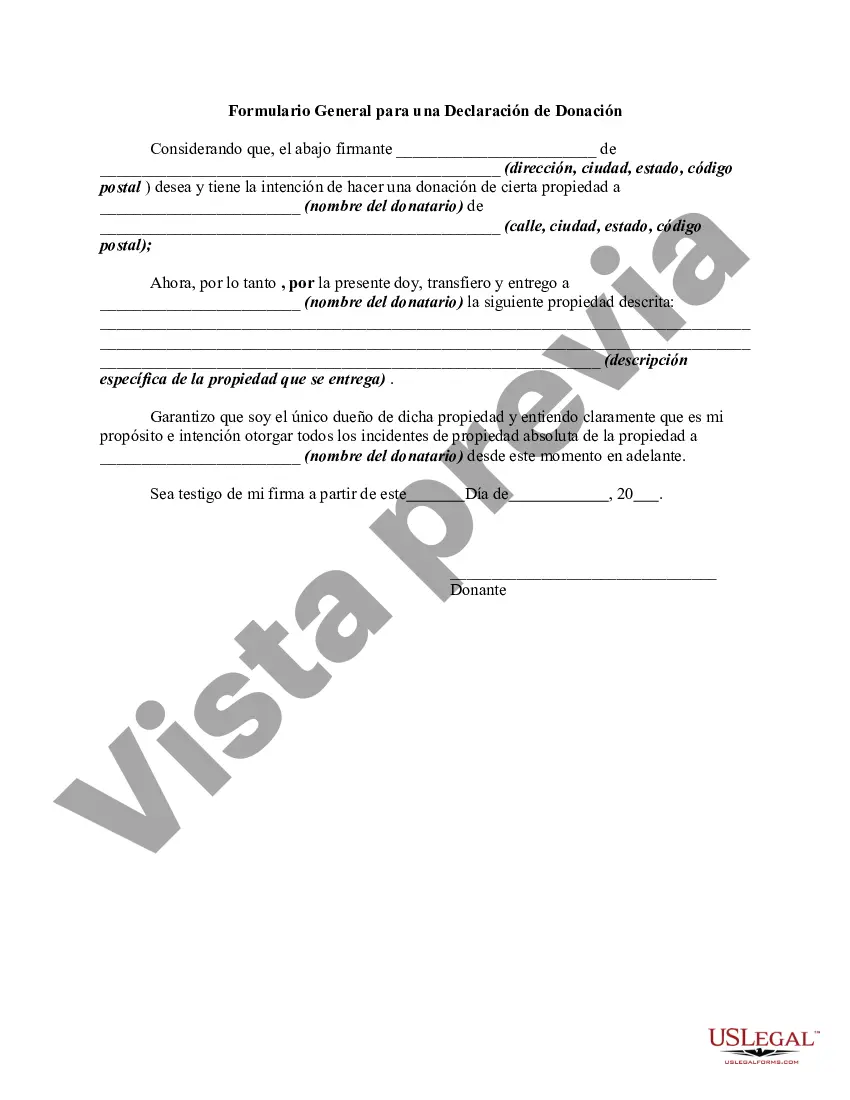

The following form is a general form for a declaration of a gift of property.

The Alameda California Declaration of Gift is a legal document used to formally transfer ownership or assets from one party (the donor) to another (the recipient) in the city of Alameda, located in the state of California. This document serves as an official record of the gift and outlines the terms, conditions, and specifics of the transfer. Key elements typically included in the Alameda California Declaration of Gift are: 1. Parties Involved: The names, addresses, and contact information of both the donor and the recipient. 2. Description of the Gift: A detailed description of the asset or property being gifted, including any relevant identification numbers or specifications. 3. Intention of the Gift: A clear statement acknowledging the donor's intent to gift the mentioned asset or property to the recipient. 4. Acceptance: The acknowledgment and acceptance of the gift by the recipient. 5. Terms and Conditions: Any specific terms or conditions related to the gift, such as restrictions on use, transferability, or obligations for maintaining the asset. 6. Declaration of Ownership: A statement affirming that the donor has legal ownership and the right to gift the mentioned asset or property. 7. Signatures and Witnesses: Signatures of both the donor and recipient, as well as any required witnesses to validate the document. There are different types of Alameda California Declaration of Gift documents, tailored to the specific nature of the gift being transferred. Some notable variations include: 1. Real Estate Declaration of Gift: Used when gifting property or real estate located in Alameda, California. 2. Vehicle Declaration of Gift: Used when gifting a vehicle registered in Alameda, California. 3. Financial Declaration of Gift: Used when gifting a sum of money or financial asset, such as stocks or bonds, within Alameda, California. 4. Personal Property Declaration of Gift: Used when gifting personal belongings, such as artwork, jewelry, or collectibles, in Alameda, California. It is important to consult with legal professionals or local authorities to ensure compliance with all relevant laws, requirements, and potential tax implications associated with the Alameda California Declaration of Gift.The Alameda California Declaration of Gift is a legal document used to formally transfer ownership or assets from one party (the donor) to another (the recipient) in the city of Alameda, located in the state of California. This document serves as an official record of the gift and outlines the terms, conditions, and specifics of the transfer. Key elements typically included in the Alameda California Declaration of Gift are: 1. Parties Involved: The names, addresses, and contact information of both the donor and the recipient. 2. Description of the Gift: A detailed description of the asset or property being gifted, including any relevant identification numbers or specifications. 3. Intention of the Gift: A clear statement acknowledging the donor's intent to gift the mentioned asset or property to the recipient. 4. Acceptance: The acknowledgment and acceptance of the gift by the recipient. 5. Terms and Conditions: Any specific terms or conditions related to the gift, such as restrictions on use, transferability, or obligations for maintaining the asset. 6. Declaration of Ownership: A statement affirming that the donor has legal ownership and the right to gift the mentioned asset or property. 7. Signatures and Witnesses: Signatures of both the donor and recipient, as well as any required witnesses to validate the document. There are different types of Alameda California Declaration of Gift documents, tailored to the specific nature of the gift being transferred. Some notable variations include: 1. Real Estate Declaration of Gift: Used when gifting property or real estate located in Alameda, California. 2. Vehicle Declaration of Gift: Used when gifting a vehicle registered in Alameda, California. 3. Financial Declaration of Gift: Used when gifting a sum of money or financial asset, such as stocks or bonds, within Alameda, California. 4. Personal Property Declaration of Gift: Used when gifting personal belongings, such as artwork, jewelry, or collectibles, in Alameda, California. It is important to consult with legal professionals or local authorities to ensure compliance with all relevant laws, requirements, and potential tax implications associated with the Alameda California Declaration of Gift.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.