Santa Clara, California Oil, Gas, and Mineral Royalty Transfer: A Comprehensive Overview Introduction: Santa Clara, California is known as a region rich in natural resources, particularly oil, gas, and minerals. Individuals and companies involved in the exploration and production of these valuable resources often engage in royalty transfers to monetize their profits or diversify their portfolios. In this article, we will provide a detailed description of Santa Clara, California Oil, Gas, and Mineral Royalty Transfer, including its definition, the process involved, and the different types of transfers available. Definition: Santa Clara, California Oil, Gas, and Mineral Royalty Transfer refers to the legal and financial process by which the ownership rights and revenue streams associated with oil, gas, or mineral deposits are transferred from the original owner to another party in exchange for an agreed-upon consideration. This transfer allows the original owner to sell a portion or all of their royalty interests while enabling the acquiring party to receive future royalty payments from the production of these resources. Process: 1. Evaluation and Offer: The process begins with the evaluation of the oil, gas, or mineral rights by specialized firms, which assess the potential value of the resources. After assessing their worth, these firms make an offer to the original owner, outlining the purchase price and transfer terms. 2. Negotiation: Once the initial offer is presented, the owner and the potential buyer engage in negotiations to reach an agreement on the purchase price, royalty rates, and other relevant factors. This phase ensures that both parties' interests are adequately represented. 3. Due Diligence: Following the negotiation, the acquiring party conducts a thorough due diligence process to verify the ownership rights, quantify the expected revenue, assess legal and financial risks, and determine the property's current and potential production capacity. 4. Document Preparation: Once due diligence is completed, legal professionals draft the necessary documents, including the purchase agreement, transfer documentation, and royalty deed, to formalize the transfer and protect the rights of both parties involved. 5. Closing and Payments: Upon reaching an agreement and finalizing the necessary documentation, the transfer is officially closed. The acquiring party provides the agreed-upon consideration to the original owner, and all relevant legal and administrative procedures are completed. Types of Transfers: 1. Partial Royalty Transfer: In this type of transfer, the original owner decides to sell only a portion of their royalty interests while retaining the remaining percentage. By doing so, they can maintain some stake in the production and continue to receive a portion of the royalty payments. 2. Full Royalty Transfer: In a full royalty transfer, the original owner sells the entirety of their royalty interests to the acquiring party. This transfer enables the original owner to monetize their entire stake in the resource and transfer all future royalty payments to the buyer. 3. Lump Sum Payment: Some royalty transfers may involve a lump sum payment, where the acquiring party offers a single upfront payment to the original owner for their royalty interests. This arrangement provides immediate liquidity to the original owner, allowing them to use the funds for other investments or personal needs. Conclusion: Santa Clara, California Oil, Gas, and Mineral Royalty Transfer offers an opportunity for individuals and companies to capitalize on the value of their ownership rights in natural resources. With various types of transfers available, including partial and full royalty transfers or lump sum payments, owners can tailor their arrangements to meet their specific goals and financial needs. By understanding the process and different transfer options, individuals can navigate the complexities of these transactions effectively while optimizing the value of their oil, gas, and mineral interests in Santa Clara, California.

Santa Clara California Oil, Gas and Mineral Royalty Transfer

Description

How to fill out Santa Clara California Oil, Gas And Mineral Royalty Transfer?

Drafting papers for the business or personal demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Santa Clara Oil, Gas and Mineral Royalty Transfer without professional help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Santa Clara Oil, Gas and Mineral Royalty Transfer by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Santa Clara Oil, Gas and Mineral Royalty Transfer:

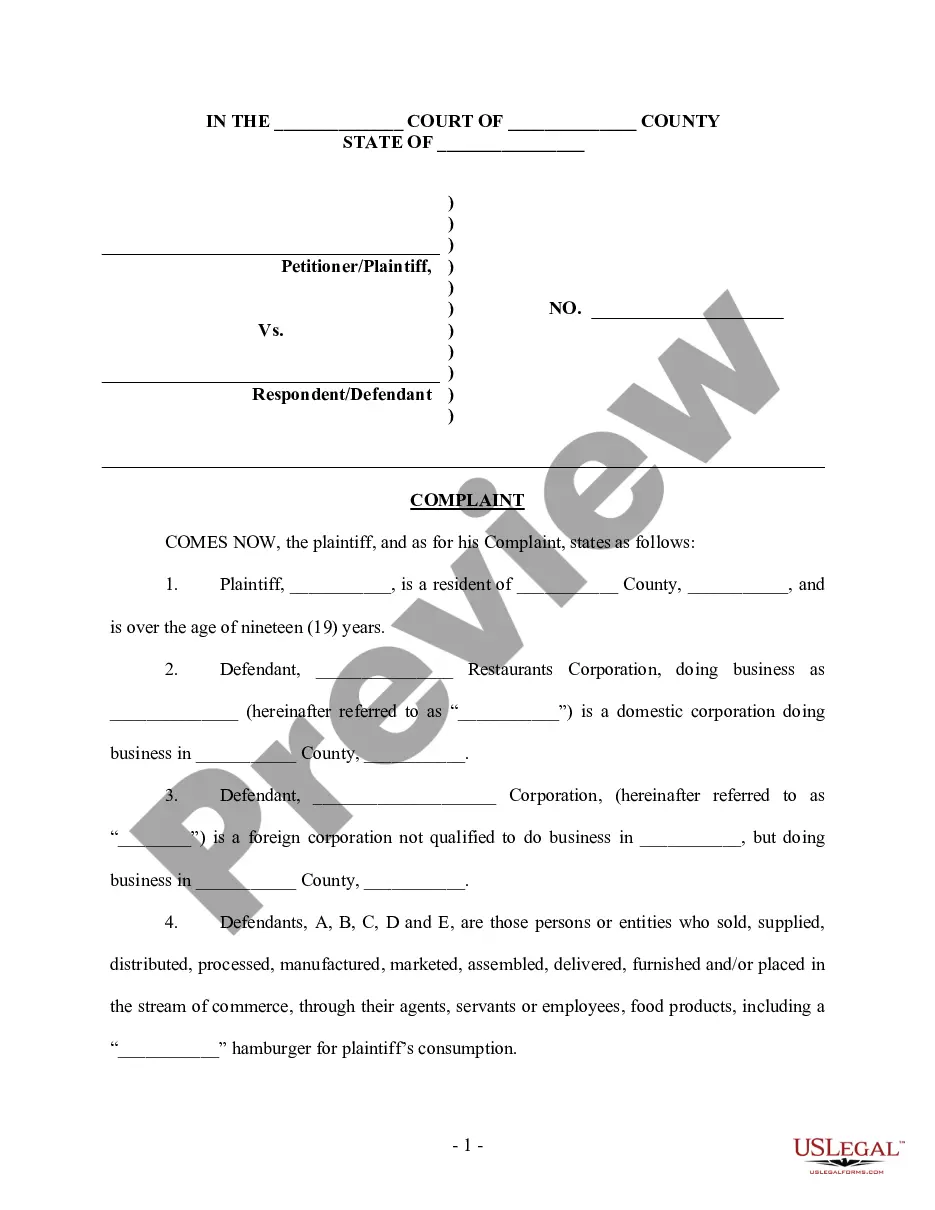

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that fits your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!