Contra Costa County, located in California, offers residents a valuable estate planning tool known as the Living Trust — Irrevocable. This type of trust provides individuals with the ability to protect and manage their assets during their lifetime and ensure a smooth transfer of wealth after their passing. By creating an irrevocable living trust, individuals can establish specific provisions, distribute wealth, and potentially minimize estate taxes. An irrevocable living trust in Contra Costa County is a legally binding document that cannot be altered or amended by the granter once it is created. This means that the assets transferred into the trust will no longer be considered part of the granter's estate, offering protection from potential creditors, lawsuits, and other claims. The trust allows the granter to designate beneficiaries who will receive the assets upon the granter's death, bypassing the probate process and ensuring privacy and efficient asset distribution. There are several types of irrevocable living trusts available in Contra Costa County, including: 1. Irrevocable Life Insurance Trusts (Slits): These trusts are specifically designed to hold life insurance policies outside the granter's estate, potentially eliminating estate tax liability. 2. Charitable Remainder Trusts (CRTs): CRTs are created for charitable purposes, allowing the granter to donate assets to a selected charity while retaining an income stream during their lifetime. 3. Qualified Personnel Residence Trusts (Parts): This trust allows the granter to transfer their primary residence or vacation home to the trust while retaining the right to live in the property for a specified period. This can be an effective strategy to minimize estate taxes. 4. Qualified Terminable Interest Property (TIP) Trusts: TIP trusts are commonly used in second marriages to provide for a surviving spouse while ensuring that the assets ultimately pass to the granter's children from a previous marriage. It is important to consult with an experienced estate planning attorney in Contra Costa County to determine which type of irrevocable living trust suits your unique circumstances. They will guide you through the process of creating and funding the trust, ensuring that your assets are protected and your wishes are carried out effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Contra Costa California Fideicomiso en Vida - Irrevocable - Living Trust - Irrevocable

Description

How to fill out Contra Costa California Fideicomiso En Vida - Irrevocable?

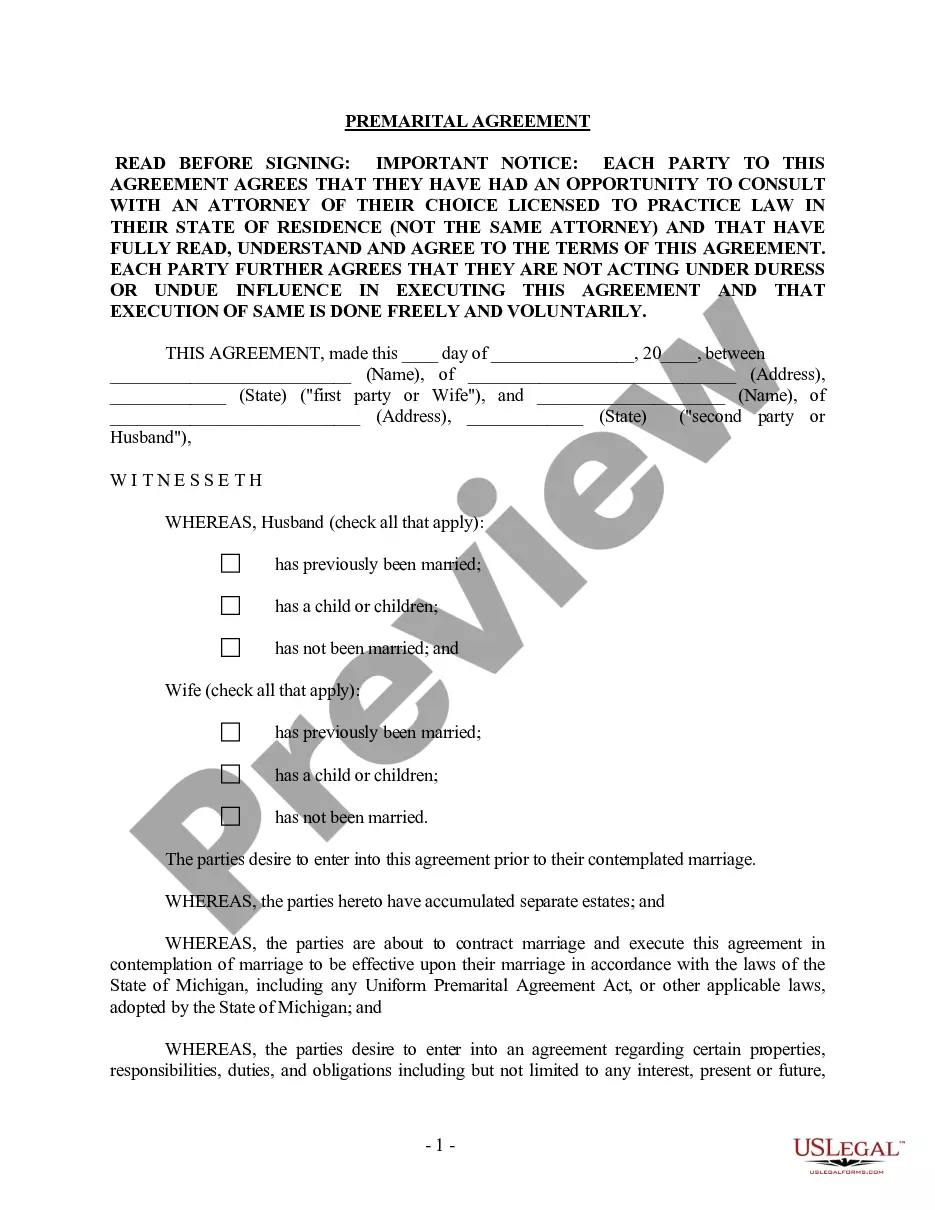

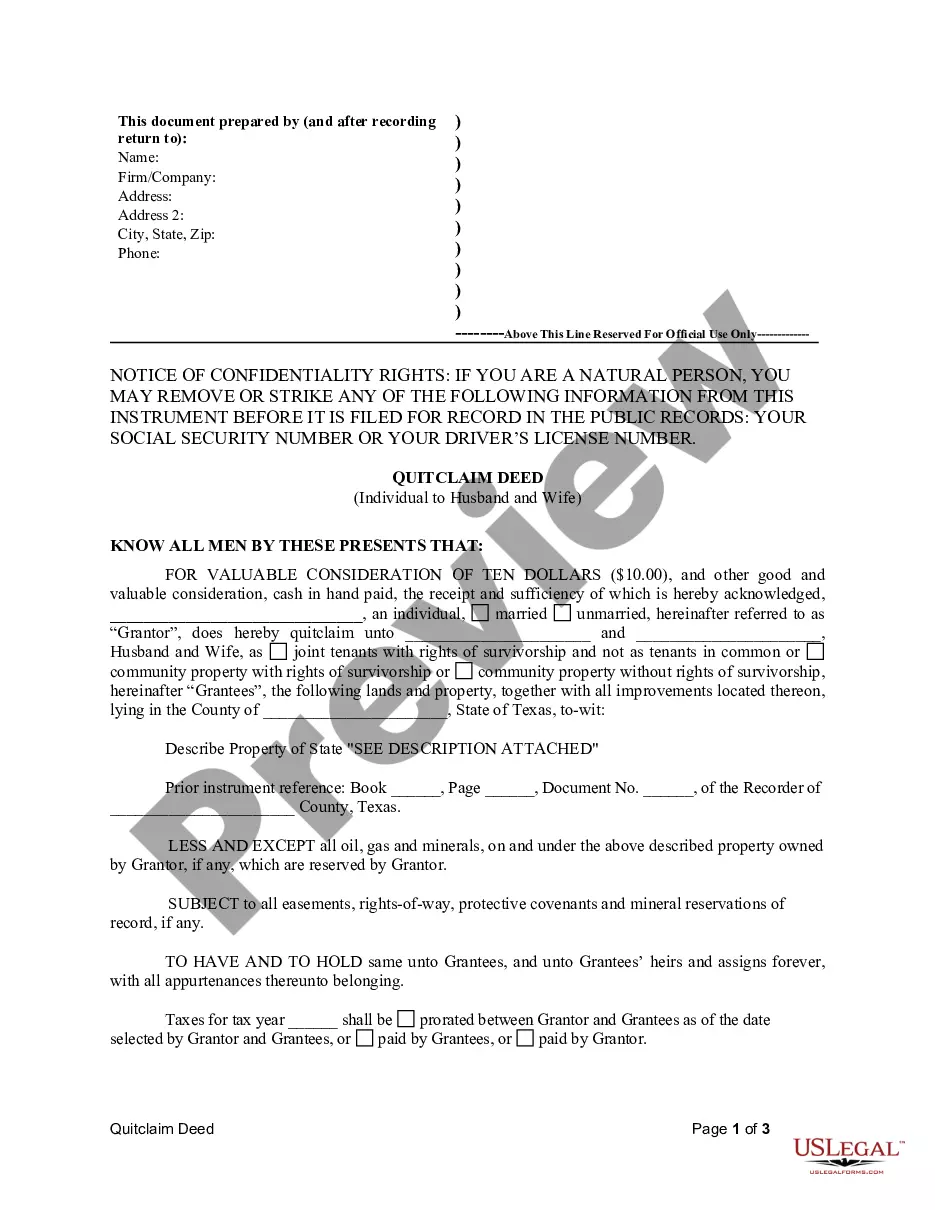

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Contra Costa Living Trust - Irrevocable, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the latest version of the Contra Costa Living Trust - Irrevocable, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Contra Costa Living Trust - Irrevocable:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Contra Costa Living Trust - Irrevocable and download it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Un fideicomiso de seguro de vida irrevocable (ILIT, por sus siglas en ingles) permite controlar mejor la planificacion patrimonial para decidir exactamente cuando, donde y a quienes se les quieren dejar los activos despues de un fallecimiento.

Lo que le haria revocable es la posibilidad de que mientras A (el fideicomitente) viva, pueda modificar dicha disposicion. Los fideicomisos irrevocables, al contrario que los revocables, no pueden ser modificados una vez se haya inscrito la disposicion testamentaria o se haya perfeccionado el contrato.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Un fideicomiso irrevocable tiene un otorgante, un fideicomisario y un beneficiario o beneficiarios. Una vez que el otorgante coloca un activo en un fideicomiso irrevocable, es un regalo para el fideicomiso y el otorgante no puede revocarlo.

Un fideicomiso irrevocable tiene un otorgante, un fideicomisario y un beneficiario o beneficiarios. Una vez que el otorgante coloca un activo en un fideicomiso irrevocable, es un regalo para el fideicomiso y el otorgante no puede revocarlo.

Articulo 821. Fallecimiento del fideicomisario. El fideicomisario que fallece antes de la restitucion, no trasmite por testamento o abintestato derecho alguno sobre fideicomiso, ni aun la simple expectativa que pasa ipso jure al sustituto o sustitutos designados por el constituyente, si los hubiere.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

La muerte del fideicomitente no va a modificar el titulo juridico por el cual los fideicomisarios van a recibir el be- neficio. No fueron senalados herederos por causa de muerte. Son fideicomisarios por fideicomiso. No son herederos.

Algunos de los tipos de contrato mas frecuente en el mercado actualmente son: Fideicomiso testamentario.Fideicomiso como medio de pago.Fideicomiso de planeacion patrimonial.Fideicomiso estructurado.