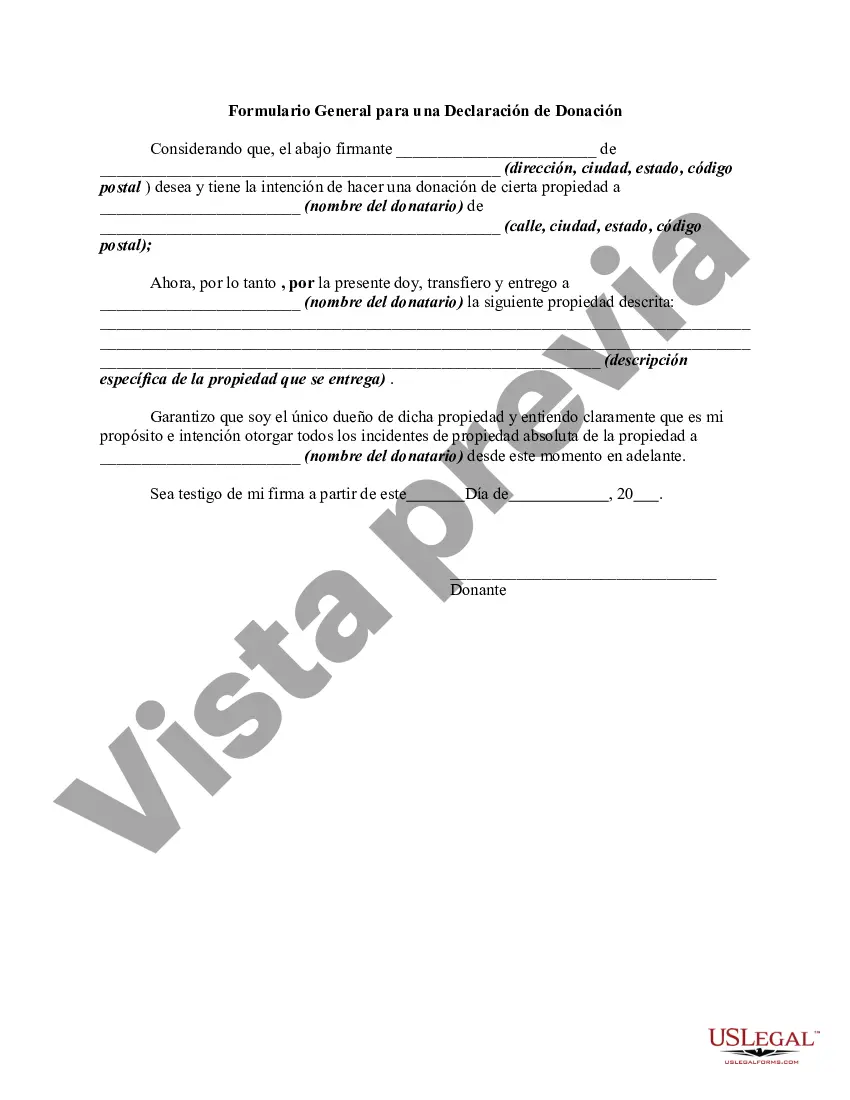

The following form is a general form for a declaration of a gift of property.

Queens New York Declaration of Gift is an official document that outlines the legal transfer of property or assets from one party to another within the Queens County, which is part of New York City. This declaration serves as evidence of the voluntary gift given by the donor to the recipient and ensures the legality and transparency of the transaction. Keywords: Queens New York, Declaration of Gift, legal transfer, property, assets, Queens County, New York City, evidence, voluntary gift, donor, recipient, legality, transparency, transaction. There are several types of Queens New York Declarations of Gift, distinguished based on the nature of the gift and the assets involved. Some common types include: 1. Real Estate Declaration of Gift: This type of declaration is used when gifting real estate property, such as a house, apartment, or land, located within Queens County. It includes details about the property's location, dimensions, value, and any restrictions or encumbrances associated with it. 2. Financial Asset Declaration of Gift: This category involves the transfer of monetary assets, including cash, stocks, bonds, or any other financial instruments. Such declarations outline the specific assets being gifted, their estimated value, and any necessary legal procedures to complete the transfer. 3. Personal Property Declaration of Gift: When gifting personal belongings like jewelry, artwork, vehicles, or other valuable possessions, a personal property declaration is required. This document describes the items being gifted, their condition, appraised value (if applicable), and any relevant warranties or supporting documents. 4. Charitable Declaration of Gift: This type of declaration applies when an individual or entity donates assets to a charitable organization or foundation in Queens, New York. It includes information about the donor, the organization, the donated assets, and any tax-related implications or benefits associated with the gift. 5. Testamentary Declaration of Gift: This declaration is made through a will or testament, bequeathing assets to a chosen recipient, either an individual or an organization, upon the donor's death. It outlines the specific assets being gifted, the conditions or instructions for their use, and any legal formalities required for the transfer upon the donor's passing. These declarations of gift are essential legal documents that protect the interests of both the donor and the recipient, ensuring a smooth and lawful transfer of assets within Queens, New York County. They provide a clear record of the gift, establish the intentions of the donor, and facilitate any necessary documentation, taxes, or legal processes involved.Queens New York Declaration of Gift is an official document that outlines the legal transfer of property or assets from one party to another within the Queens County, which is part of New York City. This declaration serves as evidence of the voluntary gift given by the donor to the recipient and ensures the legality and transparency of the transaction. Keywords: Queens New York, Declaration of Gift, legal transfer, property, assets, Queens County, New York City, evidence, voluntary gift, donor, recipient, legality, transparency, transaction. There are several types of Queens New York Declarations of Gift, distinguished based on the nature of the gift and the assets involved. Some common types include: 1. Real Estate Declaration of Gift: This type of declaration is used when gifting real estate property, such as a house, apartment, or land, located within Queens County. It includes details about the property's location, dimensions, value, and any restrictions or encumbrances associated with it. 2. Financial Asset Declaration of Gift: This category involves the transfer of monetary assets, including cash, stocks, bonds, or any other financial instruments. Such declarations outline the specific assets being gifted, their estimated value, and any necessary legal procedures to complete the transfer. 3. Personal Property Declaration of Gift: When gifting personal belongings like jewelry, artwork, vehicles, or other valuable possessions, a personal property declaration is required. This document describes the items being gifted, their condition, appraised value (if applicable), and any relevant warranties or supporting documents. 4. Charitable Declaration of Gift: This type of declaration applies when an individual or entity donates assets to a charitable organization or foundation in Queens, New York. It includes information about the donor, the organization, the donated assets, and any tax-related implications or benefits associated with the gift. 5. Testamentary Declaration of Gift: This declaration is made through a will or testament, bequeathing assets to a chosen recipient, either an individual or an organization, upon the donor's death. It outlines the specific assets being gifted, the conditions or instructions for their use, and any legal formalities required for the transfer upon the donor's passing. These declarations of gift are essential legal documents that protect the interests of both the donor and the recipient, ensuring a smooth and lawful transfer of assets within Queens, New York County. They provide a clear record of the gift, establish the intentions of the donor, and facilitate any necessary documentation, taxes, or legal processes involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.