The Cook Illinois Revocable Living Trust for Real Estate is a legal arrangement designed to manage and distribute real estate assets in Cook County, Illinois. It is a popular estate planning tool that allows individuals to maintain control over their real estate holdings while also providing for a seamless transfer of ownership upon their passing or incapacitation. A revocable living trust is a legal document created during the granter's lifetime, allowing them to retain full control over their assets. It can be amended or revoked at any time, giving the granter flexibility and the ability to make changes as their circumstances evolve. Additionally, the trust avoids probate, saving time and money for the beneficiaries and ensuring privacy as the details of the trust are kept confidential. The Cook Illinois Revocable Living Trust for Real Estate offers several benefits, including: 1. Asset Management: The trust allows the granter to maintain control and management of their real estate properties, ensuring they are properly maintained, leased, or sold in their best interests. 2. Avoidance of Probate: By placing real estate assets into the trust, they are not subject to probate court proceedings, allowing for a quicker transfer of ownership and avoiding potential disputes. 3. Privacy: Unlike a will, which becomes a public record upon probate, a revocable living trust remains private, preserving the confidentiality of the granter's assets and the beneficiaries involved. 4. Incapacity Planning: The trust includes provisions to deal with the granter's potential incapacitation, appointing a successor trustee to step in and manage the real estate assets seamlessly. 5. Flexibility and Control: The granter can make changes to the trust as their circumstances change, including adding or removing real estate properties and adjusting beneficiaries' interests. There are no specific types of Cook Illinois Revocable Living Trusts for Real Estate, as each trust is tailored to the individual's needs and goals. However, the trust can be modified to include specific provisions, such as charitable donations, discretionary distributions, or special instructions regarding the real estate assets. In conclusion, the Cook Illinois Revocable Living Trust for Real Estate is a versatile estate planning tool that enables individuals to maintain control over their real estate assets while streamlining their transfer upon incapacitation or passing. It offers benefits such as asset management, avoidance of probate, privacy, incapacity planning, and flexibility. Contacting an experienced estate planning attorney in Cook County, Illinois, is advisable to ensure the proper creation and implementation of the trust based on individual circumstances and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Fideicomiso en Vida Revocable para Bienes Raíces - Revocable Living Trust for Real Estate

Description

How to fill out Cook Illinois Fideicomiso En Vida Revocable Para Bienes Raíces?

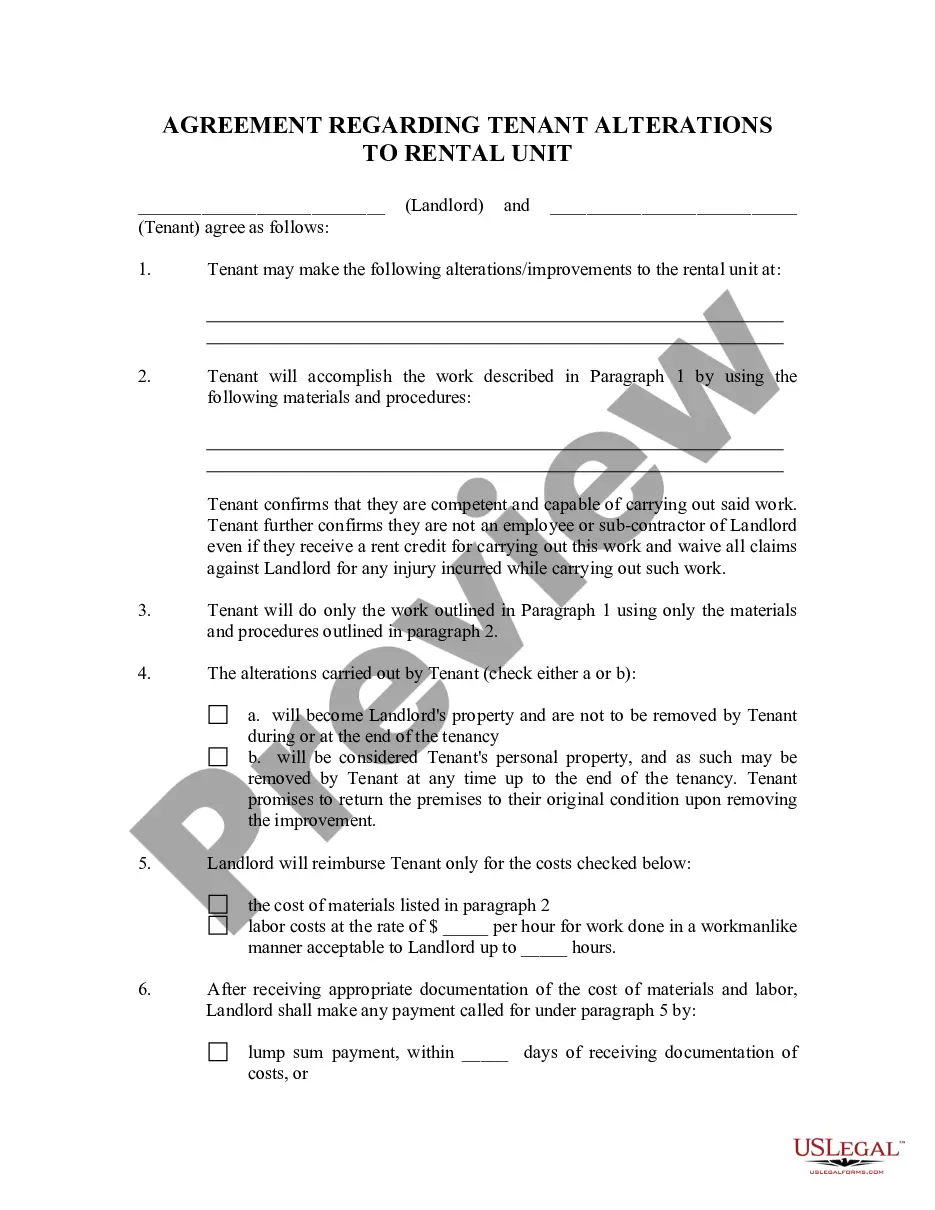

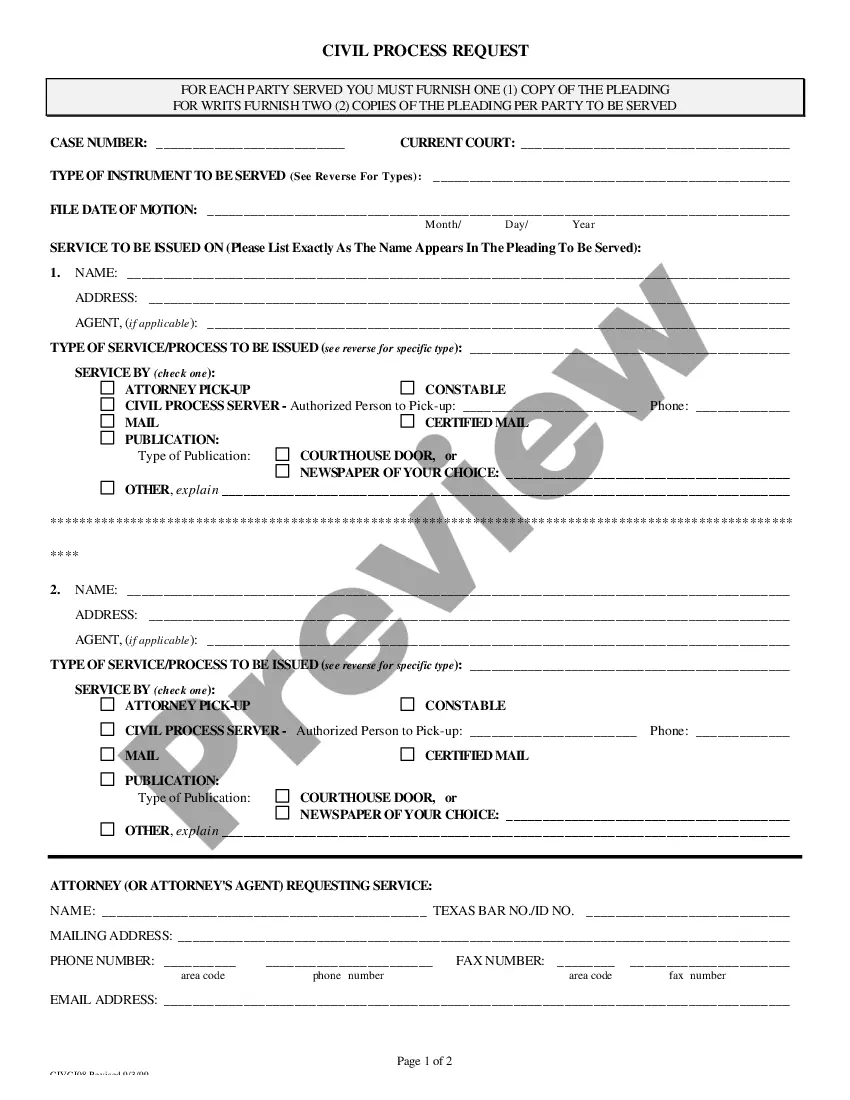

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Cook Revocable Living Trust for Real Estate, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Consequently, if you need the recent version of the Cook Revocable Living Trust for Real Estate, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cook Revocable Living Trust for Real Estate:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Cook Revocable Living Trust for Real Estate and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

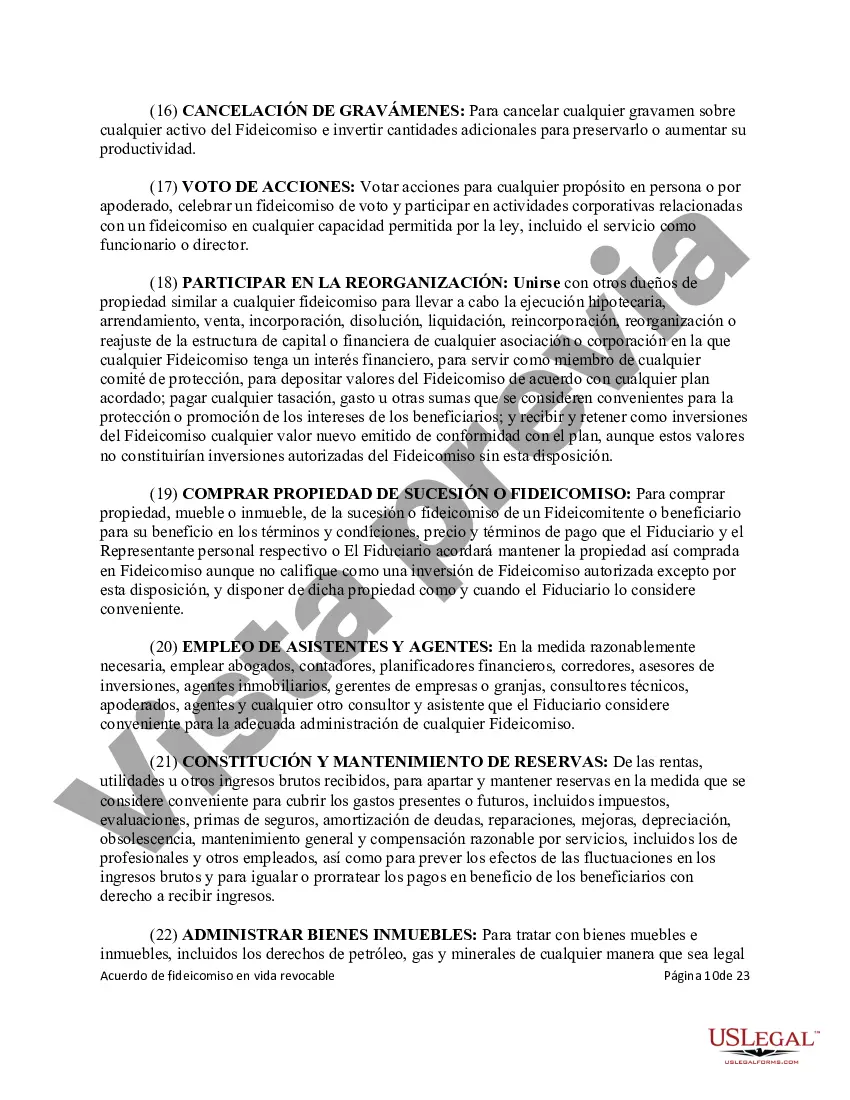

Fideicomiso Irrevocable Un Fideicomiso que no puede ser cambiado.

Concepto del Trust (Fundador o Settlor) transfiere determinados bienes o derechos a otra persona de su confianza (Fiduciario), con el fin de que los controle y administre en beneficio de terceras personas (Beneficiarios).

Podemos definir la figura angloamericana como una relacion fiduciaria, en virtud de la cual un sujeto, denominado trustee, ostenta la titularidad de determinados bienes con la obligacion de administrarlos, junto con sus frutos, en beneficio de las personas designadas como beneficiarios del trust.

Es un contrato mediante el cual una persona fisica o moral, nacional o extranjera; afecta ciertos bienes o derechos para un fin licito y determinado, en beneficio propio o de un tercero, encomendando la realizacion de dicho fin a una institucion fiduciaria.

Los fideicomisos le permiten al otorgante controlar las propiedades, aun despues de su muerte. Los fideicomisos proporcionan privacidadson contratos discretos entre dos partes que raramente son partes del registro publico. Los fideicomisos pueden funcionar para eliminar la necesidad de tutores.

Un living trust tambien conocido como fideicomiso activo es un acuerdo de 3 personas donde la primera persona (fiduciario) crea un acuerdo que le permite a la segunda persona (fideicomisario) tener derechos sobre el patrimonio o los bienes del fideicomisario en beneficio de la tercera persona (beneficiario) cuando el

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Algunos de los tipos de contrato mas frecuente en el mercado actualmente son: Fideicomiso testamentario.Fideicomiso como medio de pago.Fideicomiso de planeacion patrimonial.Fideicomiso estructurado.

Un fideicomiso es un arreglo fiduciario que coloca bienes con un tercero (un administrador fiduciario) para que los guarde en nombre de los beneficiarios (por lo general, los hijos o los conyuges).

El trust es un instrumento economico y juridico del derecho anglosajon por medio del cual se crea un patrimonio separado de la persona que lo origina (settlor) y al cual se transmite sus activos, para que un administrador (trustee, los administre en beneficio de quienes el originante designe (beneficiarios).