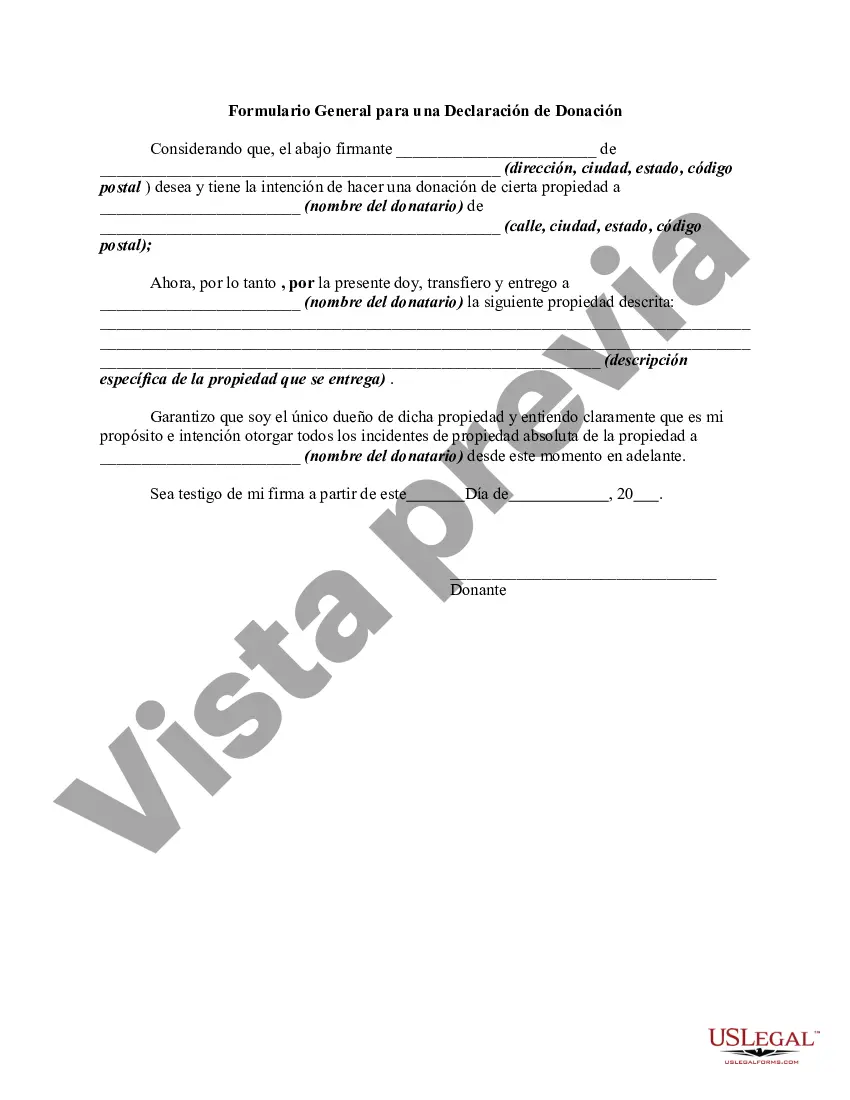

The following form is a general form for a declaration of a gift of property.

The Hennepin Minnesota Declaration of Gift is a legal document used in Hennepin County, Minnesota to transfer ownership of a gift to another individual or organization. It is a legally binding agreement that outlines the terms and conditions of the gift, ensuring clarity and transparency for all parties involved. Keywords: Hennepin Minnesota, Declaration of Gift, legal document, transfer ownership, gift, terms and conditions, clarity, transparency, parties involved. There are various types of Hennepin Minnesota Declaration of Gift, each catering to specific situations and assets. These include: 1. Hennepin Minnesota Declaration of Monetary Gift: This type of declaration is used when transferring a monetary gift, such as cash, check, or electronic transfer. It specifies the amount of the gift, the intended recipient, and any accompanying conditions or restrictions. 2. Hennepin Minnesota Declaration of Real Estate Gift: When gifting real estate property, this declaration is necessary to officially transfer ownership. It includes detailed descriptions of the property, its value, any liens or encumbrances, and the terms of the gift. 3. Hennepin Minnesota Declaration of Personal Property Gift: This declaration is used when gifting personal belongings such as jewelry, artwork, vehicles, or any movable assets. It outlines the specific items being gifted, their estimated value, and any relevant conditions or restrictions. 4. Hennepin Minnesota Declaration of Charitable Gift: For individuals who wish to donate a gift to a charity or nonprofit organization, this declaration ensures proper documentation and adherence to legal requirements. It includes the details of the charitable organization, the nature of the gift, and any tax implications or benefits. 5. Hennepin Minnesota Declaration of Intangible Asset Gift: This type of declaration is used when transferring intangible assets, such as stocks, bonds, patents, copyrights, or intellectual property rights. It specifies the nature of the asset, its estimated value, and any accompanying conditions or restrictions. Overall, the Hennepin Minnesota Declaration of Gift serves as a crucial legal instrument to facilitate the transfer of various types of gifts while ensuring compliance with the laws and regulations of Hennepin County, Minnesota. Keywords: Hennepin Minnesota, Declaration of Gift, legal document, transfer ownership, gift, terms and conditions, monetary gift, real estate gift, personal property gift, charitable gift, intangible asset gift, compliance, laws and regulations, Hennepin County.The Hennepin Minnesota Declaration of Gift is a legal document used in Hennepin County, Minnesota to transfer ownership of a gift to another individual or organization. It is a legally binding agreement that outlines the terms and conditions of the gift, ensuring clarity and transparency for all parties involved. Keywords: Hennepin Minnesota, Declaration of Gift, legal document, transfer ownership, gift, terms and conditions, clarity, transparency, parties involved. There are various types of Hennepin Minnesota Declaration of Gift, each catering to specific situations and assets. These include: 1. Hennepin Minnesota Declaration of Monetary Gift: This type of declaration is used when transferring a monetary gift, such as cash, check, or electronic transfer. It specifies the amount of the gift, the intended recipient, and any accompanying conditions or restrictions. 2. Hennepin Minnesota Declaration of Real Estate Gift: When gifting real estate property, this declaration is necessary to officially transfer ownership. It includes detailed descriptions of the property, its value, any liens or encumbrances, and the terms of the gift. 3. Hennepin Minnesota Declaration of Personal Property Gift: This declaration is used when gifting personal belongings such as jewelry, artwork, vehicles, or any movable assets. It outlines the specific items being gifted, their estimated value, and any relevant conditions or restrictions. 4. Hennepin Minnesota Declaration of Charitable Gift: For individuals who wish to donate a gift to a charity or nonprofit organization, this declaration ensures proper documentation and adherence to legal requirements. It includes the details of the charitable organization, the nature of the gift, and any tax implications or benefits. 5. Hennepin Minnesota Declaration of Intangible Asset Gift: This type of declaration is used when transferring intangible assets, such as stocks, bonds, patents, copyrights, or intellectual property rights. It specifies the nature of the asset, its estimated value, and any accompanying conditions or restrictions. Overall, the Hennepin Minnesota Declaration of Gift serves as a crucial legal instrument to facilitate the transfer of various types of gifts while ensuring compliance with the laws and regulations of Hennepin County, Minnesota. Keywords: Hennepin Minnesota, Declaration of Gift, legal document, transfer ownership, gift, terms and conditions, monetary gift, real estate gift, personal property gift, charitable gift, intangible asset gift, compliance, laws and regulations, Hennepin County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.