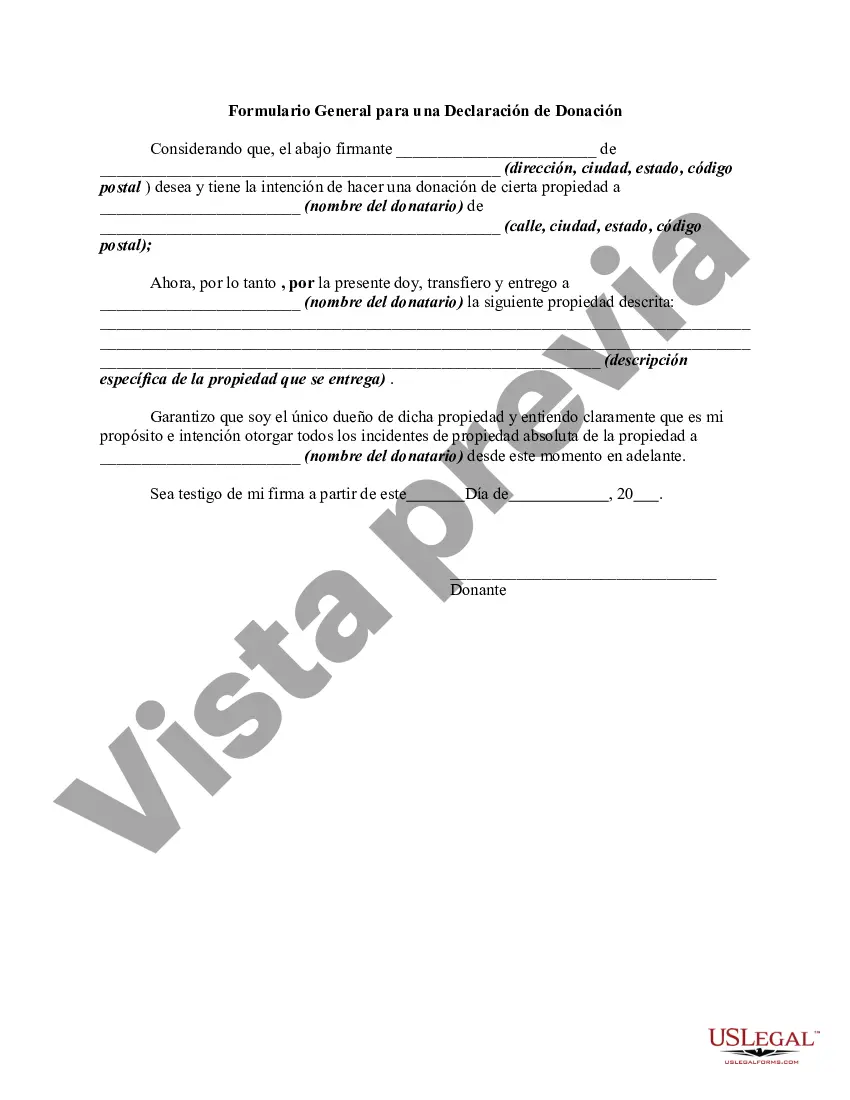

The following form is a general form for a declaration of a gift of property.

Travis Texas Declaration of Gift is a legal document that outlines the transfer of a gift between parties. Essentially, it is a written agreement that shows the intention of the donor to gift the property to the recipient. The declaration ensures transparency and clarity in the transfer process, protecting the rights and interests of both parties involved. The Travis Texas Declaration of Gift is used in various situations where an individual wants to gift their property or assets to another person or organization. It can be used for gifting real estate properties, vehicles, valuable possessions, financial assets, or even stocks and bonds. There are different types of Travis Texas Declaration of Gift that may be used depending on the nature of the gift. Some common types include: 1. Real Estate Declaration of Gift: This type of declaration is used when transferring ownership of a property such as a house, land, or commercial building as a gift. 2. Vehicle Declaration of Gift: If the gift involves a motor vehicle like a car, motorcycle, or boat, a specific declaration is used to document the gift transfer and change of ownership. 3. Monetary Declaration of Gift: In cases where the gift involves a sum of money, a declaration is made to record the amount gifted and the details of the donor and recipient. 4. Personal Property Declaration of Gift: This type of declaration is used when gifting personal belongings such as jewelry, artwork, furniture, or any other valuable possession. The Travis Texas Declaration of Gift is a legally binding document and should include essential information such as the names and contact details of the donor and recipient, a detailed description of the gift being transferred, signatures of both parties, and the date of the transfer. Additionally, it may also include clauses regarding any conditions or restrictions on the gift, tax implications, and any other relevant terms. It's crucial to consult with a lawyer or legal expert familiar with Travis Texas laws to ensure the accuracy and compliance of the Declaration of Gift. This helps to protect the interests of both the giver and the receiver and ensures a smooth and legally recognized transfer of the gift.Travis Texas Declaration of Gift is a legal document that outlines the transfer of a gift between parties. Essentially, it is a written agreement that shows the intention of the donor to gift the property to the recipient. The declaration ensures transparency and clarity in the transfer process, protecting the rights and interests of both parties involved. The Travis Texas Declaration of Gift is used in various situations where an individual wants to gift their property or assets to another person or organization. It can be used for gifting real estate properties, vehicles, valuable possessions, financial assets, or even stocks and bonds. There are different types of Travis Texas Declaration of Gift that may be used depending on the nature of the gift. Some common types include: 1. Real Estate Declaration of Gift: This type of declaration is used when transferring ownership of a property such as a house, land, or commercial building as a gift. 2. Vehicle Declaration of Gift: If the gift involves a motor vehicle like a car, motorcycle, or boat, a specific declaration is used to document the gift transfer and change of ownership. 3. Monetary Declaration of Gift: In cases where the gift involves a sum of money, a declaration is made to record the amount gifted and the details of the donor and recipient. 4. Personal Property Declaration of Gift: This type of declaration is used when gifting personal belongings such as jewelry, artwork, furniture, or any other valuable possession. The Travis Texas Declaration of Gift is a legally binding document and should include essential information such as the names and contact details of the donor and recipient, a detailed description of the gift being transferred, signatures of both parties, and the date of the transfer. Additionally, it may also include clauses regarding any conditions or restrictions on the gift, tax implications, and any other relevant terms. It's crucial to consult with a lawyer or legal expert familiar with Travis Texas laws to ensure the accuracy and compliance of the Declaration of Gift. This helps to protect the interests of both the giver and the receiver and ensures a smooth and legally recognized transfer of the gift.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.