Broward Florida Oil, Gas and Mineral Royalty Transfer refers to the process of transferring ownership rights and financial benefits associated with oil, gas, and mineral resources in Broward County, Florida. This transfer allows individuals or companies to sell their royalty interests or purchase royalty interests from others. The oil, gas, and mineral resources in Broward County contribute significantly to the state's energy and economic development. Royalty interests represent a share of the revenue generated from extracting these resources, such as oil wells, natural gas reserves, or mineral deposits. There are different types of Broward Florida Oil, Gas, and Mineral Royalty Transfers, including: 1. Royalty Interest Purchase: This type of transfer involves a buyer acquiring the rights to a portion of the royalties generated from the production of oil, gas, or minerals. The buyer receives a percentage of the revenue generated from the extraction operations. 2. Royalty Interest Sale: In this case, an individual or entity sells their ownership rights to a portion of the royalties generated by oil, gas, or mineral production. The seller receives a lump sum payment for the transfer of their royalty interests. 3. Mineral Rights Transfer: This type of transfer specifically involves the ownership rights to mineral deposits, such as coal, iron, limestone, or precious metals. Mineral rights holders can sell or lease their rights to mining companies or individuals. 4. Working Interest Transfer: While not directly related to royalty transfer, it is essential to understand its significance within the oil, gas, and mineral industry. A working interest refers to ownership of the operational costs and risks associated with extraction, including drilling, production, and maintenance. A working interest holder is responsible for a percentage of these costs and is entitled to a share of the revenue generated. However, the transfer of working interests is a separate transaction from royalty transfer. Broward Florida Oil, Gas, and Mineral Royalty Transfer transactions are conducted through legal agreements and contracts. It is essential for parties involved in these transfers to consult with industry experts or attorneys knowledgeable in mineral rights law to ensure a smooth and legally compliant process. Overall, Broward Florida Oil, Gas, and Mineral Royalty Transfer plays a crucial role in the management and monetization of the valuable natural resources in the county. It provides a means for individuals or companies to benefit financially from these resources without direct involvement in the extraction operations.

Broward Florida Oil, Gas and Mineral Royalty Transfer

Description

How to fill out Broward Florida Oil, Gas And Mineral Royalty Transfer?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Broward Oil, Gas and Mineral Royalty Transfer, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Broward Oil, Gas and Mineral Royalty Transfer from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Broward Oil, Gas and Mineral Royalty Transfer:

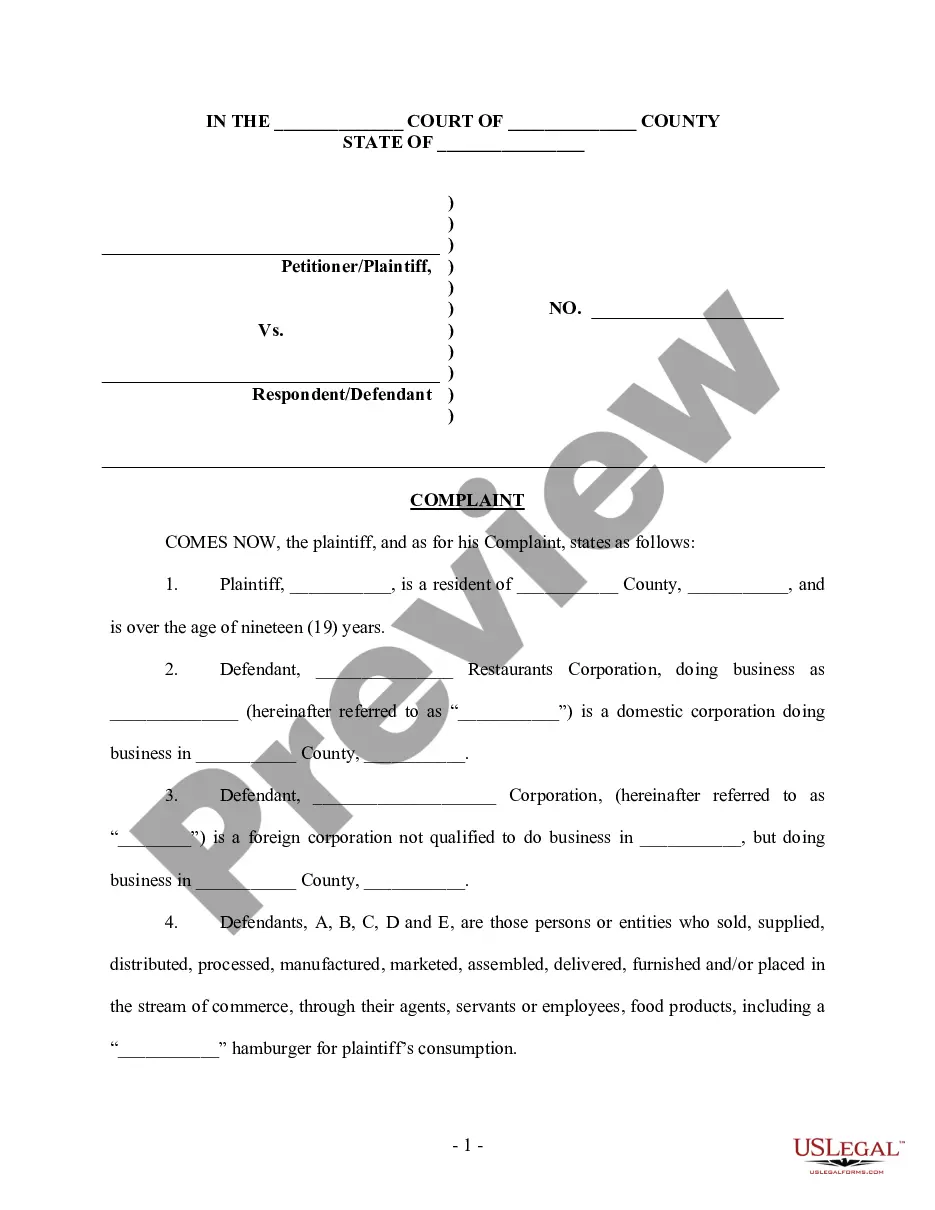

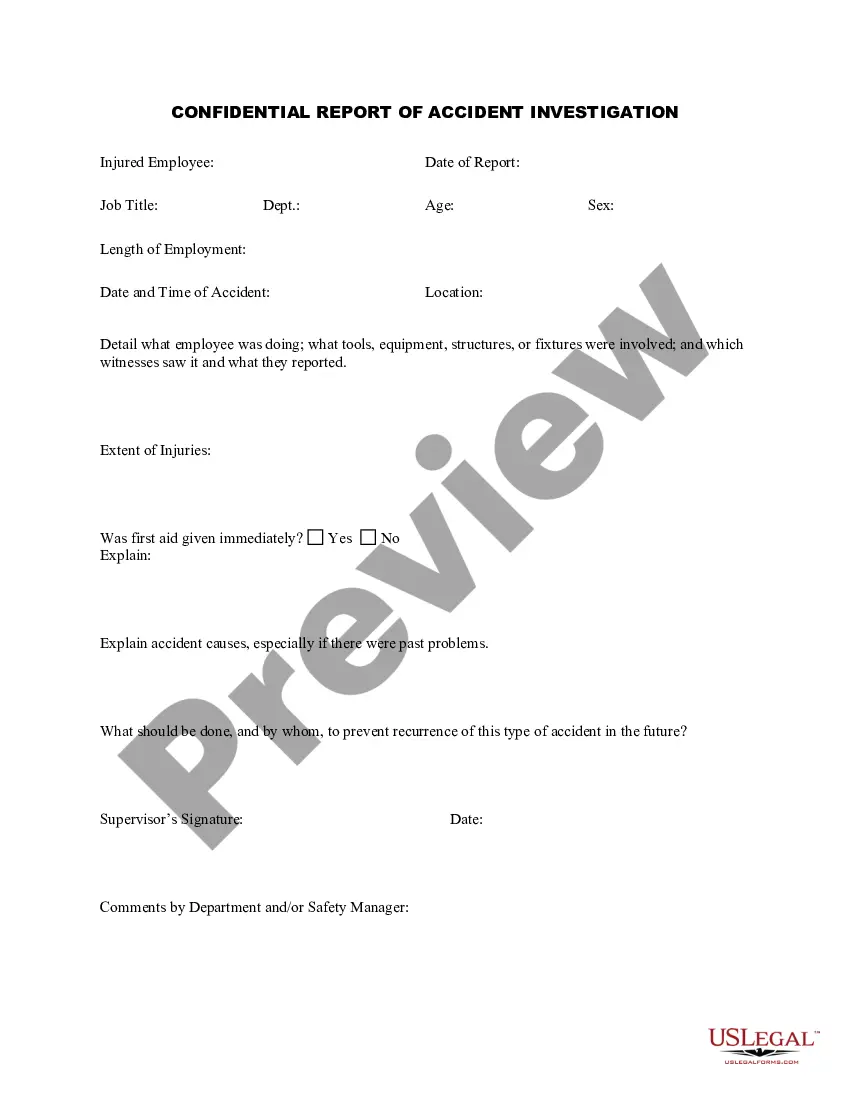

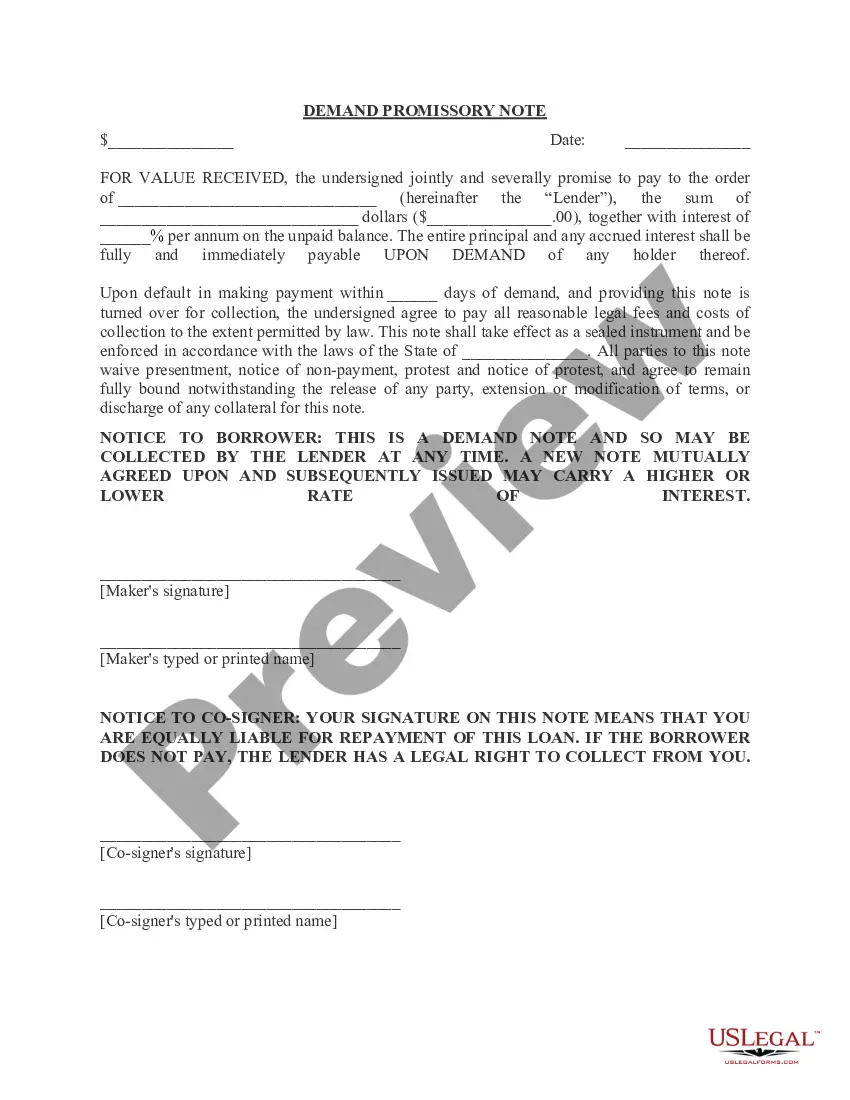

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!