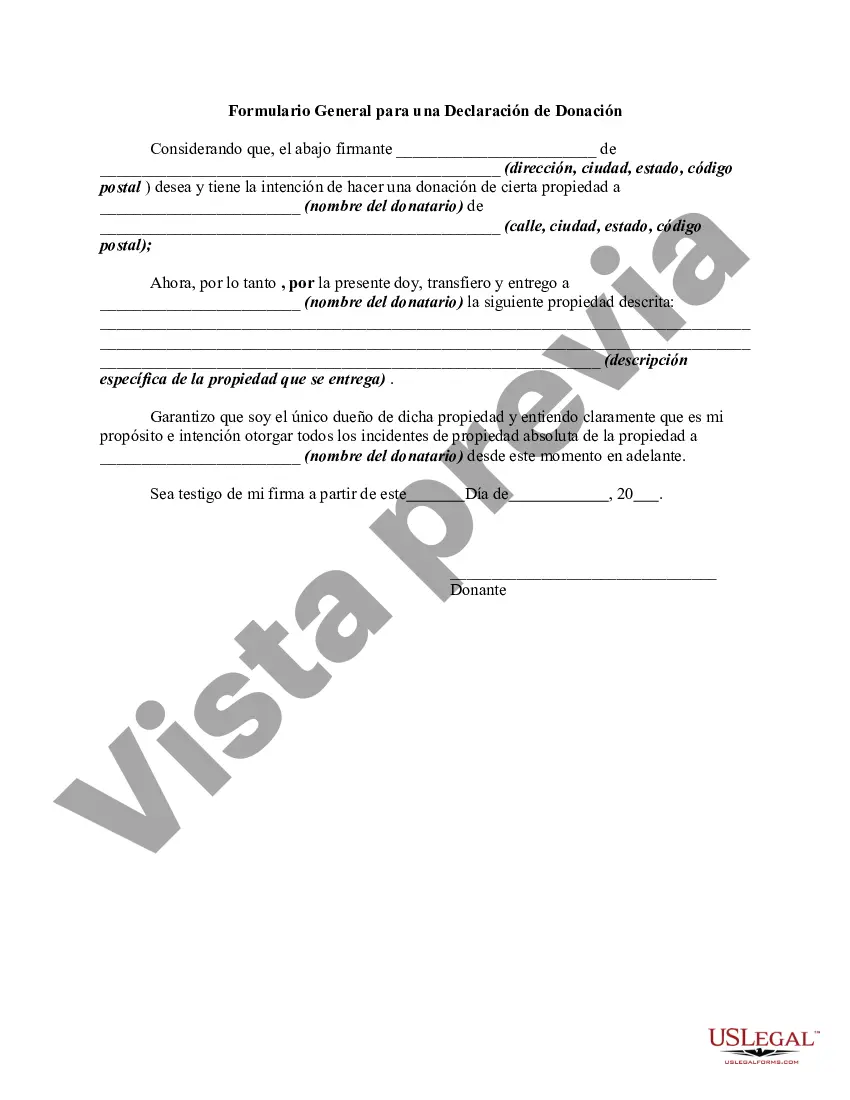

The following form is a general form for a declaration of a gift of property.

The Houston Texas Declaration of Gift is a legally binding document utilized in the state of Texas to express the intention to transfer ownership of assets from one party (the donor) to another party (the recipient) as a gift. It serves as an official record of the gifts made and helps protect the interests and rights of both parties involved in the transaction. Key Terms: Houston Texas, Declaration of Gift, legally binding document, transfer ownership, assets, donor, recipient, gift, official record, protect, interests, rights, transaction. The Houston Texas Declaration of Gift encompasses various types, each serving a specific purpose. These include: 1. Real Estate Declaration of Gift: This type of declaration is used when gifting real property, such as land, houses, or commercial buildings, in Houston, Texas. It outlines the details of the gift, including the property's legal description, value, and any conditions or restrictions imposed on the transfer. 2. Financial Declaration of Gift: This variant pertains to the gifting of financial assets, such as stocks, bonds, or cash. It outlines the donor's intention to transfer ownership of these assets as a gift to the recipient, with relevant information on the asset type, quantity, and value. 3. Personal Property Declaration of Gift: This type applies to non-real estate property, including personal belongings like vehicles, jewelry, artwork, or other valuable items. It specifies the gifts' nature, worth, and any additional terms or conditions associated with the transfer. 4. Charitable Declaration of Gift: This declaration is utilized when individuals or organizations in Houston, Texas, wish to make charitable contributions. It outlines the donation amount or asset, the purpose of the gift, and any conditions or restrictions imposed by the donor. 5. Conditional Declaration of Gift: In certain cases, a donor may wish to attach specific conditions or requirements to the gift's transfer. This type of declaration outlines such conditions and ensures they are legally enforceable. Regardless of the specific type, the Houston Texas Declaration of Gift must comply with the local laws and regulations to ensure its validity and enforceability. It is crucial that both the donor and recipient seek legal advice when drafting or executing such a declaration to protect their interests and ensure the accurate transfer of ownership.The Houston Texas Declaration of Gift is a legally binding document utilized in the state of Texas to express the intention to transfer ownership of assets from one party (the donor) to another party (the recipient) as a gift. It serves as an official record of the gifts made and helps protect the interests and rights of both parties involved in the transaction. Key Terms: Houston Texas, Declaration of Gift, legally binding document, transfer ownership, assets, donor, recipient, gift, official record, protect, interests, rights, transaction. The Houston Texas Declaration of Gift encompasses various types, each serving a specific purpose. These include: 1. Real Estate Declaration of Gift: This type of declaration is used when gifting real property, such as land, houses, or commercial buildings, in Houston, Texas. It outlines the details of the gift, including the property's legal description, value, and any conditions or restrictions imposed on the transfer. 2. Financial Declaration of Gift: This variant pertains to the gifting of financial assets, such as stocks, bonds, or cash. It outlines the donor's intention to transfer ownership of these assets as a gift to the recipient, with relevant information on the asset type, quantity, and value. 3. Personal Property Declaration of Gift: This type applies to non-real estate property, including personal belongings like vehicles, jewelry, artwork, or other valuable items. It specifies the gifts' nature, worth, and any additional terms or conditions associated with the transfer. 4. Charitable Declaration of Gift: This declaration is utilized when individuals or organizations in Houston, Texas, wish to make charitable contributions. It outlines the donation amount or asset, the purpose of the gift, and any conditions or restrictions imposed by the donor. 5. Conditional Declaration of Gift: In certain cases, a donor may wish to attach specific conditions or requirements to the gift's transfer. This type of declaration outlines such conditions and ensures they are legally enforceable. Regardless of the specific type, the Houston Texas Declaration of Gift must comply with the local laws and regulations to ensure its validity and enforceability. It is crucial that both the donor and recipient seek legal advice when drafting or executing such a declaration to protect their interests and ensure the accurate transfer of ownership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.