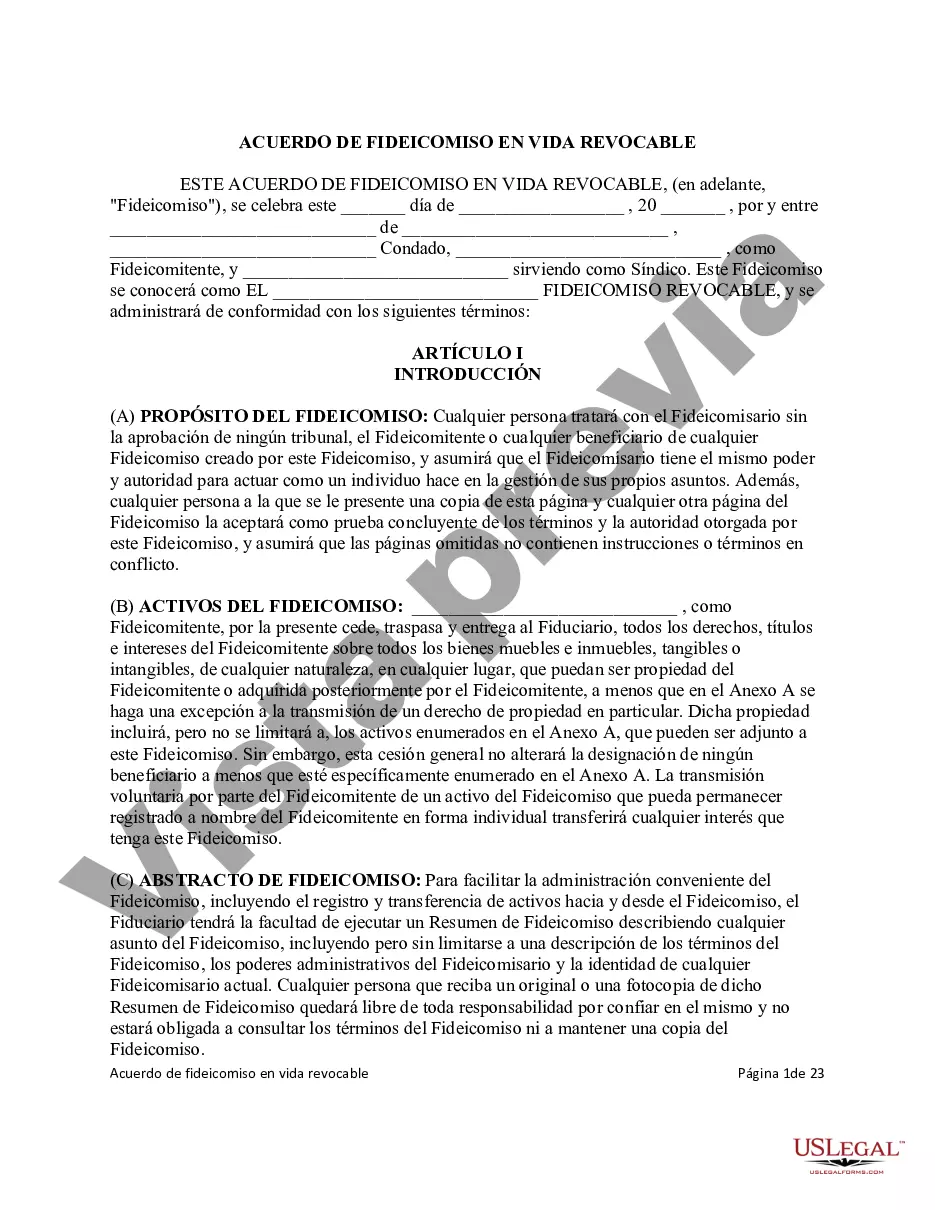

Dallas Texas Revocable Living Trust for Grandchildren is a legal document that allows grandparents in Dallas, Texas to establish a trust for the benefit of their grandchildren while retaining control and flexibility during their lifetime. A revocable living trust is an estate planning tool that holds assets on behalf of beneficiaries and can be altered or revoked by the granter at any time. The Dallas Texas Revocable Living Trust for Grandchildren provides several benefits for both the grandparents and their grandchildren. Firstly, it ensures that the grandchildren will receive a portion or the entirety of the trust assets after the grandparents pass away. This enables the grandparents to pass on their wealth, property, or other assets in a controlled and efficient manner, avoiding probate. Furthermore, the flexibility of a revocable living trust allows the grandparents to make changes to the trust's provisions, beneficiaries, or assets during their lifetime, providing them with a sense of peace of mind. They have the power to add or remove beneficiaries, allocate specific assets to certain grandchildren, and even modify the terms of distribution as circumstances change. There are various types of Dallas Texas Revocable Living Trusts for Grandchildren, each suitable for different scenarios. Some common types include: 1. General Revocable Living Trust: This trust allows for the distribution of assets to grandchildren according to the instructions set forth by the grandparents. 2. Education Trust: This trust specifically emphasizes the allocation of funds for the education-related expenses of grandchildren. The distribution of assets can be limited to educational expenses, such as tuition fees, textbooks, or other educational materials. 3. Health Care Trust: This type of trust focuses on providing assets for the healthcare needs of grandchildren. It can cover medical bills, insurance premiums, and other health-related costs. 4. Special Needs Trust: A special needs trust is designed for grandchildren with disabilities or special needs. It ensures their financial security without affecting their eligibility for government assistance programs such as Medicaid or Supplemental Security Income (SSI). In conclusion, a Dallas Texas Revocable Living Trust for Grandchildren is a highly customizable trust that allows grandparents to pass on their wealth and assets in an organized and efficient manner to benefit their grandchildren. Whether it's a general trust, education trust, health care trust, or special needs trust, each type is tailored to meet specific needs and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Fideicomiso en vida revocable para nietos - Revocable Living Trust for Grandchildren

Description

How to fill out Dallas Texas Fideicomiso En Vida Revocable Para Nietos?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life situation, finding a Dallas Revocable Living Trust for Grandchildren suiting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. Aside from the Dallas Revocable Living Trust for Grandchildren, here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can get the document in your profile at any time later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Dallas Revocable Living Trust for Grandchildren:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Dallas Revocable Living Trust for Grandchildren.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

Es un producto financiero que ademas de ser parecido a un plan de ahorro, garantiza que el beneficiario, es decir tu hija o hijo, reciba el dinero acordado para continuar sus estudios en nivel superior aun cuando faltes.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

Fideicomiso Irrevocable Un Fideicomiso que no puede ser cambiado.

Algunos de los tipos de contrato mas frecuente en el mercado actualmente son: Fideicomiso testamentario.Fideicomiso como medio de pago.Fideicomiso de planeacion patrimonial.Fideicomiso estructurado.

Un fideicomiso es un arreglo fiduciario que coloca bienes con un tercero (un administrador fiduciario) para que los guarde en nombre de los beneficiarios (por lo general, los hijos o los conyuges).

Es un contrato mediante el cual una persona fisica o moral, nacional o extranjera; afecta ciertos bienes o derechos para un fin licito y determinado, en beneficio propio o de un tercero, encomendando la realizacion de dicho fin a una institucion fiduciaria.