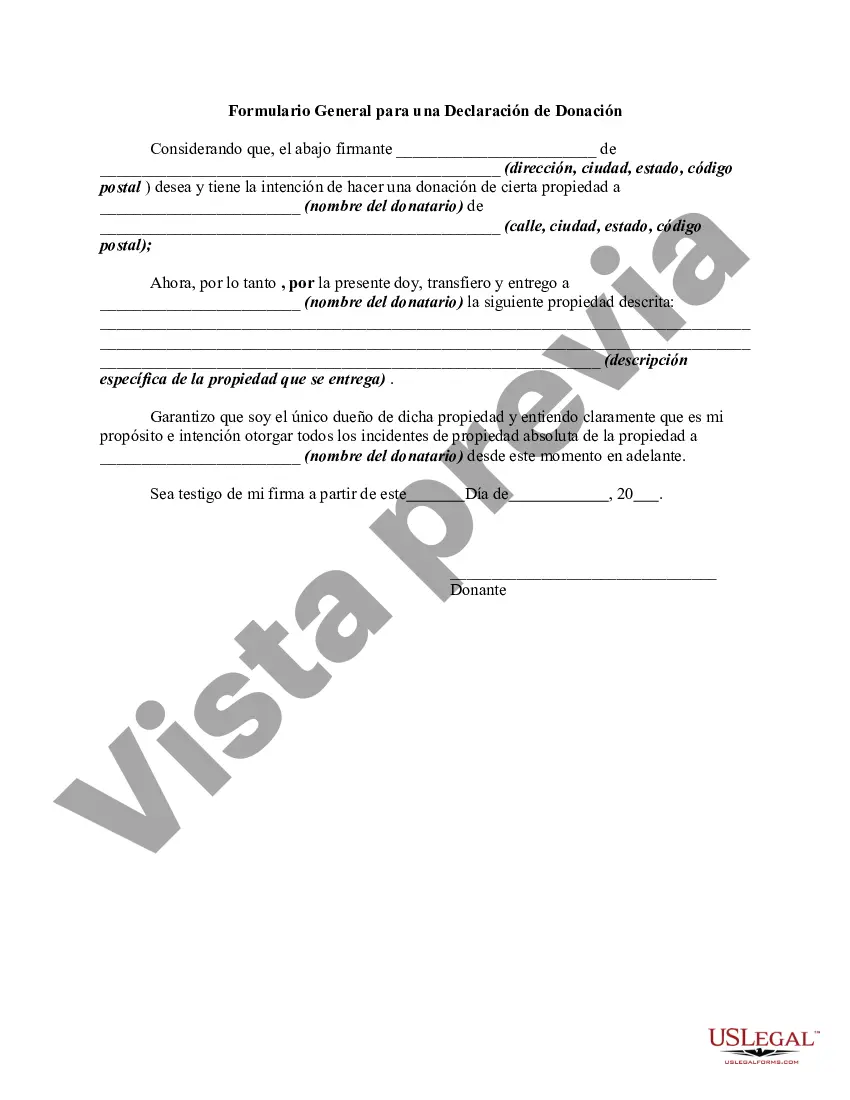

The following form is a general form for a declaration of a gift of property.

The Oakland Michigan Declaration of Gift is a legal document that outlines the terms and conditions of a gift being made by an individual or organization to another party in the Oakland County, Michigan region. This declaration serves as a formal agreement between the donor and recipient, clarifying the responsibilities, expectations, and rights of both parties involved in the gift transaction. The primary purpose of the Oakland Michigan Declaration of Gift is to establish a clear understanding of the intended donation and to ensure that all parties involved are in agreement regarding its terms. It details key information such as the nature of the gift, its specific purpose, and any conditions or restrictions that may be attached to it. This document is often used for significant gifts, including monetary donations, real estate transfers, valuable assets, or any other substantial contribution. Different types of Oakland Michigan Declaration of Gift may include: 1. Monetary Donations: This type of declaration is used when an individual or organization wishes to donate a specific amount of money to another party in Oakland County. The document will outline the exact amount being donated, any conditions or restrictions on its use, and the timeline for the funds to be transferred. 2. Real Estate Transfers: Real estate donation declarations are utilized when a person or entity intends to gift a property, land, or building to another party in Oakland County. It establishes the details of the property being transferred, including the legal description, appraised value, any existing mortgages or liens, and the recipient's responsibilities in maintaining or utilizing the donated real estate. 3. In-Kind Contributions: In some cases, a donor may choose to gift non-monetary items such as artwork, collectibles, equipment, or any other valuable assets. The Oakland Michigan Declaration of Gift for in-kind contributions specifies the specific item(s) being donated, their estimated value, any special conditions regarding their use or display, and the responsibilities of the recipient in caring for and using the gifted assets. 4. Charitable Contributions: The Oakland Michigan Declaration of Gift is often used for charitable donations, where individuals or organizations provide support to non-profit or charitable entities. This type of declaration clarifies the purpose and use of the donation, whether it is unrestricted or intended for a specific program or initiative, and any tax implications or benefits associated with the charitable contribution. In conclusion, the Oakland Michigan Declaration of Gift is a comprehensive legal document that ensures a transparent and mutually agreed upon understanding between donors and recipients of a gift. It lays out the specifics of the gift, encompassing monetary donations, real estate transfers, in-kind contributions, and charitable contributions.The Oakland Michigan Declaration of Gift is a legal document that outlines the terms and conditions of a gift being made by an individual or organization to another party in the Oakland County, Michigan region. This declaration serves as a formal agreement between the donor and recipient, clarifying the responsibilities, expectations, and rights of both parties involved in the gift transaction. The primary purpose of the Oakland Michigan Declaration of Gift is to establish a clear understanding of the intended donation and to ensure that all parties involved are in agreement regarding its terms. It details key information such as the nature of the gift, its specific purpose, and any conditions or restrictions that may be attached to it. This document is often used for significant gifts, including monetary donations, real estate transfers, valuable assets, or any other substantial contribution. Different types of Oakland Michigan Declaration of Gift may include: 1. Monetary Donations: This type of declaration is used when an individual or organization wishes to donate a specific amount of money to another party in Oakland County. The document will outline the exact amount being donated, any conditions or restrictions on its use, and the timeline for the funds to be transferred. 2. Real Estate Transfers: Real estate donation declarations are utilized when a person or entity intends to gift a property, land, or building to another party in Oakland County. It establishes the details of the property being transferred, including the legal description, appraised value, any existing mortgages or liens, and the recipient's responsibilities in maintaining or utilizing the donated real estate. 3. In-Kind Contributions: In some cases, a donor may choose to gift non-monetary items such as artwork, collectibles, equipment, or any other valuable assets. The Oakland Michigan Declaration of Gift for in-kind contributions specifies the specific item(s) being donated, their estimated value, any special conditions regarding their use or display, and the responsibilities of the recipient in caring for and using the gifted assets. 4. Charitable Contributions: The Oakland Michigan Declaration of Gift is often used for charitable donations, where individuals or organizations provide support to non-profit or charitable entities. This type of declaration clarifies the purpose and use of the donation, whether it is unrestricted or intended for a specific program or initiative, and any tax implications or benefits associated with the charitable contribution. In conclusion, the Oakland Michigan Declaration of Gift is a comprehensive legal document that ensures a transparent and mutually agreed upon understanding between donors and recipients of a gift. It lays out the specifics of the gift, encompassing monetary donations, real estate transfers, in-kind contributions, and charitable contributions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.