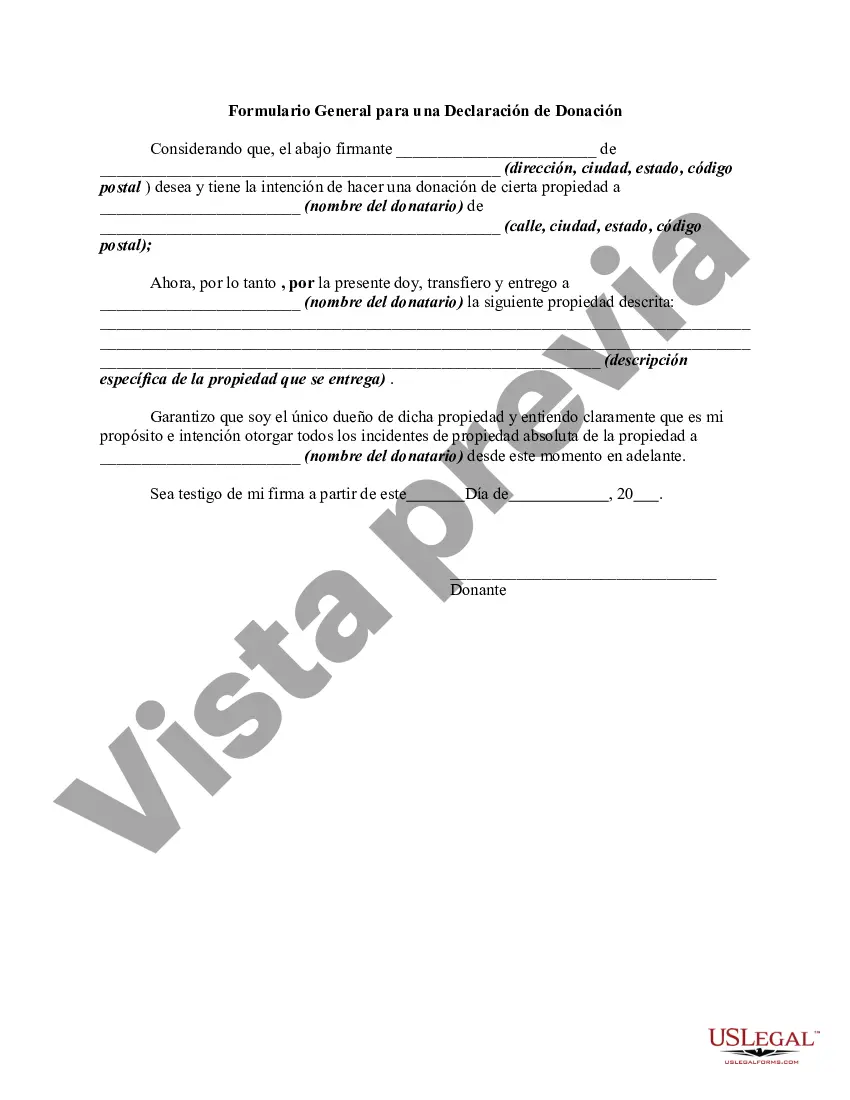

The following form is a general form for a declaration of a gift of property.

Collin Texas Declaration of Gift: A Comprehensive Overview of Types and Usage The Collin Texas Declaration of Gift is a legal document used to formally transfer ownership of property, assets, or funds from one party to another without any form of compensation. This declaration is recognized and regulated by the state laws of Texas, specifically in Collin County. Its primary purpose is to document and secure the transfer of gifts effectively. The Collin Texas Declaration of Gift encompasses various types tailored to specific situations and assets. Understanding the different types can help individuals select the most appropriate declaration according to their needs. Here is an overview of the primary types: 1. Real Estate Declaration of Gift: This type of declaration is used when gifting a property, land, or any other real estate asset. It outlines the legal description and details of the property, including the physical address, lot number, and relevant boundary information. Additionally, both the donor (the giver of the gift) and the done (the recipient) must sign the document. 2. Financial Asset Declaration of Gift: This declaration is employed when gifting financial assets, such as stocks, bonds, mutual funds, or other investments. It specifies the type of asset being gifted, including any associated account numbers or identification. Furthermore, it may include instructions on how to transfer the ownership of these assets. 3. Personal Property Declaration of Gift: When gifting personal belongings like vehicles, jewelry, artwork, or other tangible assets, the Personal Property Declaration of Gift is the applicable form. It details a description of the item(s) being gifted and can also include any relevant purchase price or appraised value information. 4. Monetary Declaration of Gift: For monetary transfers, such as cash gifts or money orders, the Monetary Declaration of Gift is utilized. This particular form may include the exact amount being gifted and can outline any conditions or limitations associated with the gift. It is important to note that the Collin Texas Declaration of Gift should always be drafted with the assistance of a qualified legal professional to ensure compliance with the state's laws and regulations. Additionally, parties involved in the gift transaction should retain copies of the declaration for their records. Overall, the Collin Texas Declaration of Gift is a vital legal instrument for transferring property, assets, or funds as gifts within Collin County, Texas. Understanding the different types available and seeking legal guidance throughout the process ensures a smooth and legally binding transfer of ownership.Collin Texas Declaration of Gift: A Comprehensive Overview of Types and Usage The Collin Texas Declaration of Gift is a legal document used to formally transfer ownership of property, assets, or funds from one party to another without any form of compensation. This declaration is recognized and regulated by the state laws of Texas, specifically in Collin County. Its primary purpose is to document and secure the transfer of gifts effectively. The Collin Texas Declaration of Gift encompasses various types tailored to specific situations and assets. Understanding the different types can help individuals select the most appropriate declaration according to their needs. Here is an overview of the primary types: 1. Real Estate Declaration of Gift: This type of declaration is used when gifting a property, land, or any other real estate asset. It outlines the legal description and details of the property, including the physical address, lot number, and relevant boundary information. Additionally, both the donor (the giver of the gift) and the done (the recipient) must sign the document. 2. Financial Asset Declaration of Gift: This declaration is employed when gifting financial assets, such as stocks, bonds, mutual funds, or other investments. It specifies the type of asset being gifted, including any associated account numbers or identification. Furthermore, it may include instructions on how to transfer the ownership of these assets. 3. Personal Property Declaration of Gift: When gifting personal belongings like vehicles, jewelry, artwork, or other tangible assets, the Personal Property Declaration of Gift is the applicable form. It details a description of the item(s) being gifted and can also include any relevant purchase price or appraised value information. 4. Monetary Declaration of Gift: For monetary transfers, such as cash gifts or money orders, the Monetary Declaration of Gift is utilized. This particular form may include the exact amount being gifted and can outline any conditions or limitations associated with the gift. It is important to note that the Collin Texas Declaration of Gift should always be drafted with the assistance of a qualified legal professional to ensure compliance with the state's laws and regulations. Additionally, parties involved in the gift transaction should retain copies of the declaration for their records. Overall, the Collin Texas Declaration of Gift is a vital legal instrument for transferring property, assets, or funds as gifts within Collin County, Texas. Understanding the different types available and seeking legal guidance throughout the process ensures a smooth and legally binding transfer of ownership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.