or obligations. To ensure the fairness and transparency of the partnership, the agreement should also include provisions on decision-making, management responsibilities, and the exit process. This entails specifying the voting rights of each partner, the distribution of authority and duties, and the procedure for resolving disputes or terminating the partnership. Different types of Queens New York Agreement Admitting New Partner to Partnership may vary based on the nature of the partnership. For example, the agreement may be tailored for a general partnership, limited partnership, or limited liability partnership (LLP). Each type has its own legal requirements and characteristics, so it is essential to consult with a qualified attorney to determine the most suitable structure for your partnership. In summary, the Queens New York Agreement Admitting New Partner to Partnership is a crucial legal document that governs the admission of new partners into an existing partnership. It establishes the rights, duties, and guidelines for the partnership, ensuring a smooth integration of the new partner and the continued success of the business. To create a comprehensive agreement, it is advisable to seek the assistance of a legal professional well-versed in New York partnership laws.The Queens New York Agreement Admitting New Partner to Partnership is a legally binding document used in the state of New York to officially accept a new partner into an existing partnership. This agreement outlines the terms and conditions of the new partner's admission, ensuring a smooth transition and establishing the rights and responsibilities of all parties involved. In order to create a comprehensive and effective Queens New York Agreement Admitting New Partner to Partnership, several key elements must be included. First and foremost, the agreement should clearly identify the existing partnership and establish its legal status. It should state the names of the current partners, their roles, and any relevant details regarding the formation or operation of the partnership. The agreement should then outline the specific terms and conditions for admitting the new partner. This includes providing the name, contact information, and background of the incoming partner. Additionally, the agreement should address the financial aspect, such as the new partner's capital contribution, profit-sharing arrangement, and liability for any existing debts or obligations. To ensure the fairness and transparency of the partnership, the agreement should also include provisions on decision-making, management responsibilities, and the exit process. This entails specifying the voting rights of each partner, the distribution of authority and duties, and the procedure for resolving disputes or terminating the partnership. Different types of Queens New York Agreement Admitting New Partner to Partnership may vary based on the nature of the partnership. For example, the agreement may be tailored for a general partnership, limited partnership, or limited liability partnership (LLP). Each type has its own legal requirements and characteristics, so it is essential to consult with a qualified attorney to determine the most suitable structure for your partnership. In summary, the Queens New York Agreement Admitting New Partner to Partnership is a crucial legal document that governs the admission of new partners into an existing partnership. It establishes the rights, duties, and guidelines for the partnership, ensuring a smooth integration of the new partner and the continued success of the business. To create a comprehensive agreement, it is advisable to seek the assistance of a legal professional well-versed in New York partnership laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.