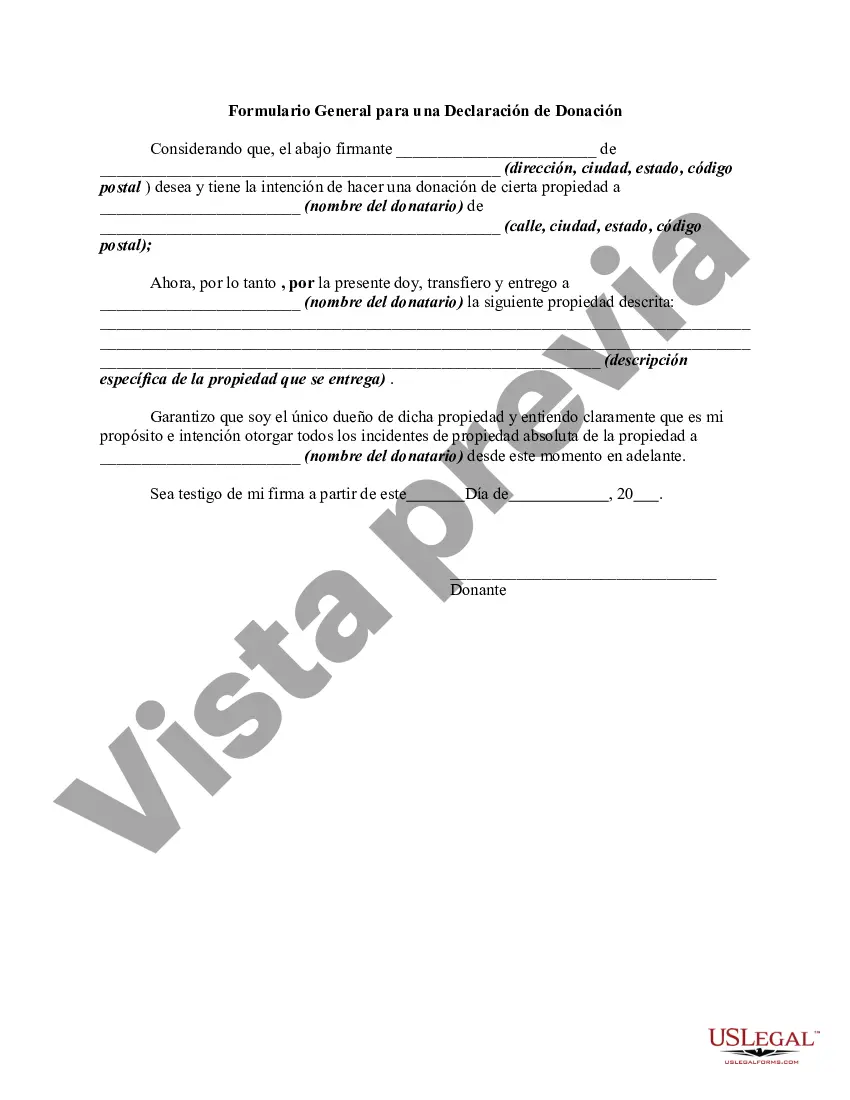

The following form is a general form for a declaration of a gift of property.

The San Bernardino California Declaration of Gift is a legal document that outlines the process of transferring or donating property or assets from one person or entity to another. It serves as a formal record of the transfer and provides legal protection for both the donor and the recipient. The declaration of gift in San Bernardino California entails several key elements that must be included to ensure its validity. It typically includes the full names and contact information of both the donor and the recipient, a detailed description of the property or assets being gifted, and the date of the transfer. Additionally, it may outline any conditions or restrictions associated with the gift, such as limitations on its use or specific instructions for its maintenance. There are various types of San Bernardino California Declaration of Gift, each catered to specific circumstances or types of assets being transferred: 1. Real Estate Declaration of Gift: This type of declaration is used when gifting real property, such as a house, land, or commercial property. It must include the legal description, address, and any relevant details regarding the property being transferred. 2. Personal Property Declaration of Gift: This type of declaration covers the transfer of tangible personal assets such as vehicles, jewelry, artwork, or furniture. It should include a detailed description of the items, including any unique identifiers such as serial numbers or markings. 3. Financial Assets Declaration of Gift: When gifting financial assets like stocks, bonds, or mutual funds, a specific declaration is required. It may need to include the name of the financial institution, the account number, and any related information necessary for the transfer. 4. Charitable Gift Declaration: If the gift is made to a charitable organization or institution, a charitable gift declaration is used. It usually includes the name and contact information of the recipient organization, along with any relevant tax identification numbers or certifications. By executing the San Bernardino California Declaration of Gift, both the donor and recipient can ensure the legality and enforceability of the transfer. It is always recommended consulting with a legal professional or an attorney to understand the specific requirements and provisions applicable to the declaration.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.