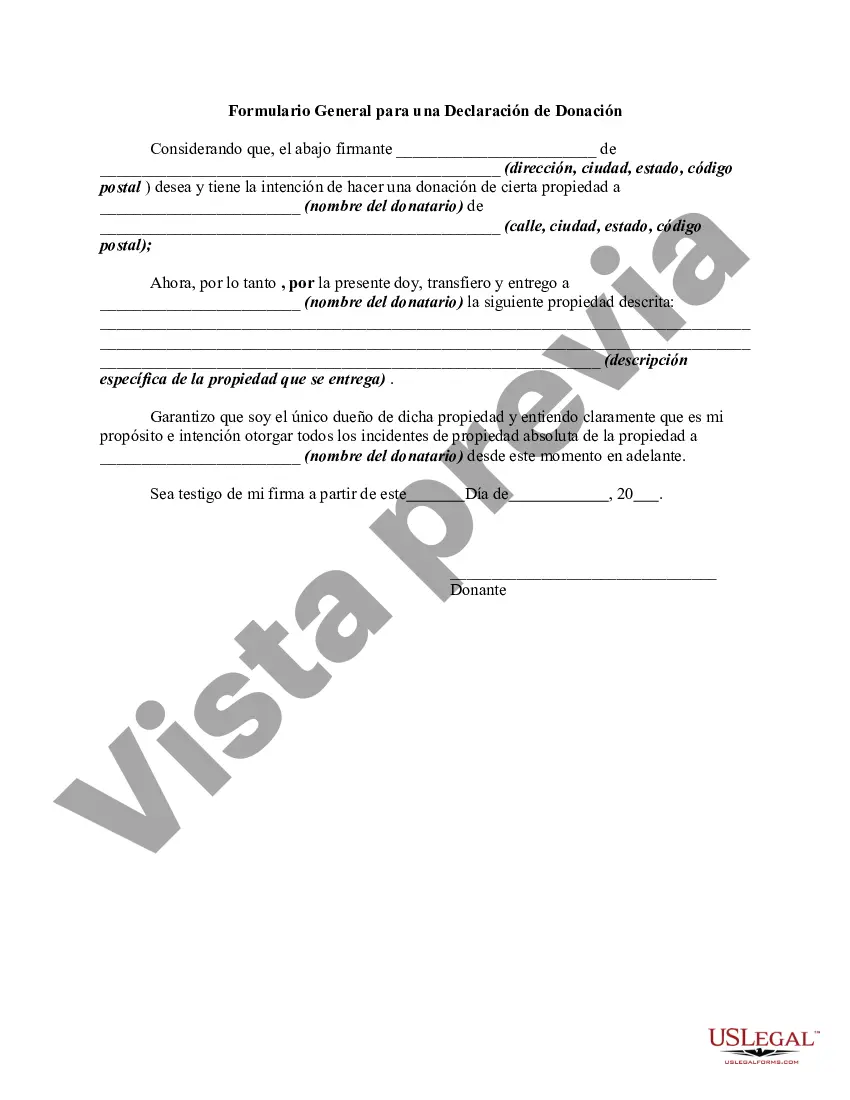

The following form is a general form for a declaration of a gift of property.

Miami-Dade Florida Declaration of Gift is a legally binding document that allows individuals to transfer ownership of assets or properties to another person or organization without any monetary exchange. It is an important legal instrument used in various situations such as estate planning, charitable donations, and gifting to family members or friends. The Declaration of Gift is governed by the laws of Miami-Dade County, Florida, and requires certain elements to be valid. These elements include a clear intention by the donor to relinquish ownership, a clear identification of the gifted item or property, and acceptance of the gift by the recipient. There are different types of Miami-Dade Florida Declaration of Gift, each designed for specific circumstances. These include: 1. Real Estate Declaration of Gift: This type of declaration is used when transferring ownership of real estate properties, such as residential homes, commercial buildings, or vacant land. 2. Personal Property Declaration of Gift: This declaration is used for transferring ownership of movable assets such as vehicles, jewelry, art collections, or valuable personal belongings. 3. Financial Asset Declaration of Gift: When gifting financial assets like stocks, bonds, or mutual funds, a financial asset declaration of gift is used. This document ensures a smooth transfer of ownership without any monetary transactions. 4. Charitable Gift Declaration: Individuals or organizations can use this type of declaration to contribute to a charitable cause or a nonprofit organization. It outlines the specific gift being made and may include certain restrictions or conditions set by the donor. 5. Family Gift Declaration: When transferring assets to family members, such as children or siblings, a family gift declaration is used. This document ensures clarity and transparency among family members and helps prevent future disputes over the gifted assets. Regardless of the specific type, all Miami-Dade Florida Declaration of Gift documents must be signed and witnessed by at least two individuals who are not beneficiaries of the gift. It is advisable to consult with an attorney or legal expert familiar with Miami-Dade County laws to ensure the proper drafting and execution of the declaration. In conclusion, the Miami-Dade Florida Declaration of Gift is an essential legal tool for transferring ownership of assets or properties without any monetary exchange. Different types of declarations cater to specific situations such as transferring real estate, personal property, financial assets, charitable donations, or gifting within the family. Following the legal requirements and seeking professional guidance can help ensure a smooth transfer of ownership and protect the interests of both the donor and the recipient.Miami-Dade Florida Declaration of Gift is a legally binding document that allows individuals to transfer ownership of assets or properties to another person or organization without any monetary exchange. It is an important legal instrument used in various situations such as estate planning, charitable donations, and gifting to family members or friends. The Declaration of Gift is governed by the laws of Miami-Dade County, Florida, and requires certain elements to be valid. These elements include a clear intention by the donor to relinquish ownership, a clear identification of the gifted item or property, and acceptance of the gift by the recipient. There are different types of Miami-Dade Florida Declaration of Gift, each designed for specific circumstances. These include: 1. Real Estate Declaration of Gift: This type of declaration is used when transferring ownership of real estate properties, such as residential homes, commercial buildings, or vacant land. 2. Personal Property Declaration of Gift: This declaration is used for transferring ownership of movable assets such as vehicles, jewelry, art collections, or valuable personal belongings. 3. Financial Asset Declaration of Gift: When gifting financial assets like stocks, bonds, or mutual funds, a financial asset declaration of gift is used. This document ensures a smooth transfer of ownership without any monetary transactions. 4. Charitable Gift Declaration: Individuals or organizations can use this type of declaration to contribute to a charitable cause or a nonprofit organization. It outlines the specific gift being made and may include certain restrictions or conditions set by the donor. 5. Family Gift Declaration: When transferring assets to family members, such as children or siblings, a family gift declaration is used. This document ensures clarity and transparency among family members and helps prevent future disputes over the gifted assets. Regardless of the specific type, all Miami-Dade Florida Declaration of Gift documents must be signed and witnessed by at least two individuals who are not beneficiaries of the gift. It is advisable to consult with an attorney or legal expert familiar with Miami-Dade County laws to ensure the proper drafting and execution of the declaration. In conclusion, the Miami-Dade Florida Declaration of Gift is an essential legal tool for transferring ownership of assets or properties without any monetary exchange. Different types of declarations cater to specific situations such as transferring real estate, personal property, financial assets, charitable donations, or gifting within the family. Following the legal requirements and seeking professional guidance can help ensure a smooth transfer of ownership and protect the interests of both the donor and the recipient.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.