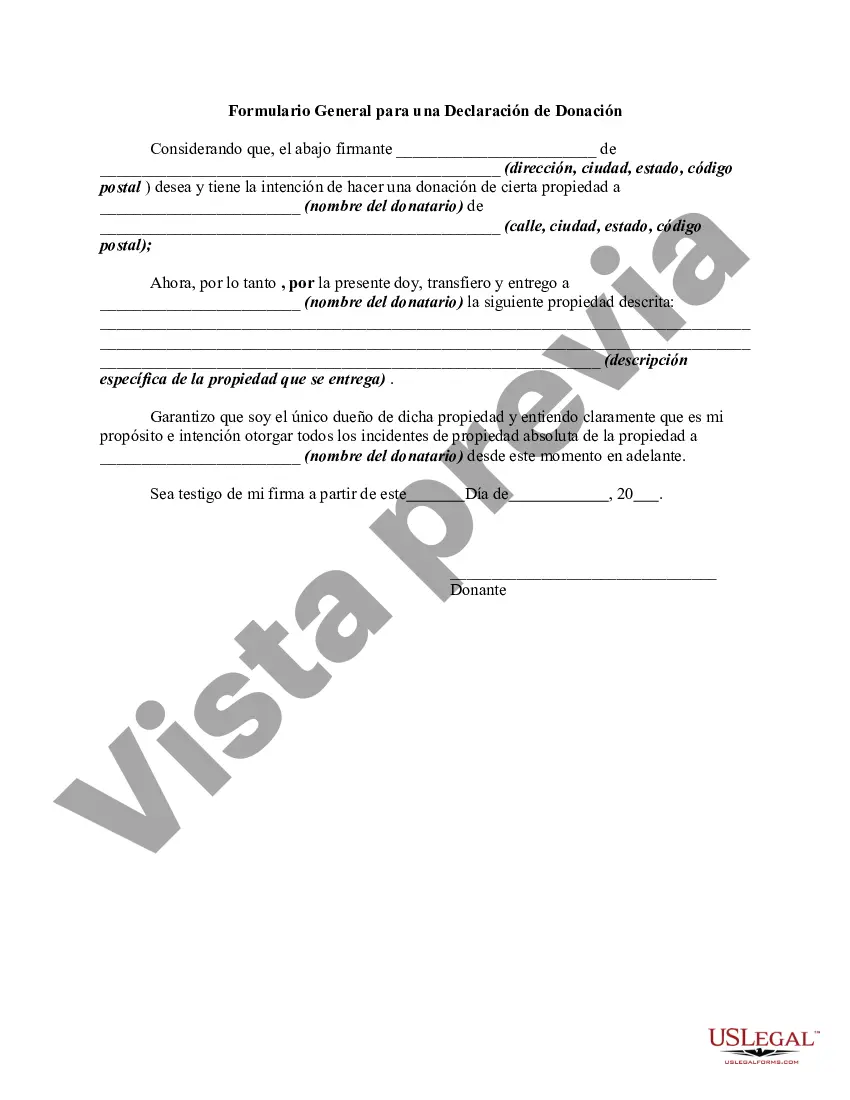

The following form is a general form for a declaration of a gift of property.

The Hillsborough Florida Declaration of Gift is an essential legal document used in Hillsborough County, Florida, that establishes the transfer of a gift from a donor to a done. This detailed description will provide an overview of the Hillsborough Florida Declaration of Gift, its purpose, uses, and different types, incorporating relevant keywords. The Hillsborough Florida Declaration of Gift serves as a binding agreement between the donor, who willingly gives the gift, and the done, who receives it. This legal document outlines the terms and conditions of the transfer, ensuring clarity and preventing any future disputes arising from the gift transaction. The primary purpose of the Hillsborough Florida Declaration of Gift is to legally document and validate the transfer of ownership of valuable assets, properties, or funds without any exchange or consideration involved. This document acts as evidence of the donor's intention to gift, protecting both the donor's and the done's rights. Various types of Hillsborough Florida Declaration of Gift include: 1. Real Estate Gift Declaration: This form is used when gifting real estate properties, such as land, houses, or buildings, in Hillsborough County, Florida. It ensures a transparent transfer of ownership, legally safeguarding the interests of both parties involved. 2. Monetary Gift Declaration: When donating funds or money to an individual, organization, or charity in Hillsborough County, Florida, this type of declaration helps establish a clear transfer and prevent any future conflicts regarding the amount and purpose of the donation. 3. Personal Property Gift Declaration: Used for donating personal belongings like vehicles, jewelry, artwork, or other valuable assets, this declaration enumerates the details of the gift and facilitates a smooth transfer of ownership. 4. Charitable Gift Declaration: In the case of charitable donations made to nonprofit organizations or foundations, this specific declaration ensures compliance with legal requirements, tax deductions, and the donor's philanthropic intent. The Hillsborough Florida Declaration of Gift is an essential legal instrument that protects the interests of both the donor and the done during the transfer of valuable assets, properties, or funds. It provides a clear record of the gift transaction, preventing potential disagreements and legal disputes in the future. By utilizing the appropriate type of declaration based on the nature of the gift, individuals and organizations can ensure a secure and legally compliant transfer process in Hillsborough County, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.